Fiper

บทคัดย่อ:Fiper is a brokerage company specializing in global financial market trading. The tradable instruments include Forex, Commodities, Metals, Indices, Shares, and Cryptocurrency. The broker also provides two real accounts with a maximum leverage of 1:500 . The minimum spread is 0.0 pips, and the minimum deposit is $250.

| FiperReview Summary | |

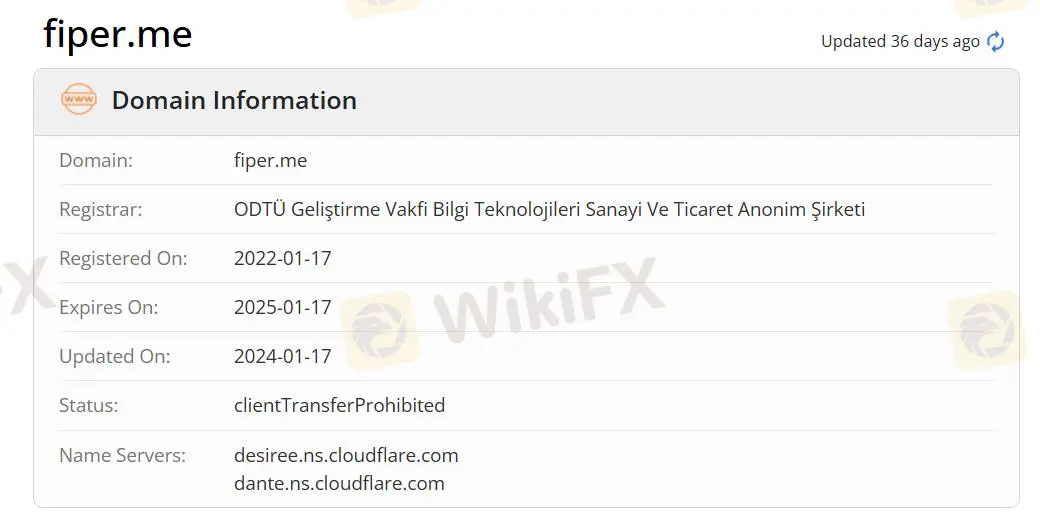

| Founded | 2022-01-17 |

| Registered Country/Region | Mauritius |

| Regulation | Offshore regulated |

| Market Instruments | Forex/Commodities/Metals/Indices/Shares/Cryptocurrency |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | Fiper Ctrader(Android/iOS/Desktop/PC/Web ) |

| Min Deposit | $250 |

| Customer Support | Social media: Facebook/Instagram/LinkedIn/Twitter/YouTube |

| Live chat | |

Fiper Information

Fiper is a brokerage company specializing in global financial market trading. The tradable instruments include Forex, Commodities, Metals, Indices, Shares, and Cryptocurrency. The broker also provides two real accounts with a maximum leverage of 1:500 . The minimum spread is 0.0 pips, and the minimum deposit is $250.

Pros and Cons

| Pros | Cons |

| Swap free | Offshore regulated |

| Leverage up to 1:500 | Unspecific fee information |

| 24/7 customer support | MT4/MT5 unavailable |

| Regulated | |

| Spread from 0.0 pips | |

| Demo account available | |

| Various tradable instruments |

Is Fiper Legit?

Fiper is offshore regulated under license number GB23201759, making it safer than the regulated one.

What Can I Trade on Fiper?

Fiper offers over 1000 market instruments, including Forex, Commodities, Metals, Indices, Shares, and Cryptocurrency.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| Cryptocurrency | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

Fiper has two account types: pro and VIP. Traders who want low spreads can choose a VIP account, while those with a small budget can open a pro account. Muslims are allowed to open Islamic accounts without swaps. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only.

| Account Type | Pro | VIP |

| Minimum Deposit | $250 | $5000 |

| Spread from | 0.1 pips | 0.0 or Custom |

| Commission | Form 5$ | Form 3$ |

| Maximum leverage | 1:500 | 1:500 |

| Stop out level | 30% | 30% |

| Minimum lot size | 0.01 | 0.01 |

| Maximum lot size | 100 | 150 |

| Island Account | ✔ | ✔ |

| Deposit | Instant | Instant |

| Withdraw | 1-5 working day | 1-12hr(working day) |

Fiper Fees

The spread tarts from 0.0 pips, the commission is from $3, and swap free. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:500 meaning that profits and losses are magnified 500 times.

Trading Platform

Fiper provides a propriety Fiper Ctrader trading platform available in Android, iOS, Desktop, PC, and Web to trade, instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported | Available Devices |

| Fiper Ctrader | ✔ | Android/iOS/Desktop/PC/Web |

Deposit and Withdrawal

The first deposit amount must be $250 or above. Fiper accepts Visa, MasterCard, Ethereum, Bank transfer, Bitcoin, and Perfect Money for deposit and withdrawal. The transfer processing times are up to 1 to 5 working days. However, the associated fees are unknown.

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

Pepperstone

STARTRADER

FXTM

Exness

DBG Markets

IC Markets Global

Pepperstone

STARTRADER

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

Pepperstone

STARTRADER

FXTM

Exness

DBG Markets

IC Markets Global

Pepperstone

STARTRADER

ข่าวล่าสุด

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

รวมรีวิวโบรกเกอร์ประจำสัปดาห์ โบรกเกอร์ไหนดี โพสต์นี้มีคำตอบ !

ข้อมูลเศรษฐกิจสหรัฐฯ ทำราคาน้ำมันร่วง รัสเซีย-ยูเครนเจรจาสันติภาพ

คำนวณอัตราแลกเปลี่ยน