AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

Abstract:When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

When choosing a broker, the most important question is always: “Are my funds safe?” The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

Official Licenses

To understand the basics, we need to look at the verified facts about the licenses AMarkets holds. The broker operates through different legal companies registered in several offshore locations, which we will explain in the next section.

Registered Entities

The following table shows the formal registrations for companies operating under the AMarkets brand. This fact-based view answers the basic question of who officially registers them.

| Regulatory Authority | Jurisdiction | Company Name | License/Registration No. | Regulatory Type |

| Mwali International Services Authority (MISA) | Comoros | AMarkets LTD | T2023284 | Offshore |

| Financial Supervisory Commission (FSC) | Cook Islands | AMarkets LLC | LLC14486/2023 | Offshore |

| Financial Services Authority (FSA) | St. Vincent & the Grenadines | AMarkets LTD | 22567 BC 2015 | Offshore (Registration) |

It's important to understand what these registrations really mean. The license from Mwali (Comoros) and registration from the FSC (Cook Islands) are typical of offshore financial centers. More importantly, the registration in St. Vincent and the Grenadines (SVG) needs to be understood correctly. The AMarkets FSA has publicly stated that it does not give out any licenses for forex or CFD trading and does not regulate, monitor, supervise, or license international business companies that engage in such activities. The FSA simply acts as a company registrar. This difference between registration and active regulation is key to judging a broker's safety profile.

Understanding Offshore Regulation

The term “offshore regulation” is important and needs clear explanation. It's not a uniform standard but a broad category for locations that offer a different approach to financial oversight compared to major economic centers. Understanding this difference is the most important part of your research.

Defining Offshore Regulation

Offshore regulators typically provide a simpler and less expensive way for a company to become a registered financial services provider. The requirements for capital, reporting, and ongoing compliance are much less strict than those in top-tier locations like the United Kingdom or Australia.

Think of it this way: getting a top-tier license is like a pilot going through tough, continuous training and health checks to be certified to fly a commercial airplane. Getting an offshore registration is more like registering a vehicle; it proves ownership and basic compliance but says little about the driver's skill or the vehicle's ongoing maintenance.

Offshore vs Top-Tier

To translate this into practical results for a trader, we can compare the protections offered by offshore and top-tier regulatory environments side by side.

· Client Fund Segregation:

· Top-Tier (e.g., FCA in the UK, ASIC in Australia): This is required and strictly enforced. Client funds must be held in separate bank accounts from the broker's operational capital. These funds cannot be used by the broker for any purpose other than helping trades and are protected if the broker goes bankrupt.

· Offshore (e.g., MISA, SVG FSA): This is often not a legal requirement or is not strictly enforced. While a broker might voluntarily separate funds as good practice, there is no regulatory requirement forcing them to do so. This creates a risk that client funds could be mixed with company funds.

· Compensation Schemes:

· Top-Tier: These locations almost always have required, government-backed investor compensation schemes. For example, the UK's Financial Services Compensation Scheme (FSCS) protects client assets up to £85,000 if a member firm fails.

· Offshore: There are typically no government-backed compensation schemes. Any protection comes from private insurance or third-party arrangements, if they exist at all.

· Regulatory Oversight & Audits:

· Top-Tier: Regulators conduct regular, intensive, and often surprise audits of a broker's finances, compliance procedures, and trade execution quality. They have the power to give substantial fines and remove licenses for misconduct.

· Offshore: Meaningful oversight is often minimal to non-existent after the initial registration is complete. Reporting requirements are less frequent and less detailed.

When we analyze a broker's regulatory profile, the difference between registration and active regulation is most important. The presence of only offshore licenses means the responsibility for ensuring the broker's trustworthiness falls more heavily on the trader.

Important Verification Step: Regulatory frameworks can change. Before proceeding with any broker, we strongly advise traders to verify the current status and validity of these licenses independently. A dedicated verification platform, such as WikiFX, can provide up-to-date information and historical context on a broker's regulatory compliance.

Extra Safety Measures

A balanced analysis requires looking beyond formal licenses to the voluntary measures a broker takes to build trust. Without top-tier regulation, AMarkets has put in place two notable extra protections to provide some level of client security and transparency.

The Financial Commission

AMarkets is a member of The Financial Commission (FinaCom), an independent, self-regulatory organization that provides external dispute resolution (EDR) for traders.

Its main function is to act as a neutral, third-party mediator to resolve complaints between traders and member brokers when they cannot be resolved directly. The most significant feature of this membership is FinaCom's Compensation Fund. This fund can cover judgments up to €20,000 per complaint, offering real financial help for clients in case of a dispute that is ruled in their favor.

However, it's important to understand FinaCom's limitation: it is not a government regulator. Its authority comes from its membership agreement with the broker, not from law. While it provides a valuable layer of protection and a clear dispute resolution process, it does not replace the comprehensive oversight of a state-run financial authority.

Verify My Trade (VMT)

To address concerns about trade execution quality, AMarkets has also secured certification from Verify My Trade (VMT). This third-party service conducts monthly audits on a sample of a broker's executed orders to certify their quality.

The benefit for traders is some assurance that trades are being executed at fair market prices without excessive slippage or requotes. VMT's certification is a positive signal of a broker's commitment to transparency in its execution practices.

The limitation, however, is that VMT's audit is narrow in scope. It focuses only on trade execution quality. It provides no oversight or protection regarding the safety of client funds, the broker's overall financial stability, or its corporate governance.

Cross-Referencing Claims: While third-party memberships like FinaCom and VMT are positive signals, their real-world effectiveness can vary. We recommend checking platforms like WikiFX to see how a broker's dispute resolution and execution quality are rated by actual users, which can reveal how these systems work in practice.

Public Regulatory Warnings

Perhaps the most important risk factor to consider in any broker research are official warnings from national regulators. These flags are non-negotiable data points that must be weighed heavily.

International Regulator Warnings

Several reputable financial authorities have publicly flagged AMarkets for operating in areas without the necessary authorization. This is a significant red flag. The list of regulators that have issued such warnings includes:

· Securities Commission Malaysia (SC Malaysia)

· Commissione Nazionale per le Società e la Borsa (CONSOB - Italy)

· National Securities and Stock Market Commission (NSSMC - Ukraine)

What Warnings Mean

A warning of this nature means that the regulator has found evidence of the broker actively seeking clients within its country's borders, a territory where the broker does not hold a local license to operate. This practice is prohibited as it bypasses the local investor protection laws that the regulator is tasked with enforcing.

For a potential client, these warnings raise serious questions about the broker's overall compliance culture and its respect for regulatory boundaries. It suggests a willingness to operate in “grey areas,” which can be a significant risk indicator. When a broker operates outside the legal framework of a given country, clients from that country have no legal help through local channels if a dispute arises.

Consolidating Risk Data: Keeping track of warnings across different global regulators is difficult. This is where broker verification tools are valuable. Platforms like WikiFX combine these warnings, user complaints, and other risk data into a single, easy-to-understand profile, making it an essential part of a trader's research process.

Conclusion on Safety

Putting together the information on AMarkets Regulation requires balancing its long operational history and voluntary safeguards against the fundamental weakness of its core licensing and the presence of regulatory red flags.

A Summary of Factors

The decision-making process can be simplified by viewing the broker through a lens of risks versus safeguards.

The Risks:

· No Top-Tier Regulation: This is the central issue. The lack of oversight from a top-tier authority, such as the FCA, ASIC, or CySEC, means key investor protections are absent.

· Limited Fund Protection: Without required fund separation and a government-backed compensation scheme, client capital is at a higher risk if the broker goes bankrupt.

· Regulatory Red Flags: Official warnings from multiple national regulators question the firm's compliance practices and respect for international financial laws.

The Safeguards:

· Long Operating History: Having been in business since 2007 (18 years as of 2025) shows a degree of business stability and resilience that newer brokers lack.

· External Dispute Resolution: Membership in The Financial Commission provides a clear path for mediation and access to a compensation fund of up to €20,000.

· Execution Transparency: VMT certification offers some independent assurance that the broker's trade execution is fair and meets industry standards.

The Final Decision

Choosing a broker like AMarkets is a calculated risk. The attractive trading conditions often found with offshore brokers—such as extremely high leverage (up to 1:3000), which is prohibited in top-tier locations—must be weighed directly against the lower level of investor protection. The framework is designed to offer flexibility to the broker and trader, but this flexibility comes at the cost of a strong safety net.

The final decision depends on your personal risk tolerance. Are you comfortable giving up the strong protections of a top-tier regulator in exchange for potentially more flexible trading conditions? Is the presence of FinaCom and VMT enough to reduce the risks posed by offshore registration and regulatory warnings? These are questions only you can answer.

Ultimately, your decision depends on your personal tolerance for risk. Before investing, research by using independent verification tools, such as WikiFX, to review the latest regulatory updates, license statuses, and real user feedback. An informed trader is a safer trader.

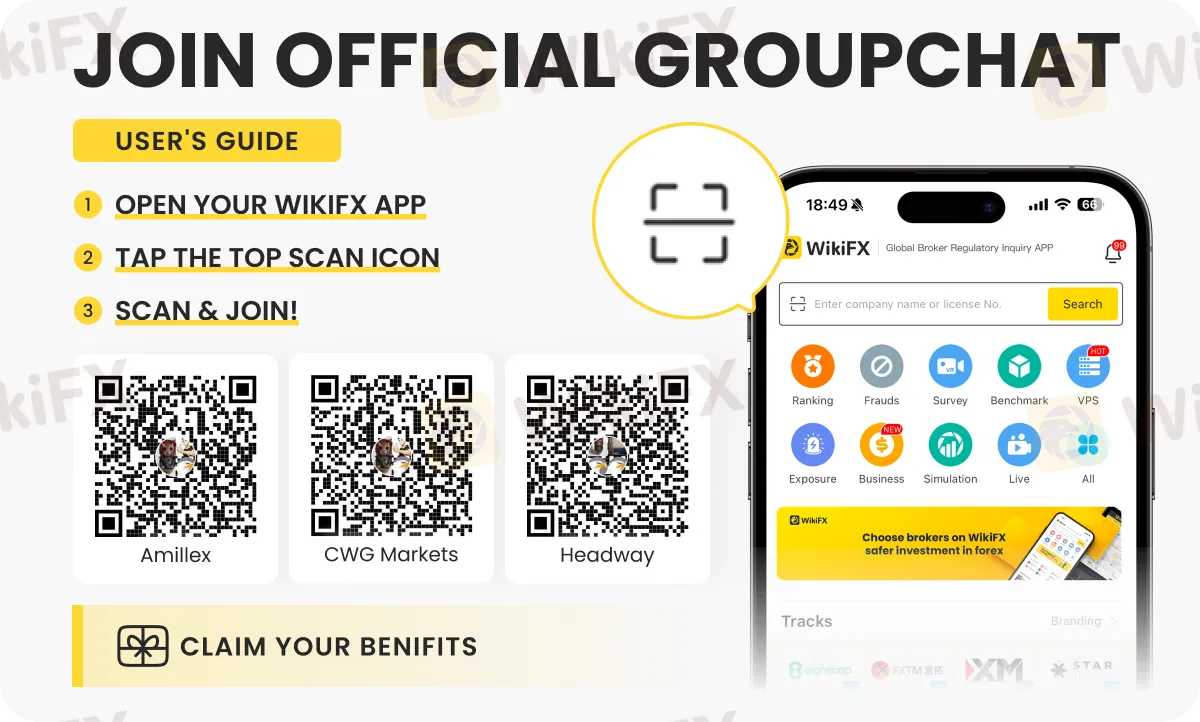

Want fast and correct forex market updates? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) where experts share everything about forex markets globally. For joining instructions, check the image below.

Read more

The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

Why Do You Always Lose When Trading?

With the year ending and 2026 just around the corner, here comes the golden question: are you profitable this year? If not, this article is a must-read!

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc