Zerodha Regulation Check: Risks for Traders

Abstract:Zerodha operates without valid regulation, posing high risks for traders. Learn the implications, risks, and compliance gaps in this in-depth analysis.

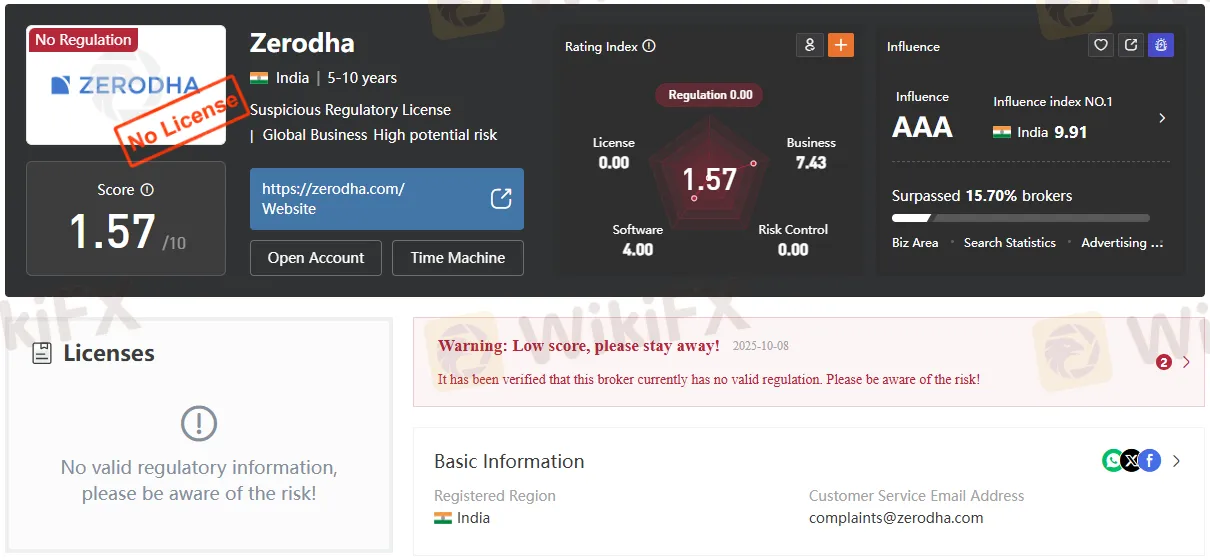

Zerodha, one of India's online brokerage firms, currently holds no recognized regulatory license—placing traders at greater risk should disputes or issues arise. As the company continues to attract a vast user base with competitive fees and an innovative platform, its lack of formal oversight calls for a careful, comprehensive risk assessment.

Is Zerodha a Regulated Broker?

Despite its considerable footprint in the Indian market, Zerodha operates without regulation by any major financial authority—national or international. As of October 2025, the firm has been verified to lack any valid regulatory license, either in India or globally. Regulatory bodies such as the FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), and CySEC (Cyprus Securities and Exchange Commission) do not oversee Zerodha‘s operations. This absence means there’s no official recourse or protection for clients in case of broker misconduct, insolvency, or disputes.

Why Regulation Matters for Traders

Regulation is crucial in financial services. Agencies like SEBI, FCA, or ASIC set rules to ensure transparency, capital adequacy, segregation of funds, and fair business practices. When a broker is unregulated:

- There is no guarantee that client funds are kept safe, segregated, or protected from operational risks.

- Dispute resolution mechanisms are usually inadequate or non-existent.

- Risk of fraud, manipulative practices, or operational failures increases.

- Compensation schemes or loss protections are absent, so traders assume full risk on their deposits.

Zerodhas Official Status: Licenses and Oversight

Since its launch in 2010, Zerodha has not secured a license from any recognized securities regulator for its core services. Its website openly shows no official licensing credentials. Platform registration data further confirms this, even though its core domain (zerodha.com) is active and secured.

Potential Risks for Zerodha Traders

- No Client Fund Safeguards: In the event of operational issues, insolvency, or fraud, traders may not recover their assets.

- No Oversight on Practices: Without regulatory scrutiny, theres less assurance on trade execution transparency, fair pricing, or ethical conduct.

- SEBI Rule Dependency: While Zerodha complies with SEBI requirements for Indian equity and commodity brokerage, its overall regulatory score is low. SEBI itself lists no global regulatory influence for Zerodha.

- Lack of Global Protections: International clients, including NRIs, receive no regulatory protection.

- No Forex/Derivative Regulation: Zerodha does not have permissions to deal in forex or overseas derivatives for Indian residents.

What Traders Can Buy and Trade on Zerodha

Zerodhas platform allows users to trade in:

- Indian Stocks

- Futures and Options (F&O)

- Mutual Funds and ETFs

- Bonds and IPOs

Notably, forex, global derivatives, commodities, and cryptocurrencies are not offered.

Account Types and Services

Zerodha offers various account categories: personal, HUF, NRI, minor, and corporate. All accounts provide the same product range, with no options for Islamic (swap-free) accounts or international trading. Demo accounts for strategy testing are available.

Fee Structure: Attractive But Not the Only Factor

- Equity Delivery: ₹0 brokerage

- Intraday & F&O: Flat ₹20 or 0.03% per order (whichever is lower)

- Mutual Funds: ₹0 commission

- Other Charges: Low to no fees for account opening and withdrawals

- All direct mutual fund investments are commission-free

While Zerodha is celebrated for its low-cost trading, this affordability—without the protection of regulatory compliance—should be weighed carefully by both new and seasoned traders.

How Zerodha Handles Deposits and Withdrawals

Deposits: Low minimums (as low as ₹1), instant UPI options, and no fees on most deposit methods. Withdrawals are processed through the proprietary platform with no set minimums or fees, arriving usually within 24-48 hours.

Expert Commentary & User Experiences

Many traders praise Zerodhas user-friendly portal and app ecosystem, including tools like Kite, Console, and Coin. However, industry experts and retail investors frequently raise concerns about the absence of formal regulation, warning that exposure to high risk is the price of convenience.

“A low fee structure shouldnt blind traders to the lack of oversight. If something goes seriously wrong, no one is obliged to intervene on your behalf.” — Independent Financial Analyst.

Warnings and Final Thoughts

Industry review sites and compliance databases consistently issue a warning: Zerodhas “no valid regulation” status scores as a high potential risk for individual and institutional clients. Those prioritizing security, compensation in case of disputes, or industry-standard protections should proceed with caution or consider fully regulated alternatives.

Read more

How to Verify if a Forex Broker is Legit or not?

Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in this article we’ll let you know the steps to verify if a broker is legit or not ?

Fortex Review: Tech Vendor, Not Regulated

Fortex operates without valid regulation, posing a high risk to traders; here’s what it is, how it works, and why an unlicensed status is a red flag for safety.

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

Kazakhstan intensifies its crypto regulation, shutting down over 130 illegal exchanges and seizing nearly $17M to combat money laundering and protect consumers.

FCA Warning List – October 2025

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning List- October 2025, alerting forex traders and investors about unauthorized brokers. These firms are operating without the necessary FCA approval. To safeguard your funds and avoid scams, be sure to check the full warning list below.

WikiFX Broker

Latest News

The Offshore vs. Onshore Broker Dilemma: Who Can You Really Trust?

XM Revamps Trading Platform with AI

Do Content Creators Need a “License”? A Plain-English Guide to the Finfluencer Idea

Axiory Review Alert: What Traders Must Know

FBS Added AI tool for Rapid Forex Insights

Trading While Traveling – Is It Possible? Digital Nomad Traders Are Making It Reality

RM8.7 Million Lost to Scam Promising US$3 Million Returns Abstract: 57 Malaysians have collectively

Top Forex Regulatory Bodies You Need to Know

Fidelity Global Innovators to High Risk in Jan 2026

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Rate Calc