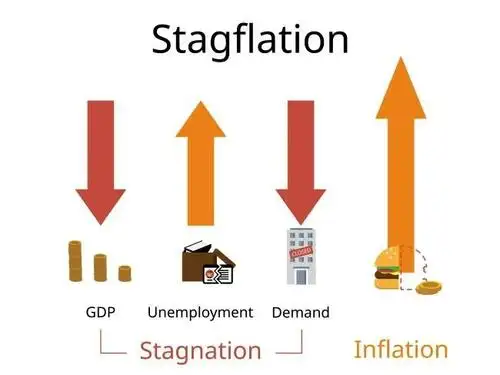

What Causes Stagflation?

In the late 1960s Edmund Phelps and Milton Friedman challenged the popular view that there can be a

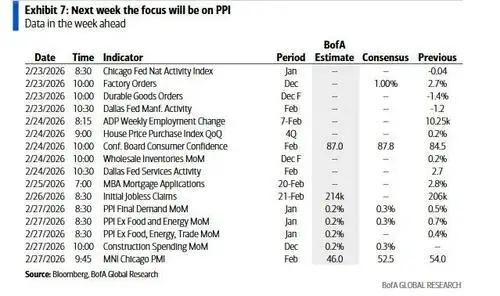

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

While much digital ink has been spilled on the Supreme Court's striking down of Trump's IEEPA tariff

Moomoo Involved Again? Investor Loses RM600,000

A 74-year-old American consultant in Kuala Lumpur lost over RM600,000 after being lured into a fraudulent investment scheme via messaging apps. The scam involved multiple platforms, staged fund transfers to numerous bank accounts, and ultimately blocked withdrawals, highlighting the growing sophistication of online investment fraud and the importance of verification and caution.

Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group UAE & Azerbaijan Scam Case – LATEST

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker Victims: $3K/$3200 Profits Stolen LATEST

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!

Stonefort Review: A Fact-Based Look at Its Trading Features and Safety

This Stonefort review gives you a fact-based look at Stonefort, a broker that has joined the busy online trading world. For traders with some experience, picking a new broker means doing careful research. Our goal is to break down how Stonefort works, from its legal standing to its trading features, so you can make a smart choice. We only use facts that can be checked from outside sources to stay fair.

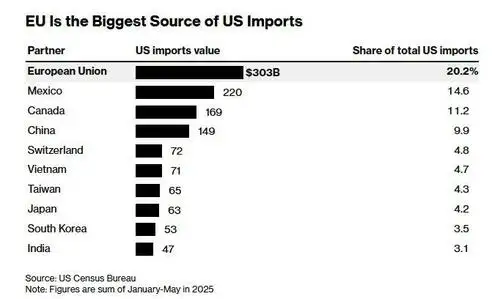

EU To Freeze Trade Deal With US After Supreme Court Overturns Trump Tariffs

: In response to the EU's decision to freeze ratification of Trump's landmark deal, the US president

Datuk and Tan Sri Charged in RM300 Million Investment Scandal

Two senior figures from Malaysia’s Islamic banking sector are expected to be formally charged at the Sessions Court today in connection with a large-scale investment scheme that allegedly led to losses exceeding RM300 million.

Is EXTREDE Safe or Scam: Looking at Real User Reviews and Common Problems

Many traders want to know: "Is EXTREDE a real broker or a scam?" This is a fair question. When you look at the EXTREDE website, it looks like a big, official, and trusted broker from around the world. It seems confident, experienced, and safe. But when you check other websites that verify brokers, you find a very different and worrying story that raises serious warning signs. This review aims to get past the marketing. We will carefully look at the facts, comparing what EXTREDE says about itself against what neutral industry watchdogs have found. We will also look at the common problems that people usually have with brokers like this. By the end of this review, you will have a clear, fact-based understanding of the real risks, helping you make a smart decision about whether EXTREDE can be trusted.

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

If you are looking for information about the EXTREDE regulation, you are asking the most important question any trader can ask before opening a trading account. The safety of your capital depends on the answer. EXTREDE's website shows an image of a trusted and licensed broker used around the world. However, our 2026 investigation shows a very different reality when these claims are checked through independent sources. This article will examine the broker's claims, present the evidence we can verify from our checks, and give a clear answer about the EXTREDE license situation. Read on!

EXTREDE Legitimacy Check: Is This a Fake or a Legitimate Trading Partner?

You are here for a direct answer: Is EXTREDE legit or a platform to avoid? We will respect your time and provide the evidence-based conclusion immediately. The details that follow will build the case, but the verdict is clear from the start. Read on to find the answer to this most sought-after question.

VAHA Detailed Analysis

In the increasingly complex landscape of forex trading, selecting a reliable broker is paramount to trading success. This comprehensive analysis report examines VAHA through a rigorous, data-driven methodology designed to provide traders and investors with an objective assessment of the broker's performance and reputation. Our analytical framework is built upon a systematic evaluation of 62 verified user reviews collected from multiple independent review platforms. These platforms, designated as Platform A, Platform B, and Platform C to maintain methodological consistency, represent diverse sources of trader feedback spanning different geographic regions and trading experience levels. By aggregating data from multiple sources rather than relying on a single platform, we minimize bias and capture a more representative picture of the broker's actual performance in real-world trading conditions.

BCEL Review 2026: Comprehensive Safety Assessment

BCEL is an unregulated financial entity established in 2020, currently holding a low safety score of 1.53 due to the absence of valid regulatory oversight. This analysis evaluates its limited transparency, regional influence, and the risks associated with its lack of disclosed trading conditions.

XTB Analysis Report

The analytical framework employed in this report utilizes quantitative metrics combined with qualitative assessment of user feedback. Each review has been processed to extract key performance indicators, including customer satisfaction levels, service reliability, platform functionality, and withdrawal experiences. Our analysis reveals an overall rating of 5.34 out of 10 for XTB, with a negative sentiment rate of 36.32%, leading to our system conclusion of "Use with Caution." These metrics are derived from systematic categorization and weighting of user-reported experiences, providing a numerical foundation for our assessment.

ZFX Broker Detailed Analysis

This report is designed to serve professional traders, retail investors, and financial advisors who require objective, data-backed information when evaluating broker options. Rather than relying on promotional materials or isolated testimonials, our analysis presents aggregated user experiences to reveal patterns and trends that individual reviews may not capture.

Retiree loses over RM300k in FB investment scam, hoping for RM9m profits

Police say 81-year-old duped by bogus high-return scheme after 15 online transfers to multiple bank accounts

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

ALPEX TRADING is an unregulated Forex broker established in 2023 with a dangerously low WikiFX Score of 1.34. Despite offering high leverage up to 1:5000 and multiple account types, the platform is plagued by severe user complaints regarding withdrawal refusals, copy trading scams, and unresponsive customer support.

BitPania Review 2026: Is this Broker Safe?

BitPania is an unregulated brokerage established in 2024 in Saint Lucia, currently holding a high-risk safety score of 1.22. This audit highlights critical concerns regarding withdrawal refusals, aggressive sales tactics, and lack of valid licensure.