Fintrexcap

บทคัดย่อ:Fintrexcap's domain was registered in Mar, 2024, quite new to the market. It offers trading services in stocks, forex, commoditeis, indices and cryptos for its clients. A free demo account is provided for practicing and 5 tiered live accounts with different investment requirements and benefits suit the needs for various client groups. The minimum deposit is $250 in the Basic account, relatively high comparing to industry standard. It uses MT5 trading platform for pleasant customer experience.

| Fintrexcap Review Summary | |

| Founded | 2024 |

| Registered Country/Region | Switzerland |

| Regulation | No regulation |

| Market Instruments | Stocks, forex, commoditeis, indices, cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | Regular spread |

| Min Deposit | $250 |

| Trading Platform | MT5 |

| Customer Support | Email, phone, Contact form |

Fintrexcap Information

Fintrexcap's domain was registered in Mar, 2024, quite new to the market. It offers trading services in stocks, forex, commoditeis, indices and cryptos for its clients. A free demo account is provided for practicing and 5 tiered live accounts with different investment requirements and benefits suit the needs for various client groups. The minimum deposit is $250 in the Basic account, relatively high comparing to industry standard. It uses MT5 trading platform for pleasant customer experience.

Furthermore, the company protects customer funds by segregated funds, multi-layer authentication and regular audits. Educational resources such as articles, tutorials, webinars, trading guides are also provided for clients to gain necessary knowledge and skills for successful trading.

However, one fact that cannot be neglected is that the broker currently operates without regulation from any authorities, degrading its credibility and reliability.

Pros and Cons

| Pros | Cons |

| Wide range of tradable products | Lack of regulation |

| Tiered accounts | High minimum deposit requirement |

| Demo accounts | New in the market |

| No deposit fees | |

| MT5 trading platform | |

| Several protection measures |

Is Fintrexcap Legit?

The broker operates without any valid supervision from any regulatory authorities. It raises a question about its legitimacy and credibility because regulated brokers usually adhere to strict industry standards to protect customer funds.

What Can I Trade on Fintrexcap?

With Fintrexcap, you can expand your trading portfolio and seize abundant market opportunities by trading in forex, cryptos, stocks, commodities and indices.

Forex: Forex, or foreign exchange, is the global marketplace for trading national currencies against one another, facilitating international trade and investment.

Cryptos: Cryptocurrencies are digital or virtual currencies that use cryptography for security, enabling peer-to-peer transactions on decentralized networks, with Bitcoin being the most well-known example.

Stocks: Stocks represent ownership shares in a company, allowing investors to buy a stake in the company's future profits and growth potential.

Commodities: Commodities are basic goods used in commerce that are interchangeable with other goods of the same type, such as oil, gold, and agricultural products, often traded on exchanges.

Indices: Indices are statistical measures that represent the performance of a specific group of assets, such as stocks or bonds, helping investors gauge market trends and economic health.

When dealing with investment activities, always adhere to the principle of diversification by allocating funds across various products rather than concentrating on a single one you feel optimistic about.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

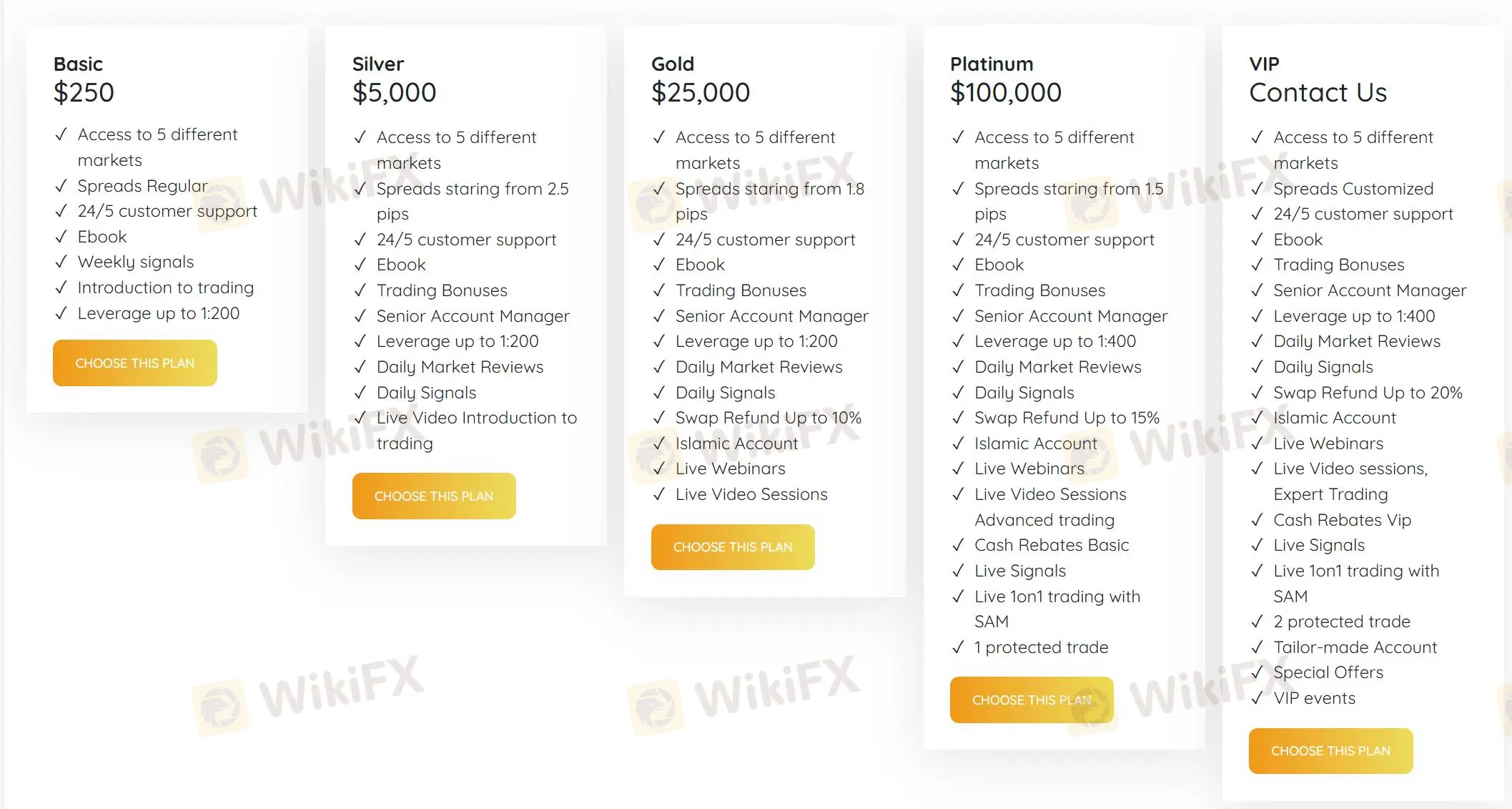

Fintrexcap does not only offer a demo account for traders to test and practice their trading strategies in a risk-free environment, but also provides five tiered live accounts to meet various needs of traders with different experience levels and financial capacities.

First comes with the Basic account whichrequires a minimum deposit of $250. It has a regular spread not specified so far and leverage up to 1:200.

Going further, the Silver account requires a minimum investment of a higher $5,000, with same leverage up to 1:200 and spread from 2.5 pips.

Gold account sets a much higher entry level at $25000, with a slightly tighter spread from 1.8 pips and max leverage up to 1:200.

When you gain enough experience and profits, you can go to the next level to the Platinum account, with an entry point of $100000 and larger leverage up to 1:400. Spread is from 1.5 pips with this account.

VIP account is the highest tier and is customizable on minimum deposit and spread that traders can make bespoke conditions basing on their preferences. Leverage level is the same as 1:400 with Platinum account.

In addition, an Islamic account is available for Gold, Platinum and VIP accounts.

The higher the rank of your account, the more resources and benefits there will be. For example, daily signals, swap refunds, cash rebates, etc.

| Plan | Minimum Deposit | Leverage | Spreads |

| Basic | $250 | Up to 1:200 | Regular |

| Silver | $5,000 | Up to 1:200 | From 2.5 pips |

| Gold | $25,000 | Up to 1:200 | From 1.8 pips |

| Platinum | $100,000 | Up to 1:400 | From 1.5 pips |

| VIP | Contact the broker | Up to 1:400 | Customized |

Trading Platform

Fintrexcap offers the well-acclaimed MetaTrader5 platform which is downloadable from Windows, Mac, iOS and Android devices. The platform is popular world wide with its advanced features and robust functions such as in-depth charting tools, intuitive interface and market analysis etc.

Deposit & Withdrawal

Fintrexcap accepts several ways for funding: bank wire transfer, credit/dbit cards and e-wallets.

Deposits are free of charge but some withdrawal methods may incur fees imposed by the payment processors or banks.

Customer Support Options

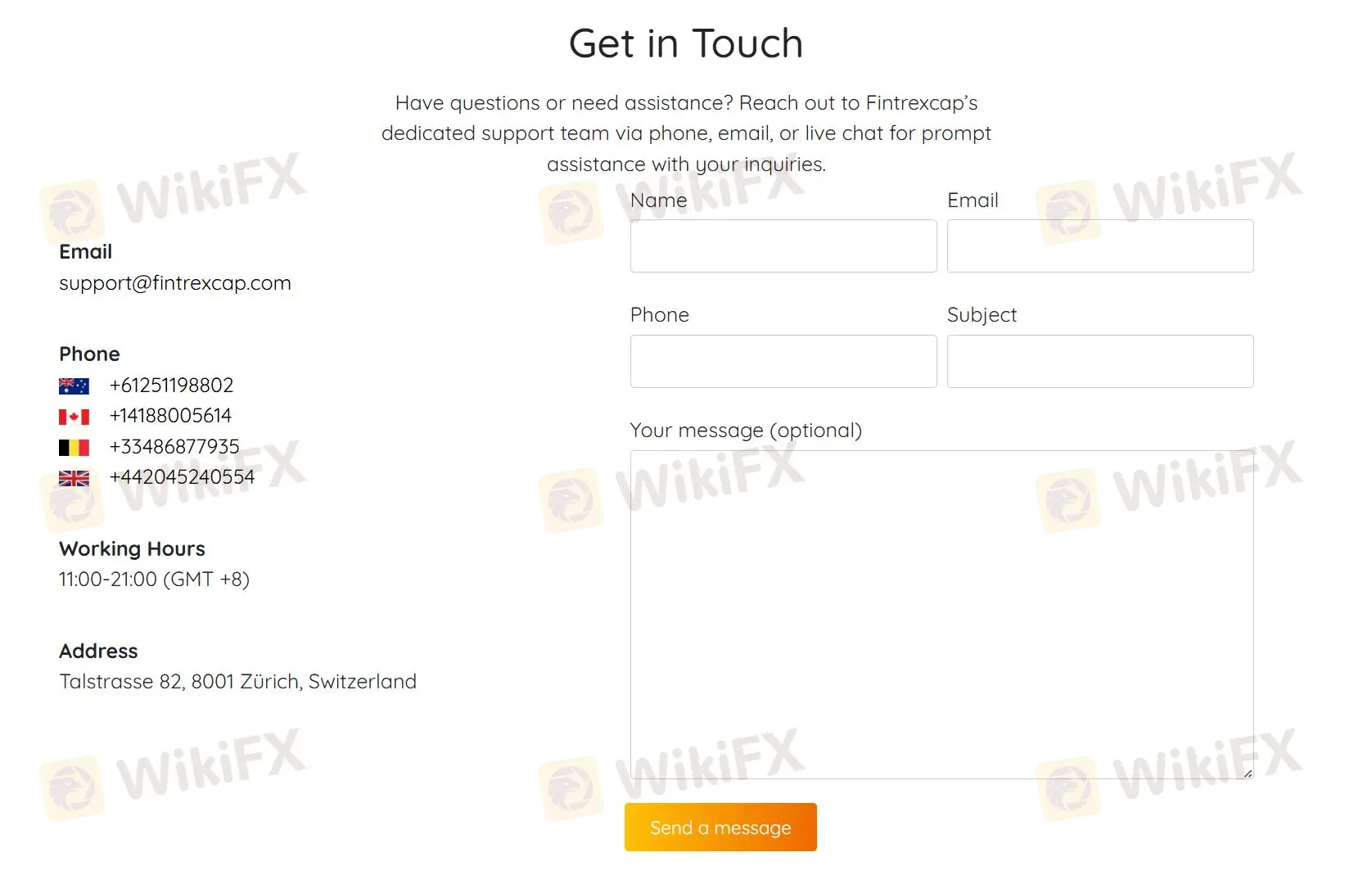

Fintrexcap can be reached 11:00-21:00 GMT+8 by phone, email, office address and a support ticket form.

| Contact Options | Details |

| Phone | +61251198802; +14188005614; +33486877935; +442045240554 |

| support@fintrexcap.com | |

| Support Ticket System | ✔ |

| Online Chat | ❌ |

| Social Media | ❌ |

| Supported Language | English |

| Website Language | English |

| Physical Address | Talstrasse 82, 8001 Zürich, Switzerland |

The Bottom Line

In summary, the broker is relatively a favourable choice for experienced traders. It offers a demo account for practicing and tiered accounts for traders with varying experience levels. Though the absence of regulation impair credibility, the company take several protection actions such as fund segregation and regular audits to offset the negative impact. Moreover, rich educational resources enable clients to access essential knowledge and skills for investment.

But beginners should reconsider due to high minimum initial capital requirement.

FAQs

Is Fintrexcap safe?

Though the broker is not regulated by any authorities, it is relatively safe due to the implementation of several customer protection measures such as fund segregation, robust encryption, multi-layer authentication and regular audits.

Is Fintrexcap good for beginners?

Not really, the minimum deposit is relatively high at $250 that beginners usually cannot afford.

What trading platform does Fintrexcap have?

Fintrexcap offers MT5 platform on Windows, iOS, Android and Mac devices.

Risk Warning

Online trading involves considerable risk, so it may not be suitable for every client. Please make sure that you totally understand the risks involved and notice that the information above provided in this review may be subject to alteration owing to the constant updating of the company's services and policies.

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

MultiBank Group

CPT Markets

ZFX

FXTM

Exness

DBG Markets

MultiBank Group

CPT Markets

ZFX

Wiki โบรกเกอร์

FXTM

Exness

DBG Markets

MultiBank Group

CPT Markets

ZFX

FXTM

Exness

DBG Markets

MultiBank Group

CPT Markets

ZFX

ข่าวล่าสุด

เหตุการณ์สำคัญทางเศรษฐกิจที่น่าสนใจสัปดาห์นี้

รู้หรือไม่? ความเสี่ยงในการลงทุนมีกี่ประเภท

รวมรีวิวโบรกเกอร์ประจำสัปดาห์ โบรกเกอร์ไหนดี โพสต์นี้มีคำตอบ !

ข้อมูลเศรษฐกิจสหรัฐฯ ทำราคาน้ำมันร่วง รัสเซีย-ยูเครนเจรจาสันติภาพ

ทองปิดบวก $10 ทำนิวไฮ รับข่าวกองทุน SPDR ทุ่มซื้อทอง

อยากเทรดให้ได้กำไรต้องมีกฎ 4 ข้อนี้!

คำนวณอัตราแลกเปลี่ยน