OpenseaFX-Some important Details about This Broker

摘要:OpenseaFX, a trading name of Opensea Group Limited, is a broker engaged in providing investors with various financial products and services. It is authorized by the Financial Conduct Authority (FCA) in the UK.

| Aspect | Information |

| Registered Country/Area | China |

| Founded year | 2-5 years ago |

| Company Name | OpenSea Limited |

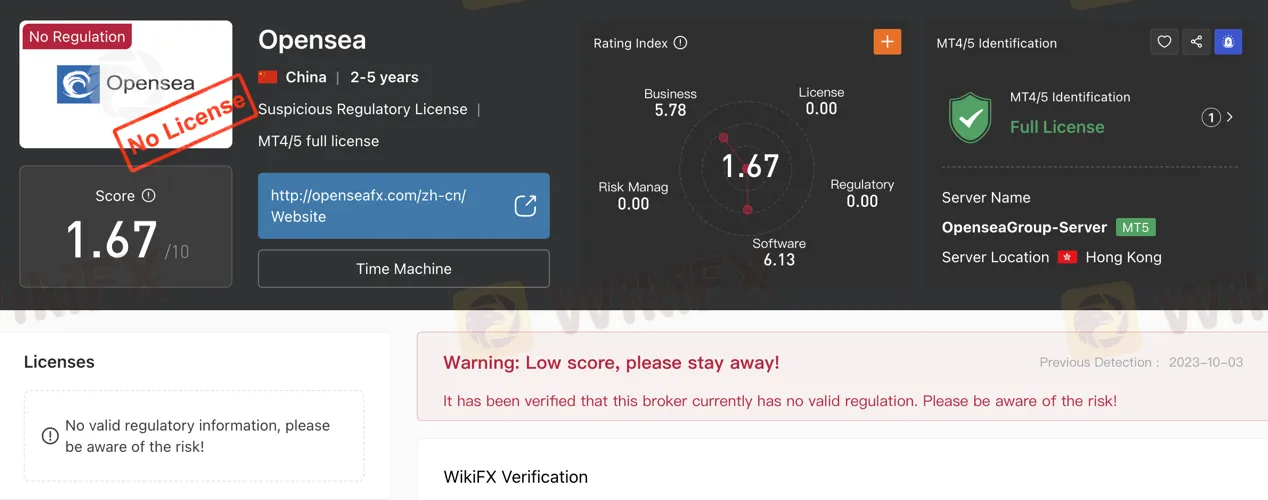

| Regulation | Not regulated, exercise caution |

| Minimum Deposit | 0 |

| Maximum Leverage | 1:500 on forex pairs |

| Spreads | 0.3% spread on both bid and ask sides |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable assets | Forex currency pairs, stocks, commodities |

| Account Types | Basic, Creator, Verified, Badged, Administrator |

| Demo Account | Information not provided |

| Islamic Account | Information not provided |

| Customer Support | Email at support@openseafx.com |

| Payment Methods | Visa, Mastercard, Maestro, Neteller |

| Educational Tools | Information not provided |

General Information

OpenseaFX, a trading name of Opensea Group Limited, is a broker engaged in providing investors with various financial products and services, including forex currency pairs, stocks, and commodities. While it offers different account types, such as Basic, Creator, Verified, Badged Collection, and Administrator Accounts, it's important to note that Opensea operates without regulatory oversight, potentially posing risks to users. The lack of valid regulation should be a concern for those considering engagement with this platform. Opensea charges a 2.5% commission on successful sales, along with a 0.3% spread on each listing's bid and ask sides. Furthermore, deposit and withdrawal methods are available, including Visa, Mastercard, Maestro, and Neteller, with associated fees and limits. OpenseaFX provides the MetaTrader 5 (MT5) trading platform for accessing global financial markets, offering various assets for trading and technical analysis tools. Customer support primarily relies on email communication at support@openseafx.com. It is essential for users to exercise caution and conduct thorough research before considering participation on this platform due to the absence of regulatory oversight.

Pros and Cons

OpenSea offers several advantages, including the utilization of the MetaTrader 5 trading platform, access to global financial markets, and the availability of leverage up to 1:500 on forex pairs. However, it operates without regulatory oversight, charges a 2.5% commission on successful sales, and currently faces the drawback of its main website being down. Additionally, it provides limited types of market instruments and offers limited information about customer support options.

| Pros | Cons |

| Utilizes MetaTrader 5 trading platform. | Operates without regulatory oversight. |

| Provides access to global financial markets. | Charges a 2.5% commission on successful sales. |

| Offers leverage up to 1:500 on forex pairs. | Main website is currently down |

| Supports multiple payment methods. | Limited types of market instruments |

| Limited information about customer support options. |

Is Opensea Legit?

OpenSea operates without regulatory oversight, posing potential risks to users. It's crucial to exercise caution when engaging with this platform due to its lack of valid regulation.

Market Instruments

OpenseaFX offers investors a range of financial instruments including forex currency pairs, stocks, commodities.

Forex Currency Pairs: OpenSea provides access to various forex currency pairs, allowing users to trade one currency against another. Examples include EUR/USD, GBP/JPY, and USD/JPY.

Stocks: The platform also offers stocks from different companies for trading. Users can invest in stocks such as Apple Inc. (AAPL), Amazon.com Inc. (AMZN), and Microsoft Corporation (MSFT).

Commodities: OpenSea enables trading in commodities like gold, oil, and silver. These commodities serve as underlying assets for trading contracts, providing users with exposure to commodity price movements.

Pros and Cons

| Pros | Cons |

| Provides access to diverse forex pairs. | Lack of regulatory oversight. |

| Offers a range of stocks for trading. | Limited information on customer support. |

| Enables trading in various commodities. |

Account Types

BASIC ACCOUNT:

A Basic Account on OpenSea is accessible to anyone and allows for basic interactions within the platform. Basic Accounts are primarily for buying, selling, and collecting NFTs. However, they do not have the capability to list NFTs for sale. Examples of Basic Accounts encompass individual collectors and casual users seeking to engage with NFTs in a limited capacity.

CREATOR ACCOUNT:

Creator Accounts are designed for individuals who want to actively participate in the NFT marketplace. These accounts can list NFTs for sale and also create and manage their collections. To establish a Creator Account, users must possess a verified email address and a profile picture. This type of account is ideal for artists, musicians, and various creators looking to sell their work as NFTs.

VERIFIED ACCOUNT:

Verified Accounts on OpenSea are recognized for their heightened authenticity and trustworthiness. To qualify as a Verified Account, users must have a verified email address, a profile picture, and at least one collection with a minimum of 75 ETH in sales volume. Verified Accounts gain access to exclusive features, including the ability to set a custom domain for their profile and display a verified badge on their listings. Prominent artists, brands, and celebrities often fall under the Verified Account category.

BADGED COLLECTION:

Badged Collections are collections that have met specific criteria, such as demonstrating substantial sales volume or cultivating a strong community following. These collections enjoy special privileges on OpenSea, such as prominent placement on the platform's homepage and within search results. Notable examples of Badged Collections encompass popular NFT projects like Bored Ape Yacht Club and CryptoPunks.

ADMINISTRATOR ACCOUNT:

Administrator Accounts are granted full control over an OpenSea account, empowering them to oversee various aspects of the platform. Users with Administrator Accounts can create, modify, and delete listings, collections, and other account settings. Additionally, they have the authority to manage other user accounts, including Creator Accounts and Verified Accounts. This type of account is typically utilized by team members at NFT projects and businesses leveraging OpenSea for their operations.

| Pros | Cons |

| Basic Account accessible to anyone for basic NFT interactions. | Basic Account cannot list NFTs for sale. |

| Creator Account enables active participation in the NFT marketplace. | Creator Account requires a verified email and profile picture. |

| Verified Account offers heightened authenticity and exclusive features. | Verified Account criteria include a minimum of 75 ETH in sales volume. |

| Administrator Account grants full control but is typically for businesses. | Limited information on Badged Collections and their privileges. |

Leverage

The maximum leverage is up to 500:1.

Trading Platform

OpenseaFX provides clients with access to the worlds financial markets through the MetaTrader 5 (MT5) platform.

Some examples of assets that can be traded on this platform include foreign exchange (forex) pairs, commodities like gold and oil, and various stock indices. MT5 is widely used by traders and offers a range of technical analysis tools and charting features for conducting market analysis and executing trades.

Spreads & Commissions

OpenSea charges a 2.5% commission on all successful sales, plus a spread of 0.3% on both the bid and ask sides of each listing. This means that sellers on OpenSea pay a total of 2.85% in fees on each successful sale

Deposit & Withdrawal

Deposit & WithdrawOpensea supports deposits and withdrawals via Visa, Mastercard, Maestro, and Neteller. Deposits are instant and incur a 3% fee. Withdrawals take 1-3 business days and incur a 2% fee. The maximum deposit is $20,000 per day. The minimum withdrawal is $50 and the maximum withdrawal is $10,000 per day.

| Pros | Cons |

| Supports various payment methods. | Deposits incur a 3% fee. |

| Offers instant deposit processing. | Withdrawals take 1-3 business days. |

| Provides a reasonably high maximum deposit limit. | Withdrawals incur a 2% fee. |

Accepted Countries

OpenseaFX mainly provides its products and services for Chinese clients.

Customer Support

OpenseaFX offers customer support primarily through email at support@openseafx.com. Clients can reach out to this address for assistance with any questions or concerns they may have.

Conclusion

In conclusion, Opensea operates without regulatory oversight, which raises potential risks for users. It offers a range of market instruments, including forex currency pairs, stocks, and commodities, but lacks the security of regulation. The platform offers different account types, from Basic to Verified Accounts, catering to various user needs. However, the absence of regulation is a notable disadvantage. OpenseaFX provides leverage up to 1:500 on forex pairs, but its fee structure, including a 2.5% commission and a 0.3% spread, may be considered high. Deposits and withdrawals are supported through multiple methods but involve fees, with withdrawals taking 1-3 business days. OpenseaFX uses the MetaTrader 5 trading platform, which is widely used but may not be suitable for all traders. Customer support is available primarily through email. Users should exercise caution when considering OpenseaFX due to its lack of regulation and associated risks.

FAQs

Q: Is Opensea a legitimate platform?

A: Opensea operates without regulatory oversight, which poses potential risks to users. Exercise caution when engaging with this platform.

Q: What types of market instruments can I trade on Opensea?

A: Opensea offers forex currency pairs, stocks, and commodities for trading, providing a diverse range of assets to choose from.

Q: What are the different types of accounts on Opensea?

A: Opensea offers Basic, Creator, Verified, Badged Collection, and Administrator Accounts to cater to various user needs and preferences.

Q: What is the leverage offered by Opensea on forex pairs?

A: Opensea offers leverage up to 1:500 on forex pairs, allowing traders to amplify their positions.

Q: What are the fees associated with trading on Opensea?

A: Opensea charges a 2.5% commission on successful sales and a 0.3% spread on bid and ask sides, resulting in a total fee of 2.85% on each successful sale.

天眼交易商

熱點資訊

外匯可分為哪些「種類」?

外匯投資如何規避風險?

2/24-3/2高風險外匯券商榜單公告

詐騙示警:外匯券商Vantage出現仿冒平台,請投資人確認官方網址是否相符

高分券商金祥國際遭控收割投資人!高收益話術引誘入金,惡意封禁帳戶全面失聯

INFINOX強化巴西市場布局,邀請影響力人士兼演員擔任品牌大使

J.P. Morgan摩根大通外匯評測:機構級平台監管資訊、市場影響力、天眼實勘一次看

仿冒通報:外匯券商XM出現假冒釣魚網站,註冊前請仔細比對官方網址

「SkyLine Guide-馬來西亞站」正式啟動:打造外匯界的本地「米其林指南」

假冒塞浦路斯CySEC捲土重來,監管機構呼籲投資人提高警覺

匯率計算