BMO Bank of Montreal

Абстракт:BMO Bank of Montreal, headquartered in Canada, operates as a broker without regulatory oversight. The company offers a diverse range of financial services, including banking, wealth management, mortgages, loans, credit cards, insurance products, and specialized business banking services. While specific trading platforms are not specified, BMO provides personal and business banking accounts, including checking and savings accounts. Customer support is available through an online support tool, phone support, branch and ATM locator, and reporting for lost or stolen cards.

| Aspect | Information |

| Registered Country/Area | Canada |

| Company Name | BMO Bank of Montreal |

| Regulation | Operates as a broker without regulatory oversight |

| Services | - Banking services - Wealth management - Mortgages and loans - Credit cards - Insurance products - Specialized business banking services |

| Trading Platforms | Not specified |

| Account Types | Personal and business banking accounts, including checking and savings accounts |

| Customer Support | - Online support tool - Phone support - Branch and ATM locator - Lost or stolen card reporting |

Overview

BMO Bank of Montreal, headquartered in Canada, operates as a broker without regulatory oversight. The company offers a diverse range of financial services, including banking, wealth management, mortgages, loans, credit cards, insurance products, and specialized business banking services. While specific trading platforms are not specified, BMO provides personal and business banking accounts, including checking and savings accounts. Customer support is available through an online support tool, phone support, branch and ATM locator, and reporting for lost or stolen cards.

Regulation

BMO Bank of Montreal operates as a broker without regulatory oversight. This lack of regulation may impact the protections and standards typically associated with regulated brokerage activities. Investors should exercise caution and conduct thorough research before engaging with BMO Bank of Montreal for brokerage services.

Pros and Cons

BMO Bank of Montreal offers a wide range of financial services, including banking, wealth management, mortgages, loans, credit cards, insurance products, and specialized business services. These services are complemented by robust online and mobile banking platforms and comprehensive customer support options.

However, it's important to note that BMO operates as a broker without regulatory oversight, potentially impacting the protections and standards associated with regulated brokerage activities. Investors should exercise caution and conduct thorough research before engaging with BMO for brokerage services.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Services

BMO Bank of Montreal offers a wide range of financial services tailored to meet the needs of individuals, businesses, and institutions:

Banking Services:

Access to ATMs for cash withdrawals and deposits.

Online and mobile banking platforms for convenient account management and transactions.

Personal and business banking accounts, including checking and savings accounts.

Wealth Management:

Financial planning services to help clients achieve their long-term financial goals.

Retirement planning solutions, including IRAs and employer-sponsored retirement plans.

Investment services such as brokerage accounts, mutual funds, and exchange-traded funds (ETFs).

Mortgages and Loans:

Personal loans for various purposes such as home improvements or debt consolidation.

Mortgage options including fixed-rate mortgages, adjustable-rate mortgages, and home equity loans.

Credit Cards:

A diverse range of credit cards with features like cashback rewards, travel rewards, and premium benefits.

Insurance Products:

Life insurance, health insurance, home insurance, auto insurance, and travel insurance to manage risk and protect assets.

Specialized Services:

Merchant services for businesses to process payments securely and efficiently.

Business banking solutions, including business checking accounts, loans, and cash management services.

Online and Mobile Banking:

Robust online and mobile banking platforms for easy access to account information, bill payment, and fund transfers.

BMO Bank of Montreal aims to provide comprehensive financial solutions backed by expertise and personalized service to help customers achieve their financial goals.

Customer Support

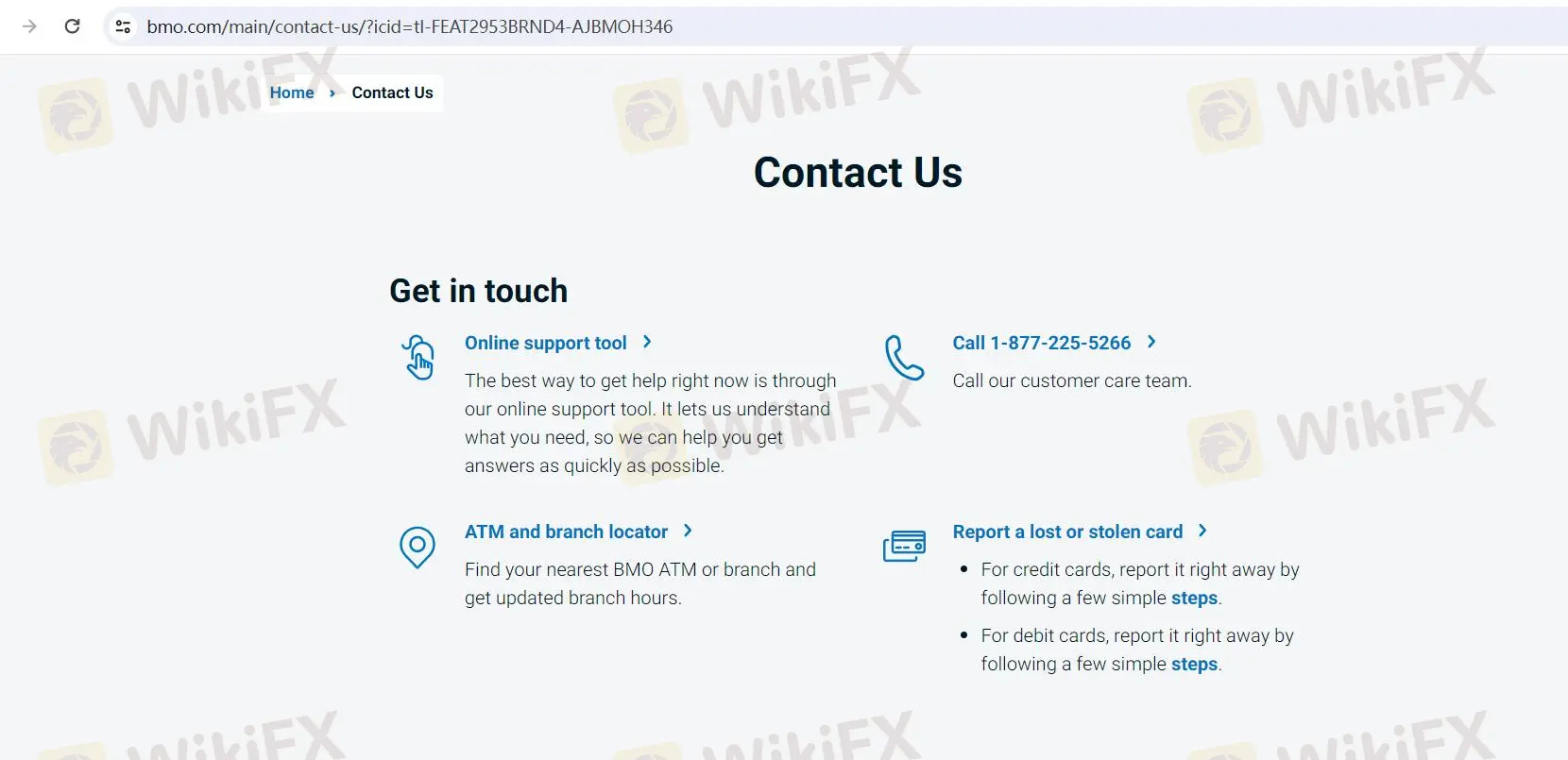

BMO Bank of Montreal offers comprehensive customer support through various channels:

Online Support Tool:

Customers can utilize the online support tool, accessible through the bank's website, to submit inquiries and receive assistance. This tool allows customers to communicate their needs effectively, enabling the customer care team to provide prompt and tailored responses.

Phone Support:

Customers can call the dedicated customer care team at 1-877-225-5266 for immediate assistance with their banking inquiries, account-related issues, or any other concerns they may have. This phone support option ensures direct access to trained representatives who can address customer queries efficiently.

Branch and ATM Locator:

The bank's website features an ATM and branch locator tool, enabling customers to easily find the nearest BMO Bank of Montreal branch or ATM. This tool provides updated information on branch locations and operating hours, facilitating convenient access to in-person support when needed.

Lost or Stolen Card Reporting:

In the unfortunate event of a lost or stolen card, customers can quickly report it by following simple steps provided on the bank's website. Whether it's a credit card or debit card, BMO Bank of Montreal ensures a streamlined process for reporting and addressing card-related issues promptly.

Overall, BMO Bank of Montreal's customer support services are designed to offer convenience, accessibility, and efficient resolution of customer inquiries and concerns. Whether through online tools, phone support, or in-person assistance at branches, the bank strives to provide a seamless and responsive customer experience.

Conclusion

In conclusion, BMO Bank of Montreal offers a comprehensive suite of financial services to cater to the diverse needs of individuals, businesses, and institutions. However, it's important to note the lack of regulatory oversight in their brokerage activities, which may impact investor protections. Customers can access robust customer support channels for assistance and guidance. As with any financial institution, individuals should conduct thorough research and exercise caution when engaging with BMO Bank of Montreal for brokerage services.

FAQs

Q: What types of accounts does BMO Bank of Montreal offer?

A: BMO provides personal and business banking accounts, including checking, savings, and investment accounts.

Q: Can I access my accounts online with BMO?

A: Yes, BMO offers online and mobile banking platforms for convenient account management and transactions.

Q: Does BMO offer mortgage options?

A: Yes, BMO provides various mortgage options, including fixed-rate and adjustable-rate mortgages.

Q: What types of insurance products does BMO offer?

A: BMO offers insurance products such as life insurance, health insurance, and home insurance.

Q: How can I report a lost or stolen card to BMO?

A: You can quickly report a lost or stolen card by following simple steps provided on the bank's website or by calling their customer care team.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

WikiFX брокеры

Подсчет курса