ChaoShang

Zusammenfassung:ChaoShang is a Hong Kong-based broker established in 2004 and regulated by the SFC. It offers securities, futures, and options trading through its proprietary mobile and web platforms.

| ChaoShang Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Trading Products | Securities, futures, and options |

| Demo Account | / |

| Trading Platform | Chaoshang Securities (Ayers) Mobile App and Chaoshang Securities Trading Website |

| Minimum Deposit | / |

| Customer Support | Phone: (852) 2152 0878; (852) 3899 2599 |

| Email: cs@chaoshangsec.com | |

| 26 Harbin Building, Harbin Road, Wan Chai, Hong Kong Room 2206-10 | |

ChaoShang Information

ChaoShang is a Hong Kong-based broker established in 2004 and regulated by the SFC. It offers securities, futures, and options trading through its proprietary mobile and web platforms.

Pros and Cons

| Pros | Cons |

| Long history | Unclear fee structure |

| Regulated by SFC |

Is ChaoShang Legit?

ChaoShang is regulated by the Hong Kong Securities and Futures Commission (SFC) with a license type of “Dealing in futures contracts,” license number BGH629.

What Can I Trade on ChaoShang?

ChaoShang offers three main trading products: securities, futures, and options.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Trading Platform

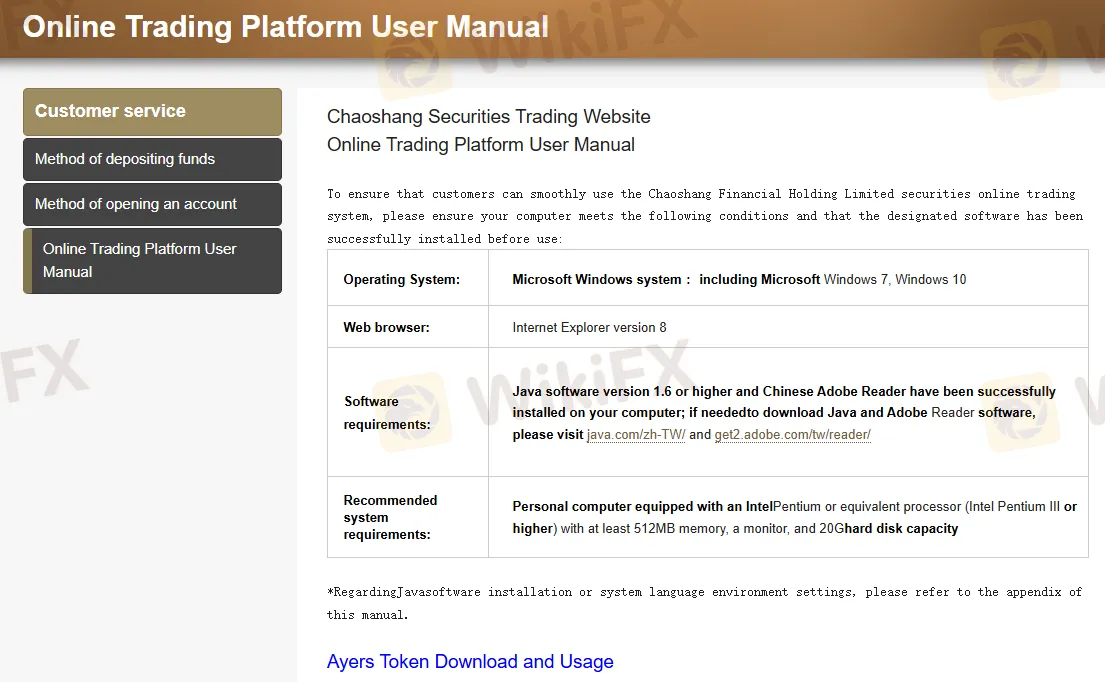

ChaoShang offers a proprietary mobile trading platform—Chaoshang Securities (Ayers) Mobile App—which supports both Android and iOS systems. In addition, it also offers a web-based trading platform — Chaoshang Securities Trading Website.

| Trading Platform | Supported | Available Devices |

| Chaoshang Securities (Ayers) Mobile App | ✔ | iOS, Android |

| Chaoshang Securities Trading Website | ✔ | Web |

Deposit and Withdrawal

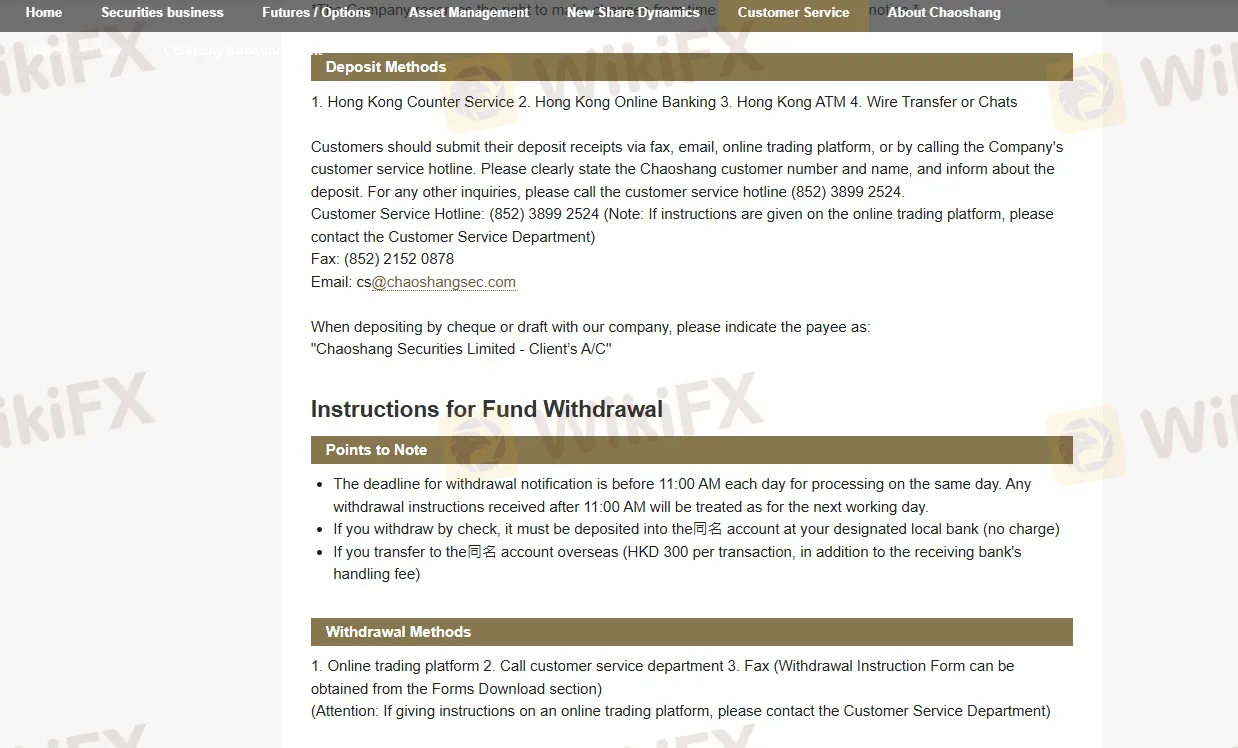

ChaoShangs deposit methods include bank transfers (Bank of Communications, Chong Hing Bank, Hang Seng Bank, Bank of China), counter services, online banking, cheque deposits, and telegraphic transfers or the Faster Payment System (FPS).

Withdrawal methods include instructions submitted via the online trading platform, phone, or fax.

WikiFX-Broker

Aktuelle Nachrichten

Japan verkauft jetzt seine eigenen ETFs – im Wert von mehreren Milliarden Euro

Wechselkursberechnung