Oriondeal

บทคัดย่อ:Oriondeal, established in 2023 and headquartered in the Marshall Islands, represents a new entrant in the online trading world. It offers a range of tradable assets including currencies, crypto, gold, oil, and stocks, aiming to cater to a broad spectrum of traders. With a maximum leverage of 1:100 and support for trading on the popular MT4 platform, Oriondeal positions itself as a potentially attractive option for traders looking for diverse trading instruments. However, it's crucial to note that Oriondeal operates without any regulatory oversight, a significant factor that raises concerns about the safety of funds and the reliability of the trading environment it offers. Potential traders should consider the risks associated with trading with an unregulated broker and thoroughly research before engaging in trading activities.

| Oriondeal | Basic Information |

| Company Name | Oriondeal |

| Founded | 2023 |

| Headquarters | Marshall Islands |

| Regulations | Unregulated |

| Tradable Assets | Currencies, Crypto, Gold, Oil, Stocks |

| Account Types | Not Specified |

| Minimum Deposit | €250 |

| Maximum Leverage | 1:100 |

| Spreads | Not Specified |

| Commission | Not Specified |

| Deposit Methods | Bitcoin |

| Trading Platforms | MT4 |

| Customer Support | Phone: +44 7960579274,Email: support@orionusdeal.com |

| Education Resources | Not Specified |

| Bonus Offerings | Not Specified |

Overview of Oriondeal

Oriondeal, founded in 2023 and headquartered in the Marshall Islands, presents itself as a trading platform without regulatory oversight, offering a broad spectrum of tradable assets including currencies, cryptocurrencies, gold, oil, and stocks. It attracts traders with a leverage of up to 1:100 and a relatively low minimum deposit requirement of €250, exclusively accepting Bitcoin for transactions. The brokerage facilitates trading on the renowned MetaTrader 4 platform, known for its comprehensive tools and features, and provides customer support through phone and email. Despite these offerings, the lack of regulation underscores the importance of due diligence by potential clients to navigate the inherent risks of trading with an unregulated entity.

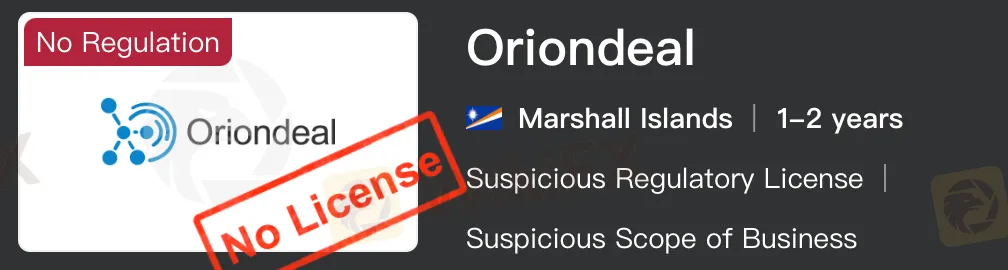

Is Oriondeal Legit?

Oriondeal is not regulated. It is important to note that this broker does not have any valid regulation, which means it operates without oversight from recognized financial regulatory authorities. Traders should exercise caution and be aware of the associated risks when considering trading with an unregulated broker like Oriondeal, as there may be limited avenues for dispute resolution, potential safety and security concerns regarding funds, and a lack of transparency in the broker's business practices.

Pros and Cons

Oriondeal emerges as an intriguing option for traders looking for diversity in trading instruments, including currencies, crypto, gold, oil, and stocks, all accessible via the acclaimed MetaTrader 4 platform. Its leverage offering of up to 1:100 and the unique method of Bitcoin for transactions cater to modern trading preferences. However, the absence of regulatory oversight poses significant concerns about the security of trader funds and the transparency of operations. Additionally, the scarcity of detailed information on spreads and commissions could hinder traders' ability to make fully informed decisions.

| Pros | Cons |

|

|

|

|

|

|

Trading Instruments

Oriondeal provides a diverse range of trading instruments including currencies (forex), cryptocurrencies, gold, oil, and stocks.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks |

| Oriondeal | Yes | Yes | Yes | No | No | Yes |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes |

Leverage

Oriondeal offers a leverage ratio of 1:100 for its trading services.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Oriondeal | FxPro | IC Markets | RoboForex |

| Maximum Leverage | 1:100 | 1:200 | 1:500 | 1:2000 |

Deposit & Withdraw Methods

Oriondeal supports Bitcoin as its payment method, with a minimum deposit requirement of €250 for starting trading activities.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | Oriondeal | Exnova | Tickmill | GO Markets |

| Minimum Deposit | €250 | $10 | $100 | $200 USD |

Trading Platforms

Oriondeal offers the MetaTrader 4 (MT4) platform for trading, renowned for its advanced trading features, analytical tools, and automated trading capabilities.

Customer Support

Oriondeal provides customer support through phone at +44 7960579274 and email at support@orionusdeal.com, ensuring clients can reach out for assistance with their trading accounts and platform queries.

Conclusion

Oriondeal presents a mixed proposition for traders. On one hand, its offering of a diverse range of trading instruments, the use of the popular MetaTrader 4 platform, and the provision of up to 1:100 leverage are notable advantages that cater to various trading strategies and preferences. On the other hand, the absence of regulatory oversight is a significant drawback, raising concerns about the safety of client funds and overall transparency of the broker's operations. This lack of regulation may deter prospective clients seeking a secure and transparent trading environment. Ultimately, while Oriondeal may offer attractive trading conditions, the potential risks associated with its unregulated status cannot be overlooked, and traders should proceed with caution.

FAQs

Q: Is Oriondeal regulated?

A: Oriondeal does not have any regulatory oversight, which is important to consider for those concerned with the security of their investments

Q: What is the minimum deposit required to start trading with Oriondeal?

A: minimum deposit of €250 is required to commence trading with Oriondeal.

Q: Which assets can I trade with Oriondeal?

A: You can trade currencies, cryptocurrencies, gold, oil, and stocks with Oriondeal.

Q: How can I deposit funds into my Oriondeal account?

A: Deposits into Oriondeal accounts can be made using Bitcoin.

Q: What is the maximum leverage available at Oriondeal?

A: Oriondeal offers leverage of up to 1:100.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

GMI

Pepperstone

FXTM

Exness

DBG Markets

IC Markets Global

GMI

Pepperstone

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

IC Markets Global

GMI

Pepperstone

FXTM

Exness

DBG Markets

IC Markets Global

GMI

Pepperstone

คำนวณอัตราแลกเปลี่ยน