The Traders Domain Spreads, leverage, minimum deposit Revealed

Abstract:Traders Domain is a St. Vincent and the Grenadines registered online broker that provides investors with trading services in Forex, Commodities, Stocks, etc. Traders Domain does not display any regulatory information on its official website.

| The Traders Domain | Basic Information |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Founded in | 2018 |

| Company Address | Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines |

| Regulation | No regulation |

| Tradable Instruments | Forex, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Standard, ECN, Islamic, PAMM, and MINI BTC |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips (certain account types) |

| Commission | $67per lot traded |

| Deposit Methods | Credit/debit cards, bank wire transfer, e-wallets |

| Customer Support | Email, live chat, phone |

| Educational Resources | Limited educational resources |

| Bonus Offers | None |

*Please note that the information in this table is subject to change and you should always refer to the broker's official website for the most up-to-date information.

Overview of The Traders Domain

The Traders Domain is a forex and CFD broker that is registered in Saint Vincent and the Grenadines. The broker was established in 2018 and offers trading in a range of financial instruments, including forex, cryptocurrencies and more. The Traders Domain provides traders with a range of account types, including Standard, ECN, Islamic, PAMM, and MINI BTC, with minimum deposit requirements of $100 and the maximum trading leverage up to 1:500.

The broker offers its clients the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are widely regarded as the most popular and reliable trading platforms in the industry. Traders can access the platforms via desktop, web, and mobile devices. The Traders Domain provides a range of trading tools and features, including a range of technical analysis tools, expert advisors, and copy trading services.

Is The Traders Domain legit or a scam?

The Traders Domain is registered in Saint Vincent and the Grenadines, but it is not regulated by any reputable financial authority. It is important to note that trading with an unregulated broker carries a higher risk as there is no oversight by a regulatory body to ensure fair practices and protection of clients' funds. Traders should conduct thorough research and due diligence before opening an account with an unregulated broker.

Pros and Cons

On the plus side, The Traders Domain offers multiple account options, with a minimum deposit of $100 for all account types, leverage up to 1:500. However, The Traders Domain is not regulated, which can be a concern for some traders who prioritize the security and safety of their investments.

| Pros | Cons |

| MT4 & MT5 trading platform | Not regulated |

| Acceptable minimum deposit amount | Commissions charged on most accounts |

| Generous leverage up to 1:500 | Limited payment methods supported |

| Multiple account options | Limited educational resources |

| Limited customer support options | |

| Limited research and analysis tools | |

| Limited trading instruments | |

| Not accept clients from some countries |

Market Intruments

The Traders Domain offers a range of trading instruments including forex and cryptocurrencies. However, it seems that these are the only instruments available for trading, and there is no mention of other popular instruments such as commodities or indices. While forex and cryptocurrencies can provide ample trading opportunities, the lack of diversity in trading instruments may not suit some traders who prefer a wider range of options.

| Pros | Cons |

| None | Limited currency pairs and cryptocurrency offered |

| No other popular trading instruments, like commodities, stocks, indices, energy offered |

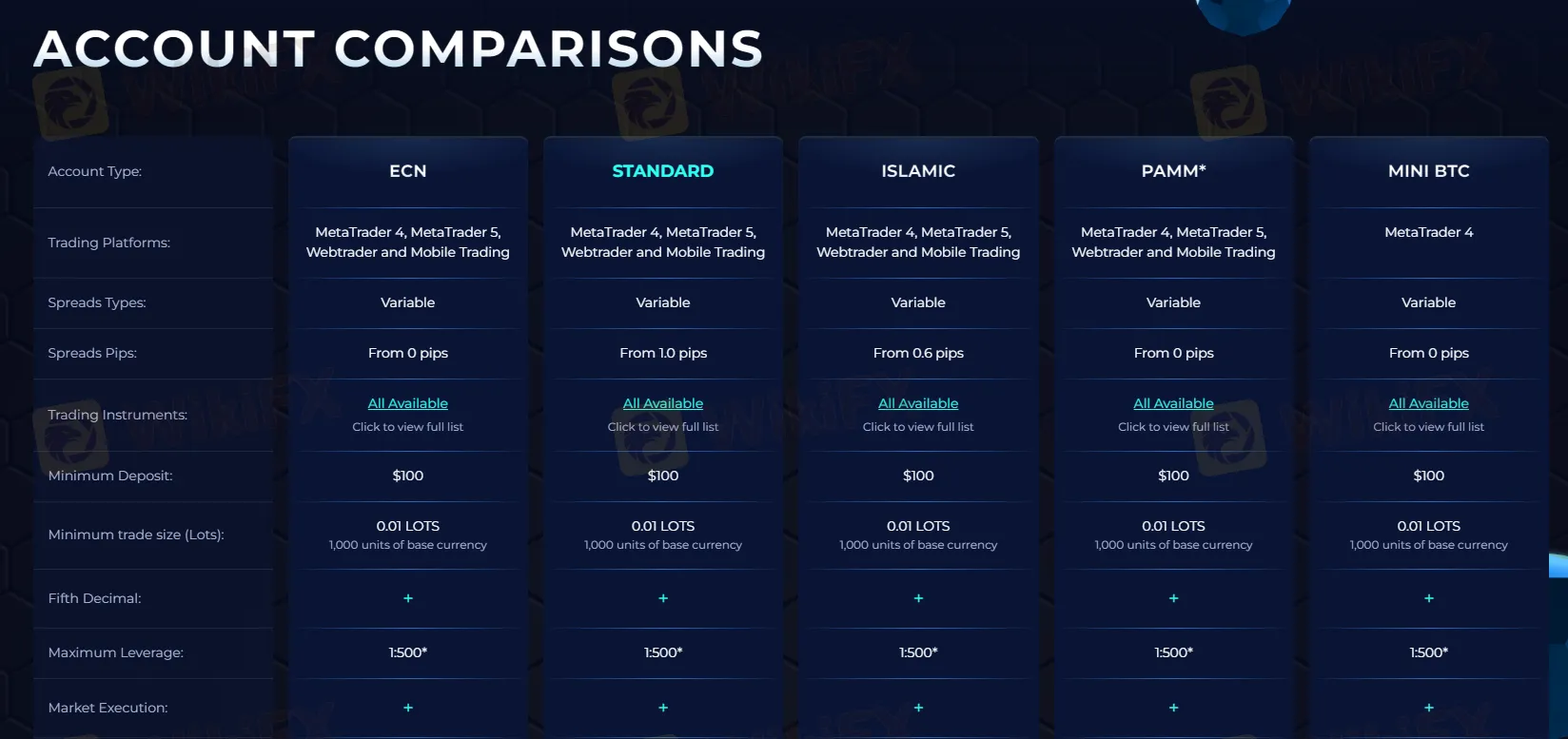

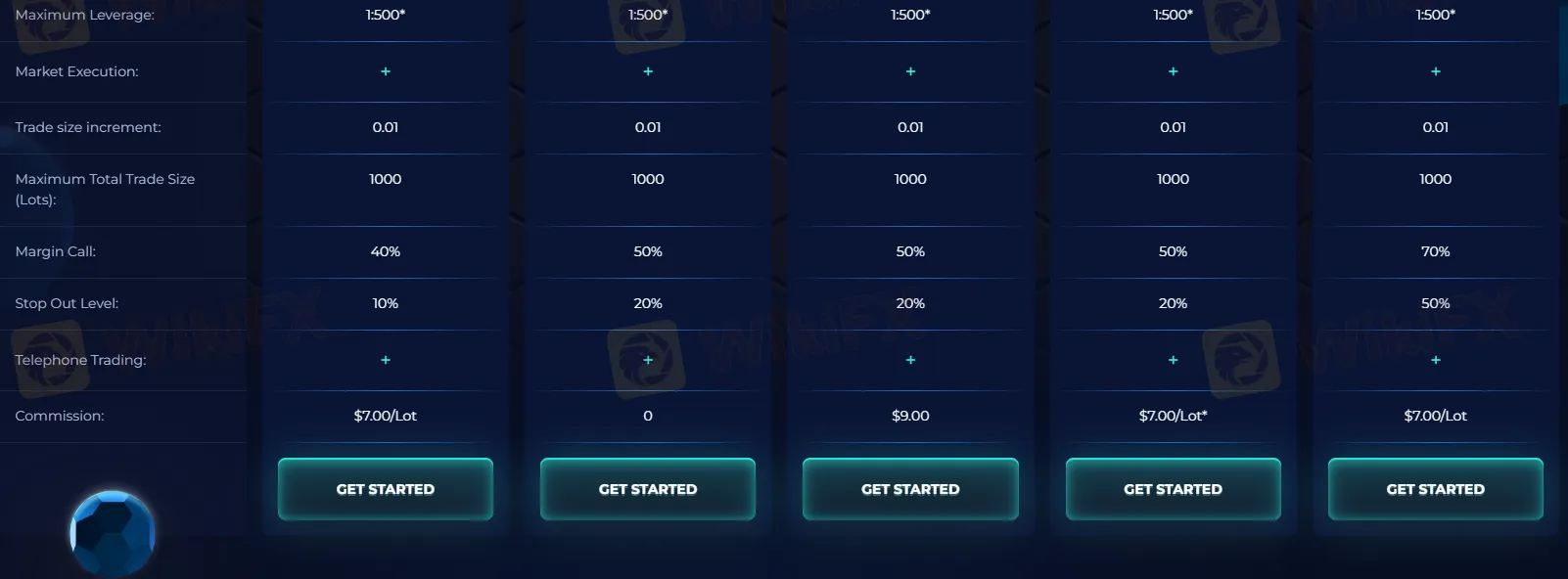

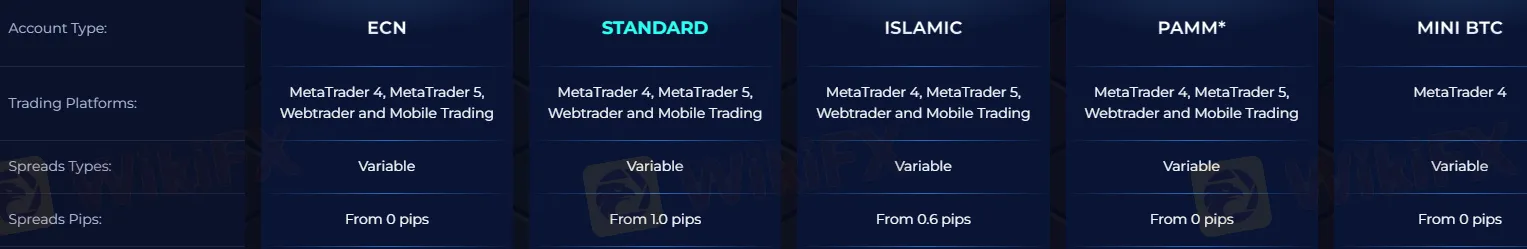

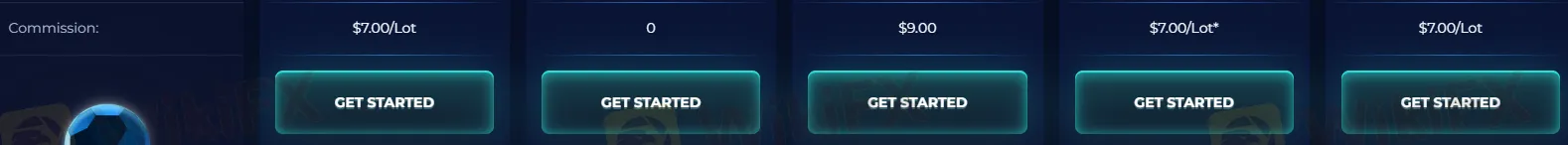

Account Types

The Traders Domain offers a range of account types to cater to the needs of various traders. The ECN account is suitable for experienced traders who require direct access to liquidity providers. The Standard account is designed for beginners and retail traders who prefer fixed spreads. The Islamic account follows the principles of Islamic finance, and the PAMM account is suitable for money managers who want to manage multiple accounts. The MINI BTC account is ideal for traders who want to trade cryptocurrencies in smaller amounts. All accounts require a minimum deposit of $100, which is quite reasonable compared to other brokers.

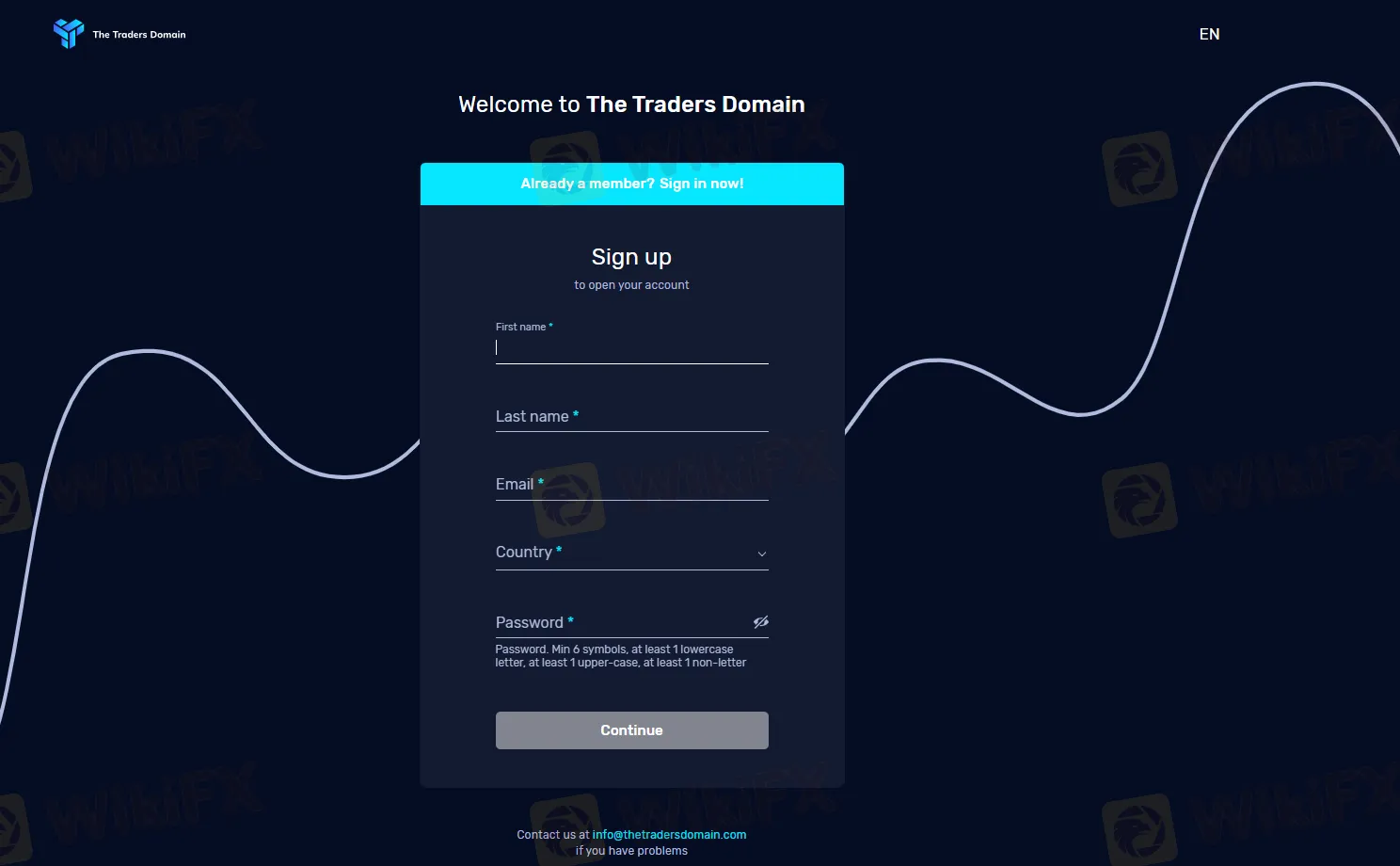

How to open an account?

If you want to open an account with The Traders Domain, it's pretty simple.

Head over to their website and click on the “Open A Live Account” button.

You'll need to fill out some basic information, like your name, email, and phone number.

. Then, you'll choose which type of account you want to open - they have options like Standard, ECN, and Islamic accounts, to name a few.

Once you've chosen your account type, you'll need to make a deposit to fund your account. The minimum deposit for all account types is $100. The Traders Domain accepts a variety of payment methods, including credit/debit cards, bank transfers, and cryptocurrencies like Bitcoin.

After you've made your deposit, you'll need to verify your account by providing some identification documents. This is a standard procedure to prevent fraud and ensure the safety of your account. Once your account is verified, you can start trading.

Leverage

The Traders Domain offers flexible leverage options to its traders, with a maximum of 1:500. This means that traders can trade with a higher amount than what they have in their accounts. However, it is important to note that high leverage can increase both potential profits and losses. So, traders should always use leverage with caution and implement appropriate risk management strategies.

It is also worth noting that The Traders Domain offers different account types, and each account type has a different spread structure. For instance, the ECN account offers tighter spreads with a commission charged per trade, while the standard account has wider spreads with no commission charged. Additionally, the Islamic account is swap-free, and traders can request it at the time of account opening.

Spreads & Commissions (Trading Fees)

When it comes to trading fees, traders need to be aware of the spreads and commissions charged by a broker. The Traders Domain offers variable spreads that start from 0 pips.

It is also worth noting that The Traders Domain offers different account types, and each account type has a different spread structure. For instance, the ECN account offers tighter spreads with a commission charged per trade, while the standard account has wider spreads with no commission charged. Additionally, the Islamic account is swap-free, and traders can request it at the time of account opening.

Non-Trading Fees

Non-trading fees refer to the fees charged by a broker that are not directly related to trading activities. These fees can include withdrawal fees, inactivity fees, and account maintenance fees, among others. In the case of The Traders Domain, the broker does not charge any fees for deposits or withdrawals. However, clients may be subject to fees from payment providers, such as banks or payment processors. Additionally, the broker may charge an inactivity fee of $50 per month for accounts that have been dormant for a period of six months or longer.

Trading Platform

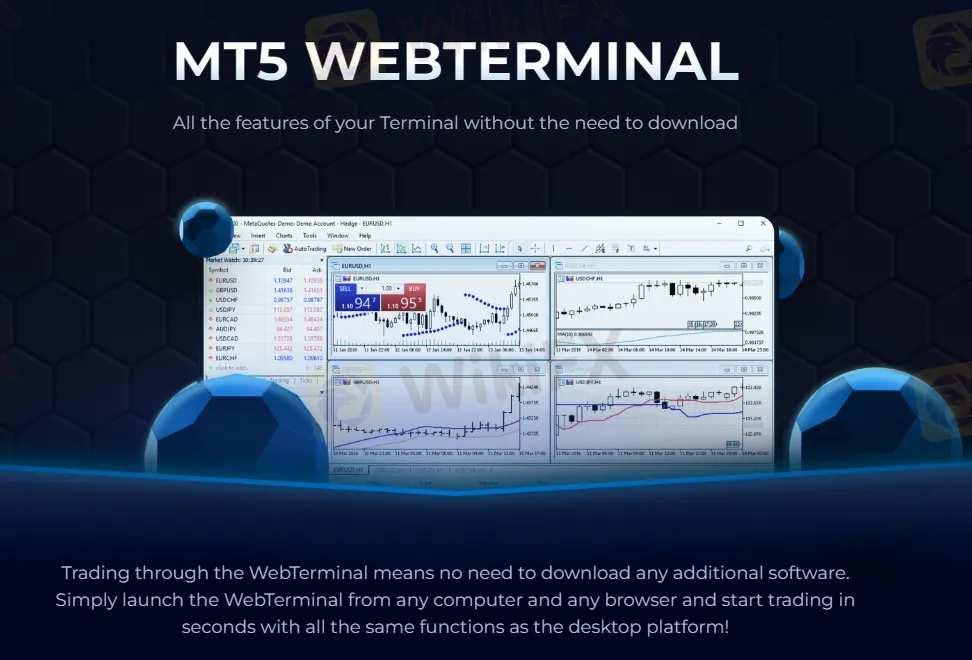

The Traders Domain offers two of the most popular trading platforms in the industry, MT4 and MT5. Both platforms are available for desktop and mobile devices, allowing traders to access their accounts and monitor their trades anytime and anywhere. MT4 is widely recognized for its user-friendly interface, powerful charting capabilities, and the ability to automate trading with the use of Expert Advisors (EAs). MT5, on the other hand, is the newer version of the platform, offering additional features such as more advanced charting tools and the ability to trade a wider range of financial instruments. The Traders Domain also offers the WebTrader platform, which is a browser-based trading platform that does not require any software download or installation.

Deposit & Withdrawal

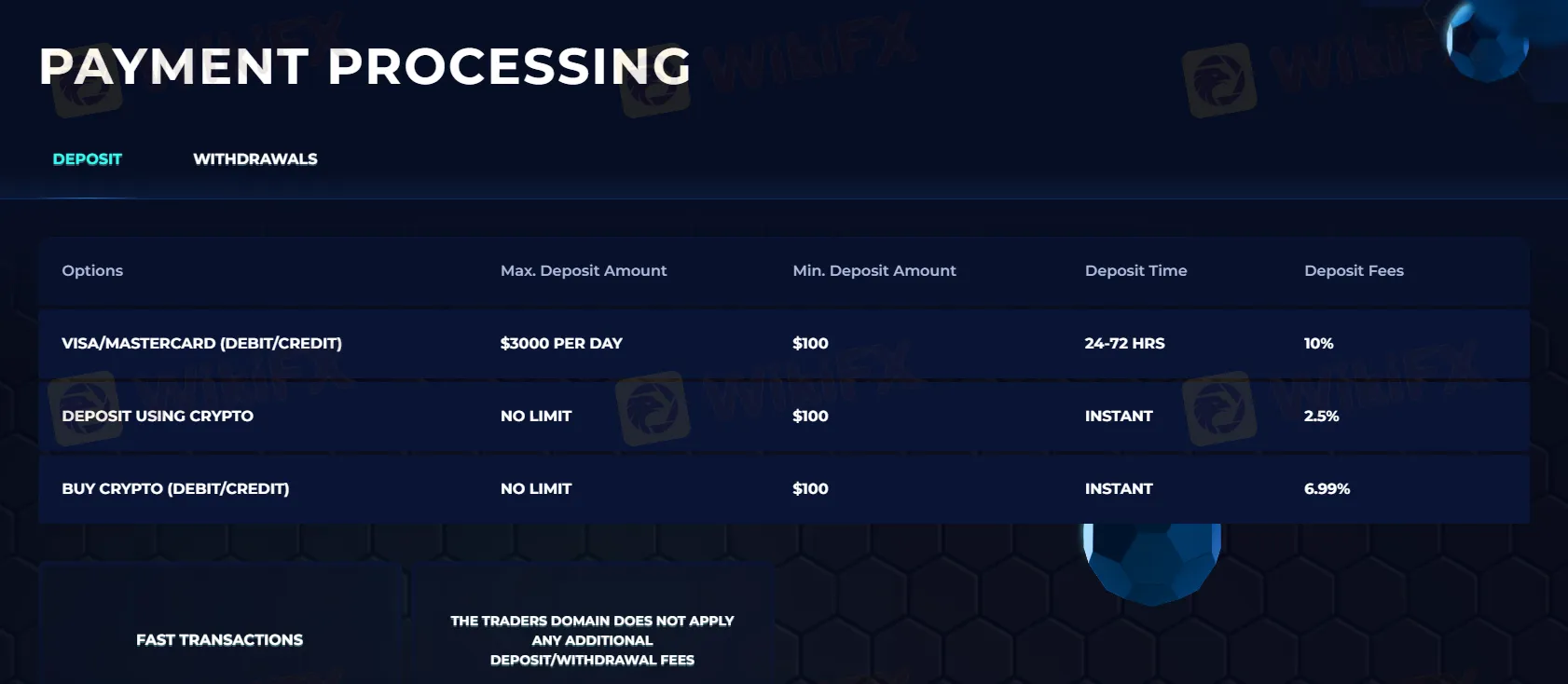

The Traders Domain offers a range of deposit and withdrawal methods to suit the needs of its clients. Clients can deposit funds using VISA, Mastercard, and cryptocurrencies, among others. The minimum deposit for all account types is $100, which is relatively low compared to other brokers in the industry. The maximum deposit amount through VISA/MasterCard ( Debit/Credit) is $3,000 per day, with a 10% deposit fee. Deposits through crypto have no limits of maximum deposit, with a deposit fee of 2.5%. Buy crypto (debit/credit) has a 6.99% deposit fee.

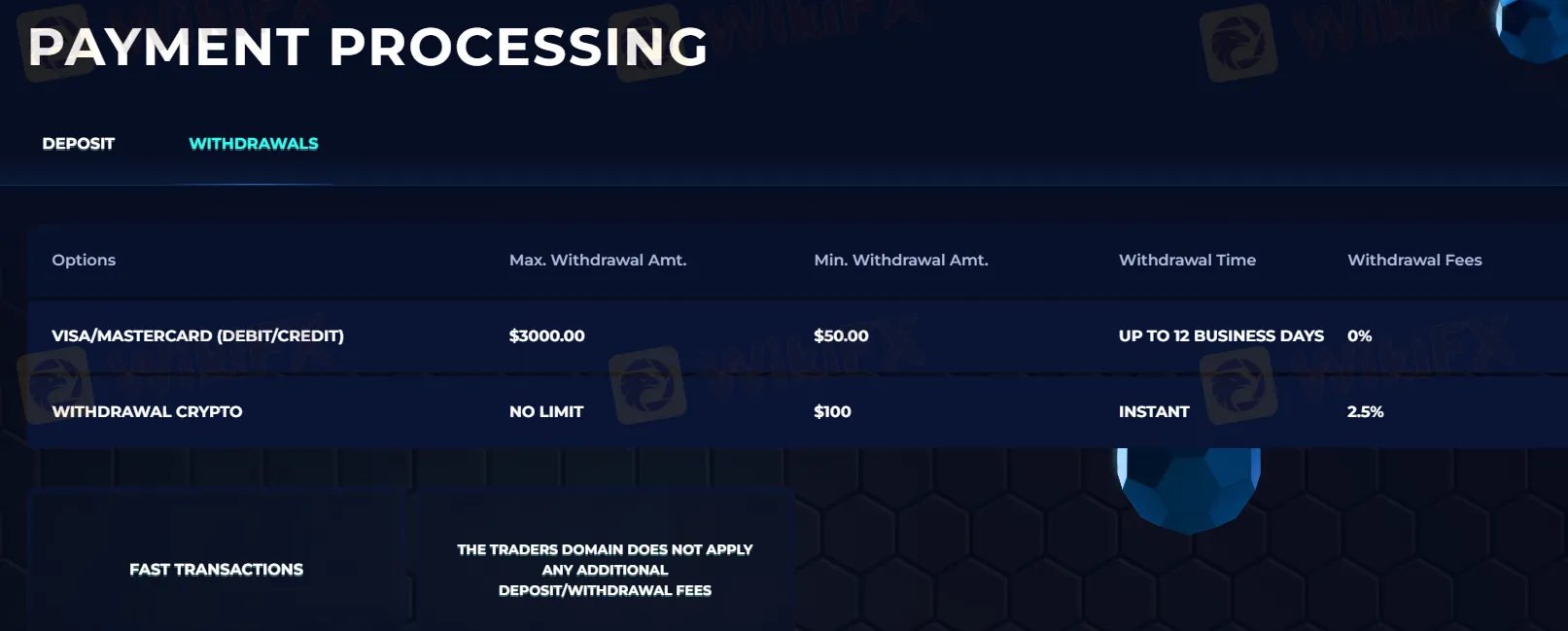

Please note that clients may incur withdrawal fees depending on the payment method used. For example, withdrawals through crypto are subject to a fee of 2.5%. It's worth noting that some payment methods may take longer than others to process, so clients should check with the broker for more information on processing times.

Customer Support

The Traders Domain offers various customer support options including a live chat feature on their website, email support, and phone support during working hours. Additionally, they have an extensive FAQ section on their website that covers a wide range of topics related to trading and account management. However, this broker only has a presence on Instagram, where customers can interact with the support team and get the latest news and updates.

| Pros | Cons |

| Live Chat Supproted | Only one social media platform available - Instagram |

| A comprehensive FAQs section | |

| Email & Phone support available |

Educational Resources

Unfortunately, it seems that The Traders Domain does not provide any educational resources for its clients. There is no dedicated educational section on the broker's website.

Conclusion

Overall, The Traders Domain is a forex and crypto broker that offers multiple account types, leverage of up to 1:500, and a choice of trading platforms, including both MT4 and MT5. However, there are also some potential drawbacks to consider, such as the lack of regulation, limited market instruments, absence of educational resources, and non-trading fees such as withdrawal fees may apply. Therefore, traders should carefully evaluate their options and conduct thorough research before deciding whether to open an account with The Traders Domain or not.

FAQs

Q: Is The Traders Domain a regulated broker?

A: No, The Traders Domain is not a regulated broker.

Q: What is the minimum deposit required to open an account with The Traders Domain?

A: The minimum deposit required to open an account with The Traders Domain is $100 for all account types.

Q: Does The Traders Domain offer any bonuses or promotions?

A: It is not clear if The Traders Domain offers any bonuses or promotions, as the information is not provided on their website.

Q: What is the maximum leverage offered by The Traders Domain?

A: The maximum leverage offered by The Traders Domain is 1:500.

Q: What trading instruments are available at The Traders Domain?

A: The Traders Domain offers a limited range of trading instruments, which includes forex and cryptocurrencies.

Q: Does The Traders Domain charge any non-trading fees?

A: Yes, The Traders Domain charges non-trading fees such as withdrawal fees and inactivity fees. It is important to review their fee schedule carefully before opening an account.

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

XS.com Broker Partnership Expands Liquidity with Centroid Integration

EC Markets: A Closer Look at Its Licenses

Rate Calc