BidMarkets

Zusammenfassung:BidMarkets' businesss was started from 2014, and we can only get very limited information about this company due to unavailable website. The company requires a minimum deposit of $300, which is relatively high comparing to industry standard. Leverage is up to 1:400 and the broker is said to provide a lousy web-based trading platform with simplistic functions.

Note: BidMarkets' official website: https://bidmarkets.com/ is currently inaccessible normally.

| BidMarkets Review Summary | |

| Founded | 2014 |

| Registered Country/Region | / |

| Regulation | No regulation |

| Market Instruments | / |

| Demo Account | ✅ |

| Spread | 1 pip |

| Leverage | Up to 1:400 |

| Trading Platform | Web-based |

| Min Deposit | $300 |

| Customer Support | Tel: +44 (0) 2045771076 |

| Email: soporte@bidmarkets.com | |

BidMarkets Information

BidMarkets' businesss was started from 2014, and we can only get very limited information about this company due to unavailable website. The company requires a minimum deposit of $300, which is relatively high comparing to industry standard. Leverage is up to 1:400 and the broker is said to provide a lousy web-based trading platform with simplistic functions.

There are some facts that cannot be ignored by you if you want to trade with this broker. Firstly is that the broker operates without valid regulation from authority bodies, meaning less compliance to industry rules and customer protection. Wosely, it even receives warning from the CNMV, a Spanish regulatory body. Moreover, there's one piece of WikiFX exposure about scam issues about this broker. All these signs direct to a possible conclusion: this broker is a scam. That's why we strongly recommend you always to get rid of such brokers.

Regulatory Status

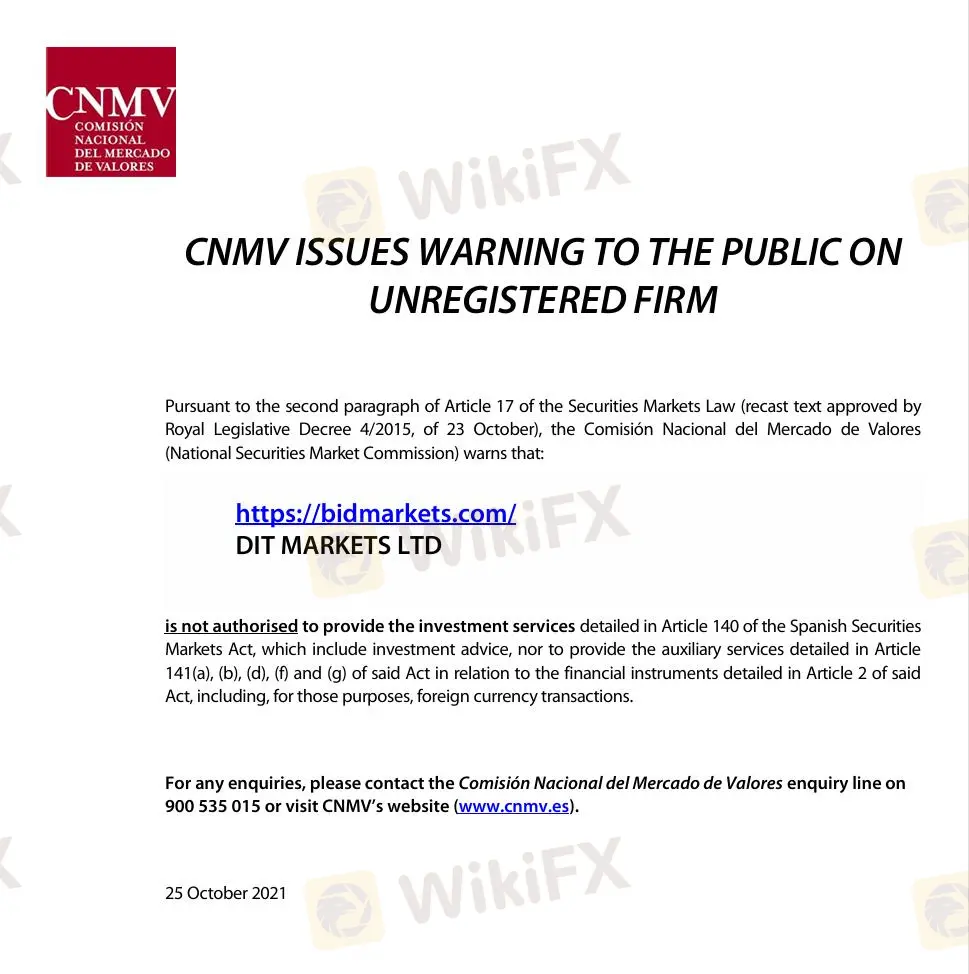

Regulation is a critical factor when assessing the legitimacy and reliability of a brokerage firm, and unfortunately, BidMarkets does not operate under valid regulatory oversight.

What's even worse, the National Securities Market Commission (CNMV) issued a specific warning regarding the BidMarkets website in 2021 that the firm is not authorized to offer financial services in Spain.

Downsides of BidMarkets

Unavailable website: BidMarkets' website cannot be opened currently, which indicates possibility of cease of operation.

Regulatory concerns: The broker not only operates without valid regulation by any financial institutions, but also received a warning letter from the Spanish regulator CNMV about unauthorization to offer financial services, which further highlights its illegitimacy and high risks to investors.

WikiFX exposure: Ther's one piece of exposure from WikiFX about scam issues, indicating unsatisfactory customer experience with this broker that investors can take reference to.

Account Type

BidMarkets offers a demo account for traders to practice themselves before tapping into real trading.

While for live accounts, there's only one Standard account with a minimum deposit of $300 available. The threshold is a little higher than the industry average, which is usually from $100.

Leverage

BidMarkets offers leverage up to 1:400, which allows investors to control a position of 500 times of their initial deposits.

However, you should be very prudent to use such tool since leverage not only amplify profits, but losses will be augmented at same level as well.

Fees

Spread is said to start from 1 pip,but other fees such as commissions are not publically disclosed.

Trading Platform

BidMarkets boasts an “award winning platform”, but actually it's just a web-based platform with only simplistic and limited trading functions.

Deposit and Withdrawal

BidMarkets advertises a wide range of payment methods with icons on its website: Neteller, Skrill, bank transfer, cash payments and credit/debit cards.

However, these info are doubtful due to inaccessibility to accounts.

WikiFX-Broker

Aktuelle Nachrichten

Rocket Pool Preisprognose: Anstieg um mehr als 40% - Open Interest Rekordniveau erreicht

Hanno Renner, Michael Wax, Julia Bösch: 316 Alumni des Münchner CDTM starten eigenen Fonds

Elon Musks Bruder Kimbal verkauft Tesla-Aktien im Wert von 28 Millionen Dollar – das könnte der Grund sein

Dogecoin-Preis: DOGE stabilisiert sich bei $0,25 - PEPE und TRUMP verzeichnen zweistellige Verluste

Lilium-Aus: Flugtaxi-Startup muss erneut Insolvenz anmelden, Gehälter werden nicht gezahlt

Commerzbank plant massiven Jobabbau: Bis zu 4000 Arbeitsplätze in Gefahr

Lilium-Showdown? Flugtaxi-Startup verkündet erneutes Insolvenzverfahren – dann meldet sich der neue Investor

Influencer-Restaurants: Lanch bekommt 26 Millionen Euro in Series A

„Wie man sich kontrolliert auf die Fresse legt: Skater-Kette des Seriengründers Titus Dittmann meldet Insolvenz an

US-Zölle auf Stahl und Aluminium: Von der Leyen erwägt Vergeltung mit Zöllen auf Produkte aus den USA

Wechselkursberechnung