Capital Market

概要:Capital Market, registered in Cyprus, claims to offer a web-based trading platform. However, reports indicate that their CYSEC license may be a suspicious clone. The platform is notably limited compared to industry standards like MetaTrader 4 and MetaTrader 5, which offer advanced features for technical analysis and automated trading. With high minimum deposit requirements for its three account types, Capital Market's services are not suitable for all traders.

Note: Capital Market's official website: https://www.capitalmarketcorp.com/ is currently inaccessible normally.

| Capital Market Review Summary | |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC (Suspicious Clone) |

| Market Instruments | Not mentioned |

| Demo Account | Unavailable |

| Leverage | Not mentioned |

| Spread | Not mentioned |

| Trading Platform | Web-based |

| Minimum Deposit | $5,000 |

| Customer Support | Phone, email |

Capital Market Information

Capital Market, registered in Cyprus, claims to offer a web-based trading platform. However, reports indicate that their CYSEC license may be a suspicious clone. The platform is notably limited compared to industry standards like MetaTrader 4 and MetaTrader 5, which offer advanced features for technical analysis and automated trading. With high minimum deposit requirements for its three account types, Capital Market's services are not suitable for all traders.

Pros & Cons

| Pros | Cons |

| None | Limited Trading Features |

| High Minimum Deposit | |

| CYSEC (Suspicious Clone) | |

| Inaccessible Website |

Cons:

Limited Trading Features: The platform lacks advanced functionalities found in popular trading platforms like MT4 and MT5, such as technical analysis tools and automated trading capabilities.

High Minimum Deposit: The minimum deposit requirements are relatively high, starting at $5,000, which may deter novice traders or those with limited capital.

CYSEC (Suspicious Clone): The CYSEC license is suspected to be a fraudulent copy, raising significant doubts about the brokers legitimacy and reliability.

Inaccessible Website: Reports of compromised or restricted access to their official website further amplify concerns regarding the trustworthiness of their trading services.

Is Capital Market Legit?

There have been reports suggesting that the Cyprus Securities and Exchange Commission (CySEC) license, specifically a Market Making (MM) license under number 319/17 is suspected to be a fraudulent copy. Clients should exercise caution in such scenarios as dealing with cloned or false regulatory credentials is a red flag that often indicates potential scams or illicit activities.

Additionally, the accessibility of their official website is compromised or restricted. Websites that are difficult to access, frequently down, or lack clear, professional communication can be indicative of a lack of stability or integrity within the company.

These elements culminate in a heightened level of risk for individuals considering investments within the capital market through this particular broker. Remember, any investment, especially those in the financial markets, comes with its risks, and diligence is key to managing those risks effectively.

Account Types

Capital Market offers three live account types including Individual, Diversified and Corporate with the minimum deposit requirement of $5,000, $30,000, and $100,000 respectively.

- Individual Account:

Minimum Deposit: $5,000

This account type is designed for individual retail traders who have moderate investment capital and are looking to trade in the financial markets.

- Diversified Account:

Minimum Deposit: $30,000

This account type suggests it is for investors who have larger amounts of capital to trade with and possibly offers more diversified investment options or services.

- Corporate Account:

Minimum Deposit: $100,000

This account type is typically for corporate entities or high-net-worth individuals who have substantial capital to invest and require specialized services or access to different financial instruments.

However, these account types have higher minimum deposit requirements compared to many legitimate brokers that offer micro accounts starting from $100-200. The higher minimum deposit could potentially limit accessibility for smaller retail investors or beginners in trading.

Trading Platform

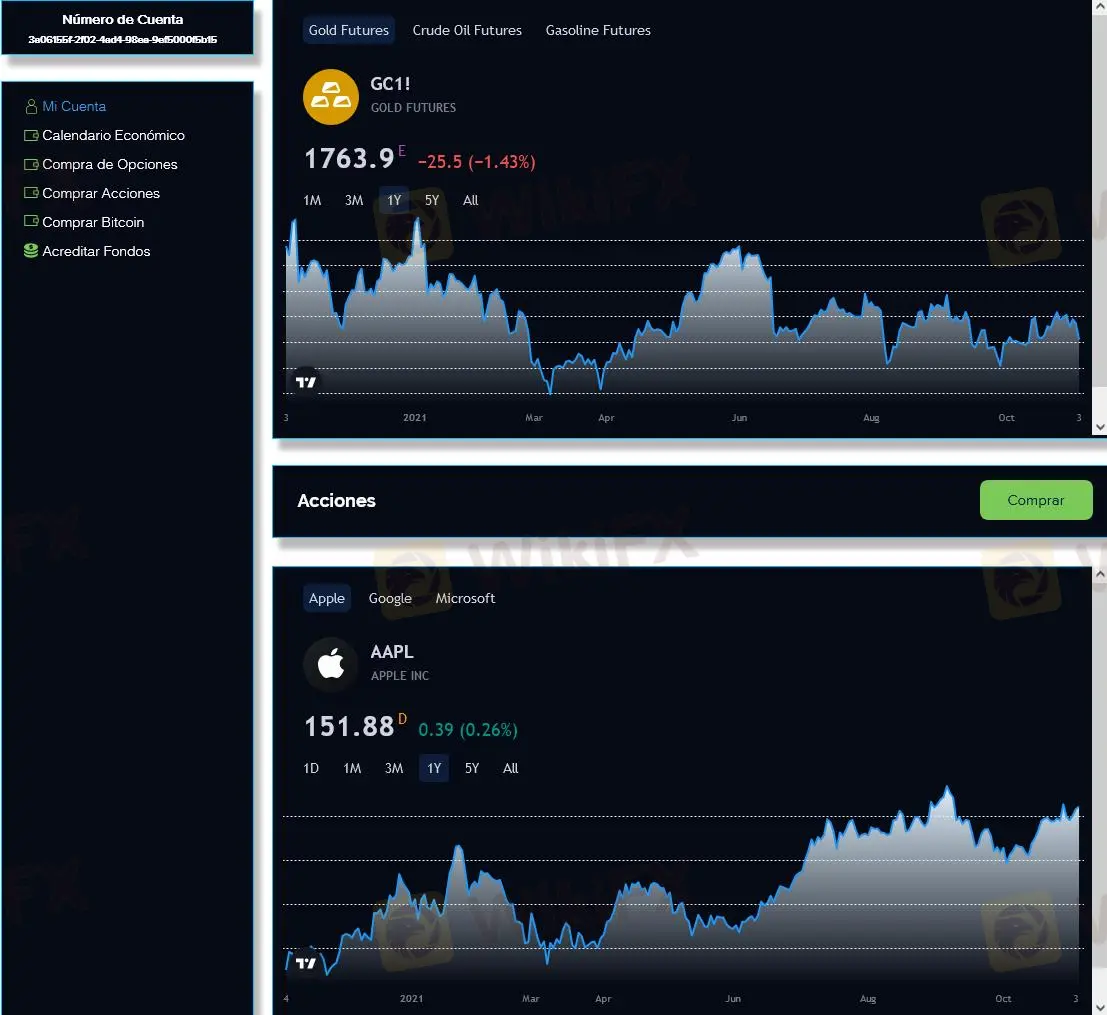

The trading platform provided by Capital Market is a web-based interface accessible through their website. This platform offers basic functionalities such as viewing real-time prices of major commodities and stocks of well-known companies through simple charts. Users can monitor market movements and track prices conveniently without the need for extensive technical knowledge or software installation.

However, compared to industry-leading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), Capital Market's web-based platform is limited. These popular trading platforms typically provide extensive tools for technical analysis, customizable charting options, automated trading capabilities through Expert Advisors (EAs), and support for various order types and trading strategies.

Deposits & Withdrawals

Capital Market provides its clients with various options for depositing and withdrawing funds.

One of the primary methods available is wire transfers, which are suitable for larger transactions but come with the caveat that they are irreversible and not eligible for chargebacks. This characteristic makes them vulnerable in situations involving potential fraud or service disputes.

For clients preferring credit cards, Capital Market supports this widely accepted method, offering convenience for transactions; however, users should verify any associated fees or restrictions that their card issuer may apply, especially for international transactions.

Additionally, Capital Market lists PayPal as an option for both deposits and withdrawals. Despite mentioning specific deposit amounts like $200, $400, or $600, it appears that the functionality for these selections might not be fully operational, as indicated by inactive buttons. Clients intending to use PayPal are advised to seek clarity directly from Capital Market regarding its current availability and terms. Moreover, deposits through Western Union are accepted, although similar to wire transfers, they do not qualify for chargebacks.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: +1-914-826-8089

Email: info@capitalmarketlatam.com

Conclusion

Capital Market presents a basic trading solution with a web-based platform and multiple account types, making it accessible for certain investors. However, the significant regulatory concerns, including the suspected fraudulent nature of its CYSEC license, coupled with high minimum deposit requirements and limited trading features, cast serious doubt on its legitimacy and reliability.

Frequently Asked Questions (FAQs)

Is Capital Market regulated by any financial authority?

No. It has been verified that this broker currently has no valid regulation.

How can I contact Capital Market?

You can contact via phone, +1-914-826-8089 and email: info@capitalmarketlatam.com.

What platform does Capital Market offer?

It offers web-based platform.

What is the minimum deposit for Capital Market?

The minimum initial deposit to open an account is $5,000.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFXブローカー

話題のニュース

WikiEXPO、リバランド政府とのパートナーシップを締結―グローバルな金融取引における革新と健全な発展を促進

【WikiFX】2024年度悪徳業者まとめ~前編

レート計算