G. H. Financials

Абстракт:G. H. Financials, an established financial service provider with a rich history spanning over 25 years, operates globally from key financial hubs in the UK, USA (Chicago), and Hong Kong. The firm specializes in offering clearing, settlement, and market access solutions for exchange-traded futures and options contracts. With a commitment to tailored global clearing solutions, G. H. Financials caters to a diverse clientele, ranging from individual traders to large investment banks. The company's reputation is underpinned by its adherence to rigorous regulatory standards, holding licenses from esteemed authorities such as the Securities and Futures Commission (SFC) in Hong Kong, reaffirming its legitimacy in the financial industry.

| Company Information | Details |

| Company Name | G. H. Financials |

| Registered In | UK, USA, Hong Kong |

| Regulation Status | Regulated by SFC |

| Years of Establishment | Over 25 years |

| Trading Instruments | Futures, Options, Swaps, ETFs, Forex |

| Account Types | Individual, Joint, Corporate, Institutional |

| Maximum Leverage | Up to 50:1 for futures, Up to 20:1 for options |

| Minimum Spread | Competitive, varies by instrument |

| Trading Platform | Choice of software or ISV partners |

| Deposit and Withdrawal Method | Bank wire transfer, Credit card, Debit card, PayPal |

| Customer Service | Email, Phone, Contact Page |

Overview of G. H. Financials

G. H. Financials, an established financial service provider with a rich history spanning over 25 years, operates globally from key financial hubs in the UK, USA (Chicago), and Hong Kong. The firm specializes in offering clearing, settlement, and market access solutions for exchange-traded futures and options contracts.

With a commitment to tailored global clearing solutions, G. H. Financials caters to a diverse clientele, ranging from individual traders to large investment banks. The company's reputation is underpinned by its adherence to rigorous regulatory standards, holding licenses from esteemed authorities such as the Securities and Futures Commission (SFC) in Hong Kong, reaffirming its legitimacy in the financial industry.

Is G. H. Financials Legit or a Scam?

G. H. Financials maintains a legitimate status as a regulated financial service provider. The firm is duly regulated by the Securities and Futures Commission (SFC), ensuring compliance with regulatory standards for futures contracts.

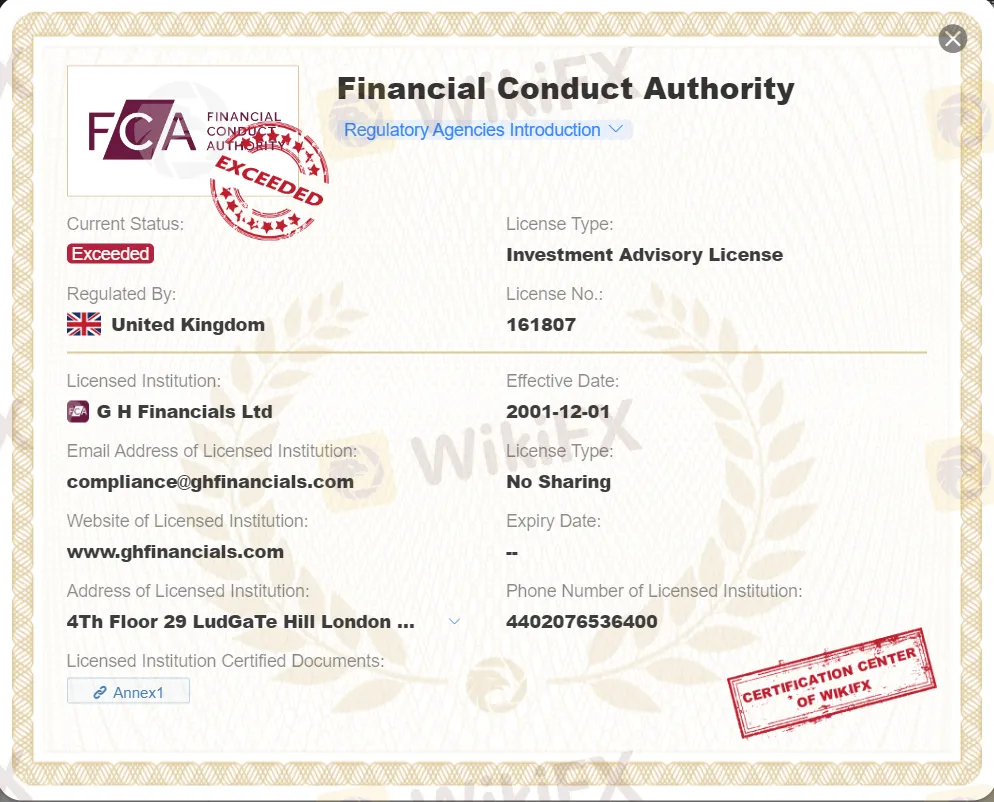

Additionally, G. H. Financials holds a valid license issued by the United Kingdom's Financial Conduct Authority (FCA) under license number 161807. This license encompasses a broad business scope, including Investment Advisory and Non-Forex activities, further solidifying the firm's legitimacy in the financial industry. Clients can have confidence in G. H. Financials' adherence to regulatory guidelines, ensuring a secure and compliant trading environment.

Pros and Cons

| Pros | Cons |

| Regulated by SFC | Niche focus on futures and options |

| Customized services | Limited disclosed information |

| Global presence | |

| Tailored clearing | |

| Competitive pricing |

Pros:

Regulated by SFC for safety: G. H. Financials' adherence to SFC regulations ensures a secure trading environment.

Customized Services: Tailored solutions for diverse client needs.

Global Presence: Strategic offices in London, Chicago, and Hong Kong.

Tailored Clearing: Comprehensive solutions for various market instruments.

Cons:

Niche Focus: Primarily specialized in futures and options.

Limited Disclosed Information: Limited details on account types and fees.

Market Instruments

G. H. Financials offers a diverse array of clearing services for an extensive range of market instruments, ensuring clients have access to an expansive trading landscape. These instruments encompass futures, options, swaps, exchange-traded funds (ETFs), and the forex market.

Whether clients seek exposure to traditional futures and options or are interested in the dynamic world of ETFs and forex, G. H. Financials' comprehensive clearing services cater to a broad spectrum of trading preferences and strategies.

Account Types

G. H. Financials recognizes the varied needs of its clientele and offers a suite of account types designed to accommodate different trading profiles. These encompass individual accounts, joint accounts for collaborative trading efforts, corporate accounts tailored to businesses, and institutional accounts for larger entities.

By providing this diverse range of account types, G. H. Financials ensures that traders at all levels, from individual investors to large institutions, can access the services and features that align with their specific requirements and objectives.

How to Open an Account?

Opening an account with G. H. Financials is a straightforward process. Prospective clients can initiate the account setup by visiting the firm's official website and completing the online application form.

During this process, clients will be required to furnish personal details, including their name, address, and contact information, in addition to financial information such as income and net worth. This streamlined procedure ensures that clients can swiftly embark on their trading journey with G. H. Financials.

Leverage

Leverage is a critical factor in trading, and G. H. Financials provides clients with varying leverage options based on their account type and the specific market instrument being traded.

For instance, individual account holders typically enjoy a maximum leverage of 50:1 for futures and 20:1 for options. This tailored approach ensures that clients can utilize leverage in a manner that aligns with their trading strategies and risk tolerance, ultimately enhancing their trading flexibility.

Spreads & Commissions

Competitive spreads and commissions are a hallmark of G. H. Financials' pricing structure. The exact spreads and commissions that clients incur are contingent on the market instrument they trade and their chosen account type. This transparent approach to pricing allows clients to assess the cost-effectiveness of their trading activities, ensuring that they have a clear understanding of the associated fees and charges.

Trading Platform

G. H. Financials maintains a software-agnostic stance, allowing clients the flexibility to choose their preferred trading software. However, to enrich the client experience, G. H. Financials has established strong commercial relationships with notable Independent Software Vendors (ISVs), including CGQ, FFastFill, ITIVITI, and others.

These ISVs provide specialized trading solutions that seamlessly integrate with our services. Through these valued partnerships, G. H. Financials ensures clients have access to state-of-the-art technology and a diverse array of trading platforms. This approach empowers clients to select the trading software that best aligns with their unique trading styles and preferences, all while benefiting from G. H. Financials' renowned reliability and support.

Deposit & Withdrawal

G. H. Financials facilitates convenient and secure deposit and withdrawal processes, offering a variety of payment methods. These methods include bank wire transfers, credit cards, debit cards, and PayPal.

This extensive range of options ensures that clients can select the most suitable and convenient method for managing their funds, enhancing the overall efficiency and convenience of their financial transactions with G. H. Financials.

Customer Support

For all inquiries and further information, please feel free to contact our dedicated customer support team. You can reach us via email at enquiries@ghfinancials.com or directly at our office numbers: +44-20-7653-6410 for London, +1-312-586-1801 for Chicago, and +852-2209-1588 for Hong Kong.

Alternatively, our contact page offers convenient communication options. We are committed to providing you with prompt and responsive assistance, and your inquiries are of utmost importance to us.

Brokers Comparison

| Aspect | G. H. Financials | OctaFX | JustMarkets |

| Regulatory Compliance | Regulated by FCA | Regulated by CySEC and FSA | Regulated by ASIC and FCA |

| Market Focus | Futures & Options Clearing | Forex, Cryptos, CFDs | Forex, CFDs, Commodities |

| Client Types | Professional traders, banks | Retail traders, investors | Retail and institutional |

| Technology | Cutting-edge tech, STP | MT4/MT5, mobile platforms | Proprietary platform |

| Customization | Bespoke clearing solutions | Limited customization | Personalized solutions |

Educational Resources

G. H. Financials places a strong focus on providing educational resources, which encompass a spectrum of informative materials, including articles, webinars, market insights, news updates, events, and a specialized focus on futures and options clearing. These resources are thoughtfully designed to empower traders and investors with valuable knowledge and insights to navigate the intricacies of the financial markets.

Conclusion

In conclusion, G. H. Financials stands as a reputable financial service provider with over 25 years of experience, offering a range of specialized services in clearing, settlement, and market access for exchange-traded futures and options contracts. The company operates globally from key financial centers in London, Chicago, and Hong Kong, ensuring accessibility to major markets.

With a strong commitment to regulatory compliance, G. H. Financials is regulated by SFC, providing clients with confidence in a secure trading environment. The firm's customization, competitive pricing, and global presence are notable advantages. However, its niche focus on futures and options contracts may not suit all traders, and the limited disclosure of account information could be a drawback for some.

FAQs

Q: What regulatory bodies oversee G. H. Financials' operations?

A: G. H. Financials is regulated by the Securities and Futures Commission (SFC) in Hong Kong, ensuring regulatory compliance for a secure trading environment.

Q: Can I access multiple financial markets with G. H. Financials?

A: Yes, G. H. Financials offers clearing services for a diverse range of market instruments, including futures, options, swaps, ETFs, and forex, enabling access to multiple financial markets.

Q: How can I open an account with G. H. Financials?

A: Opening an account with G. H. Financials is a straightforward process. Visit our official website and complete the online application form, providing personal and financial information.

Q: What leverage options are available for traders at G. H. Financials?

A: The leverage options vary based on your account type and the specific market instrument being traded. For example, individual account holders can typically enjoy a maximum leverage of 50:1 for futures and 20:1 for options.

Q: What deposit and withdrawal methods does G. H. Financials accept?

A: G. H. Financials accepts various deposit and withdrawal methods, including bank wire transfers, credit cards, debit cards, and PayPal, providing flexibility and convenience for managing your funds.

WikiFX брокеры

WikiFX брокеры

Подсчет курса