GoldFx

บทคัดย่อ:GoldFX is a relatively new forex broker registered in Saint Vincent and the Grenadines that claims to offer a variety of trading instruments, including forex, cryptocurrencies, commodities, stocks, ETFs, and indices through the MetaTrader 5 (MT5) platform.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| GoldFx Review Summary in 10 Points | |

| Founded | Within 1 year |

| Registered Country/Region | Saint Vincent and the Grenadines |

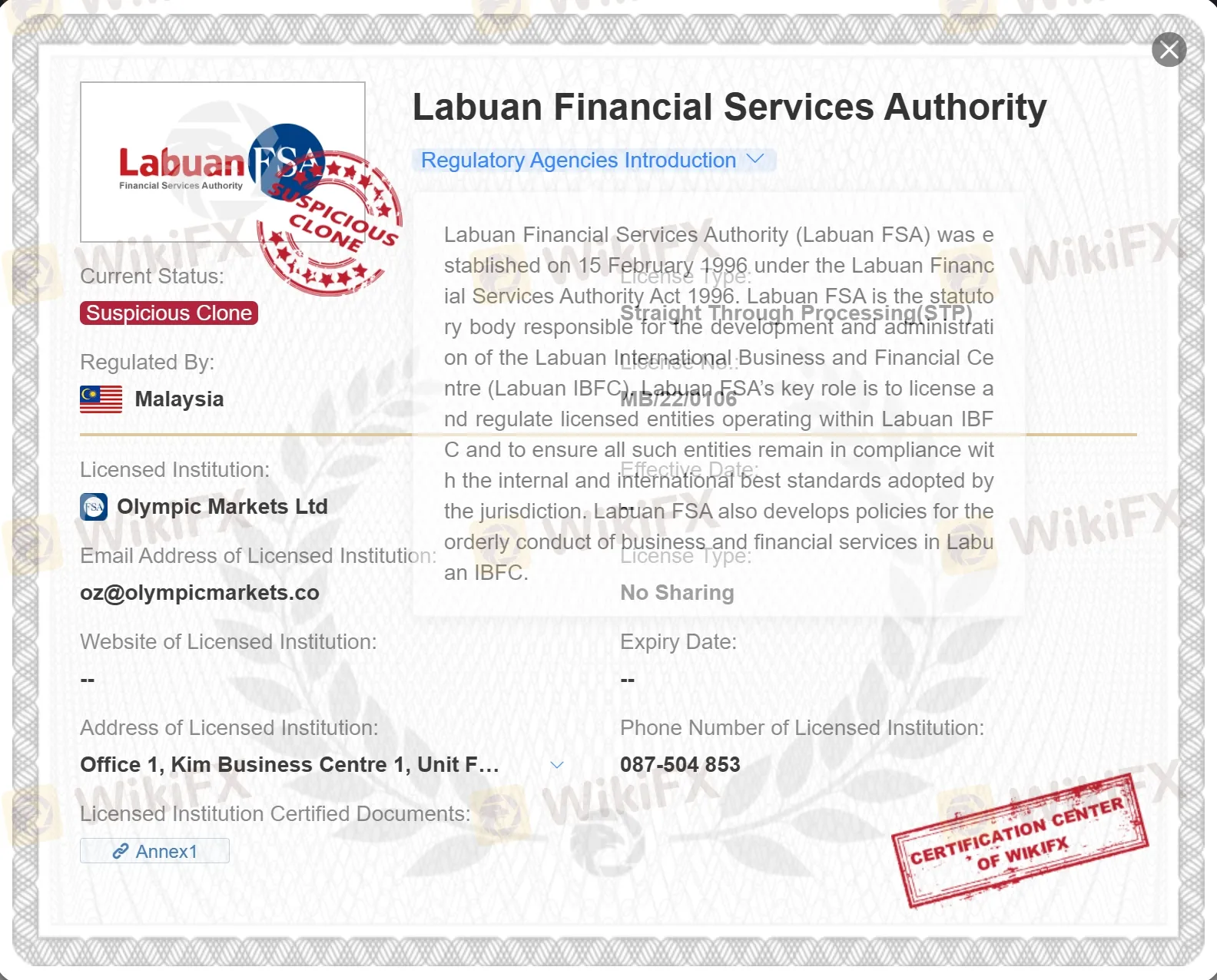

| Regulation | LFSA (Suspicious clone) |

| Market Instruments | CFDs on forex, cryptocurrencies, commodities, stocks, ETFs, indices and treasuries |

| Demo Account | N/A |

| Leverage | 1:2000 |

| EUR/USD Spread | From 0.8 pips (Std) |

| Trading Platforms | MT5 |

| Minimum Deposit | $10 |

| Customer Support | Live chat, phone, email |

What is GoldFx?

GoldFX is a relatively new forex broker registered in Saint Vincent and the Grenadines that claims to offer a variety of trading instruments, including forex, cryptocurrencies, commodities, stocks, ETFs, and indices through the MetaTrader 5 (MT5) platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Offers a variety of trading instruments | • Suspicious clone LFSA license |

| • Tight spreads | Relatively new broker |

| • MT5 supported | |

| • Low minimum deposit amount ($10) | |

| • Live chat support |

GoldFx Alternative Brokers

There are many alternative brokers to GoldFx depending on the specific needs and preferences of the trader. Some popular options include:

Axi: A good choice for traders who are looking for a regulated broker with a wide range of trading instruments.

IronFX: A good choice for traders who are looking for a broker with a high level of customer support.

Decode Global: A good choice for traders who are looking for a broker with a low minimum deposit requirement.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is GoldFx Safe or Scam?

GoldFx appears to be operating without valid regulation, and their license from the Labuan Financial Services Authority (LFSA, No. MB/22/0106) is deemed suspicious. Such a situation raises significant concerns about the legitimacy and safety of the brokerage.

A lack of proper regulation means that GoldFx may not be subject to the oversight and guidelines set by reputable financial authorities, potentially exposing investors to higher risks. Furthermore, the suspicious nature of their license raises doubts about the authenticity of their operations.

Given these red flags, it is crucial to exercise extreme caution when dealing with GoldFx. Investors should refrain from engaging with unregulated brokers, as there may be increased vulnerability to fraudulent activities or unethical practices. And explore regulated and reputable alternatives that prioritize investor protection and adhere to industry standards. Remember, the safety of your funds and personal information should always be a top priority when dealing with any financial institution.

Market Instruments

GoldFx provides an extensive array of trading instruments, encompassing over 2,500 offerings to cater to the diverse needs of traders. Among the market instruments available, traders can access a broad range of Contracts for Difference (CFDs) on forex pairs, allowing them to speculate on the price movements of various currency pairs without owning the underlying assets.

Additionally, GoldFx offers CFDs on cryptocurrencies, providing exposure to the fast-growing digital asset market.

For those interested in commodities, CFDs on precious metals like gold and silver, as well as energy resources and agricultural products, are available.

Traders can also explore CFDs on individual stocks, enabling them to trade on price fluctuations of well-known companies.

Furthermore, CFDs on Exchange-Traded Funds (ETFs) and indices offer opportunities to invest in diversified portfolios and track specific market segments.

Lastly, GoldFx offers CFDs on treasuries, allowing traders to speculate on government bonds' price movements.

Accounts

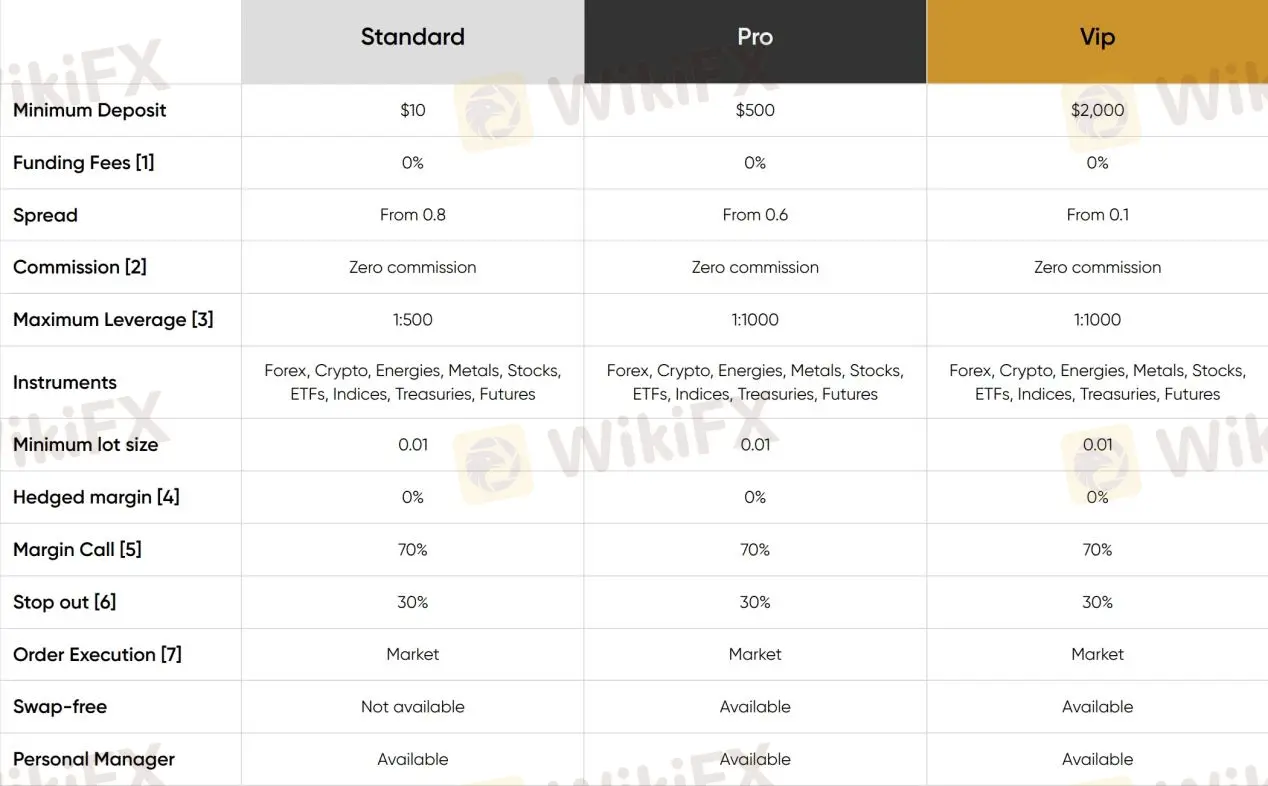

GoldFx offers a range of account options to accommodate different trading preferences and experience levels. The Standard account is an accessible entry point, requiring a minimum deposit of $10, making it suitable for new traders or those looking to start with a smaller investment.

The Pro account is designed for more experienced traders, with a higher minimum deposit of $500. It offers enhanced features, tighter spreads, and potentially more favorable trading conditions.

For seasoned and high-volume traders, the VIP account is available, requiring a minimum deposit of $2,000 and providing premium benefits, personalized support, and exclusive features.

Additionally, GoldFx caters to traders who follow Islamic principles by offering Islamic (Swap-free) accounts, which are designed to be compliant with Sharia law, allowing traders to avoid paying or earning interest on overnight positions.

These diverse account options allow traders to choose an account that aligns with their trading style, experience, and financial capabilities, ensuring a tailored and inclusive trading experience with GoldFx.

Leverage

GoldFx offers a wide range of leverage options to suit the trading needs and risk preferences of its clients. The maximum leverage offered by GoldFx is an impressive 1:2000, which provides traders with the potential to amplify their trading positions significantly.

The leverage varies depending on the asset class being traded. For stocks, ETFs, and treasuries, the maximum leverage is set at 1:10, offering a conservative approach to trading these instruments. Indices have a leverage of 1:100, while commodities and cryptocurrencies offer 1:50 and 1:10 leverage, respectively. For forex trading, GoldFx provides a considerable leverage of 1:500, enabling traders to access larger positions in the foreign exchange market.

However, it is essential to exercise caution when using high leverage, as it magnifies both potential gains and losses, requiring responsible risk management to protect against substantial market fluctuations.

Spreads & Commissions

GoldFx offers a variety of account types, each equipped with different spreads to cater to traders' needs. The Standard account features spreads starting from 0.8 pips, providing a competitive offering for traders seeking a more accessible entry point. The Pro account offers tighter spreads, starting from 0.6 pips, suitable for experienced traders looking for enhanced trading conditions. For high-volume and seasoned traders, the VIP account boasts the tightest spreads, starting from an impressive 0.1 pips, offering the potential for cost-efficient trading.

Notably, GoldFx stands out by providing zero commission across all account types, eliminating additional costs commonly associated with trading. This transparency ensures that traders can focus on executing their strategies without incurring commission charges. By tailoring spreads to suit different trading styles and eliminating commissions, GoldFx creates a favorable trading environment, empowering traders to seize opportunities in the financial markets effectively.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| GoldFx | From 0.8 pips (Std) | 0 (Std) |

| Axi | From 0.4 pips (Std) | 0 (Std) |

| IronFX | From 0.6 pips | $10 per lot |

| Decode Global | From 1.5 pips (Std) | 0 (Std) |

Note: The information presented in this table may be subject to change and it is always recommended to check with the broker's official website for the latest information on spreads and commissions.

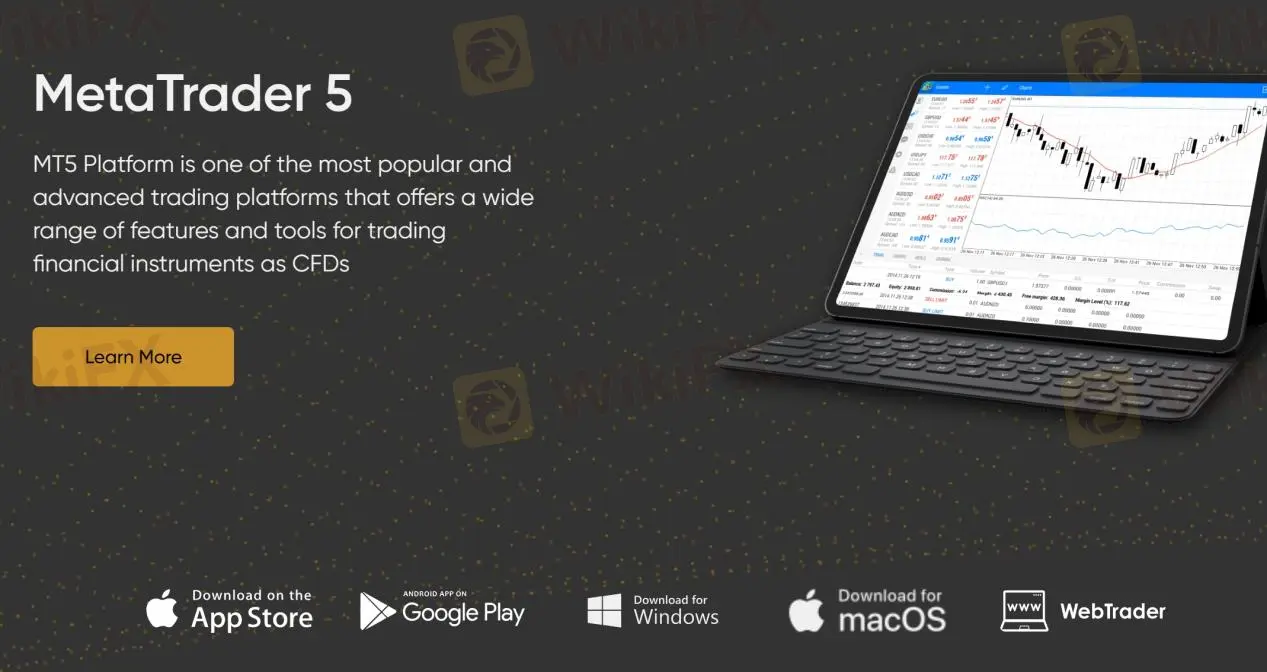

Trading Platforms

GoldFx provides a versatile and comprehensive range of trading platforms, ensuring traders can access the markets seamlessly from various devices.

For mobile users, GoldFx offers MT5 for iOS and Android, allowing traders to trade on the go through their smartphones or tablets. The mobile app provides a user-friendly interface, advanced charting tools, and one-click order placement, making it convenient for traders to execute trades efficiently.

Additionally, GoldFx caters to desktop users by offering MT5 for Windows and macOS, providing a robust and feature-rich trading experience on personal computers.

Traders who prefer web-based platforms can utilize WebTrader, which allows them to access their accounts and trade directly from web browsers without the need for software installation.

With MT5 available on multiple devices, GoldFx ensures traders have the flexibility and convenience to manage their portfolios and engage with the financial markets according to their preferences and lifestyle.

See the trading platform comparison table below:

| Broker | Trading Platform |

| GoldFx | MT5 |

| Axi | MT4 |

| IronFX | MT4, WebTrader |

| Decode Global | MT4/5 |

Copy Trading

GoldFx provides a copy trading feature, empowering traders to benefit from the expertise of experienced investors. Through this innovative service, less-experienced traders can automatically replicate the trades of successful and skilled traders, commonly referred to as signal providers. By connecting their accounts to the copy trading platform, traders can browse and select from a wide range of signal providers based on their trading strategies, performance, and risk profiles.

Once a signal provider is chosen, all their trades will be automatically mirrored in the investor's account, allowing them to participate in the markets without the need for active trading or deep market knowledge. Copy trading with GoldFx offers a convenient and potentially rewarding solution for traders seeking to diversify their portfolios and achieve their financial goals with the guidance of seasoned market professionals.

Trading Tools

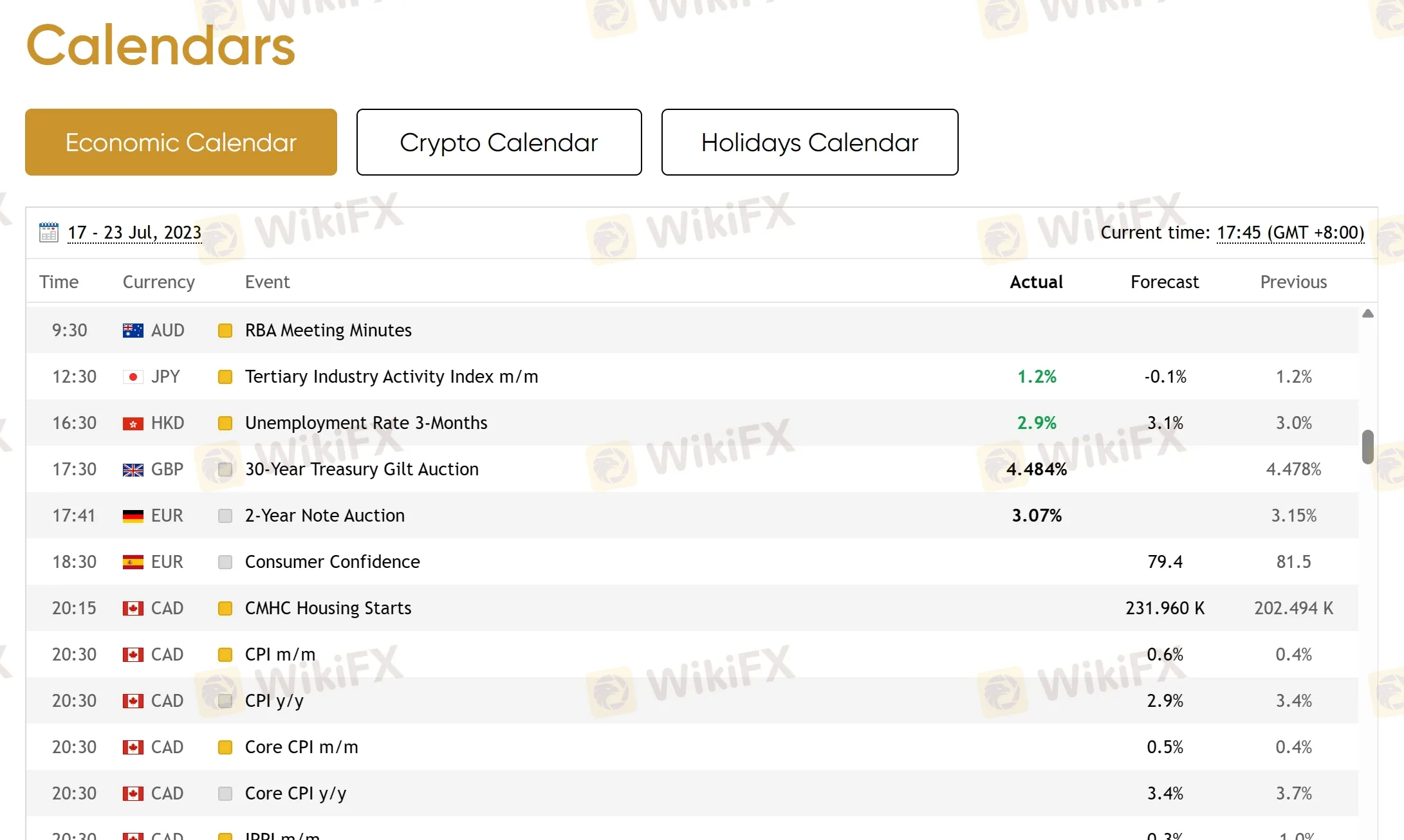

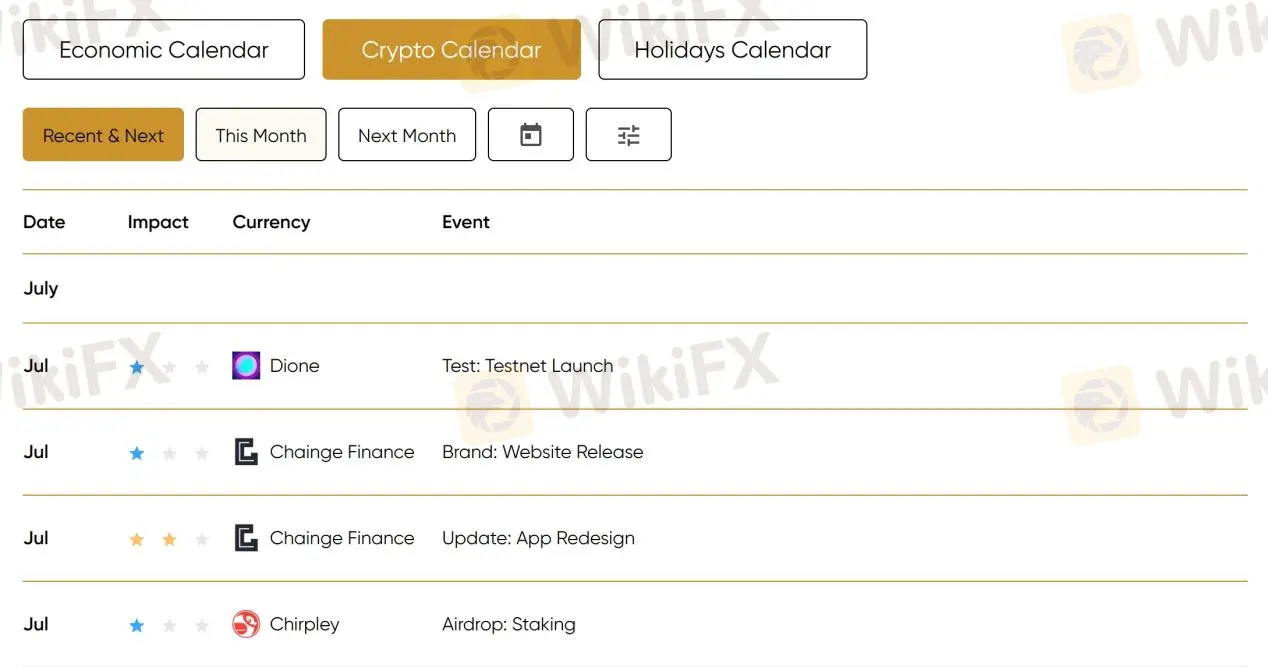

GoldFx equips traders with a comprehensive set of trading tools to enhance their market analysis and decision-making. The Economic Calendar provides real-time updates on key economic events and indicators, helping traders stay informed about potential market-moving events and their expected impact on various assets.

The Crypto Calendar is specifically designed for cryptocurrency traders, offering insights into important events and developments within the rapidly evolving crypto market.

Additionally, the Holidays Calendar informs traders of upcoming market holidays, enabling them to adjust their trading strategies accordingly to account for reduced market activity during these periods.

These trading tools are invaluable in helping traders make informed decisions, identify potential trading opportunities, and navigate the financial markets effectively.

Deposits & Withdrawals

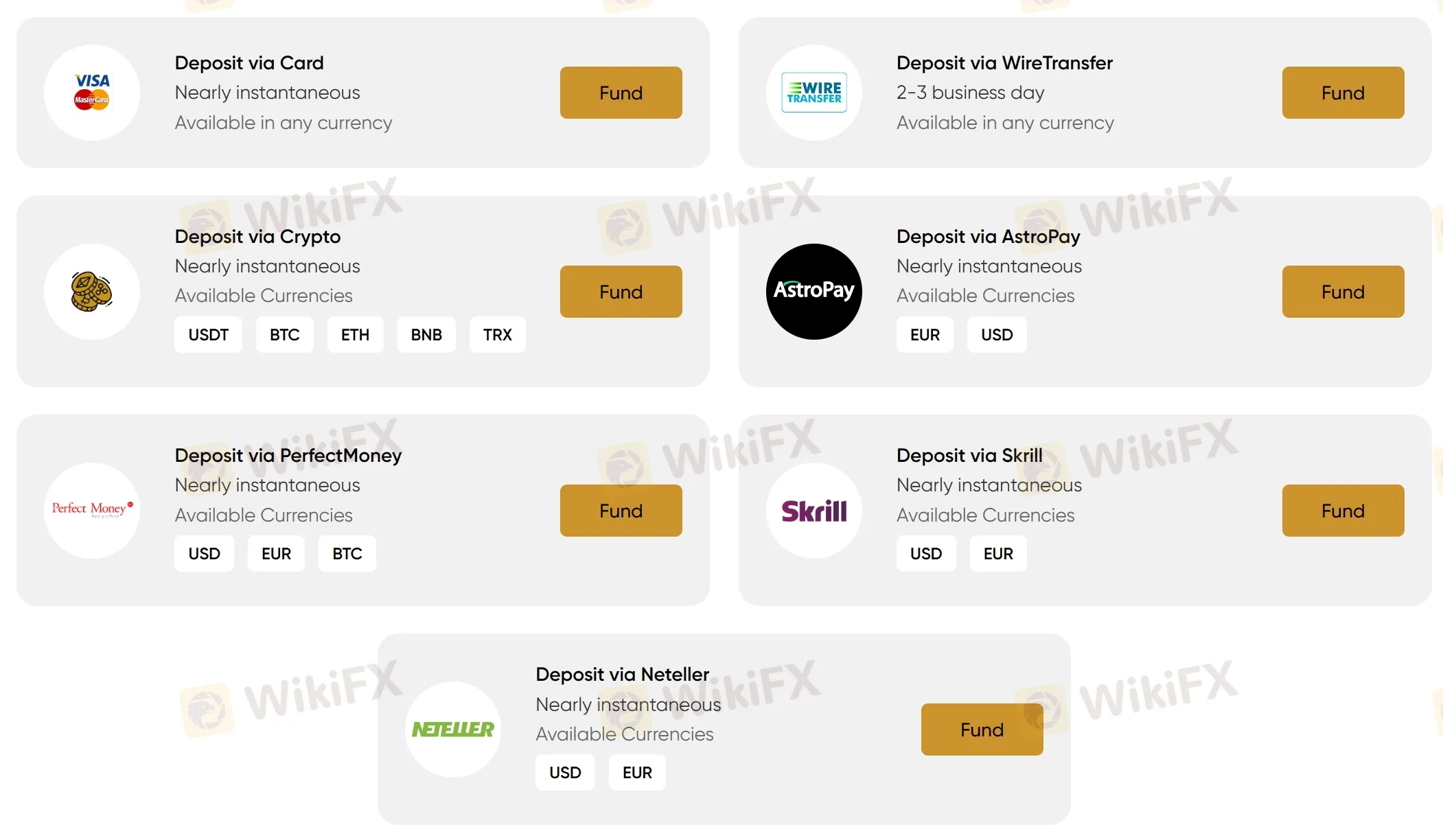

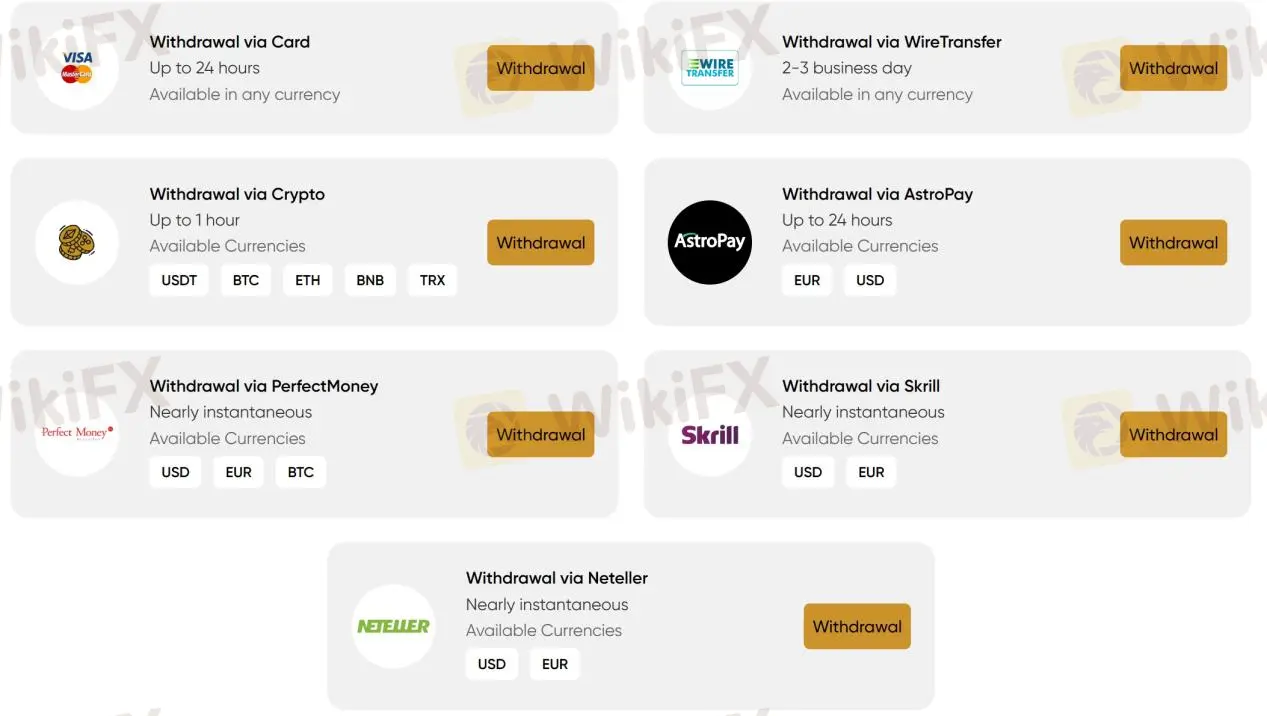

GoldFx offers a diverse range of deposit and withdrawal options to accommodate traders' preferences and convenience. Deposits can be made using Card (Visa/MasterCard/Maestro), Wire Transfer, Crypto, AstroPay, Perfect Money, Skrill, and Neteller. Most deposits are processed almost instantly, providing traders with prompt access to their trading accounts. However, Wire Transfer deposits may take up to 2-3 business days to reflect in the account.

GoldFx minimum deposit vs other brokers

| GoldFx | Most other | |

| Minimum Deposit | $10 | $100 |

For withdrawals, GoldFx ensures efficient processing times. Withdrawals via Card and AstroPay take up to 24 hours, while withdrawals via Wire Transfer may take 2-3 business days. Crypto withdrawals are expedited and typically take up to 1 hour. Withdrawals via PerfectMoney, Skrill, and Neteller are nearly instantaneous, allowing traders to access their funds promptly.

Customer Service

GoldFx offers a comprehensive and accessible customer service experience, providing support from Monday to Friday, 9:00 a.m. to 6:00 p.m. UTC+2. Traders have multiple channels to reach out to the customer support team, including live chat, phone: +44 20 3650 3070, and email: support@goldfx.com, ensuring timely assistance and quick resolution of queries.

The availability of support through popular social networks like Twitter, Facebook, Instagram, and LinkedIn further enhances accessibility for traders who prefer these platforms for communication. Additionally, GoldFx offers a Help Center, catering to self-service options with detailed resources and answers to frequently asked questions.

Overall, GoldFx's customer service is considered reliable and responsive, with various options available for traders to seek assistance.

Education

GoldFx takes education seriously, providing a comprehensive range of educational resources to empower traders with knowledge and skills. Traders have access to a diverse array of learning materials, includingebooks, tutorials, a video academy, and market analysis.

The ebooks cover various trading topics and strategies, offering in-depth insights and practical guidance. Tutorials provide step-by-step instructions on using trading platforms and tools effectively. The video academy offers engaging and informative video content, making complex concepts more accessible. Market analysis helps traders stay informed with regular updates on market trends and potential trading opportunities.

Conclusion

In conclusion, GoldFx is a multi-asset broker offering a diverse range of trading instruments, competitive spreads, and various account types to suit different traders' needs. The platform's commitment to education through ebooks, tutorials, and market analysis demonstrates their dedication to empowering traders with knowledge and skills. Additionally, GoldFx's accessibility through multiple communication channels, including live chat, phone, email, and social networks, enhances their customer service experience.

However, as with any broker, it is essential to conduct thorough research, verify regulatory credentials, and read customer reviews before making any decisions. Traders should exercise caution and consider their risk tolerance and preferences when choosing a broker.

Frequently Asked Questions (FAQs)

| Q 1: | Is GoldFx regulated? |

| A 1: | No. Their Labuan Financial Services Authority (LFSA, No. MB/22/0106) license is a suspicious clone. |

| Q 2: | At GoldFx, are there any regional restrictions for traders? |

| A 2: | Yes. The information on their site is not directed at residents of the Belarus, Belgium, Canada, Cuba, Iran, Iraq, Japan, North Korea, Russian Federation, Sudan, Syria, United States and is not intended for the use of any person in any jurisdiction where such use would be contrary to local law or regulation. |

| Q 3: | Does GoldFx offer Islamic accounts? |

| A 3: | Yes. |

| Q 4: | Does GoldFx offer the industry leading MT4 & MT5? |

| A 4: | Yes. It supports MT5. |

| Q 5: | What is the minimum deposit for GoldFx? |

| A 5: | The minimum initial deposit to open an account is $10. |

| Q 6: | Is GoldFx a good broker for beginners? |

| A 6: | No. It is not a good choice for beginners. Though it offers wide range of trading instruments with low minimum deposit requirement and competitive trading conditions through the MT5 trading platform, it currently lacks valid regulation. Trading with this broker takes a lot of risks. |

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

EBC

ATFX

FOREX.com

FXTM

Exness

DBG Markets

EBC

ATFX

FOREX.com

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

EBC

ATFX

FOREX.com

FXTM

Exness

DBG Markets

EBC

ATFX

FOREX.com

ข่าวล่าสุด

ชาวเน็ตขอแชร์!! ประสบการณ์เทรดเกือบ 10 ปี หลายเรื่องที่มือใหม่อาจจะเข้าใจผิด

ทองปิดบวก 18 ดอลลาร์ รับข่าวแบงก์ชาติจีนรุกซื้อทองคำ

เริ่มต้นปีมาลองเช็กดวงกันหน่อย...ราศีไหนการเงินปัง!

อัยการไม่ฟ้องคดีดิไอคอน"แซม-มิน" ปล่อยตัวพ้นเรือนจำ ส่วน"กันต์" กับ 15 บอสไม่รอด

ข้อคิดดีๆ จากหนังสือ "เมื่อเส้นทางการทำงาน โรยไปด้วยเปลือกทุเรียน"

สืบนครบาลรวบ บัญชีม้าแก๊งคอลเซ็นเตอร์ปลอมเป็นตำรวจ หลอกว่ามีส่งของผิดกฎหมายตกค้าง

WikiFX รีวิวโบรกเกอร์ |easyMarkets โพสต์นี้มีคำตอบ !

เฟดส่งสัญญาณชะลอหั่นดอกเบี้ย กังวลผลกระทบเงินเฟ้อจากนโยบาย “ทรัมป์”

ทองปิดบวก 7 ดอลลาร์ ขานรับจ้างงานภาคเอกชนชะลอตัว

ราคาบิทคอยน์ปี 2025!! เป้าต่อไปคือเท่าไหร่?

คำนวณอัตราแลกเปลี่ยน