WIKIFX REPORT: The US dollar’s surge strengthens its global dominance amid search for safety

Abstract:The market turbulence triggered by runaway inflation, fears of a global recession and the war in Ukraine seems to have halted the slow erosion of the US dollar’s dominance.

The dollar is back with a vengeance

The market turbulence triggered by runaway inflation, fears of a global recession and the war in Ukraine seems to have halted the slow erosion of the US dollars dominance.

Despite widespread predictions that the greenbacks global significance in global finance will shrink, the factors underpinning its current strength also mean that the emerging alternatives, such as the Chinese yuan (CNY), cryptocurrencies or central-bank digital money, are unlikely to dent its hegemony.

Higher yield

The dollar is the strongest it‘s been for two decades. The US dollar index (DXY), which tracks the US currency’s value against a basket of six major currencies, the euro (EUR), the Japanese yen (JPY), the British pound (GBP), the Canadian dollar (CAD), Swedish krona (SEK) and the Swiss franc (CHF), has gained 17% this year.

This dramatic upward swing has been a function of the US Federal Reserve taking a more aggressive stance against skyrocketing inflation than its peers — the European Central Bank, the Bank of England, and other major central banks.

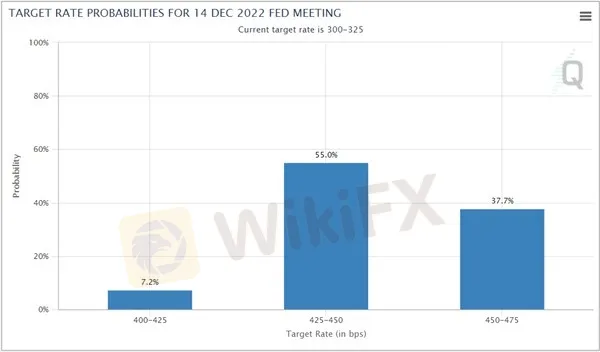

The Fed lifted its target policy rate in three large steps to between 3% and 3.25% by end-September. It was close to zero at the beginning of the year. Futures pricing predicts a 55% probability that the key US interest rate will reach as high as 4.50% by year-end, according to the CME Groups FedWatch Tool.

Fed target rate predictions of futures traders for end-2022

This higher yield has lured investors hungry for returns into dollar-denominated assets, further strengthening the greenback.

Troubled times

Economic challenges around the globe abound. The resulting financial market volatility is prompting investors to take shelter in the dollar, seen as a safe haven in troubled times. Many major currencies, such as the euro, the Japanese yen, the British pound, and the Chinese yuan, have reached multi-year lows against their US counterpart.

It‘s not only the highest inflation rates in more than 40 years that are contributing to the economic upheaval. The war in Ukraine is still raging, pushing up the price of energy, and hurting the economies of fuel importers, among them many European countries that share the euro. The single currency sunk to below parity with the dollar (EUR/USD) earlier this year on concern of an impending economic downturn in the euro region, and on views that the ECB wasn’t tough enough on inflation.

On the flip side, the US as a net energy exporter is one of the beneficiaries of higher energy costs. This helps the US economy perform better than other major economies, feeding dollar strength yet again.

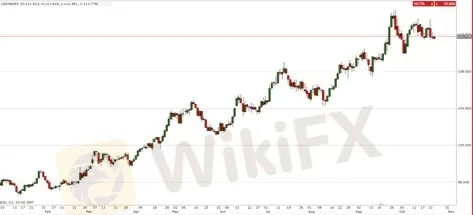

The Chinese economy, the world‘s second largest, is being hit by ongoing lockdowns and other restrictions under the country’s zero Covid policy and a real-estate market rout. The yuan has also depreciated sharply against the dollar (USD/CNY), even after several attempts by the authorities to support it.

In the UK, the pound touched a record low against the dollar in September (GBP/USD) on concern that fiscal measures put forward by the new cabinet will prove unsustainable. The government was forced to reverse tax cut plans, even costing the prime minister her job, and the Bank of England needed to step in, in an unprecedented move to stabilise the pound.

The Bank of Japan also sold dollars last month to prop up the yen for the first time since 1998, following a more than 20% slide in the value of the Japanese currency versus the dollar (USD/JPY).

Forex trading

While this large-scale volatility opens plenty of opportunities for foreign-exchange traders, they also must tread carefully and apply risk management tools to avoid getting burned by sudden currency swings.

Of course, the dollar‘s appreciation is not a one-way street. According to some analysts the greenback is ripe for a correction. Should the Fed begin to focus on stimulating growth, instead of combatting inflation, the dollar’s downtrodden counterparts could begin to rebound.

The likelihood of such reversal may be slim after the latest labour-market report revealed that the US economy was in rude health. Companies added more jobs than economists had forecast, and the unemployment rate unexpectedly fell.

Take a view on which way the US dollar and foreign currencies will go by trading forex contracts for difference (CFDs). Go long, or go short with ThinkMarkets, with excellent trading conditions.

Great pretenders

The dollar has been the preeminent currency in global finance since World War II. Central banks hold about 60% of their reserves in the US currency and most government borrowing is also done in dollars. Its the currency most often used to settle trade transactions, and most commodities, from oil to gold, are priced and traded in dollars.

Whats more, in foreign exchange markets, the US dollar is involved in almost 90% of all transactions, according to a paper prepared for US lawmakers by the Congressional Research Service.

In the current volatile environment and because of the dollars sheer weight, any unexpected geopolitical event or economic indicator might send ripples through currency markets.

Trade the volatile forex market today. However, to limit exposure to currency swings, make full use of technical analysis and risk management tools available on ThinkTrader.

In recent years, there have been a growing number of pretenders to the dollar‘s crown. But for now, the economic constellation is favourable for entrenching the dollar’s position as the dominant global currency.

Read more

BDFX Exposure: Alleged Misleading Market Advice & Poor Withdrawal Management

Do BDFX officials mislead you with poor market advice that leads to capital losses? Do you feel they themselves cannot trade the risk management analysis perfectly? Did the Comoros-based forex broker close your forex trading account and steal your funds? Did your numerous fund withdrawal requests go in vain? These are potential forex investment scams. Many traders have highlighted these trading issues on broker review platforms. Check out some of their complaints in this BDFX review article.

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

24Five Scam Alert: No License, High Risk Trading

24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

PM Financials Scam Alert: Withdrawal Issues Exposed

PM Financials Scam Alert: Broker lacks a valid license, ignores withdrawal requests, and scams traders. Don’t get trapped — stay away.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc