WGL

Abstract:WGL operates as an online brokerage, facilitating trading across Forex, indices, commodities, and cryptocurrencies, offering leverage up to 1:500 and starting spreads at 0.0 pips. However, several concerning aspects warrant caution when considering this platform. As of now, the WGL website is inaccessible, and the company's lack of transparency regarding account tiers and minimum deposit requirements, coupled with the absence of disclosed regulatory information, has led some users to question its legitimacy. It is advisable to exercise caution when dealing with unregulated offshore brokers like WGL and instead opt for regulated and reputable platforms to mitigate the risk of potential financial loss or fraudulent activities.

| WGL Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | Vanuatu |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Commodities, Cryptocurrencies |

| Demo Account | N/A |

| Leverage | Up to 1:500 |

| Spread | Starter Account: Starting from 1.0 pip, Advanced Account: Starting from 0.5 pips, Pro Elite Account: Starting from 0.1 pip |

| Trading Platform | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Min Deposit | $100 |

| Customer Support | Phone: +678 2246768 |

| Email: cs@wseeglobal.com | |

WGL Information

WGL is an online brokerage that facilitates trading in forex, indices, commodities and cryptocurrencies, offering leverage of up to 1:500 and a starting spread of 0.0. It is registered in Vanuatu and has been operating for more than 5 years.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unregulated Status |

| High Leverage | Website Inaccessibility |

| Outdated Trading Platforms | |

| Inefficient Customer Support |

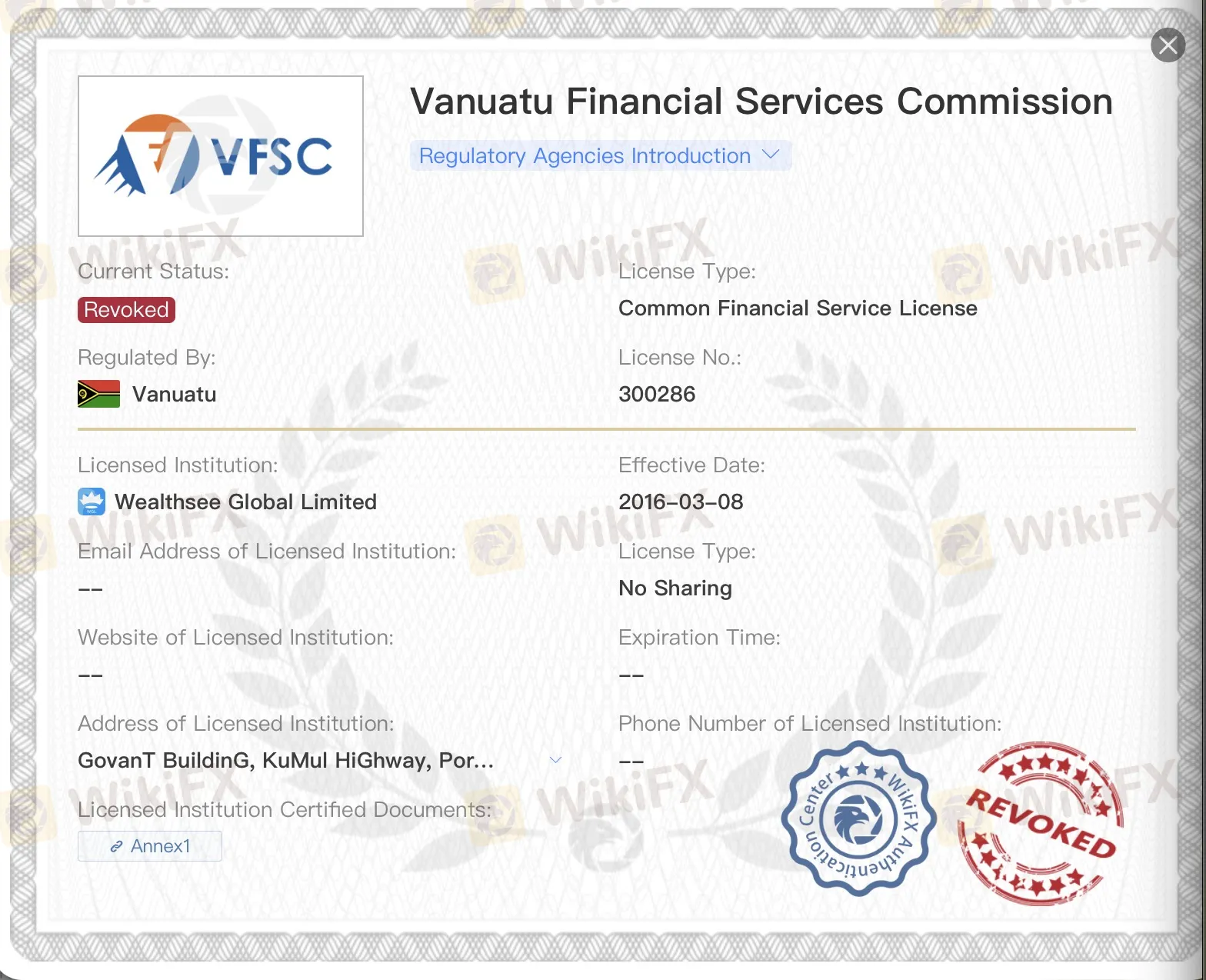

Is WGL Legit?

WGLoperates without regulation of any regulatory institutions. It had been licensed by the Vanuatu Financial Services Commission (VFSC), but that has now been revoked.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| VFSC | Revoked | VATEE PTY LIMITED | Retail Forex License | 40097 |

What Can I Trade on WGL?

Clients get services of trading Forex, Indices (NASDAQ, S&P500, Dow Jones, DAX30, CAC40, FTSE100, and Nikkei225), Commodities (Gold, Silver, Oil, and Natural Gas), Cryptocurrencies (Bitcoin, Ethereum, and Litecoin) from WGL.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Crypto currencies | ✔ |

| Bonds | ❌ |

| Binary Options | ❌ |

| Mutual Funds | ❌ |

| Futures | ❌ |

Account Types

WGLoffers three live account types, namely Starter Account, Advanced Account, and Pro Elite Account.

Starter accounts require a minimum deposit of $100. The spread, starting at 1.0, leverages up to 1:200

Advanced Accounts require a minimum deposit of $1,000. It starts with a spread of 0.5 points and leverages up to 1:400.

Pro Elite accounts require a minimum deposit of $10,000. The spread, starting at 0.1 point, leverages up to 1:500.

| Minimum Deposit | Spread | Leverage | |

| Starter Account | $100 | start from 1 | 1:200 |

| Advanced Account | $1,000 | start from 0.5 | 1:400 |

| Pro Elite Account | $10,000 | start from 0.1 | 1:500 |

Leverage

WGL offers a maximum trading leverage of up to 1:500.

WGL Fees

The spread of the Starter Account, Advanced Account, and Pro Elite Account is 1, 0.5, 0.1 respectively.

Trading Platform

MetaTrader 4 (MT4), MetaTrader 5 (MT5) are the platforms chosen by WGL for clients.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MetaTrader 5 (MT5) | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

WGL offers a variety of methods of deposit and withdrawal, including Bank Wire Transfers, Credit/Debit Card, E-Wallet Services, Bank Wire Transfers, Credit/Debit Card Refunds, and E-Wallet Withdrawals.

Read more

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

NPE Market Review: Why to Stay Away

NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

ZarVista Community Feedback: What Users Really Think About This Broker

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc