PUHUEI

บทคัดย่อ:PUHUEI, based in New Zealand, presents a concerning profile for potential traders. Operating as an unregulated broker, it lacks the oversight and accountability that come with regulation, raising questions about investor protection and ethical practices. With a reported maximum leverage of up to 500 and spreads starting at 1.2 pips for major Forex pairs, PUHUEI may attract traders seeking high leverage and competitive spreads. However, the platform's limitations become apparent in areas such as customer support, where direct contact information is limited, and reliance on social media platforms for communication can hinder prompt assistance. Additionally, PUHUEI severely lacks comprehensive educational resources, leaving traders ill-equipped to navigate the complex world of financial markets. Furthermore, the reported website downtime raises concerns about accessibility, casting doubt on its overall reliability. Traders should exercise caution and carefully weigh the risks and benefits

| Aspect | Information |

| Registered Country/Area | New Zealand |

| Company Name | PUHUEI |

| Regulation | Unregulated |

| Maximum Leverage | Up to 500 |

| Spreads | 1.2 pips for major Forex pairs |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Over 300 CFD instruments, including Forex, cryptocurrencies, metals, futures, shares, indices, and commodities |

| Account Types | Demo Account, Real Account |

| Demo Account | Available for practice with virtual funds |

| Customer Support | Limited direct contact information, reliance on social media platforms |

| Payment Methods | Credit/debit cards, e-wallets, bank transfers, and more |

| Educational Tools | Severely lacking in comprehensive educational resources |

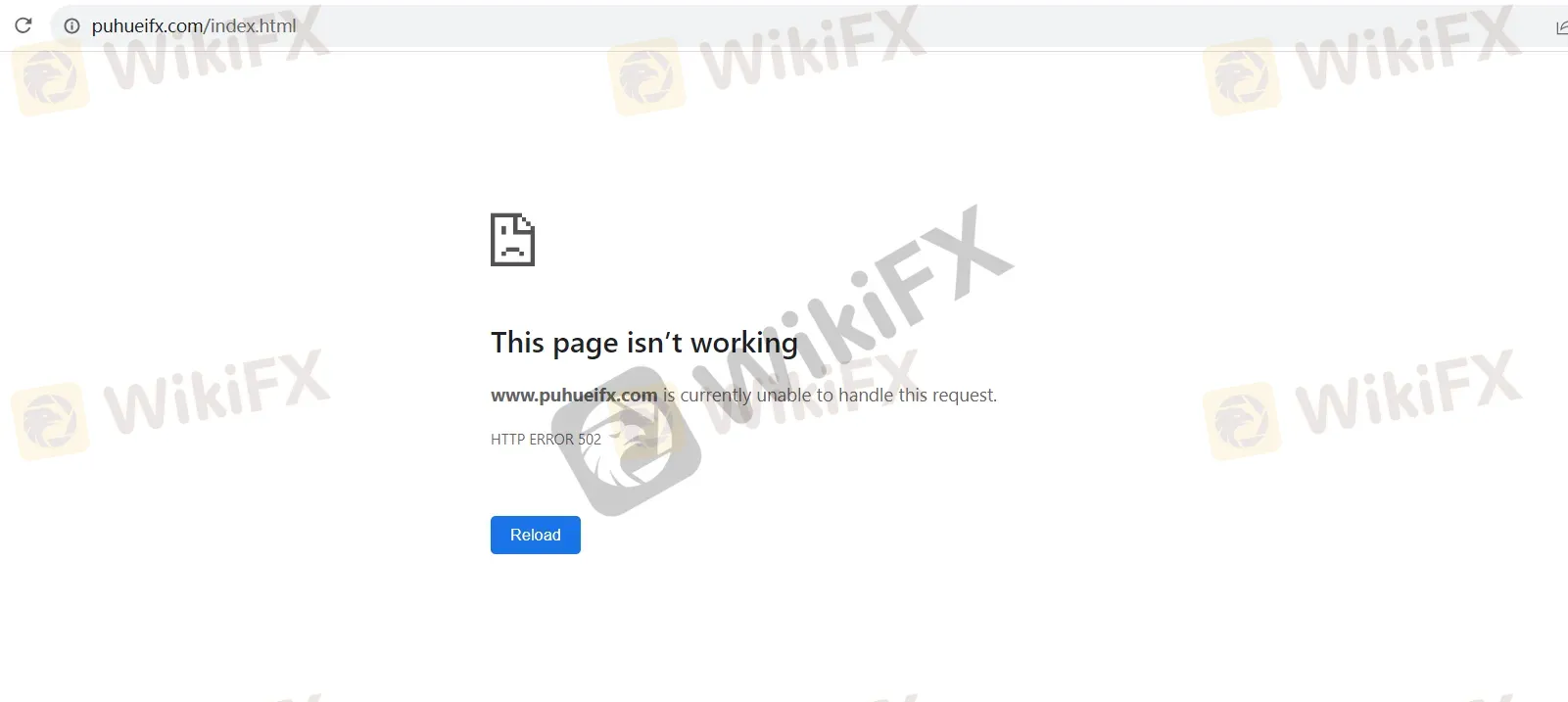

| Website Status | Website downtime reported, affecting accessibility |

Overview

PUHUEI, based in New Zealand, presents a concerning profile for potential traders. Operating as an unregulated broker, it lacks the oversight and accountability that come with regulation, raising questions about investor protection and ethical practices. With a reported maximum leverage of up to 500 and spreads starting at 1.2 pips for major Forex pairs, PUHUEI may attract traders seeking high leverage and competitive spreads. However, the platform's limitations become apparent in areas such as customer support, where direct contact information is limited, and reliance on social media platforms for communication can hinder prompt assistance. Additionally, PUHUEI severely lacks comprehensive educational resources, leaving traders ill-equipped to navigate the complex world of financial markets. Furthermore, the reported website downtime raises concerns about accessibility, casting doubt on its overall reliability. Traders should exercise caution and carefully weigh the risks and benefits when considering PUHUEI as their trading platform.

Regulation

PUHUEI operates as an unregulated broker, which is a crucial aspect that potential traders should carefully evaluate. Unlike regulated brokers that are subject to stringent oversight and compliance with industry standards, unregulated brokers lack this crucial layer of accountability. This absence of regulatory supervision raises concerns about investor protection, ethical practices, and the overall transparency of the brokerage. Traders who engage with unregulated brokers may be exposed to heightened risks, as there are no safeguards in place to ensure fair and responsible conduct. It's important to note that while unregulated brokers can offer certain advantages such as flexibility, they also present a significant downside in terms of the potential lack of recourse in case of disputes or irregularities. Therefore, individuals considering PUHUEI or any unregulated broker should exercise a high degree of caution and thoroughly assess the associated risks before proceeding with any financial transactions.

Pros and Cons

PUHUEI offers a range of advantages, including a diverse selection of over 300 CFD instruments, portfolio diversification opportunities, and competitive spreads. The availability of Demo and Real Accounts caters to traders with different needs, and the user-friendly MetaTrader 4 platform enhances the trading experience. However, notable drawbacks include the absence of regulatory oversight, limited educational resources, and a lack of direct customer support contact information. Allegations of using fake clone licenses and website downtime further raise concerns about reliability. Traders considering PUHUEI should weigh these pros and cons carefully when making their decision.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Instruments

PUHUEI boasts an extensive range of over 300 CFD (Contract for Difference) instruments to cater to the diverse interests and preferences of its traders. These instruments span various financial markets, ensuring traders have abundant options to diversify their portfolios and explore unique trading opportunities.

Forex: PUHUEI empowers traders to participate in the foreign exchange market, offering a broad spectrum of currency pairs for trading.

Cryptos: PUHUEI acknowledges the surging popularity of cryptocurrencies and includes them as trading instruments. Traders can engage in CFD trading of various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others.

Metals: Precious metals such as gold, silver, platinum, and palladium are also available as trading instruments.

Futures: PUHUEI's offering extends to futures contracts, affording traders the opportunity to speculate on the future prices of various commodities, indices, and other assets.

Shares: The platform offers CFDs on shares of diverse companies, providing exposure to the stock market without requiring traders to physically possess the stocks.

Indices: PUHUEI includes a selection of major stock market indices from around the world.

Commodities: In addition to metals and futures contracts, PUHUEI offers a broader range of commodities, encompassing agricultural products, energy resources, and more.

Account Types

PUHUEI offers two distinct account types, catering to traders with varying levels of experience and objectives:

Demo Account: The Demo Account is a valuable tool tailored for traders who are newcomers to online trading or wish to evaluate PUHUEI's platform and test trading strategies without risking real capital.

Real Account: The Real Account is designed for traders ready to engage in live trading with actual funds. It grants access to the complete range of trading instruments and features offered by PUHUEI.

Leverage

PUHUEI offers traders the flexibility to employ leverage, with a maximum limit of up to 500. Leverage is a powerful tool in online trading, allowing traders to control larger positions in the market with a smaller capital investment.

While high leverage can amplify potential profits, it also significantly increases the level of risk associated with trading. Traders should exercise caution and carefully consider their risk management strategies when utilizing leverage.

Spreads & Commissions

Spreads:

Forex: PUHUEI offers spreads starting at 1.2 pips for major currency pairs.

Cryptos: Trading cryptocurrencies on PUHUEI involves spreads starting at 0.5% for major cryptocurrencies.

Metals: PUHUEI provides spreads for precious metals. For example, gold spreads start at 0.15 pips.

Futures: The platform offers spreads for futures contracts.

Indices: Major indices such as the S&P 500 and Dow Jones have spreads starting from 0.5 points.

Commodities: PUHUEI offers different spreads for various commodities.

Commissions:

Real Account: PUHUEI's Real Account offers commission-free trading across all instruments.

Demo Account: PUHUEI's Demo Account allows traders to practice risk-free with virtual funds, and there are no commissions associated with demo trading.

Please note that spreads and commissions may vary based on market conditions and account types.

Deposit & Withdrawal

PUHUEI provides a wide array of deposit and withdrawal options for its clients, catering to diverse preferences and geographical locations. These include credit/debit cards, e-wallets, bank transfers, and more. Traders can withdraw using the same method they used for deposits.

Key features include instant deposits, rapid withdrawals within a 30-minute timeframe, and secure local payment options tailored to specific regions, enhancing overall fund management and security.

Trading Platforms

PUHUEI relies on the widely acclaimed MetaTrader 4 (MT4) trading platform. Utilizing MT4 provides traders with numerous advantages:

User-friendly design

Advanced charting tools

Support for automated trading with Expert Advisors (EAs)

Extensive customization options

Robust security measures

Wide community support

Compatibility with various operating systems

Customer Support

The customer support offered through support@puhueifx.com is notably subpar, characterized by frustratingly slow response times, impersonal and vague communication, and a glaring lack of direct contact options such as a telephone number. This deficiency in support can leave traders feeling stranded in critical situations and hinder their ability to promptly address issues or inquiries, ultimately detracting from the overall reliability and user experience provided by PUHUEI.

Educational Resources

PUHUEI's educational resources are notably lacking. The platform does not provide comprehensive materials to help traders enhance their knowledge and skills in the financial markets. This absence of educational content limits traders' ability to understand trading strategies, market analysis, and risk management.

Compared to many reputable brokers that offer a range of educational content like webinars, tutorials, articles, and videos, PUHUEI does not provide these resources. This places traders using PUHUEI at a disadvantage, especially if they are new to trading or looking to improve their expertise.

The lack of educational resources reflects a lack of commitment on PUHUEI's part to support its clients in making informed trading decisions. In the competitive world of online trading, access to quality educational materials is crucial, and PUHUEI's shortfall in this area is a significant drawback.

Summary

PUHUEI, as an unregulated broker, presents substantial concerns for potential traders. The absence of regulatory oversight raises serious questions about investor protection, ethical practices, and overall transparency. Traders who engage with unregulated brokers like PUHUEI may face elevated risks without the safeguards provided by regulated entities. Furthermore, the platform's customer support is notably subpar, characterized by frustratingly slow response times and a lack of direct contact options, leaving traders feeling unsupported during critical situations. The absence of comprehensive educational resources further hinders traders' ability to navigate financial markets effectively. While PUHUEI offers an extensive range of trading instruments and leverage options, these shortcomings in regulation, support, and education significantly diminish its overall reliability and user experience. Potential traders should exercise extreme caution when considering PUHUEI as their trading platform.

FAQs

Q1: Is PUHUEI regulated?

A1: No, PUHUEI operates as an unregulated broker, which means it lacks oversight and compliance with industry standards that regulated brokers adhere to.

Q2: What trading instruments are available on PUHUEI?

A2: PUHUEI offers a diverse range of over 300 CFD instruments, including Forex, cryptocurrencies, metals, futures, shares, indices, and commodities.

Q3: What are the account types offered by PUHUEI?

A3: PUHUEI provides two account types: a Demo Account for practice with virtual funds and a Real Account for live trading with actual capital.

Q4: What is the maximum leverage available on PUHUEI?

A4: PUHUEI offers a maximum leverage of up to 500, allowing traders to control larger positions with a smaller capital investment.

Q5: Does PUHUEI provide educational resources for traders?

A5: Unfortunately, PUHUEI's educational resources are lacking, leaving traders without comprehensive materials to enhance their knowledge and skills in the financial markets.

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

GMI

CPT Markets

FXTM

Exness

DBG Markets

IC Markets Global

GMI

CPT Markets

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

GMI

CPT Markets

FXTM

Exness

DBG Markets

IC Markets Global

GMI

CPT Markets

ข่าวล่าสุด

ทรัมป์ปัดตอบประเด็นภาวะถดถอยทางเศรษฐกิจจากนโยบายภาษีปัจจุบัน

ดอลลาร์แข็งค่า นักลงทุนจับตาดัชนี CPI สหรัฐฯ

เป็นเทรดเดอร์เงินล้าน ตั้งแต่อายุน้อย เพราะทำ 6 นิสัยนี้

ประกาศเปิดตัวแอป WikiFX เวอร์ชัน 3.6.4

ชาวเน็ตแชร์! ประสบการณ์สูญเงิน 4 แสนเทรดแบบพนัน อัดเงินหวังถอนสุดท้ายหมดตัว

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

WikiFX รีวิวโบรกเกอร์ | BOQ โพสต์นี้มีคำตอบ !

กระทรวงศึกษาธิการสหรัฐฯ จ่อปลดพนักงานครึ่งหนึ่ง ทรัมป์เล็งยุบกระทรวงฯ

ชาวเน็ตแชร์! 3 เหตุการณ์ที่อาจทำให้ได้มุมมองใหม่ๆ ในการเลือกโบรกเกอร์

นักวิเคราะห์เตือน! ราคา Bitcoin หลุดแนวรับสำคัญแล้ว เป้าราคาต่อไปอาจอยู่ที่ $69,000

คำนวณอัตราแลกเปลี่ยน