24Five Scam Alert: No License, High Risk Trading

Abstract:24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

Introduction

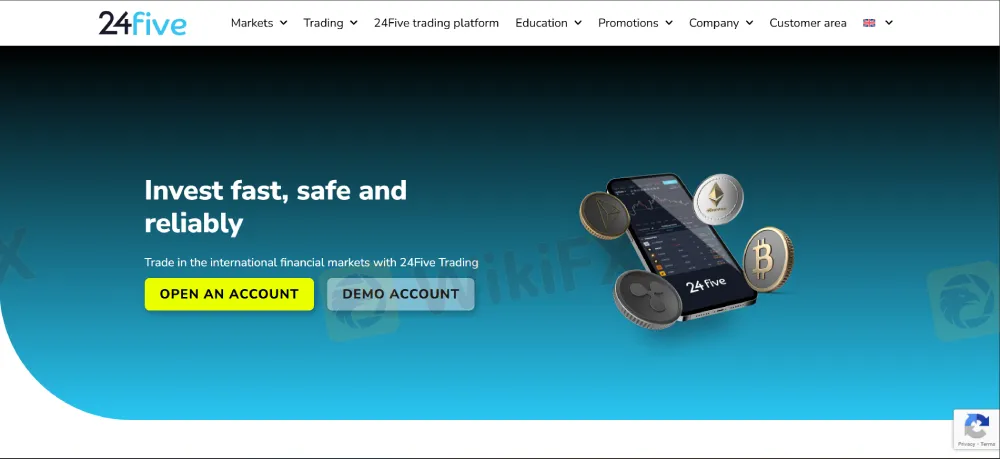

24Five Scam Alert urgently warns traders about the severe risks from this broker. 24Five, registered in the UK, claims to offer multi-asset trading in forex, commodities, indices, futures, stocks, cryptocurrencies, energies, and metals. However, beneath its polished marketing is a potentially dangerous reality: the broker operates without any valid regulatory license. This lack of oversight puts clients in immediate jeopardy. Reports of blocked withdrawals and unreliable platforms reveal a pattern of deception. This article examines the companys background, regulatory failures, trading conditions, and user experiences, and explains why engaging with 24Five is dangerous. Protecting funds is urgent—avoiding 24Five is essential.

No License, No Regulation

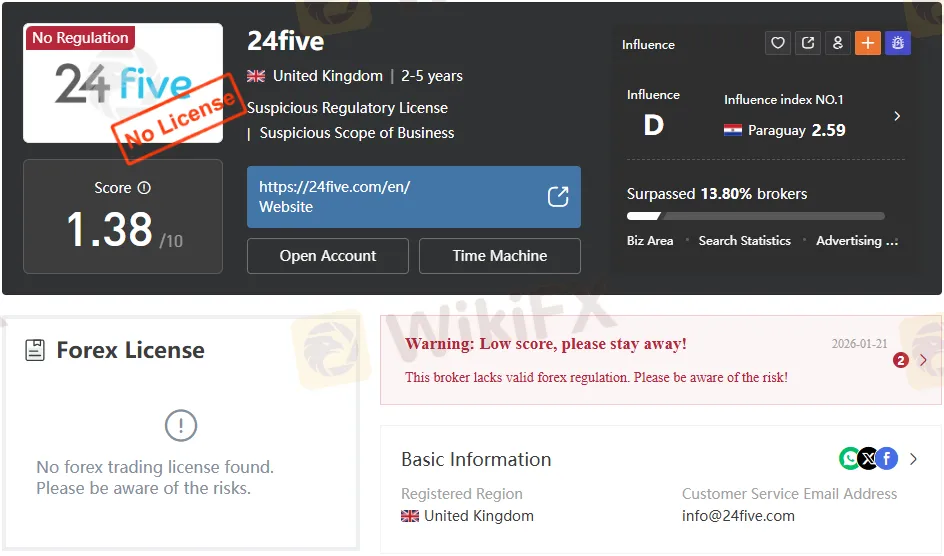

24Fives main issue is its lack of regulation. Although it claims UK registration, it does not hold a valid forex license. UK regulators, like the FCA, demand transparency, capital, and client safeguards—standards 24Five ignores.

The company‘s profile states “No regulation” and “No forex trading license found.” This is not a minor omission; it’s a critical emergency. Without regulation, 24Five can manipulate spreads, impose hidden fees, and restrict withdrawals at will, leaving traders with zero legal recourse. The brokers claims of regulatory compliance make its deception more dangerous.

Suspicious Business Scope

24Five advertises a wide range of tradable instruments—forex, commodities, indices, futures, stocks, cryptos, energies, and metals. Although this diversity may seem attractive, offering so many instruments without regulatory approval suggests an attempt to lure inexperienced traders.

The company claims a top influence index but scores only 1.38/10, far below most brokers. This exposes misleading marketing, especially when paired with unregulated operations designed to attract deposits rather than safe trading.

Company Background and Domain Data

24Five was founded in 2016 and says it is registered in the UK. Its domain, 24five.com, was registered on April 15, 2016, and expires on April 15, 2027. The domain cannot be deleted, renewed, transferred, or updated, suggesting tight online control.

The server is in the US, and Cloudflare manages its name servers. This shows a wide digital presence but not transparent governance. No office is listed; traders get only an email (info@24five.com) and a UK phone number (+44 7784108738) for contact. Limited access is typical of high-risk brokers.

Trading Platform Limitations

24Five offers only its own trading platform, unlike reputable brokers with MetaTrader 4 or 5. The platform lacks advanced analysis tools, strong automated trading systems, and support for common strategies. This restricts traders ability to analyze and automate trades.

Accessible on mobile, tablet, and PC, the platform has issues. Despite claims of “next generation graphics” and “100+ indicators,” users report instability, slow execution, and confusing navigation. The lack of industry-standard platforms further limits the use of trusted analytic tools, making trading less reliable.

Deposit, Withdrawal, and Bonus Risks

24Five accepts deposits and withdrawals via Visa, Mastercard, AstroPay, and bank transfer, but doesnt disclose processing times or fees. This lack of transparency is risky because traders cannot predict delays or charges.

Bonuses range from $35 to $300 for larger deposits, but restrictive terms make withdrawals hard. Such schemes can trap traders into meeting unrealistic requirements before they can access funds.

Users repeatedly report blocked withdrawals and warn the platform “only takes your money.” These are urgent alarms from defrauded victims.

Low Trust Score and Influence Index

24Five scores 1.38 out of 10 in its trust and reliability rating, indicating how dependable traders believe the broker is. Its so-called top influence index (a measurement of a company's reputation in the trading community) is contradicted by regional scores—Paraguay (2.59), Brazil (2.56), and Canada (2.51)—which all outperform it.

These numbers reveal 24Fives false leadership claims, showing a crisis of trust among traders.

Marketing vs. Reality

24Five promises “safe” and “reliable” trading, but behind this facade is a serious risk. The unregulated platform and negative reviews are a clear warning: you are at risk with 24Five.

The companys marketing aims to attract inexperienced traders with promises of safety and opportunity. In fact, the lack of transparency and regulation exposes clients to real danger.

User Complaints and Exposure Cases

User reviews are urgent warnings. One victim says, “It only takes your money, you cant withdraw it, and its platform is rubbish.” This is a serious alert for lost money.

Cases in Paraguay and elsewhere show trader losses, negative balances, and failed transactions, proving 24Five is high-risk and illegitimate.

Hidden Risks in Tradable Instruments

24Five advertises over 500 assets, but this variety is misleading. Lacking regulation, the broker can manipulate prices, spreads, and execution, putting traders fully under its control.

Offering ETFs, bonds, and mutual funds without licenses underscores the broker's questionable legality and intent.

Customer Support Concerns

24Five offers 24/5 support, but with no office or transparency, its effectiveness is doubtful. Complaints often go unresolved.

Reports of frozen funds and ignored pleas show support is a broken promise. Without regulation, traders are vulnerable and alone when problems arise.

Regional Influence and Market Reach

24Fives influence index is below 2.6 in Paraguay, Brazil, Canada, and Colombia. Despite its global claims, it fails to build real credibility.

This lack of credibility further undermines its legitimacy. Regional traders are especially vulnerable as local regulators may lack jurisdiction.

Domain and Technical Details

The domain 24five.com is tightly controlled; deletions, renewals, transfers, and updates are all restricted. While this may suggest stability, it also points to efforts to prevent scrutiny. The domain was last updated on April 4, 2024, and remains active until 2027.

The US server location and Cloudflare‘s name server control highlight the broker’s reliance on digital infrastructure over transparent governance. These technical details reinforce the view that 24Five is more of a digital front than a true financial institution.

Bottom Line: Protect Your Funds

The investigation into 24Five reveals a broker operating without regulation, misleading clients, and trapping traders through unclear withdrawal policies and bonus schemes. Its trust score of 1.38/10, lack of a valid license, and proprietary platform all point to high risk. User complaints confirm that funds are often inaccessible, and the platform is unreliable.

For traders and investors, the actionable advice is clear:

- Immediately verify a broker's regulatory status with recognized authorities before opening any account.

- Avoid unregulated brokers like 24Five. Prioritize security and financial safety.

- Protect funds by using brokers with clear withdrawal terms, offices, and verified licenses.

- Carefully review bonus terms and conditions, as hidden restrictions often make withdrawals difficult or impossible.

24Five presents as a global solution, but in fact, it is high-risk and unlicensed. Avoid it to protect your capital and trust only regulated institutions.

Read more

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

PM Financials Scam Alert: Withdrawal Issues Exposed

PM Financials Scam Alert: Broker lacks a valid license, ignores withdrawal requests, and scams traders. Don’t get trapped — stay away.

LHCM Under Scrutiny: FCA Agreement Limits New Business as Exante Group Links Surface

LHCM enters an FCA voluntary agreement, pausing new clients and deposits, while its role as Exante’s UK operating entity draws closer attention from WikiFX.

Fortrade Secures DFSA License in Dubai

Fortrade gains DFSA approval for its Dubai entity, strengthening compliance and expanding presence in the DIFC financial hub.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc