Mazi Finance

บทคัดย่อ:Mazi Finance, established in 2023 and headquartered in the United Arab Emirates, offers a range of trading assets including Forex, Stocks, Cryptocurrencies, Commodities, and Indices. With account types such as Standard, Professional, and Raw Spread, traders can choose the option that best suits their needs. The platform boasts competitive advantages like low minimum deposits starting from $50, tight spreads from 0.0 pips, and maximum leverage of up to 1:100.

| Aspect | Information |

| Company Name | Mazi Finance |

| Registered Country/Area | United Arab Emirates |

| Founded Year | 2023 |

| Regulation | Not regulated |

| Market Instruments | Forex, Stocks, Cryptocurrencies, Commodities, Indices |

| Account Types | Standard, Professional, Raw Spread |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1:400 |

| Spreads | From 0.0 pips |

| Trading Platforms | MT5, Web Terminal, Android & iOS app |

| Customer Support | Phone(+44 7700312787 or landline at +971 4 256 1911), Email(support@mazifinance.com), Online chat |

| Deposit & Withdrawal | Mastercard, Visa, and Binance Pay |

| Educational Resources | Economic Calendar, News, Investment Calculator |

Overview of Mazi Finance

Mazi Finance, established in 2023 and headquartered in the United Arab Emirates, offers a range of trading assets including Forex, Stocks, Cryptocurrencies, Commodities, and Indices. With account types such as Standard, Professional, and Raw Spread, traders can choose the option that best suits their needs. The platform boasts competitive advantages like low minimum deposits starting from $50, tight spreads from 0.0 pips, and maximum leverage of up to 1:400.

Regulatory Status

Mazi Finance operates without regulation, which raises risks regarding transparency and oversight.

Pros and Cons

| Pros | Cons |

| Powerful platforms for every investor | Lack of regulatory oversight |

| Free real-time charts and market news | |

| 1:400 Maximum Leverage | |

| 24/5 Customer Support |

Pros:

- Powerful platforms for every investor: Mazi Finance offers robust trading platforms suitable for traders of all levels, providing advanced features and tools to enhance trading experience.

- Free real-time charts and market news: Traders can access real-time charts and market news without any additional cost, allowing them to stay updated with the latest market trends and make informed trading decisions.

- 1:100 Maximum Leverage: Mazi Finance offers a maximum leverage of 1:100, allowing traders to amplify their trading positions with a relatively small amount of capital. This high leverage can potentially increase profits, but it also comes with increased risk.

- 24/5 Customer Support: The platform provides round-the-clock customer support services, available five days a week. Traders can reach out to customer support representatives for assistance with account-related queries, technical issues, ensuring a seamless trading experience.

Cons:

- Lack of regulatory oversight: Mazi Finance operates without regulatory oversight, which means it may lack the necessary regulatory compliance measures to ensure the safety and security of traders' funds and personal information.

Market Instruments

Mazi Finance offers over 500 trading instruments across various asset classes, including:

- Stocks: CFDs on leading global stocks for price speculation.

- Cryptos: Trade digital assets like Bitcoin, Ethereum, and Tether.

- Forex: Major, minor, and exotic currency pairs.

- Indices: Exposure to entire industries for broader market trends.

- Metals & Commodities: Gold, silver, oil, and natural gas for hedging and safe-haven investments.

Account Types

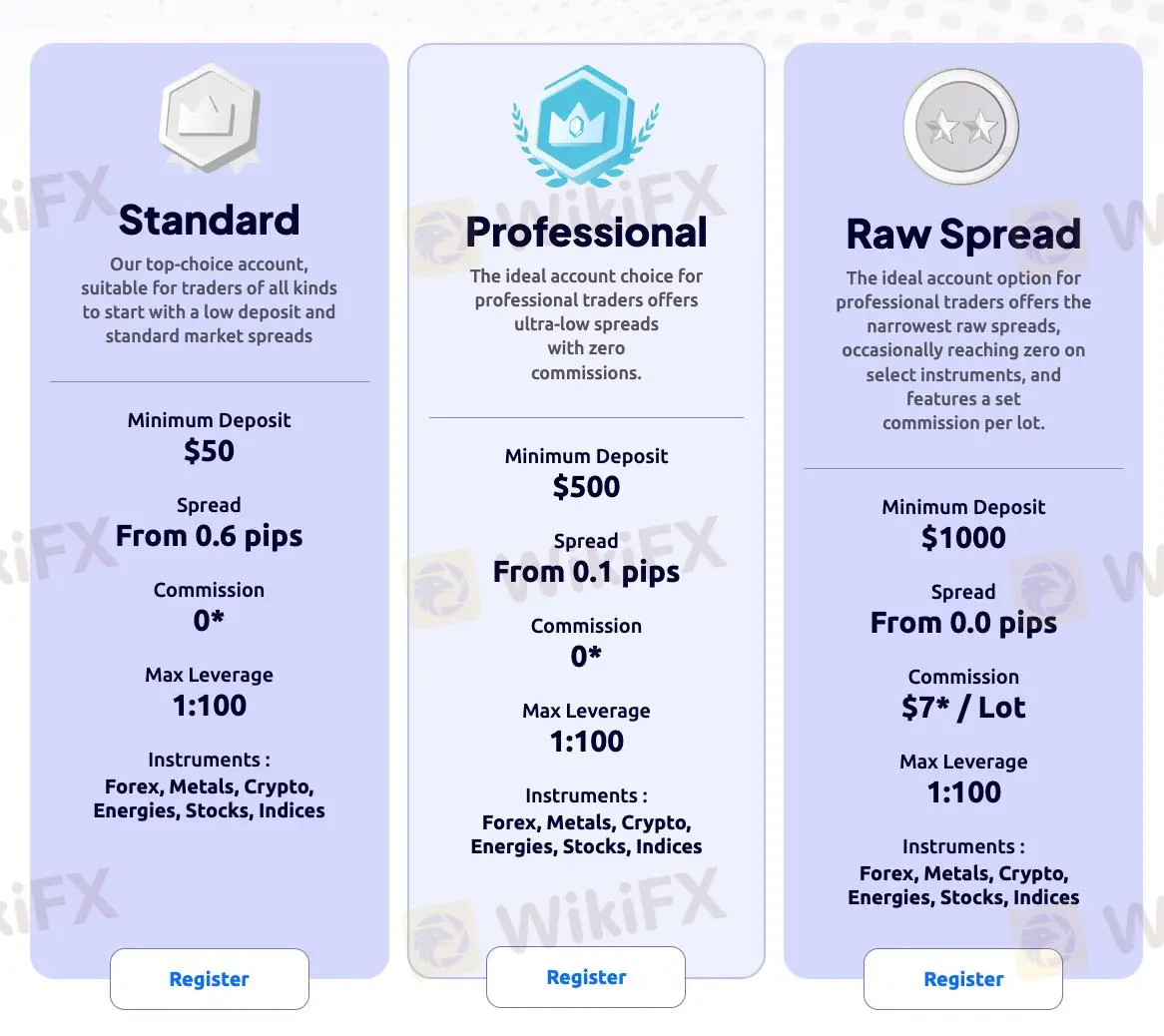

Mazi Finance offers three trading accounts:

- Standard Account: Ideal for beginners, with a $50 minimum deposit and spreads from 0.6 pips, providing a low-cost entry into trading.

- Professional Account: For experienced traders, featuring ultra-low spreads from 0.1 pips, no commissions, and a $500 minimum deposit.

- Raw Spread Account: For advanced traders, offering the tightest spreads from 0.0 pips and a $7 commission per lot, designed for those prioritizing the lowest possible spreads.

| Account Type | Minimum Deposit | Spread | Commission | Max Leverage |

| Standard | $50 | From 0.6 pips | 0 | 1:100 |

| Professional | $500 | From 0.1 pips | 0 | 1:100 |

| Raw Spread | $1,000 | From 0.0 pips | $7 / Lot | 1:100 |

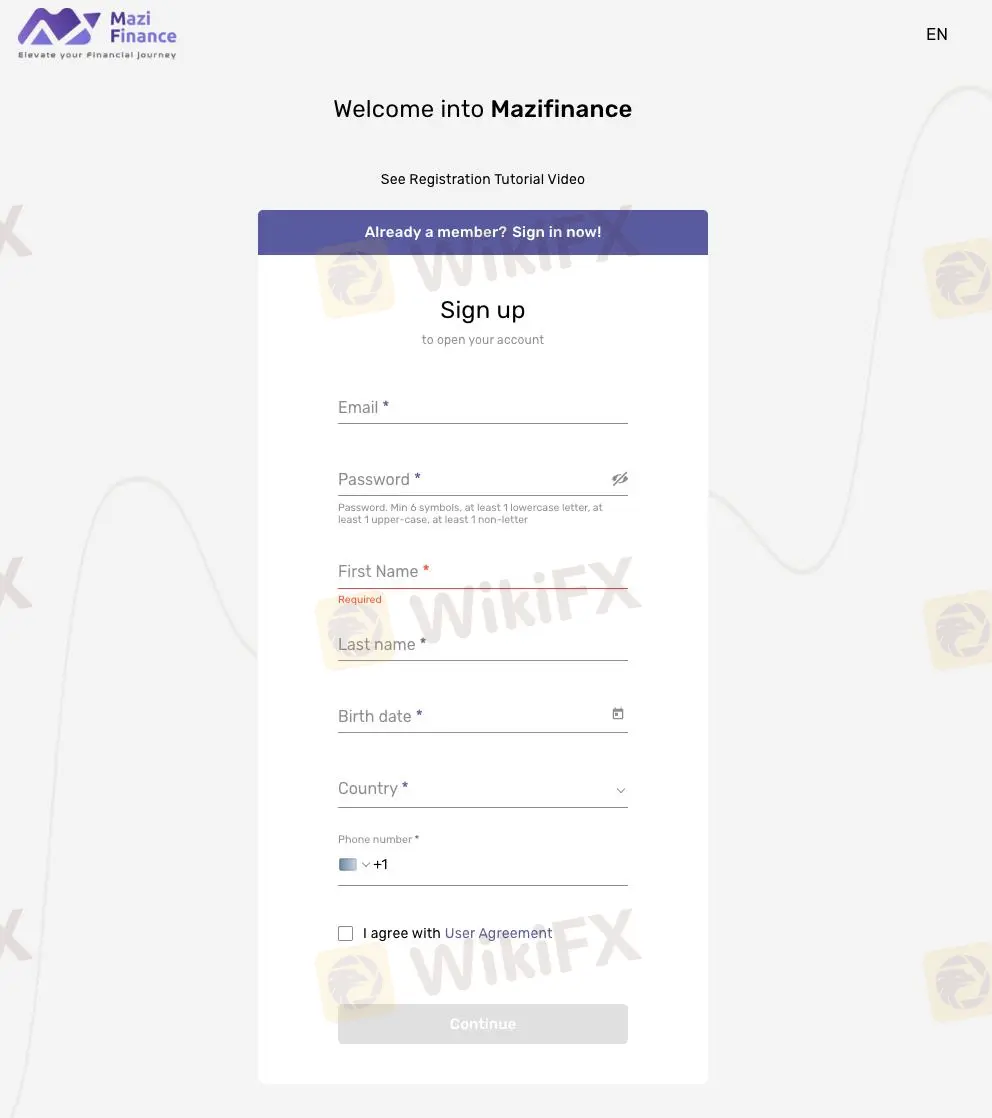

How to Open an Account?

- Visit the Mazi Finance website: Go to the official Mazi Finance website using your preferred web browser.

- Click on “Open Account”: Look for the “Open Account” or “Sign Up” button on the homepage and click on it.

- Fill out the registration form: Provide the required information such as your name, email address, country of residence, and phone number. Create a password for your account.

- Choose an account type: Select the type of trading account you wish to open, such as Standard, Professional, or Raw Spread. Each account type has different features and minimum deposit requirements.

- Verify your identity: Upload the necessary documents to verify your identity, such as a government-issued ID and proof of address.

- Fund your account: Once your account is verified, you can fund it using one of the available payment methods. Follow the instructions to deposit funds into your trading account.

Leverage

Mazi Finance offers maximum leverage of up to 1:100 for all trading accounts. Leverage allows traders to amplify their positions in the market with a smaller initial investment. With a leverage ratio of 1:100, traders can control positions that are 100 times larger than their capital.

Spreads & Commissions

Mazi Finance offers three trading accounts with varying spreads (from 0.0 pips) and commission structures, ranging from no commission to a $7 commission per lot for advanced traders.

| Account Type | Spreads | Commission | Ideal for |

| Standard Account | From 0.6 pips | No commission | Beginners |

| Professional Account | From 0.1 pips | No commission | Experienced traders |

| Raw Spread Account | From 0.0 pips | $7 per lot | Advanced traders |

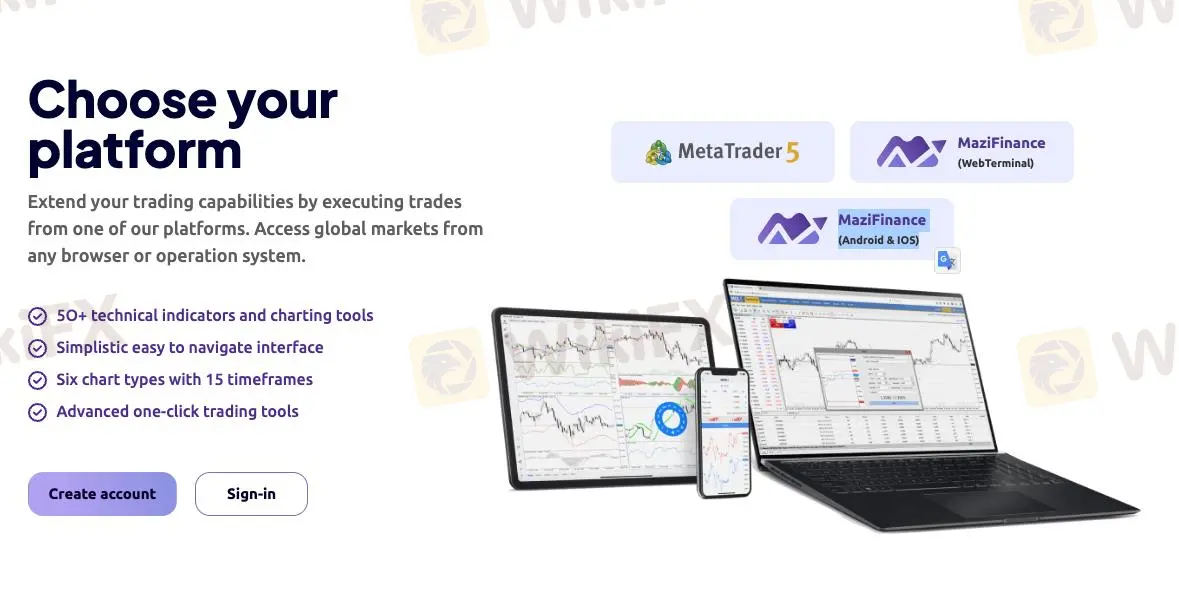

Trading Platform

Mazi Finance offers traders access to two primary trading platforms: MT5 and the MaziFinance WebTerminal, along with a mobile app available on both Android and iOS devices.

The MT5 platform is a popular choice among traders globally, known for its advanced features and user-friendly interface. It provides access to a wide range of trading instruments, including Forex, commodities, stocks, and cryptocurrencies. With MT5, traders can benefit from over 50 technical indicators and charting tools, along with six chart types and 15 timeframes for comprehensive market analysis.

Deposit & Withdrawal

Mazi Finance offers a variety of payment methods to facilitate deposits and withdrawals for traders. Users can fund their accounts using Mastercard, Visa, and Binance Pay.

Customer Support

Mazi Finance provides comprehensive customer support to assist traders with their queries. Traders can reach out to the support team via phone at +44 7700312787 or landline at +971 4 256 1911. Additionally, support is available through email at support@mazifinance.com. For quick assistance, traders can utilize the online chat feature on the platform or fill out the contact form.

FAQs

What is the minimum deposit required to open an account?

The minimum deposit varies depending on the account type, ranging from $50 to $1000.

What trading platforms are available on Mazi Finance?

Mazi Finance offers the MT5 platform as well as a web terminal and mobile app for Android and iOS devices.

Is there a maximum leverage limit on Mazi Finance?

Yes, the maximum leverage is up to 1:400 on Mazi Finance.

Wiki โบรกเกอร์

Wiki โบรกเกอร์

ข่าวล่าสุด

มือใหม่ 90% ไม่เคยรู้! MT4 กับ MT5 ต่างกันตรงไหน ระวังเทรดพังเพราะเลือกผิด

รีวิว ThinkMarkets ใช้แล้วเป็นยังไง? สำนักงานดูดีแล้วเทรดลื่นหรือเปล่า

เชื่อหรือไม่!? เทรดเดอร์คนแรกของโลกอาจเป็นชาวบาบิโลน

รีวิว Headway ถอนเงินยากจริงหรือเปล่า ใครเคยใข้รีบบอกด่วน!

คำนวณอัตราแลกเปลี่ยน