Forex Options Trading: The Smart Way to Ease Market Volatility

Abstract:Want to feel at ease amid forex market volatility? Consider exploring forex options that work as derivatives based on underlying currency pairs. With multiple flexible alternatives, forex options trading is the approach you need to adopt to navigate the seemingly complex forex market. Read this article for more insights.

Want to feel at ease amid forex market volatility? Consider exploring forex options that work as derivatives based on underlying currency pairs. Trade forex options involve using a wide range of strategies that can be employed in currency trading. Now, the strategy the traders may employ depends greatly on the option type they select and the broker or platform through which they can access it. Forex options are traded in a decentralized market, making them more flexible than options traded on centralized exchanges.

Trade Forex Options - An Overview

Options traded in the forex market are different from those in stocks or other financial markets. Forex options trading allows you to trade without actual asset delivery. These options trade over the counter (OTC), allowing traders to choose prices and expiration dates that align with their profit or hedging strategy. What makes forex trade options more appealing is the lack of obligation for traders to fulfill the contractual terms. Forex options are attractive because they limit downside risk to just the premium paid, while offering unlimited upside potential.

Forex options trading will be used to hedge potential open positions in the forex cash market. This is also known as the physical and spot market. With trade forex options, traders can trade and gain by predicting the market movement based on political, economic, or any other developments.

Understanding the Intricacies of Forex Options Trading

Notwithstanding the benefits that forex options trading has to offer, traders will still have to deal with certain complexities. These options feature many dynamic parts that make value determination complicated. Traders may witness risks including interest rate differentials, the time horizon for expiration, market volatility, and the existing currency pairs price. Trading forex options may see high premium charges. The strike price and the expiration date help determine the premium. The best part is that forex options trading allows traders to realize some payoffs without any need to follow the process involved in purchasing a currency pair.

Types of Forex Trade Options

Retail forex traders have two types of currency options trading with both involving short-term trades of a currency pair while emphasizing its future interest rates. These are Traditional Vanilla Call or Put Option and Single Payment Option Trading Product.

Traditional Vanilla Call or Put Option

This allows traders the right but not an obligation to purchase or sell any currency at the agreed price and on the date of execution. There will be one long currency pair and one short currency pair. The buyer needs to mention their purchase amount, purchase rate, and the expiration date. The seller responds by sharing a quoted premium for the trade. Traditional options may feature European or American-style expirations. Traders, however, gain the right and do not find themselves obligated to both call and put options. Should the current exchange rate put options out of the money, they will expire worthless.

Single Payment Options Trading Product

Featuring a more flexible contract structure than a traditional option, a single payment option trading (SPOT) product offers binary or digital options. For instance, the buyer will speculate that EUR/USD will breach 1.3000 in 12 days. The buyer will thus get premium quotes based on the probability of this incident. With the occurrence of this event, the buyer gains profit. If it does not happen, the buyer will lose the premium paid for this. SPOT contracts involve a premium higher than those charged for traditional trade forex options contracts.

Illustrations of Trade Forex Options

An investor feels that the Euro will surge against the USD and thus buys a currency call option on the Euro at a strike price of $115, as currency prices remain quoted at 100 times the exchange rate. As the investor enters into the contract, the spot price of the Euro remains equivalent to $110. So, if on the expiration date, the Euros spot price remains at $118. The currency option has, therefore, expired in the money. Investors receive a profit worth $300 (100 x ($118-$115), which is lower than the premium paid for the currency call option.

Defining the Strike Price

The strike price remains the lowest point at which options can be exercised. You cant exercise options if the strike price is not reached. However, exchanges usually sell options at varying strike prices, freeing you from one until you commit.

What Does Out of the Money Mean?

If the option fails to reach a point where it can be sold or purchased, it reaches the Out of the Money (OTM) stage.

Summing Up

Forex options trading is indeed a vital proposition for investors seeking both safe and profitable shores in an otherwise tumultuous forex market. Traders can also choose from different options - Traditional and SPOT to navigate the seemingly complex market. However, the success in forex options trading depends on your investment goals, risk appetite and knowledge.

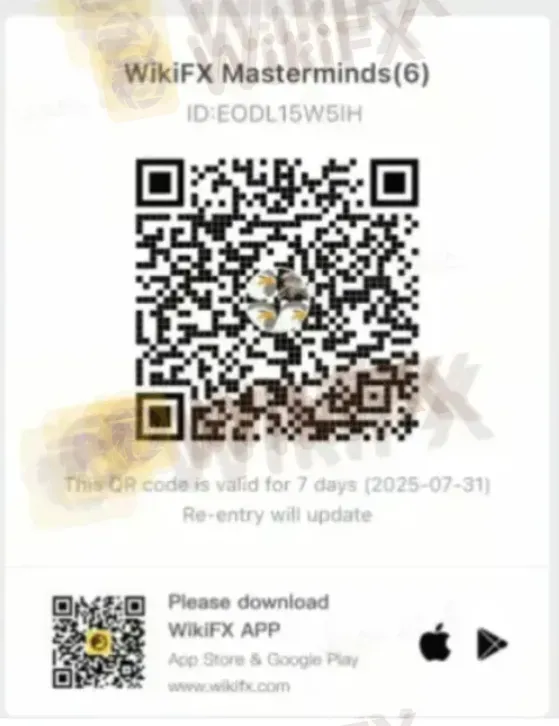

WikiFX Masterminds Is Now Live!

Join a growing community where forex insights take center stage for an informed trading journey.

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Install the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations, you have joined the community.

Read more

UNFXB Exposed: Vanishing Profits & High Spreads Frustrate Traders

Not feeling satisfied with the welcome bonus offer of UNFXB? Finding it hard to receive withdrawals from the broker despite repeated attempts? Does your trading profit vanish suddenly? Are high spreads draining your capital? Do you also face account closure issues with UNFXB? You have added to a long list of traders who have faced these issues. In this article, we will talk extensively about these issues. Take a look!

VCG Markets: An Unknown FX Broker That Deserves a Closer Look! Be Cautious

VCG Markets is not much popular among traders and investors, but it is active in the forex market and can swindle those who are not aware. So this is a broker you need to be cautious about. This broker has several major red flags you need to know about to protect your money. Read this article to know VCG Markets.

Why Are Investors Losing Trust in StoneX? What You Need to Know

StoneX is a FCA-regulated broker, but despite this, investors are losing interest. What are the key reasons behind this shift in investor sentiment?

Trader’s Way Exposed: Where Winning Trades Turn into Losses Overnight

Is your trading experience at Trader’s Way full of unpleasant surprises? Do you see your winning trades suddenly converting into losses? Does the broker ask you to pay the additional fee for withdrawals? These issues are very common for traders at Trader’s Way. In this article, we have shared the stunning reviews of the broker on the review platform. Take a look!

WikiFX Broker

Latest News

Pip Value Calculation Guide: How Much Is a Pip in Forex Really Worth?

Football Meets Finance: PSG Signs Global Partnership With WeTrade

Checkout List of 7 "FCA WARNED" Unauthorized Brokers

Why Are Investors Losing Trust in StoneX? What You Need to Know

Trader’s Way Exposed: Where Winning Trades Turn into Losses Overnight

Activity Upgraded! The 2025 WikiFX “Global Broker Review Contest” Grandly Launches!

What is Free Margin in Forex - An Insightful Guide You Can’t Miss Out

UAE Retail Investors Show Strong Preference for Local Stocks Amid Global Tensions

Wetrade: A Closer Look at Its Licenses

The Ultimate Guide: How to Count and Calculate Pips in Forex

Rate Calc