Broctagon外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:Located in Singapore, Broctagon was founded in 2014 and provides a wide variety of trading options in forex, commodities, shares, indices, futures, and cryptocurrency CFDs. The business offers traders trading and demo accounts to test out different tactics, despite operating without regulatory oversight. Additionally, it is available via well-known trading platforms including ZERO trader, cTrader, MT4, and MT5.

| BroctagonReview Summary | |

| Founded | 2014 |

| Registered Country/Region | Singapore |

| Regulation | Unregulated |

| Market Instruments | 1,800+, Forex, Commodities, Shares, Indices, Futures, Crypto CFDs |

| Demo Account | ✅ |

| Leverage | 1:500 |

| Spread | From 0 pips |

| Trading Platform | MT4, MT5, cTrader, ZERO trader |

| Min Deposit | / |

| Customer Support | Live chat, Contact form |

| Email: info@broctagon.com | |

| Social Media: LinkedIn, Facebook, Instagram, Twitter | |

| Company Address: 14 Robinson Road #06-01, Singapore 048545 | |

Located in Singapore, Broctagon was founded in 2014 and provides a wide variety of trading options in forex, commodities, shares, indices, futures, and cryptocurrency CFDs. The business offers traders trading and demo accounts to test out different tactics, despite operating without regulatory oversight. Additionally, it is available via well-known trading platforms including ZERO trader, cTrader, MT4, and MT5.

Pros and Cons

| Pros | Cons |

| Diverse range of tradable assets | Absence of regulation |

| Demo accounts | Unclear minimum deposit requirements |

| MT4 and MT5 supported | Limited payment options |

| Multiple contact channels |

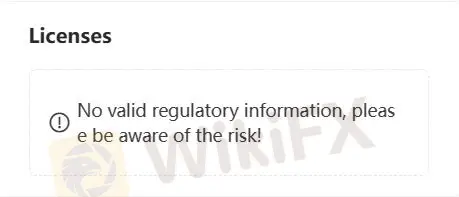

Is Broctagon Legit?

No, Broctagon is unregulated. It operates without being monitored by established financial regulatory bodies. Please be aware of the risk!

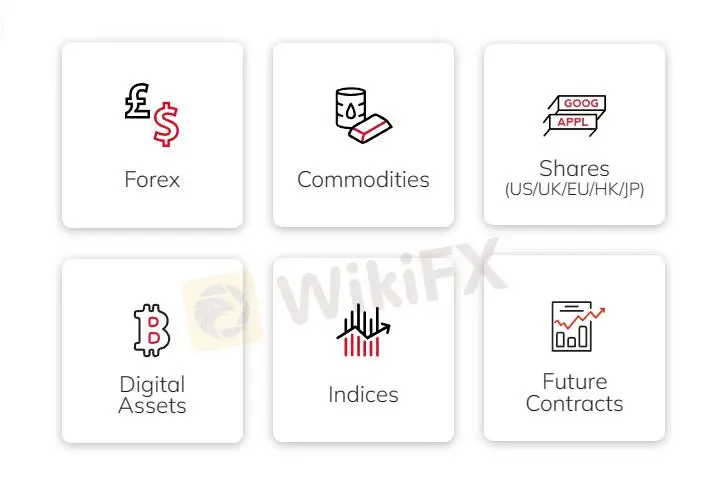

What Can I Trade on Broctagon?

Over 1800 tradable assets are available on this platform, including Forex, Commodities, Shares, Indices, Futures, and Crypto CFDs.

| Trading Asset | Available |

| forex | ✔ |

| commodities | ✔ |

| shares | ✔ |

| indices | ✔ |

| futures | ✔ |

| Crypto CFDs | ✔ |

| bonds | ❌ |

| options | ❌ |

| ETFs | ❌ |

Leverage

Broctagon offers leverage of up to1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Fees

| Forex Pairs | Symbol | Spread |

| Euro vs United States Dollar | EURUSD | 0.00028 |

| United States Dollar vs Japanese Yen | USDJPY | 0.124 |

| British Pound vs United States Dollar | GBPUSD | 0.0015 |

| United States Dollar vs Swiss Franc | USDCHF | 0.00115 |

| United States Dollar vs Canadian Dollar | USDCAD | 0.0015 |

Trading Platform

MT4, MT5, cTrader, and ZERO trader trading platforms are all available on this platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| cTrader | ✔ | Desktop, Mobile, Web | / |

| ZERO trader | ✔ | Desktop, Mobile, Web | / |

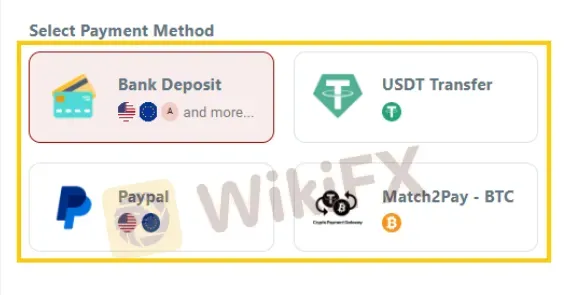

Deposit and Withdrawal

Broctagon facilitates deposits through various methods such as bank deposit, USDT transfer, PayPal, and Match2pay-BTC. Withdrawal methods vary based on the broker's configuration and may require specific fields to be completed. Traders can select their preferred withdrawal method, and additional fields will appear accordingly for completion.

熱點資訊

交易,用一種最簡單方式來跟漲或跟跌

市場解析:OANDA安達曾以傳承自豪,如今成為 FTMO 收購戰利品

外匯牌價怎麼看?

LION獅子國際遭投資人實名爆料!惡意喊單導致大幅虧損,指控用戶違約拒絕出金

Valetax受模里西斯FSC監管、低點差、高槓桿,獲97%用戶好評

Magic Compass寶匯是否值得信賴?全面解讀平台監管資訊、交易環境、用戶評價、營運概況

MarketsCo監管牌照、展業區域存疑,還遭加拿大CSA示警,極具投資詐騙風險

匯率計算