There are 9 US states with no income tax, but 2 of them still tax investment earnings - Business Insider

Abstract:The states with no income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

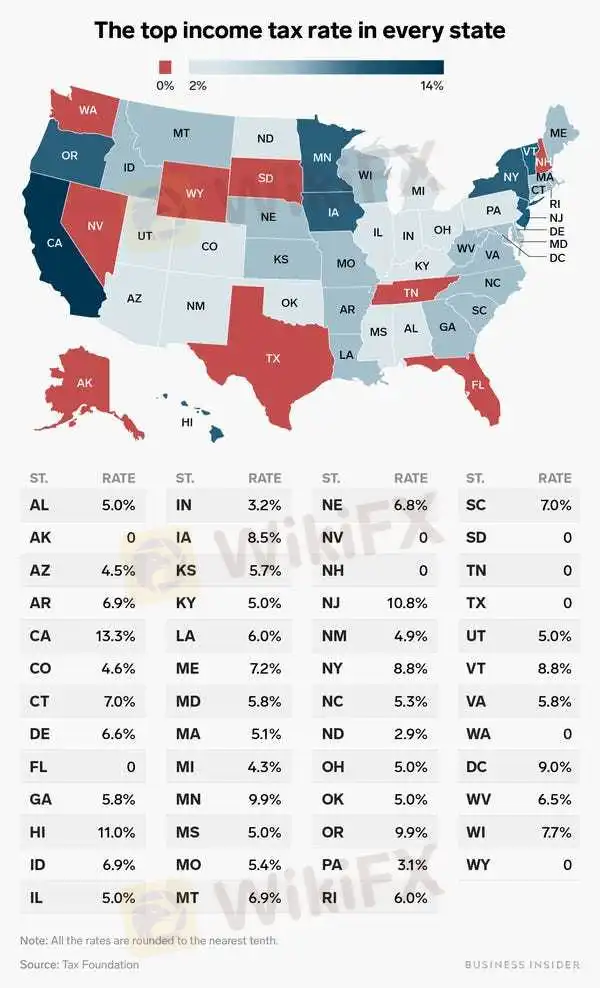

Taxes are due for income earned in 2019 by April 15.Most Americans file a state income tax return and a federal income tax return.If you live in one of nine states with no income tax, you may not need to file a state return.Read more personal finance coverage.Taxes are due Wednesday, April 15.If you owe at least $5 in federal income taxes, you have to file a federal tax return. Some people, however, are off the hook when it comes to filing a state tax return.That's because seven US states don't impose state income tax — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.New Hampshire and Tennessee don't tax earned income either, but they do tax investment income — in the form of interest and dividends — at 5% and 2%, respectively, for the 2019 tax year. If you live in either state and received income from your investments, you may need to file a state return.The other 41 states have either a flat income tax — meaning everyone, regardless of how much they earn, pays the same percentage of their income to the government — or a progressive income tax, which means your tax rate is determined by your income. The chart below lists the top tax rate in every state for the 2019 tax year.

Ruobing Su/Business Insider

But living in a state with no income tax doesn't necessarily mean you're getting off scot-free. Texas and New Hampshire, for instance, may not tax your earnings, but they do have some of the highest property tax rates in the country, which could ding you if you're a property owner.Likewise, Tennessee doesn't tax your paycheck, but it will get you in the checkout line. The state has one of the highest sales tax rates in the country at 7%.Still, everyone is subject to federal income taxes regardless of where you live. How much you pay depends on how much you earn, also known as your tax bracket. In 2018, about 76 million Americans didn't owe federal income tax because their earnings were too low.After you file your taxes, you may get a state tax refund or a federal tax refund — or both if you live in a state that taxes income. The IRS says the fastest way to get your tax refund is the method already used by most taxpayers: filing electronically and selecting direct deposit as the method for receiving your refund.More tax day coverage:When are taxes due?How to file taxes for 2019What is a tax credit?H&R Block vs. TurboTax

Read more

Job security concerns in tech jumped, especially at these companies - Business Insider

New research from the anonymous social media network Blind shows job concerns among employees at tech companies jumped 33% in a month.

Some lenders extend mortgage rate lock periods during coronavirus - Business Insider

If you're buying or refinancing on a home amid the coronavirus outbreak, ask your lender whether it's offering rate lock period extensions.

Everything you need to know about life insurance, in one place - Business Insider

If you want to learn more about life insurance, figure out if it's for you, and get some tips on where to start, you've come to the right place.

Bank of America letting cardholders defer payments due to coronavirus - Business Insider

You can submit a request to defer your personal and business Bank of America credit card payments online.

WikiFX Broker

Latest News

FCA Charges UK Finfluencers Over High-Risk CFD Ads

Valutrades Reports Rising Revenue—But Is the Broker Reliable?

SkyLine Review —— XM: Building Lasting Trust Through a Superior Trading Experience

Q3 Trading Results Analysis: Season's End, Shared Growth

The Fed Models Were Wrong About The US Economy

Simulated Trading Competition Experience Sharing

Neex Secures UAE License, Expands Middle East Ops

Exness Redefines Forex Trading Standards

Robo Trading Explained: What It Is and How It Works?

Robinhood Sues Massachusetts Over Sports Bet Rules

Rate Calc