EPFX

บทคัดย่อ:EPFX, a securities firm incorporated in South Africa in 2001, offers 300+ trading instruments, 6 account types and 4 trading platforms. In addition, it supports spreads from 0 points and commission-free trading. At present, the regulatory status of EPFX is abnormal and has been judged to be "Exceeded".

| EPFXReview Summary | |

| Founded | 2001 |

| Registered Country/Region | South Africa |

| Regulation | Exceeded |

| Market Instruments | ForexCommoditiesIndicesShares CFDsCrypto CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 0.2 (EUR/USD) |

| Trading Platform | MT5C-TraderCopy TraderDemo Trader |

| Min Deposit | $25 |

| Customer Support | Phone: +1888 239 7924 |

| Email: support@epfx.com | |

| Social Media: Instagram, Facebook, Youtube | |

| Physical Address: 1Hood Avenue Rosebank Johannesburg Gauteng 2196 | |

EPFX Information

EPFX, a securities firm incorporated in South Africa in 2001, offers 300+ trading instruments, 6 account types and 4 trading platforms. In addition, it supports spreads from 0 points and commission-free trading. At present, the regulatory status of EPFX is abnormal and has been judged to be “Exceeded”.

Pros and Cons

| Pros | Cons |

| 300+ instruments | Abnormal regulatory state |

| 6 types of accounts | A withdrawal fee is charged |

| Some accounts spread from 0.0 | |

| Some accounts are commission-free | |

| 12 different ways to deposit or withdraw money |

Is EPFX Legit?

| Regulated Country/Region |  |

| Regulated Authority | FSCA |

| Regulated Entity | EPFX (PTY) LTD |

| License Type | Financial Service Corporate |

| License Number | 53180 |

| Current Status | Exceeded |

What Can I Trade on EPFX?

EPFX offers 300+ instruments, including 36 Forex, 5 crypto CFDs,18 share CFDs,4 commodities,6 indices and more.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares CFDs | ✔ |

| Crypto CFDs | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

Account Types

EPFX has 6 types of accounts for traders to choose from: RAW Spreads, Zero Commission, Hybrid, Islamic, 50% Deposit Bonus, Cent Account.

They have a minimum deposit of $25 and a maximum leverage of 1:500.

| Account Types | RAW Spreads | Zero Commission | Hybrid | Islamic | 50% Deposit Bonus | Cent Account |

| Spreads | From 0.0 | - | From 0.5 | From 0.0 | From 0.0 | - |

| Commission | - | $0.00 | - | - | - | $0.00 |

| Minimum Deposit | $25 | $25 | $25 | $25 | $25 | $25 |

| Deposit Fees | $0 | $0 | $0 | $0 | $0 | $0 |

| Leverage | 1:25 to 1:500 | 1:25 to 1:500 | 1:25 to 1:500 | 1:25 to 1:500 | 1:200 to 1:500 | 1:25 to 1:500 |

EPFX Fees

The starting spread of the account ranges from 0.0 to 0.5. There are no deposit fees for all accounts. Zero Commission and Cent Account do not charge commission.

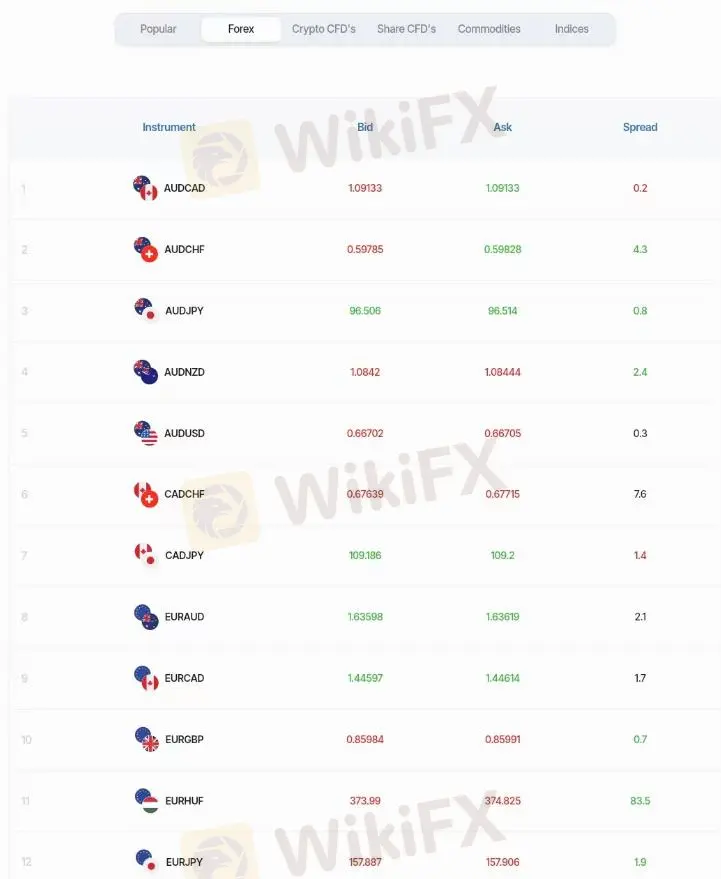

In forex pairs, the spread of EUR/USD is 0.2, and the rest of the forex pairs range from 0.2 to 5875.

| Instrument | Spread |

| AUDCAD | 0.2 |

| AUDCHF | 4.3 |

| AUDJPY | 0.8 |

| AUDNZD | 2.4 |

| AUDUSD | 0.3 |

| CADCHF | 7.6 |

| CADJPY | 1.4 |

| EURAUD | 2.1 |

| EURCAD | 0.7 |

| EURGBP | 0.7 |

| EURHUF | 83.5 |

| EURJPY | 1.9 |

| ... | ... |

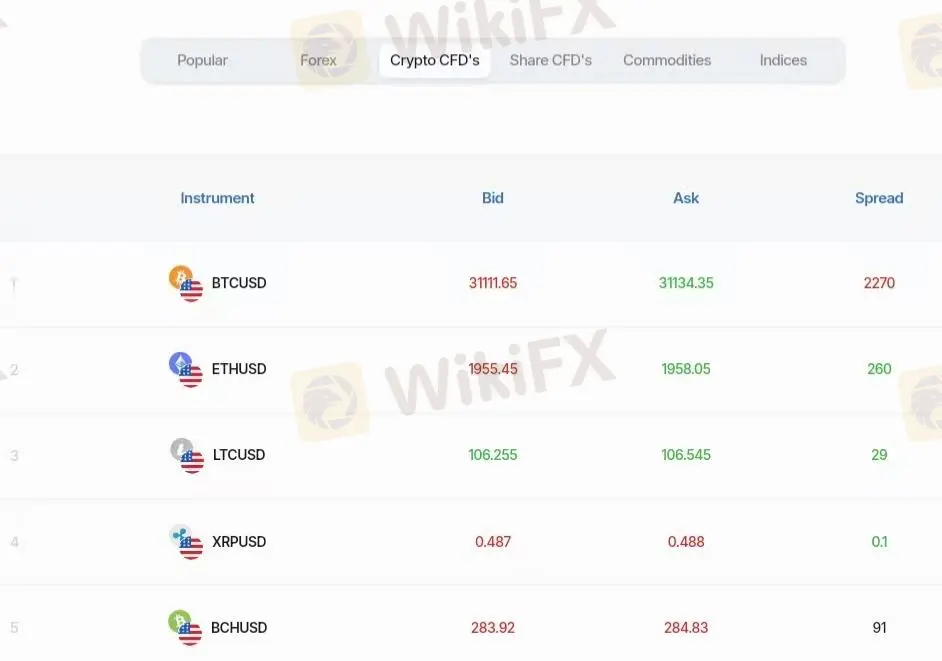

The spread of Crypto CFDs ranges from 0.1 to 2270.

| Instrument | Spread |

| BTCUSD | 2270 |

| ETHUSD | 260 |

| LTCUSD | 29 |

| XRPUSD | 0.1 |

| BCHUSD | 91 |

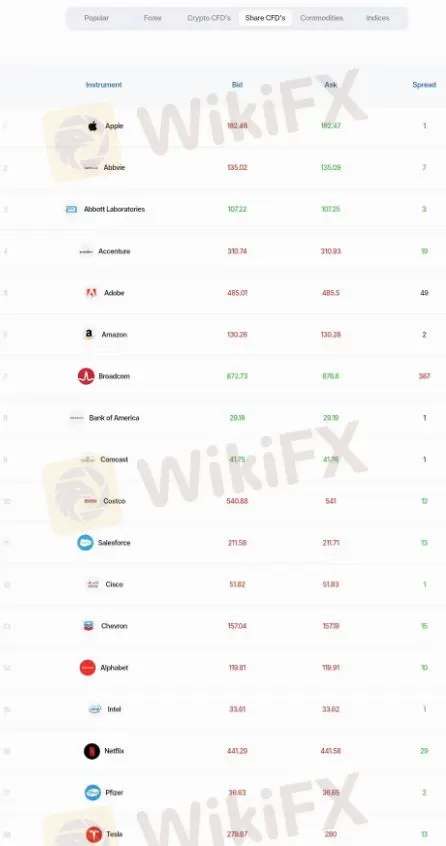

The spread of Share CFDs ranges from 1 to 387.

| Instrument | Spread |

| Apple | 0.01 |

| AbbVie | 0.03 |

| Abbott Laboratories | 0.03 |

| Accenture | 0.09 |

| Adobe | 0.49 |

| Amazon | 0 |

| Broadcom | 0.87 |

| Bank of America | 0.01 |

| Carvana | 0 |

| Codelco | 0.12 |

| Salesforce | 0.13 |

| Cisco | 0.01 |

| Chevron | 0.05 |

| Alphabet | 0.1 |

| Intel | 0.01 |

| Netflix | 0.29 |

| Pfizer | 0.02 |

| Tesla | 0.13 |

Commodity spreads range from 2.5 to 20.

| Instrument | Spread |

| Gold | 20 |

| Silver | 2.5 |

| US Crude Oil | 3.7 |

| Brent Crude Oil | 11.3 |

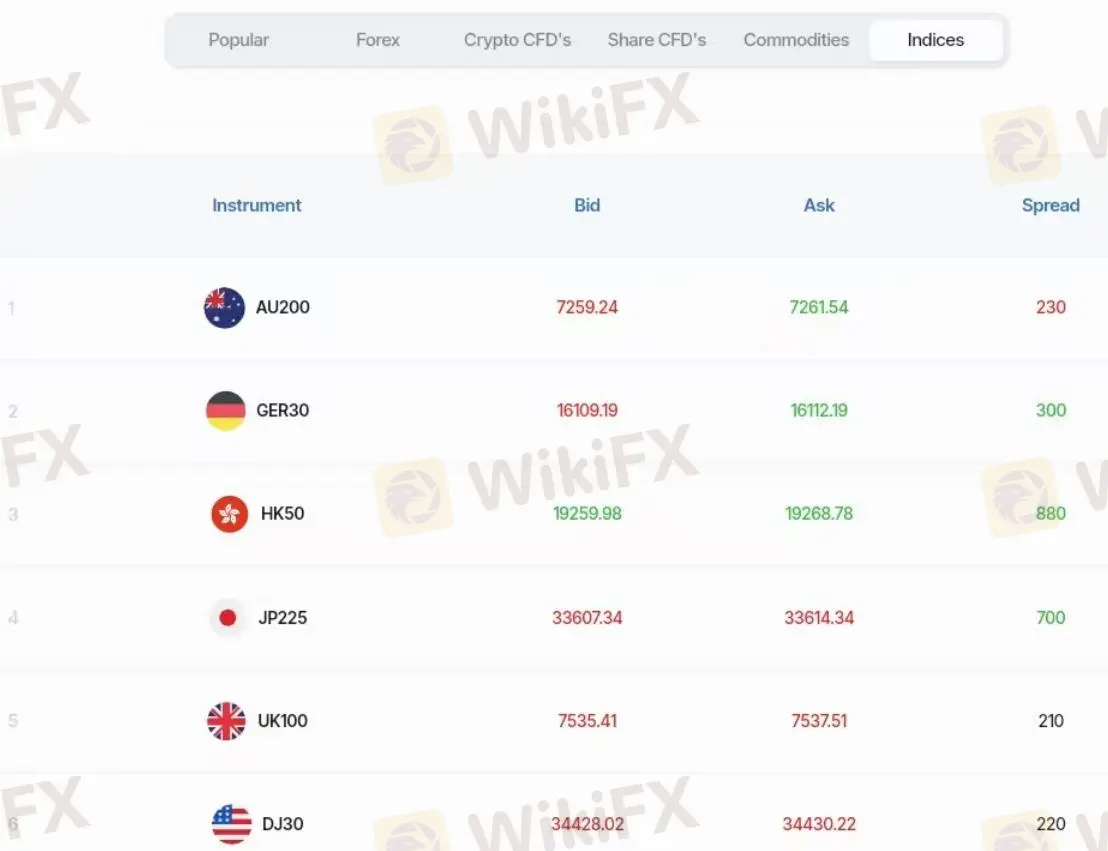

Indices spreads range from 210 to 800.

| Instrument | Spread |

| AU200 | 230 |

| GER30 | 300 |

| HK50 | 880 |

| JP225 | 700 |

| UK100 | 210 |

| DJ30 | 220 |

Trading Platform

EPFX offers four trading platforms: MT5, C-Trader, Copy Trader, Demo Trader. They can be used on desktop or mobile.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile | All traders |

| C-Trader | ✔ | Desktop, Mobile | All traders |

| Copy Trader | ✔ | - | All traders |

| Demo Trader | ✔ | - | Beginners |

| MT4 | ❌ |

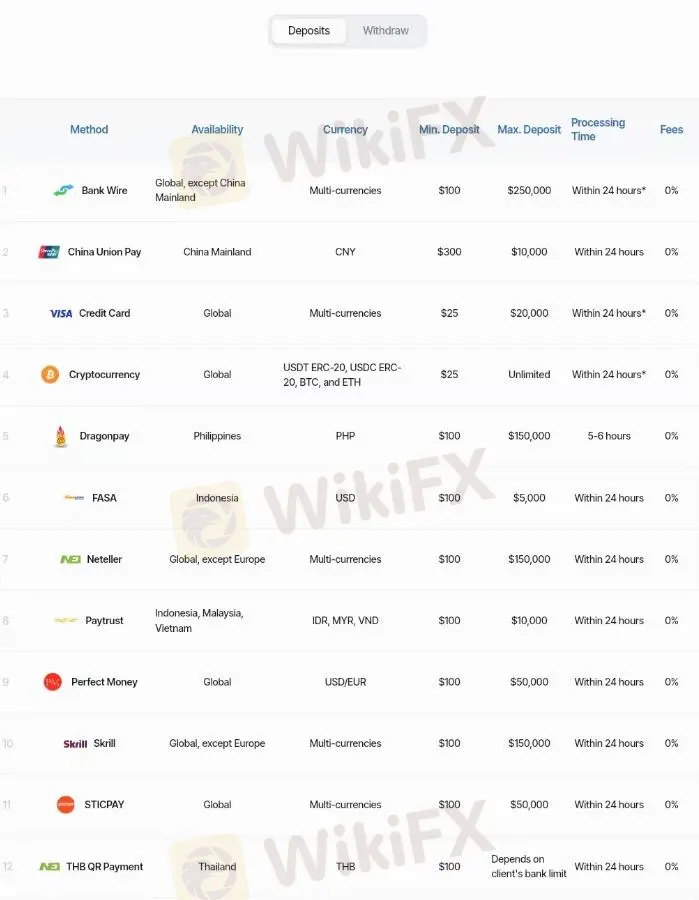

Deposit and Withdrawal

EPFX has 12 deposit options, most with a minimum deposit of $100 and a few with a minimum deposit of $25 or $300.

| Deposit Method | Availability | Currency | Min. Deposit | Max. Deposit | Processing Time | Fees |

| Bank Wire | Global, except China Mainland | Multi-currencies | $100 | $250,000 | Within 24 hours | 0% |

| China Union Pay | China Mainland | CNY | $300 | $10,000 | Within 24 hours | 0% |

| VISA Credit Card | Global | Multi-currencies | $25 | $20,000 | Within 24 hours | 0% |

| Cryptocurrency | Global | USDT ERC-20, USDC ERC-20, BTC, ETH | $25 | Unlimited | Within 24 hours | 0% |

| Dragonpay | Philippines | PHP | $100 | $150,000 | 5-6 hours | 0% |

| FASA | Indonesia | USD | $100 | $5,000 | Within 24 hours | 0% |

| Neteller | Global, except Europe | Multi-currencies | $100 | $150,000 | Within 24 hours | 0% |

| Paytrust | Indonesia, Malaysia, Vietnam | IDR, MYR, VND | $100 | $10,000 | Within 24 hours | 0% |

| Perfect Money | Global | USD/EUR | $100 | $50,000 | Within 24 hours | 0% |

| Skrill | Global, except Europe | Multi-currencies | $100 | $150,000 | Within 24 hours | 0% |

| STICPAY | Global | Multi-currencies | $100 | $50,000 | Within 24 hours | 0% |

| THB QR Payment | Thailand | THB | $100 | Depends on client's bank limit | Within 24 hours | 0% |

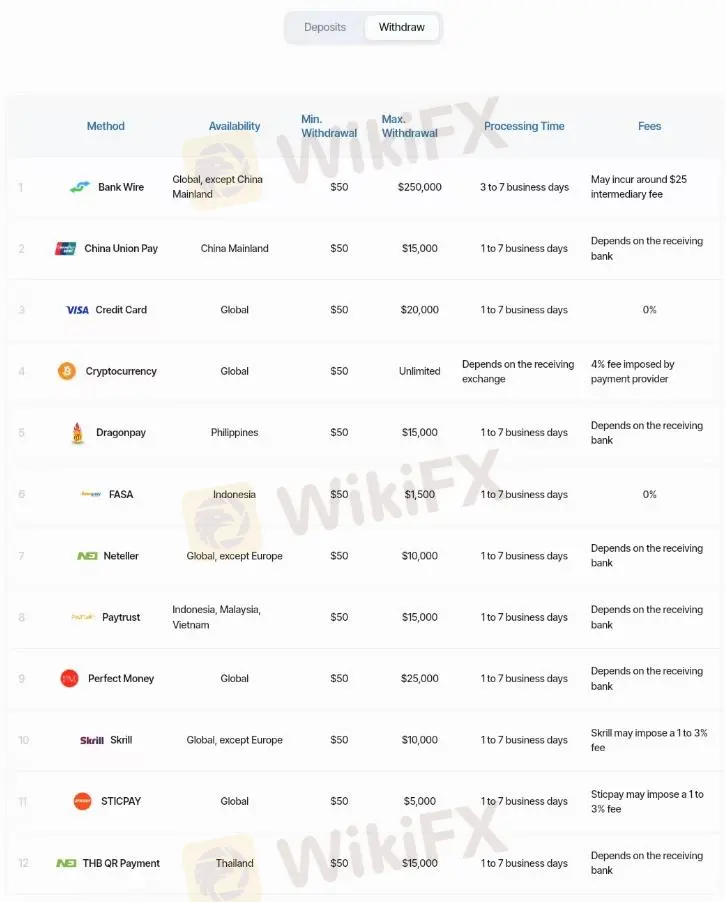

EPFX also has 12 withdrawal methods, with a minimum withdrawal amount of $50, and a certain withdrawal fee is charged on demand.

| Withdrawal Method | Availability | Min. Withdrawal | Max. Withdrawal | Processing Time | Fees |

| Bank Wire | Global, except China Mainland | $50 | $250,000 | 3 to 7 business days | May incur around $25 intermediary fee |

| China Union Pay | China Mainland | $50 | $15,000 | 1 to 7 business days | Depends on the receiving bank |

| VISA Credit Card | Global | $50 | $20,000 | 1 to 7 business days | 0% |

| Cryptocurrency | Global | $50 | Unlimited | Depends on the receiving exchange | 4% fee imposed by payment provider |

| Dragonpay | Philippines | $50 | $15,000 | 1 to 7 business days | Depends on the receiving bank |

| FASA | Indonesia | $50 | $1,500 | 1 to 7 business days | 0% |

| Neteller | Global, except Europe | $50 | $10,000 | 1 to 7 business days | Depends on the receiving bank |

| Paytrust | Indonesia, Malaysia, Vietnam | $50 | $15,000 | 1 to 7 business days | Depends on the receiving bank |

| Perfect Money | Global | $50 | $25,000 | 1 to 7 business days | Depends on the receiving bank |

| Skrill | Global, except Europe | $50 | $10,000 | 1 to 7 business days | Skrill may impose a 1 to 3% fee |

| STICPAY | Global | $50 | $5,000 | 1 to 7 business days | Sticpay may impose a 1 to 3% fee |

| THB QR Payment | Thailand | $50 | $15,000 | 1 to 7 business days | Depends on the receiving bank |

Wiki โบรกเกอร์

Wiki โบรกเกอร์

คำนวณอัตราแลกเปลี่ยน