CST

摘要:CST, established in 2022 in the United States, offers a trading platform for various markets, including cryptocurrency, Forex, and CFDs on commodities. The absence of regulatory oversight is a notable drawback, potentially affecting the platform's transparency and user protection. However, CST stands out with its competitive advantages, such as a low minimum deposit of $250, high leverage of up to 1:500, and variable spreads starting from just 0.1 pips. Traders can choose between Standard and ECN account types, and the platform is accessible via MetaTrader 5. While customer support is available via email and phone, educational resources are limited, requiring traders to seek external learning opportunities.

| Aspect | Information |

| Company Name | CST |

| Registered Country/Area | United States |

| Founded Year | 2022 |

| Regulation | Not regulated |

| Market Instruments | Cryptocurrency, Forex, CFDs on commodities |

| Account Types | Standard, ECN |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable, starting from 0.1 pips |

| Trading Platforms | MetaTrader 5 |

| Customer Support | Email: support@cryptosmartrades.com, Phone: +1 (740) 343-9873 |

Overview of CST

CST, established in 2022 in the United States, offers a trading platform for various markets, including cryptocurrency, Forex, and CFDs on commodities. The absence of regulatory oversight is a notable drawback, potentially affecting the platform's transparency and user protection.

However, CST stands out with its competitive advantages, such as a low minimum deposit of $250, high leverage of up to 1:500, and variable spreads starting from just 0.1 pips. Traders can choose between Standard and ECN account types, and the platform is accessible via MetaTrader 5. While customer support is available via email and phone, educational resources are limited, requiring traders to seek external learning opportunities.

Is CST legit or a scam?

CST operates without regulation from any regulatory authority, potentially giving rise to issues regarding the transparency and supervision of the exchange. Unregulated exchanges lack the oversight and legal safeguards provided by regulatory authorities, thereby increasing the risk of fraud, market manipulation, and security breaches.

In the absence of proper regulation, users will encounter difficulties in pursuing remedies or resolving disputes. Furthermore, the absence of regulatory scrutiny can result in a less transparent trading environment, posing challenges for users in assessing the legitimacy and dependability of the exchange.

Pros and Cons

| Pros | Cons |

| User-Friendly Platform | Not regulated |

| Multiple Account Types | Limited Educational Resources |

| Competitive Spreads | Limited Customer Support |

| Not available in some countries or regions |

Pros:

User-Friendly Platform: CST provides a user-friendly trading platform that is easy to navigate and suitable for traders of various experience levels. The platform's intuitive interface allows users to execute trades efficiently and access a range of trading tools.

Multiple Account Types: CST offers multiple account types, providing flexibility for traders to choose an account that aligns with their trading preferences and capital availability. These account types serve a range of trading strategies.

Competitive Spreads: CST offers competitive spreads, which can be advantageous for traders looking to minimize trading costs. Competitive spreads can help traders maximize their potential returns, especially when trading frequently.

Cons:

Not Regulated: CST operates without regulation from any regulatory authority. This lack of regulatory oversight can raise issues about the transparency and oversight of the exchange. Unregulated exchanges lack the legal protections and oversight provided by regulated platforms, potentially increasing the risk of fraud, market manipulation, and security breaches.

Limited Educational Resources: CST provides limited educational materials and resources for traders. This can be a drawback for new traders or those looking to enhance their trading skills. Comprehensive educational resources can help traders develop their knowledge and make informed trading decisions.

Limited Customer Support: The customer support options at CST are limited compared to some other platforms. Limited customer support affect the level of assistance and guidance available to traders, especially in complex or urgent situations. Traders will face challenges in resolving issues or seeking support.

Not Available in Some Countries or Regions: CST's services are not be accessible in certain geographical locations, limiting the platform's user base and market reach. Traders in regions where CST is not available need to consider alternative platforms for their trading needs.

Market Instruments

CST offers a variety of trading assets, including cryptocurrency, Forex, and Contracts for Difference (CFDs) on commodities.

Cryptocurrency: CST provides access to the cryptocurrency market, allowing traders to buy and sell various cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading involves speculating on the price movements of these digital assets, and traders can take advantage of the market's volatility to potentially profit from their trades.

Forex (Foreign Exchange): The platform offers Forex trading, where traders can participate in the foreign exchange market. Forex trading involves trading currency pairs, such as EUR/USD or GBP/JPY, with the aim of profiting from fluctuations in exchange rates. It's a popular market for both beginners and experienced traders.

CFDs on Commodities: CST also provides the opportunity to trade Contracts for Difference (CFDs) on various commodities. This includes trading commodities like gold, oil, and agricultural products without owning the physical assets. CFD trading allows traders to speculate on the price movements of these commodities.

Account Types

CST offers a range of account types, each tailored to meet the varying needs and preferences of different traders.

Standard Account:

The Standard Account at CST requires a minimum deposit of $250 and offers leverage up to 1:200. This account type features variable spreads starting from 0.6 pips and does not charge any commission fees. The absence of commission makes it a suitable option for traders who are new to the platform or prefer a straightforward fee structure. The relatively wider spreads appeal to those who prioritize simplicity and are not focused on high-frequency trading. This account type is often chosen by traders looking to start with a moderate initial investment.

ECN Account:

The ECN (Electronic Communication Network) Account at CST requires a higher minimum deposit of $500. It offers higher leverage, up to 1:500, which can be attractive to traders seeking greater exposure to the markets. This account type features variable spreads starting from a tighter 0.1 pips, offering competitive pricing. However, it does come with a commission of $7 per round turn per lot, which can impact the overall cost of trading. The ECN Account is suitable for experienced traders who are comfortable with both higher leverage and the commission-based fee structure. It serves those who require a more cost-effective spread and have the expertise to navigate the complexities of the financial markets.

| Account Type | Minimum Deposit | Leverage | Spreads | Commission |

| Standard Account | $250 | Up to 1:200 | Variable, starting from 0.6 pips | None |

| ECN Account | $500 | Up to 1:500 | Variable, starting from 0.1 pips | $7 per round turn per lot (Negotiable) |

How to Open an Account?

Opening an account with CST is a straightforward process. Here are the concrete steps to follow:

Visit CST's Website: Start by going to CST's official website. This is where you'll initiate the account opening process.

Select Account Type: Choose the type of account you wish to open. CST typically offers multiple account types, each with its own features and requirements. Select the one that suits your trading needs.

Complete Registration: Fill out the online registration form with your accurate personal information. This includes details like your full name, contact information, and email address.

Verify Your Identity: As part of the Know Your Customer (KYC) process, you'll need to provide certain identification documents. These typically include a government-issued ID (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement).

Account Review: After submitting your registration and documents, CST will review your application. This process involves verifying the information provided and ensuring compliance with regulatory requirements.

Fund Your Account: Once your account is approved, you can proceed to fund it. Choose a suitable deposit method, such as credit/debit card or bank transfer, and transfer the necessary funds to meet the minimum deposit requirement for your chosen account type.

Leverage

CST offers maximum leverage levels to its traders, allowing them to magnify their trading positions. The maximum leverage provided by CST can vary depending on the type of account you choose. However, it's essential to note that higher leverage also entails higher risk, and traders should use it judiciously.

For example, in the Standard Account, CST offers leverage of up to 1:200, while in the ECN Account, the maximum leverage could be up to 1:500. Leverage allows traders to control larger positions with a relatively smaller amount of capital, potentially amplifying both profits and losses. Therefore, traders should carefully consider their risk tolerance and trading strategy when selecting the account type and leverage level that best suits their needs. It's crucial to be aware of the potential risks associated with high leverage and to use it responsibly in your trading activities.

Spreads & Commissions

CST offers a range of spreads and commissions depending on the type of account chosen, and these factors can significantly impact the overall trading costs for users.

In the Standard Account, traders can expect variable spreads starting from 0.6 pips. This account type does not charge any commission fees per round turn lot. The Standard Account is well-suited for traders who are just starting in the forex and CFD markets or those who prefer simplicity in the fee structure. The absence of commission charges makes it an accessible option for traders with smaller volumes or those looking for straightforward pricing.

On the other hand, the ECN Account offers tighter variable spreads, starting from 0.1 pips, but it does charge a commission of $7 per round turn per lot. This account type is more suitable for experienced traders or those who engage in high-frequency trading with larger volumes. The ECN Account's lower spreads and transparent commission structure can be advantageous for traders who prioritize cost-effectiveness and have a better understanding of the market.

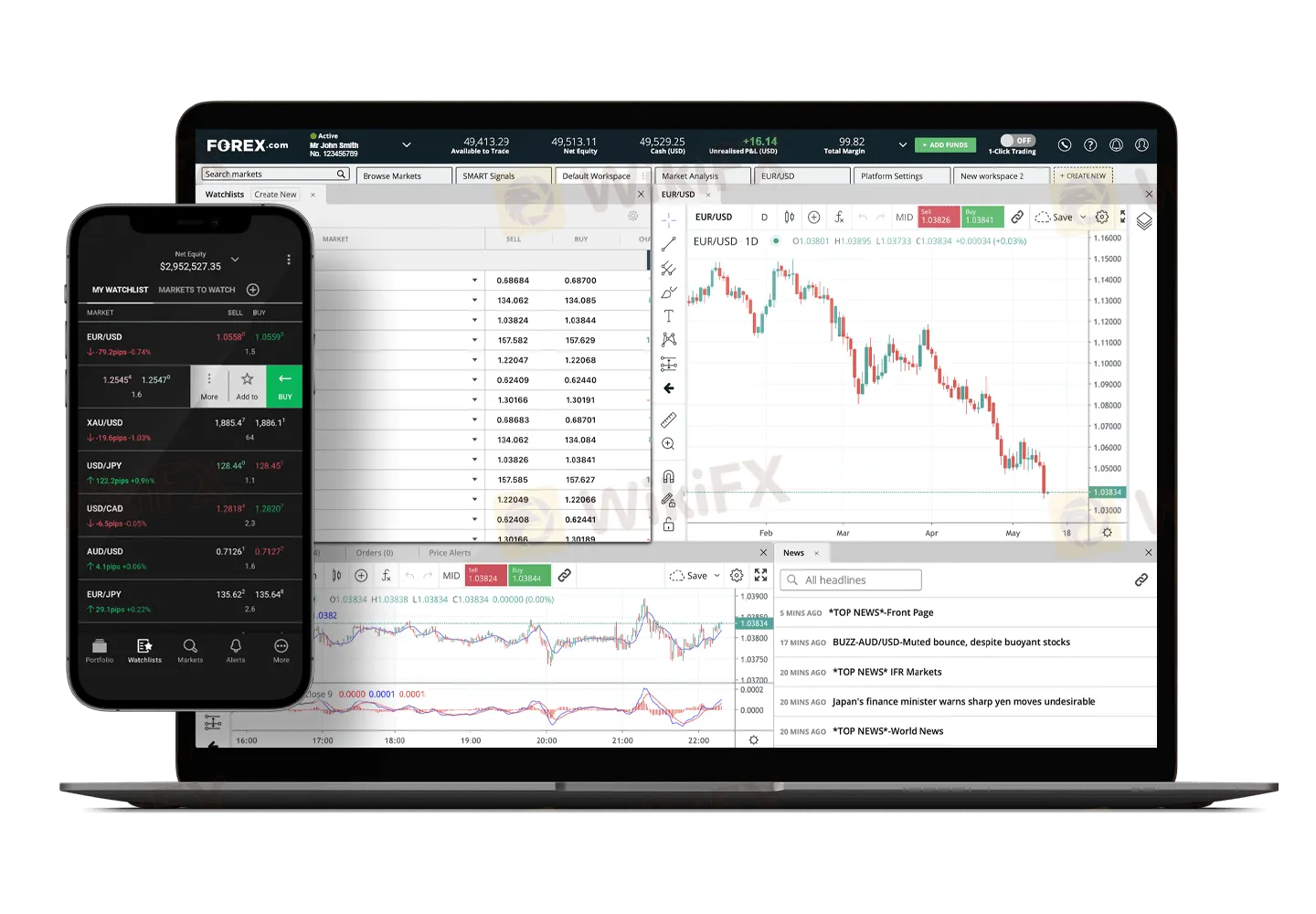

Trading Platform

CST provides its traders with access to the MetaTrader 5 (MT5) trading platform. MT5 is a widely recognized and versatile trading platform used by many brokers and traders globally.

MT5 offers a comprehensive set of features that can appeal to traders of various experience levels. It includes advanced charting tools, a wide range of technical indicators, and supports automated trading through Expert Advisors (EAs). The platform is known for its user-friendly interface, making it accessible to both beginners and experienced traders.

One notable feature of MT5 is its capability to handle multiple asset classes, including Forex, commodities, indices, stocks, and cryptocurrencies. This versatility allows traders to diversify their portfolios and explore various financial markets within a single platform.

Furthermore, MT5 provides traders with the ability to conduct thorough historical data analysis, which is valuable for backtesting trading strategies and making data-driven decisions. The platform's compatibility with mobile devices and web browsers enhances its accessibility, ensuring that traders can access their accounts and execute trades from anywhere with an internet connection.

Customer Support

CST offers customer support through multiple channels to assist its clients. Traders can reach out to the customer service team via email at support@cryptosmartrades.comor by phone at +1 (740) 343-9873. This availability of both email and phone support indicates a commitment to addressing client inquiries.

Conclusion

In conclusion, CST offers a user-friendly trading platform with multiple account types and competitive spreads for a wide range of traders. The platform's ease of use makes it accessible to both novice and experienced traders, while the availability of different account types allows users to tailor their trading experience to their specific needs. Competitive spreads further enhance the platform's appeal, offering cost-effective trading opportunities.

However, CST's lack of regulation poses a significant disadvantage, potentially compromising the transparency and oversight of the exchange. The absence of regulatory oversight means that traders benefit from the legal protections and oversight provided by regulated platforms, exposing them to increased risks such as fraud and market manipulation. Additionally, the limited educational resources and customer support options will hinder traders' ability to acquire knowledge and receive timely assistance, particularly in complex situations.

FAQs

Q: What trading assets are available on CST?

A: CST offers cryptocurrency, Forex, and CFDs on commodities.

Q: Are there different account types on CST?

A: Yes, CST offers Standard and ECN accounts with varying minimum deposits and spreads.

Q: What is the maximum leverage on CST?

A: CST provides leverage of up to 1:500 on ECN accounts.

Q: Is CST regulated?

A: No, CST is not regulated by any regulatory authority.

Q: Does CST offer educational resources?

A: CST has limited educational resources available.

Q: Is CST available in all countries?

A: CST is available in some countries or regions.

天眼交易商

热点资讯

美联储的杰斐逊:乐于将联邦基金利率维持在当前水平

美元/印度卢比在印度储备银行降息预期中走强

预计英国央行(BoE)将在通胀稳定和经济增长疲弱的情况下下调利率

又一中国外汇玩家被杀猪盘狂砍7万刀 牌照撤销!骗局狂飙!看见这个平台赶快逃

白银价格预测:XAG/USD仍在32.00美元附近低迷;看涨偏向依旧

欧元/日元价格预测:最小阻力路径在158.50下方的下行方向

英镑在英国央行政策决定前企稳

黑平台碾压正主 TradeEU Global正疯狂收割 铺天盖地的广告怎么防

捷克央行行长探索比特币作为未来储备资产的可行性

日本的加藤认为通胀压力将继续上升

汇率计算