EuroStandarte

บทคัดย่อ:EuroStandarte, founded in 2020 and headquartered in Poland under the name Pineda International SP ZOO, operates as an unregulated European broker. This lack of regulatory oversight is a significant cause for concern, as it potentially exposes clients to risks related to safety, transparency, and dispute resolution. The minimum deposit requirement for a basic account with EuroStandarte is $250, which is relatively high compared to industry averages. The broker offers a maximum leverage of up to 1:400, which is relatively high and carries increased risk. Unfortunately, specific information about spreads is not provided, raising questions about trading cost transparency. EuroStandarte uses the MetaTrader 4 (MT4) trading platform, known for its user-friendly interface, but it does not offer educational resources for traders. While the broker offers a range of account types and a variety of payment methods, its website is currently not operational, casting doubts about its reliability. It i

| Aspect | Information |

| Registered Country/Area | Poland |

| Founded Year | 2020 |

| Company Name | Pineda International SP ZOO |

| Regulation | Unregulated European Broker |

| Minimum Deposit | $250 (Basic Account) |

| Maximum Leverage | Up to 1:400 |

| Spreads | Information not provided |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex (FX), CFDs, Commodities, Indices, Shares, Options |

| Account Types | Basic, Standard, Business, Premium, VIP |

| Customer Support | Live chat, email (support@eurostandarte.com), phone |

| Payment Methods | Bpay, GiroPay, MasterCard, Wire transfer, others |

| Educational Tools | Not available |

Overview

EuroStandarte, founded in 2020 and headquartered in Poland under the name Pineda International SP ZOO, operates as an unregulated European broker. This lack of regulatory oversight is a significant cause for concern, as it potentially exposes clients to risks related to safety, transparency, and dispute resolution. The minimum deposit requirement for a basic account with EuroStandarte is $250, which is relatively high compared to industry averages. The broker offers a maximum leverage of up to 1:400, which is relatively high and carries increased risk. Unfortunately, specific information about spreads is not provided, raising questions about trading cost transparency. EuroStandarte uses the MetaTrader 4 (MT4) trading platform, known for its user-friendly interface, but it does not offer educational resources for traders. While the broker offers a range of account types and a variety of payment methods, its website is currently not operational, casting doubts about its reliability. It is advisable for traders to exercise caution and explore alternative brokers with proper regulatory credentials to ensure a more secure and trustworthy trading experience.

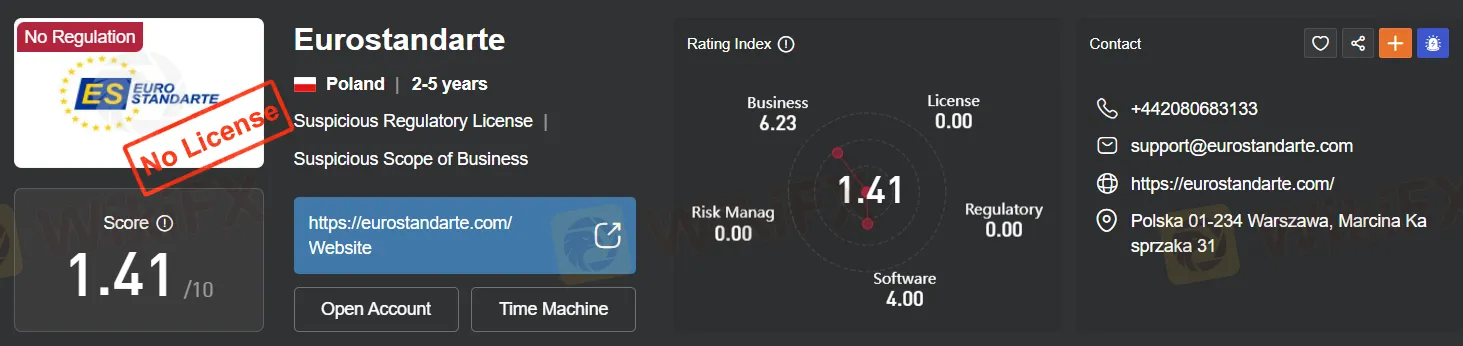

Regulation

EuroStandarte, operating under the company name Pineda International SP ZOO and headquartered in Poland, is an unregulated financial trading platform. The absence of regulatory oversight raises concerns about the safety of client investments, the transparency of operations, and the lack of recourse in the event of disputes or financial issues. It is advisable for potential clients to consider alternative brokers with proper regulatory credentials to ensure a more secure and trustworthy trading experience.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

EuroStandarte presents a mixed picture of strengths and weaknesses. On the positive side, it offers diverse trading instruments, multiple account types with associated benefits, and high leverage options. The MetaTrader 4 platform enhances the trading experience, and the customer support team generally receives positive ratings.

However, significant drawbacks include the lack of regulatory oversight, which raises concerns about client safety and transparency. The broker imposes high minimum deposit requirements for certain account types, and it lacks transparency regarding spreads and commissions. Moreover, EuroStandarte does not provide educational resources for traders, and its non-functional website further adds to doubts about reliability. Traders should exercise caution and consider alternative brokers with regulatory credentials for a more secure trading experience.

Market Instruments

Based on the information provided, EuroStandarte offers a range of trading instruments to its clients. These instruments cover various asset classes, providing traders with diverse investment opportunities. However, specific details about the available instruments, such as spreads, were not provided in the text.

EuroStandarte's trading instrument offerings encompass several asset categories, including Forex (FX), Contracts for Difference (CFDs), commodities, indices, shares, and options. Within the Forex market, traders can likely access a wide array of currency pairs for foreign exchange trading. CFDs provide opportunities to speculate on the price movements of various assets without owning them, which may include indices, commodities, and shares. Additionally, the inclusion of options suggests that traders may have the ability to engage in options trading strategies.

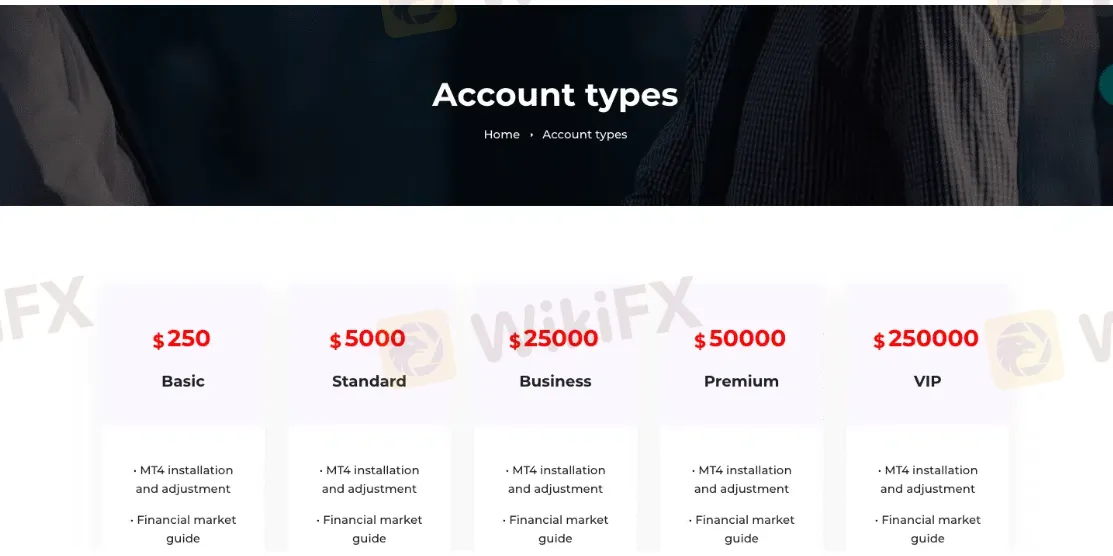

Account Types

EuroStandarte presents a choice of five distinct account types, each with varying minimum deposit requirements:

Basic Account: The entry-level option, requiring a $250 deposit, which is double the industry average and represents a relatively substantial initial investment.

Standard Account: This account tier mandates a minimum deposit of $5,000.

Business Account: To access the Business account, traders must deposit $25,000.

Premium Account: The Premium account comes with a minimum deposit requirement of $50,000.

VIP Account: The most exclusive tier, the VIP account, demands a substantial deposit of $250,000.

While each account type supposedly offers its own set of benefits, including access to a financial market guide, an assigned financial analyst, weekly market reviews, trade insurance, and in-depth market analysis, it's imperative to exercise caution. Given concerns about EuroStandarte's operations and its lack of regulatory oversight, potential traders should conduct thorough due diligence to confirm the actual offerings and conditions associated with each account type before making any decisions.

Leverage

EuroStandarte offers a maximum trading leverage of up to 1:400, as mentioned in the provided information. Leverage allows traders to control larger positions with a relatively smaller amount of capital. In this case, a leverage of 1:400 means that for every $1 in the trader's account, they can potentially control a position worth up to $400 in the market. While high leverage can amplify potential profits, it also increases the level of risk and potential losses. Traders should use leverage cautiously and be aware of the associated risks, especially in volatile markets. The availability of such high leverage levels suggests that EuroStandarte caters to traders who may seek more substantial market exposure, but it also underscores the importance of risk management when using leverage.

Spreads and Commissions

EuroStandarte's lack of transparency regarding its spreads raises significant concerns. While the broker claims to offer “tight” spreads, this vague description does not provide potential traders with the necessary information to evaluate how their trading costs compare to industry standards. The absence of specific details about spreads is a notable red flag and adds to the skepticism surrounding this broker.

In addition to the issue of spreads, EuroStandarte's maximum leverage of up to 1:400 is relatively high when compared to the industry's average. While high leverage can amplify potential profits, it also involves a heightened level of risk, increasing the potential for significant losses. Traders should exercise caution when trading with such high leverage levels, as it can lead to rapid and substantial capital depletion, especially in volatile markets.

Overall, the lack of transparency regarding spreads, combined with the relatively high maximum leverage, underscores the importance of thorough research and risk management for traders considering EuroStandarte as their brokerage choice. It is advisable for traders to seek out brokers that provide clear and detailed information about trading costs and leverage, helping them make informed decisions while managing their risk effectively.

Deposit & Withdrawal

EuroStandarte provides a range of deposit and withdrawal options to facilitate efficient and timely transactions for its clients. While the available information does not specify details like fees, processing times, or transaction limits, the broker offers several payment channels for clients to choose from. These include Bpay, GiroPay, MasterCard, Wire transfer, and potentially other methods. To ensure a smooth financial experience, clients are advised to carefully review the broker's terms and conditions for each payment method. This includes understanding any potential fees, transaction limits, and processing times that may apply to both deposits and withdrawals. For comprehensive and specific information on transaction details, clients can refer to the broker's official website or reach out to the broker directly.

Trading Platforms

EuroStandarte offers the popular MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and powerful features. With MT4, traders can access and customize the platform to their liking, benefiting from essential tools like indicators and signal alerts. Moreover, its mobile compatibility ensures traders can conveniently trade and monitor the markets using their smartphones. This versatility enhances the overall trading experience and flexibility, making MT4 a valuable asset for EuroStandarte's clients.

Customer Support

EuroStandarte offers multiple avenues for client support. You can access their live chat tool for instant assistance at any time. Additionally, you have the option to contact them via email at support@eurostandarte.com or make direct phone calls. Their dedicated support team is readily available to assist with any inquiries or concerns. Reviewers have generally rated their support with four out of five stars, highlighting the quality assistance provided by this trading platform's support team. It's a testament to the excellent customer service you can expect from EuroStandarte.

Educational Resources

EuroStandarte does not appear to offer educational resources based on the information provided. Traders looking for educational materials, such as tutorials, webinars, or educational articles, may need to explore alternative sources or consider brokers that provide comprehensive educational resources to support their trading journey.

Summary

EuroStandarte, operating under the company name Pineda International SP ZOO in Poland, presents a concerning profile as an unregulated financial trading platform. The absence of regulatory oversight raises significant questions about the safety of client investments and the transparency of its operations, leaving traders without essential protections in case of disputes or financial issues. While the broker offers a range of trading instruments across various asset classes, including Forex, CFDs, and more, the lack of specific details about spreads and commissions is a red flag. Additionally, EuroStandarte provides a choice of five account types, but the high minimum deposit requirements and doubts about the accuracy of the associated benefits require cautious consideration. The broker's maximum leverage of up to 1:400 carries elevated risks, especially given the lack of regulatory oversight. Furthermore, the absence of transparency regarding spreads is concerning. While EuroStandarte offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface, it falls short in providing educational resources to support traders. Despite a generally positive customer support rating, the overall outlook is marred by the fact that the broker's website is no longer functional, further raising doubts about its reliability and credibility. Traders are strongly advised to explore alternative brokers with proper regulatory credentials to ensure a safer and more trustworthy trading experience.

FAQs

Q1: Is EuroStandarte a regulated broker?

A1: No, EuroStandarte is an unregulated financial trading platform, which raises concerns about client protection and transparency.

Q2: What is the minimum deposit required to open an account with EuroStandarte?

A2: The minimum deposit varies depending on the account type, with the basic account requiring $250 and the VIP account demanding a substantial $250,000 deposit.

Q3: Does EuroStandarte offer educational resources for traders?

A3: No, based on the available information, EuroStandarte does not appear to provide educational materials or resources for traders.

Q4: What is the maximum leverage offered by EuroStandarte?

A4: EuroStandarte offers a maximum trading leverage of up to 1:400, which is relatively high and carries increased risk.

Q5: Is EuroStandarte's customer support responsive?

A5: EuroStandarte offers multiple support channels, including live chat, email, and phone support. Reviewers have generally rated their support positively, highlighting its quality and responsiveness.

อ่านเพิ่มเติม

เทรด Forex เลือก ‘Leverage’ เทรดยังไง เท่าไหร่ดี?

รู้หรือไม่ว่าสิ่งหนึ่งที่ทำให้ตลาด Forex ทำกำไรได้สูงปี๊ดดดดคือ ‘Leverage’ มันสามารถทำให้คุณได้กำไรเป็นร้อยเป็นพันเท่าจากเงินเพียงไม่กี่บาท แต่นี่ก็เป็นดาบสองคม เพราะมันก็เพิ่มความเสี่ยงให้สูงปี๊ดเช่นกัน! ตกลง Leverage มันคืออะไร ทำงานยังไง แล้วเทรดเดอร์ต้องเลือก Leverage เท่าไหร่ถึงจะดี?

ขอเตือนเป็นครั้งสุดท้ายกับโบรกเกอร์นี้ว่าให้หลีกเลี่ยง!

โบรกเกอร์เจ้านี้เป็นโบรกเกอร์ที่มีประวัติไม่ดีมาค่อนข้างนาน เพราะนักลงทุนหลายรายไม่สามารถถอนเงินออกมาได้ตั้งแต่ปีที่แล้ว

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

Eightcap

Pepperstone

CXM Trading

FXTM

Exness

DBG Markets

Eightcap

Pepperstone

CXM Trading

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

Eightcap

Pepperstone

CXM Trading

FXTM

Exness

DBG Markets

Eightcap

Pepperstone

CXM Trading

ข่าวล่าสุด

ทรัมป์ยืนยันมาตรการภาษีของเม็กซิโก และแคนาดาจะมีผลบังคับใช้ในวันนี้

“ทรัมป์” เตือนญี่ปุ่น-จีนอย่าลดค่าเงินพร่ำเพรื่อ ขู่เก็บภาษีชดเชยเสียเปรียบ

ทองปิดบวก $19.50 สงครามการค้าหนุนแรงซื้อต่อเนื่อง

รู้หรือไม่? ใครบ้างที่ต้องเสียภาษีจากการใช้คริปโต

7 ความเชื่อผิดๆ เกี่ยวกับบิตคอยน์ อันตรายจริงหรือแค่เรื่องลวง?

ถ้ารู้จัก "เงินเย็น" ก็เป็นนักเทรดที่ดีได้ เพราะเป็นเรื่องสำคัญกับการลงทุน

ทรัมป์อาจเปิดทางเจรจาลดภาษีให้เม็กซิโกและแคนาดาในวันนี้

WikiFX รีวิวโบรกเกอร์ | AXEL โพสต์นี้มีคำตอบ !

ทองปิดบวก $5.40 รับแรงซื้อสินทรัพย์ปลอดภัย-จับตาจ้างงานสหรัฐฯ

นี่อาจเป็น NFT ตัวแรกของโลก? หลังพบเบาะแสคนขาย JPG แลก BTC

คำนวณอัตราแลกเปลี่ยน