Powell’s Dovish Tone Hammers Dollar

Zusammenfassung:Federal Reserve Chair Jerome Powell indicated that recent U.S. economic data suggest inflation is returning to a downward trajectory. However, he emphasised the need for more evidence before the Fed considers shifting its current monetary policy. Consequently, the dollar eased from its recent highs, while U.S. equity markets, buoyed by the dovish tone, saw the Nasdaq and S&P 500 reaching all-time highs.

Jerome Powell Dovish Statement softens dollar to below $106 mark.

The market is awaiting todays U.S. job data to gauge the dollar's strength.

BTC slid by 2% in the last session despite the market's risk appetite improvement.

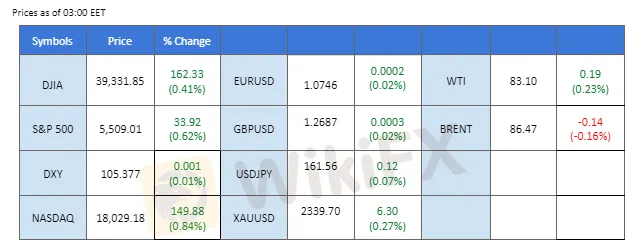

Market Summary

Federal Reserve Chair Jerome Powell indicated that recent U.S. economic data suggest inflation is returning to a downward trajectory. However, he emphasised the need for more evidence before the Fed considers shifting its current monetary policy. Consequently, the dollar eased from its recent highs, while U.S. equity markets, buoyed by the dovish tone, saw the Nasdaq and S&P 500 reaching all-time highs.

Traders are now focused on today‘s ADP Nonfarm Employment Change and Initial Jobless Claims data to further gauge the dollar’s strength. Meanwhile, the Australian dollar received a boost from strong Retail Sales data, reinforcing expectations of a potential rate hike from the RBA due to persistently high inflation.

In the commodity markets, gold prices remained stable despite the easing dollar, while oil prices hovered near recent highs, with traders awaiting today's crude inventories data for further insights. In the cryptocurrency market, Bitcoin prices fell by over 2% in the last session despite improved risk appetite. This decline was influenced by the German government's recent sell-off of nearly $100 million worth of BTC, which has dampened market sentiment.

Current rate hike bets on 31st July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (89.7%) VS -25 bps (10.3%)

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the US dollar against a basket of six major currencies, retreated slightly due to dovish expectations following Fed Chair Jerome Powell's statements. Powell indicated that the current inflation status in the United States is stable, suggesting that the US central bank is likely to start its easing cycle. Following his statements, US 10-year Treasury yields pulled back. However, the losses experienced by the dollar were limited by the US jobs report, which showed an increase in US JOLTs Job Openings in May. Job openings, a measure of labor demand, rose by 221,000 to 8.140 million in May, according to the Job Openings and Labor Turnover Survey (JOLTS) report.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 44, suggesting the index might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 106.05, 106.50

Support level: 105.50, 105.15

XAU/USD, H4

Gold prices continue to consolidate within a range, as mixed sentiment has left investors struggling to find a clear direction. On a positive note, gold prices found support from dipping US Treasury yields and a weaker US dollar, following dovish comments from Federal Reserve Chair Jerome Powell regarding the Fed's disinflationary efforts. However, gains in the gold market were limited by a better-than-expected JOLTs Job Openings report, which complicates the outlook for the Nonfarm Payrolls and Unemployment Rate reports due later this week.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 2335.00, 2370.00

Support level: 2295.00, 2275.00

GBP/USD,H4

The GBP/USD pair, despite sliding in the earlier session, rose sharply and topped its previous high at 1.2675. This surge was primarily driven by the softening of the dollar following the dovish remarks from Fed Chair Jerome Powell yesterday. Several economic data releases are expected to impact the pair's movement. The UK PMI readings are due later today, followed by U.S. job data, including the ADP Employment Change and the Initial Jobless Claims. These reports will provide further direction for the pair.

GBP/USD has a more certain trend reversal signal following a higher-high price pattern formed in the last session. The RSI is moving toward the overbought zone, while the MACD is crossing above the zero line, suggesting bullish momentum is forming.

Resistance level: 1.2760, 1.2850

Support level: 1.2600, 1.2540

EUR/USD,H4

The Euro remained flat, showing little reaction to statements from European Central Bank President Christine Lagarde. She mentioned that the euro zone is advanced on the disinflationary path, but further easing of monetary policy depends on economic performance. Despite the flat trend for the Euro, significant volatility is expected ahead of the French elections. Investors should continue monitoring the election outcome for further trading signals.

EUR/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the pair might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 1.0810, 1.0870

Support level: 1.0735, 1.0675

Nasdaq (US100), H4

The Nasdaq has risen above its psychological resistance level at the 20,000 mark. Risk appetite improved after Fed Chair Jerome Powell delivered a dovish statement yesterday, indicating that recent U.S. economic indicators suggest inflation is on a downtrend trajectory. This has reinforced the likelihood of a rate cut in September, boosting market sentiment.

The Nasdaq has given a bullish bias signal as the index has surpassed its all-time high and broken above its key resistance level at the 20,000 mark. The RSI remains in the upper region, while the MACD flows at elevated levels, suggesting that the bullish momentum remains strong.

Resistance level: 20350.00, 20850.00

Support level: 19880.00, 19540.00

AUD/USD, H4

The AUD/USD pair is attempting to break above its key resistance level near 0.6675, supported by favourable fundamental factors. The dovish tone from Fed officials has hindered the U.S. dollar's strength, while the latest Australian Retail Sales reading exceeded market expectations, reinforcing the likelihood of a further rate hike from the RBA. This combination of factors has boosted the strength of the Aussie dollar.

The pair is attempting to break above the key resistance level at 0.6675; a break above such a level suggests a bullish signal for the pair. The RSI remains near the 50 level while the MACDflowsclose to the zero line, w, giving the pair a neutral signal.

Resistance level: 0.6730, 0.6780

Support level: 0.6611, 0.6550

BTC/USD, H4

BTC slid by more than 2% in the last session after a technical rebound from its recent low level. The delay of the ETH ETF launch to later this month and the continuous offloading of BTC by the German government have dampened market sentiment. However, it is believed that there is a key support level near $60,000, where BTC whales have been accumulating BTC around this level.

BTC is sliding toward its key support level at the near $60,000 range. The RSI is dropping toward the oversold zone, while the MACD has crossed after breaking above the zero line, suggesting that the bullish momentum is easing.

Resistance level: 64860.00, 67540.00

Support level: 57060.00, 52530.00

CL OIL, H4

Crude oil prices retreated slightly as fears that Hurricane Beryl would disrupt supplies diminished, with the storm expected to avoid most oil fields as it heads toward Jamaica. Previously, oil prices had extended gains amid fears of supply disruption due to the hurricane. However, losses were limited by upbeat oil inventory data. According to the American Petroleum Institute (API), US crude oil inventories declined sharply by 9.163 million barrels, much higher than the market expectations of a 150K decline.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the commodity might extend its losses toward support level.

Resistance level: 84.35, 86.35

Support level: 81.80, 80.05

WikiFX-Broker

Aktuelle Nachrichten

Auszeit vom Job? Mit diesen 5 Tipps bekommt ihr euren Sabbatical-Wunsch beim Chef durch

Dieses europäische Land könnte schon bald wieder Negativzinsen einführen

Wechselkursberechnung