SafeCaps

บทคัดย่อ:SafeCaps is a brokerage firm that places its emphasis on delivering trading services through its proprietary SafeCaps Webtrader platform. This platform serves as the primary avenue for clients to engage in trading activities. SafeCaps strives to provide a user-friendly trading experience, with an intuitive interface and convenient accessibility across various devices. Traders can access a diverse range of trading instruments spanning different asset classes, including forex, commodities, stocks, indices, and digital currencies.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| SafeCaps Review Summary | |

| Registered Country/Region | Cyprus |

| Regulation | No regulation |

| Market Instruments | forex, commodities, stocks, indices, digital currencies |

| Leverage | 1:500 |

| EUR/USD Spread | 0.1 pips (Std) |

| Trading Platforms | SafeCaps Webtrader |

| Minimum Deposit | €5,000 |

| Customer Support | telephone, email, online messaging |

What is SafeCaps?

SafeCaps is a brokerage firm that places its emphasis on delivering trading services through its proprietary SafeCaps Webtrader platform. This platform serves as the primary avenue for clients to engage in trading activities. SafeCaps strives to provide a user-friendly trading experience, with an intuitive interface and convenient accessibility across various devices. Traders can access a diverse range of trading instruments spanning different asset classes, including forex, commodities, stocks, indices, and digital currencies.

However, it is important to note that SafeCaps operates without valid regulation, which may raise concerns among potential clients. The absence of regulation means that there may be a lack of oversight and regulatory safeguards typically associated with regulated brokers. Traders should carefully consider the potential risks and implications of trading with an unregulated brokerage.

Pros & Cons

| Pros | Cons |

| • Diverse trading instruments | • No valid regulation |

| • Competitive spreads | • No MT4/5 supported |

| • Trading tools provided | • Only crypto payments offered |

| • Low minimum deposit | |

| • Multiple contact ways | |

| • Flexible leverage ratios | |

| • Commission-free trading on Standard accounts |

SafeCaps Alternative Brokers

There are many alternative brokers to SafeCaps depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - A CFD service provider that offers a simple, user-friendly platform and a wide range of tradable instruments, making it suitable for those interested in CFD trading.

Forex.com - As a leading forex broker, it provides a wide range of currency pairs, a robust trading platform, and high-quality research tools, making it an excellent option for forex traders.

XTB - Known for its combination of educational materials, comprehensive market analysis, and a custom trading platform, it's an excellent choice for new and experienced traders alike.

Is SafeCaps Safe or Scam?

While SafeCaps offers a variety of trading instruments, account types, and customer support channels, it's important to note that the lack of valid regulation raises concerns about the level of oversight and protection provided to clients. Regulation plays a crucial role in ensuring transparency, client fund protection, and adherence to industry standards. Without proper regulation, there may be potential risks associated with account security, fair trading practices, and dispute resolution. Traders should exercise caution when considering an unregulated brokerage.

Market Instruments

SafeCaps is a brokerage firm that offers a diverse range of trading instruments across various asset classes. Here's a brief summary describing the market instruments available at SafeCaps:

Forex: SafeCaps allows trading in the foreign exchange market, commonly known as Forex. Forex trading involves the buying and selling of different currencies in pairs. Traders can speculate on the relative value of currency pairs, such as EUR/USD or GBP/JPY, to profit from price fluctuations.

Commodities: SafeCaps provides access to commodity trading, where traders can participate in the buying and selling of physical goods. This includes commodities like gold, silver, oil, natural gas, agricultural products, and more. Commodity trading allows investors to speculate on price movements and hedge against inflation.

Stocks: SafeCaps enables traders to invest in stocks, which represent ownership in publicly traded companies. Through the brokerage, traders can access a wide range of stocks listed on major stock exchanges. By buying and selling stocks, traders can benefit from price movements and company performance.

Indices: SafeCaps offers trading in indices, which are a measure of the performance of a specific group of stocks representing a particular market. Traders can speculate on the overall movement of an index, such as the S&P 500 or the NASDAQ 100, without trading individual stocks.

Digital Currencies: SafeCaps facilitates trading in digital currencies, also known as cryptocurrencies. This includes popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others. Traders can participate in the price movements of these digital assets, taking advantage of the volatility and potential opportunities in the cryptocurrency market.

Accounts

The Standard account is designed for traders who are starting out or have a smaller trading capital. It typically has a minimum deposit requirement of €5,000. This account type provides access to the basic features and trading instruments offered by SafeCaps, allowing traders to trade forex, commodities, stocks, indices, and digital currencies.

Moreover, the Premium account is suitable for traders with a larger trading capital and a higher level of trading experience. It usually requires a minimum deposit of €25,000. This account type provides enhanced features and benefits compared to the Standard account. Traders with a Premium account may have access to additional services, personalized support, advanced trading tools, and potentially lower trading costs.

Lastly, The Business account is tailored for corporate entities, institutions, or professional traders who have substantial trading capital and specific requirements. It generally requires a higher minimum deposit of €100,000. The Business account offers a range of features and services specifically designed to meet the needs of institutional clients, including dedicated account managers, customized trading solutions, and access to institutional-grade trading platforms.

| Account Type | Minimum Deposit |

| Standard | €5,000 |

| Premium | €25,000 |

| Business | €100,000 |

Leverage

SafeCaps offers leverage options for different types of accounts. Leverage is a tool that allows traders to control larger positions in the market with a smaller amount of capital. Here's a brief description of the leverage options provided by SafeCaps:

| Types of Accounts | Maximum Leverage |

| Standard | 1:40 or 1:100 |

| Premium | 1:200 or 1:300 |

| Business | up to 1:500 |

For the Standard account, SafeCaps offers leverage options of 1:40 or 1:100. This means that for every unit of capital in the trading account, traders can access a trading position that is 40 or 100 times larger. Leverage amplifies both potential profits and losses, so traders should exercise caution and understand the risks involved.

The Premium account at SafeCaps provides leverage options of 1:200 or 1:300. With these leverage ratios, traders can control larger positions in the market compared to their available capital. Higher leverage ratios increase the potential profitability of trades, but they also come with increased risk, as losses can be magnified.

The Business account offered by SafeCaps provides the highest leverage option, which can go up to 1:500. This allows traders with larger capital to have even greater control over their positions in the market. However, it's important to note that higher leverage also entails higher risk, and traders should have a thorough understanding of leverage and risk management strategies.

Spreads & Commissions

Here's a brief description of the spreads and commissions offered by SafeCaps for different types of accounts:

Standard Account:

Spread: SafeCaps offers a competitive spread starting from 0.1 pips for the Standard account. The spread represents the difference between the buying and selling price of a financial instrument. A lower spread allows traders to enter and exit positions more cost-effectively.

Commission: SafeCaps does not charge any commissions for trades conducted through the Standard account. This means that traders only need to consider the spread as the cost of executing their trades.

Premium Account:

Spread: For the Premium account, SafeCaps offers a spread starting from 1.3 pips. Although slightly higher than the Standard account, it is still competitive compared to industry standards.

Commission: SafeCaps charges a commission from €0.5 per lot for trades conducted through the Premium account. The commission is an additional fee charged on top of the spread and is typically based on the volume (lot size) of the traded instrument.

Business Account:

Spread: The Business account at SafeCaps offers a spread starting from 1.5 pips. While slightly wider than the other account types, it still provides traders with access to competitive pricing.

Commission: SafeCaps charges a variable commission ranging from €1.9 to €4.0 per lot for trades conducted through the Business account. The specific commission rate may depend on the traded instrument and other factors. Traders should review the commission structure to understand the exact costs involved.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread (pips) | Commissions (per lot) |

| SafeCaps | 0.1 | No commission |

| Plus500 | Average of 0.6 | No commissions |

| Forex.com | Average of 0.6 | Varies (depending on account type) |

| XTB | Average of 0.2 | Not provided |

Trading Platform

SafeCaps offers SafeCaps Webtrader as its primary trading platform, providing clients with a robust and comprehensive tool to engage in online trading.

It appears that SafeCaps solely offers the SafeCaps Webtrader as its trading platform, without the option of using popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). This means that clients may not have access to some of the advanced trading features and tools commonly available on the MT4/MT5 platforms.

If the absence of MT4/MT5 features is a concern for you, it may be worth considering other brokers that provide these popular platforms. However, it's important to note that the SafeCaps Webtrader may still offer essential trading functionalities and tools, even if it doesn't have the full range of features found in MT4/MT5. Traders should evaluate their specific trading requirements and preferences when deciding on a brokerage and trading platform.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| SafeCaps | SafeCaps Webtrader |

| Plus500 | Plus500 WebTrader, Plus500 Mobile App |

| Forex.com | MT4, Forex.com Web Platform, Forex.com Mobile App |

| XTB | xStation 5 |

Trading Tools

Here's a brief description of the trading tools offered by SafeCaps to its clients:

Prices: SafeCaps provides clients with access to real-time market prices for various financial instruments across different asset classes. These prices allow traders to stay informed about the current market conditions, track price movements, and make well-informed trading decisions. Accurate and timely pricing data is essential for traders to analyze the markets effectively and execute trades at competitive prices.

Trading Plan: SafeCaps emphasizes the importance of a trading plan and provides resources to help clients develop and maintain one. A trading plan is a personalized set of guidelines and rules that outline a trader's approach to the markets. It includes criteria for entering and exiting trades, risk management strategies, and overall trading goals.

Trading Calculators: SafeCaps offers trading calculators that assist traders in performing various calculations related to their trades. These calculators can include tools such as pip calculators, margin calculators, profit/loss calculators, and position size calculators. Traders can utilize these tools to determine the potential profitability, risk, and proper position sizing for their trades.

Trading Strategies: SafeCaps may provide clients with access to various trading strategies or educational resources on trading strategies. These strategies can range from technical analysis-based approaches to fundamental analysis-driven methodologies.

Deposits & Withdrawals

SafeCaps allows clients to make deposits using several digital currencies. These include Ripple, Terra, Tether, Ogecoin, Solrnr, Ethereum, Bitcoin, and Cardano. Clients can initiate a deposit by transferring the desired amount of their chosen cryptocurrency to their SafeCaps trading account. The specific process may involve generating a unique wallet address or using a designated deposit method provided by SafeCaps. It is important to note this company only supports cryptocurrency payments, not credit/debit cards, bank wire transfers, and e-wallets such as Skrill and Neteller.

SafeCaps minimum deposit vs other brokers

| SafeCaps | Most other | |

| Minimum Deposit | €5,000 | $100 |

Customer Service

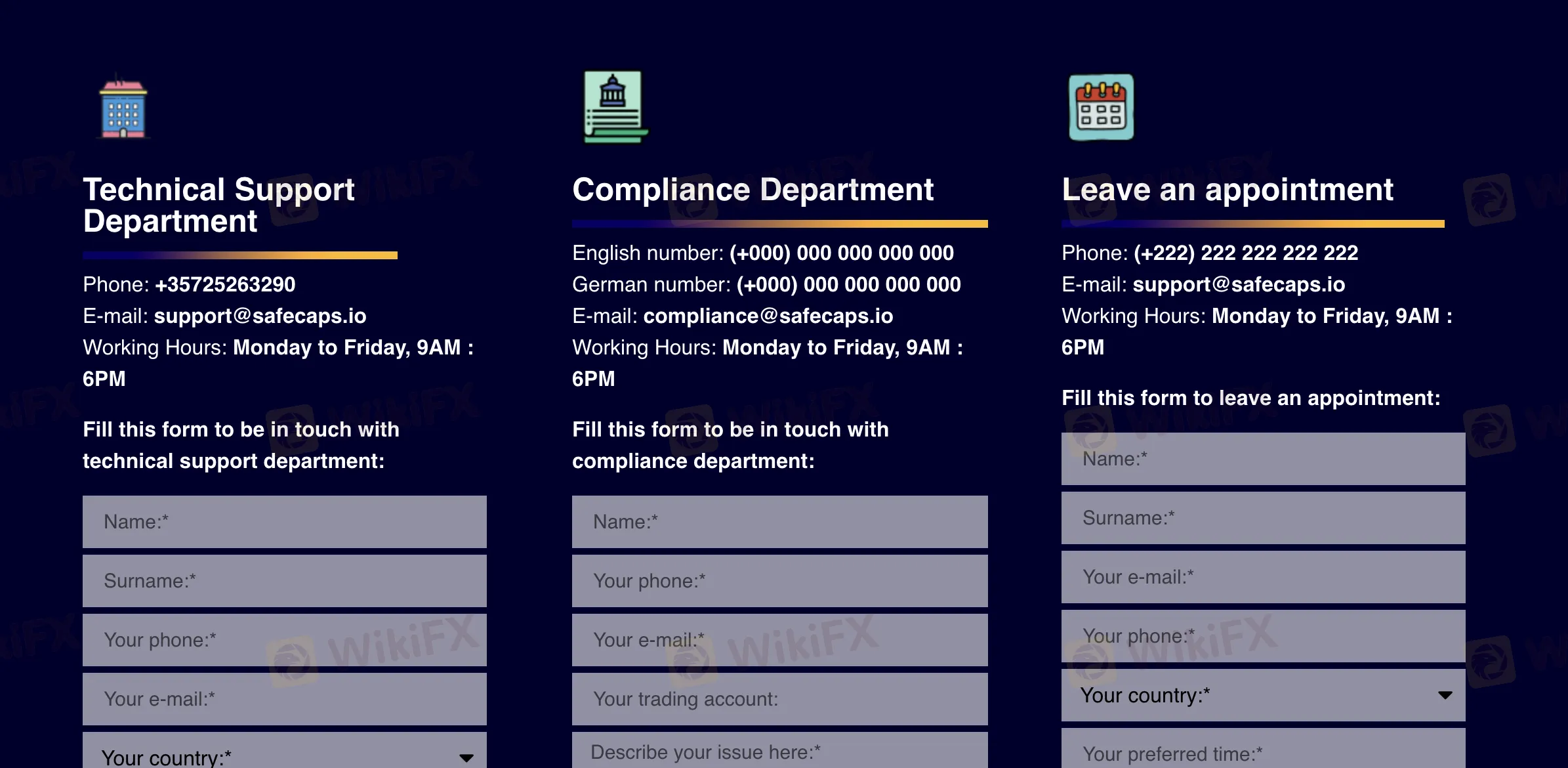

SafeCaps provides technical support department and compliance department for customer service, via phone: +35725263290, email: support@safecaps.io, compliance@safecaps.io and online messaging. The working hours are Monday to Friday, 9AM : 6PM. And you can leave an appointment by email: support@safecaps.io.

Conclusion

In conclusion, SafeCaps is a brokerage firm that offers a wide range of trading instruments across various asset classes, including forex, commodities, stocks, indices, and digital currencies. The brokerage provides different account types, leverage options, and competitive spreads to cater to the diverse needs of traders. The SafeCaps Webtrader platform offers intuitive features, advanced tools, and account management capabilities to enhance the trading experience.

However, it's important to note that SafeCaps currently lacks valid regulation, which raises concerns regarding client protection and oversight. Regulation is crucial in ensuring transparency, fund security, and adherence to industry standards. Traders should exercise caution and conduct thorough research when considering an unregulated broker like SafeCaps.

Frequently Asked Questions (FAQs)

Q1: What trading instruments does SafeCaps offer?

A1: SafeCaps offers a variety of trading instruments across different asset classes, including forex, commodities, stocks, indices, and digital currencies.

Q2: Does SafeCaps have a regulated status?

A2: No, currently SafeCaps operates without valid regulation, which may raise concerns about client protection and oversight.

Q3: What are the minimum deposit requirements for different account types at SafeCaps?

A3: SafeCaps has different minimum deposit requirements based on the account type. For example, the Standard account requires a minimum deposit of €5,000, while the Premium account requires €25,000, and the Business account requires €100,000.

Q4: How can I contact SafeCaps customer support?

A4: You can contact SafeCaps customer support through phone at +35725263290, via email at support@safecaps.io (for general support) or compliance@safecaps.io (for compliance-related inquiries), and through online messaging.

Wiki โบรกเกอร์

FXTM

FOREX.com

Exness

DBG Markets

XM

ATFX

FXTM

FOREX.com

Exness

DBG Markets

XM

ATFX

Wiki โบรกเกอร์

FXTM

FOREX.com

Exness

DBG Markets

XM

ATFX

FXTM

FOREX.com

Exness

DBG Markets

XM

ATFX

ข่าวล่าสุด

"อย่าให้ความโลภพาคุณพลาด" เคล็ดลับควบคุมการเทรดอย่างมีสติ

การใช้ Sentiment Analysis เทรดตามความรู้สึกของตลาด

รวมรีวิวโบรกเกอร์ประจำสัปดาห์ โบรกเกอร์ไหนดี โพสต์นี้มีคำตอบ !

เตือน! อันตรายจากวันหยุดยาว เคลียร์พอร์ตก่อนสาย

"สร้างวินัยเทรด" เคล็ดลับพัฒนานิสัยการเทรดที่ดีในปีนี้

ดอลลาร์แข็งค่า อานิสงส์บอนด์ยีลด์พุ่ง

ข้อคิดดีๆ จากหนังสือ MINDSET สู่ความสำเร็จ

ทองปิดบวก $7.30 นักลงทุนจับตาทิศทางดอกเบี้ยเฟด

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจก่อนสิ้นปีนี้

คำนวณอัตราแลกเปลี่ยน