Will the Euro Fall on France Consumer Confidence? Riots in Sight

Abstract:The Euro may fall after France releases its Consumer Confidence data. The Yellow Vest protests have weighed on data amid a broader European-wide economic de-acceleration

TALKING POINTS - YELLOW VESTS PROTESTS, CONSUMER CONFIDENCE, EURO

Euro may dip on French Consumer Confidence Report

Yellow Vest protests may be disrupting economic activity

Deeper EU-wide economic slowdown on the horizon?

See our free guide to learn how to use economic news in your trading strategy!

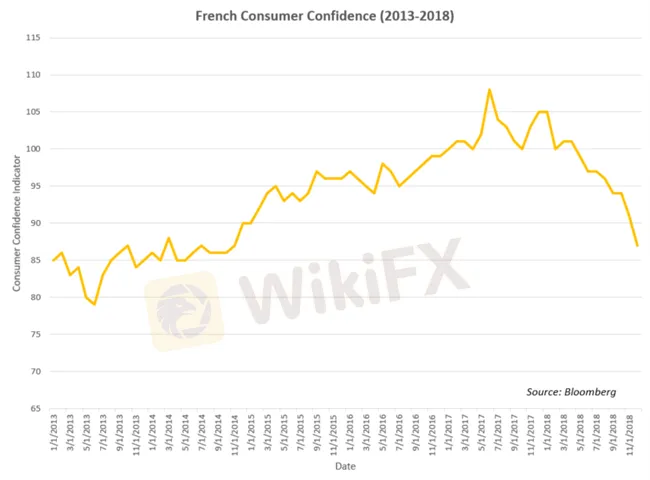

EUR/USD may dip after France‘s CPI data is released on January 29 at 07:45 GMT. Forecasts currently stand at 88 with the previous report showing 87. Broadly speaking, economic data coming out of France has been lackluster and frequently falling short of expectations. The Yellow Vest (gilet jaunes) protests have played a crucial role in France’s economic performance, particularly consumer confidence.

YELLOW VESTS PROTESTS IMPACT

The protests emerged in the last breaths of 2018. The protesters were motivated primarily by rising fuel prices, the high cost of living and grievances against certain tax codes. The protests turned into riots and eventually devolved into clashes with police and the destruction of property.

The participants involved gave a list of demands, some of which required the repealing of the fuel tax, raising the minimum wage and the resignation of President Emmanuel Macron. As a result of the domestic tribulations, his ratings have plummeted. Meanwhile, nationalist politician Marie La Pens popularity has grown, putting France in danger of having a Eurosceptic representation in the European Parliament in 2019.

The disturbance from the protests have only worsened, with a counter-movement known as the “Red Scarves” (foulards rouges) having marched against the initial protestors this past Sunday. This kind of political fissuring and discontent is part of a broader European trend in political fragmentation that may be made more apparent this year in the European Parliamentary (EP) elections in May.

The protests have resulted in trade losses because of blocked routes necessary for transportation along with slower consumption. Other notable indicators that have taken a hit have been the Composite and Services PMI data, coming in at 47.9 and 47.5, undershooting the forecasts of 51 and 50.5, respectively.

The Yellow Vests are now beginning to organize themselves into a political unit and are aiming to participate in the EP elections. They are currently forecasted to win 13 percent of the vote. Macron may also anger Eurosceptics around the continent because his revised budget deficit – as a way to accommodate the protestors demand – may breach the 3 percent threshold. This would put Brussels in a tighter spot with Italy.

As the third largest Eurozone economy – following the UK and Germany – what happens in France politically and economically can bear tremendous implications for the Euro. Growth in Germany is already slowing, Italy is teetering on a recession, and the UK is in the midst of a tangled Brexit arrangement.

EUR/USD OUTLOOK

The Euro, after breaking above a key resistance, appears now to be bouncing off 1.1435, and could potentially head down to 1.1415. If French Consumer Confidence comes in lower than expected, it could cause EUR/USD to break below the latter price level.

EUR/USD – Daily Chart

Later this week, a cascade of European economic data will be released primarily on January 31 and February 1. The release of these indicators – particularly Italys GDP – will almost certainly impact the Euro. The IMF, ECB and World Bank all have made forecasts of slower growth in Europe. This data will therefore be a key event to monitor because the results could validate the outlooks and exert pressure on the Euro.

Read more

【MACRO Insight】The road to European energy independence is fraught with difficulties as Russia reclaims its position as the largest natural gas supplier

During the Russia-Ukraine conflict, despite Europe's efforts to reduce reliance on Russian natural gas, Russia's gas exports unexpectedly surpassed those of the United States in May, highlighting Europe's challenge in achieving energy independence. European natural gas prices surged 40% in three months due to increased demand in Asia and supply uncertainties. Despite high inventories, supply risks persist. The EU is seeking to diversify its sources and increase storage capacity to cope with mark

GEMFOREX Numbers Outlook – February 2023

these are the GEM numbers of the month for February:

GemForex - weekly analysis

The Week Ahead: Will the FED pivot to the emerging dynamics?

GemForex - weekly analysis

European Central Bank under enormous pressure ahead of Fed rates

WikiFX Broker

Latest News

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

Evest Broker Review: Regulated, but Complaints Persist

Is Eightcap Safe or Scam? Eightcap User Reputation : Looking at Real User Reviews

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

Rate Calc