MALEYAT

Abstract:MALEYAT Group (PTY) LTD, based in South Africa, is a regulated forex broker operating under the oversight of the Financial Sector Conduct Authority (FSCA). The company offers a variety of account types, including a Risk-Free Demo Account, Standard, Premier, and Elite, each with varying minimum deposit requirements and leverage options of up to 1:500. While the specific spreads are not detailed, MALEYAT provides trading access to a wide range of assets, including forex, indices, commodities, cryptocurrencies, stocks, and metals through its user-friendly Maleyat Web Trader platform. The broker offers 24/5 customer support through multiple channels, including phone, email, and a contact form, with a physical presence in South Africa. Payment methods include credit cards, eWallets, bank transfers, local solutions, and cryptocurrency wallets. However, educational resources appear to be limited, and information about Islamic accounts and the current website status is not provided.

| Aspect | Information |

| Registered Country/Area | South Africa |

| Company Name | MALEYAT Group (PTY) LTD |

| Regulation | Financial Sector Conduct Authority (FSCA) |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.0 pips |

| Trading Platforms | Maleyat Web Trader |

| Tradable Assets | Forex, Indices, Commodities, Cryptocurrencies, Stocks, Metals |

| Account Types | Risk-Free Demo, Standard, Premier, Elite |

| Demo Account | Available |

| Customer Support | 24/5 availability, phone, email, contact form, South Africa HQ |

| Payment Methods | Credit Cards, eWallets, Bank Transfers, Local Solutions, Cryptocurrency Wallets |

| Educational Tools | Limited resources (not specified) |

Overview

MALEYAT Group (PTY) LTD, based in South Africa, is a regulated forex broker operating under the oversight of the Financial Sector Conduct Authority (FSCA). The company offers a variety of account types, including a Risk-Free Demo Account, Standard, Premier, and Elite, each with varying minimum deposit requirements and leverage options of up to 1:500. Payment methods include credit cards, eWallets, bank transfers, local solutions, and cryptocurrency wallets.

Regulation

MALEYAT operates under the regulatory oversight of the Financial Sector Conduct Authority (FSCA). However, the regulatory status is suspicious clone.

Pros and Cons

| Pros | Cons |

|

|

| |

| |

| |

|

Market Instruments

MALEYAT offers a diverse range of market instruments to cater to the various investment and trading preferences of its clients. These market instruments include:

- Forex (Foreign Exchange): MALEYAT allows traders to participate in the global forex market, offering a wide range of currency pairs. Forex trading involves the exchange of one currency for another and is one of the largest and most liquid financial markets globally.

- Indices: MALEYAT provides access to a selection of major stock market indices, such as the S&P 500, Dow Jones Industrial Average, and NASDAQ. Trading indices allows investors to speculate on the overall performance of a specific group of stocks or the broader stock market.

- Commodities: MALEYAT offers commodities trading, allowing clients to trade a variety of raw materials and resources, including energy commodities (e.g., oil and natural gas), agricultural commodities (e.g., wheat and soybeans), and metals (e.g., gold and silver).

- Crypto (Cryptocurrencies): Cryptocurrency trading is available on MALEYAT's platform, enabling clients to trade digital assets like Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies. The crypto market is known for its high volatility and potential for significant price movements.

- Shares (Stocks): MALEYAT provides access to a selection of publicly traded company stocks from various global stock exchanges. Clients can invest in individual stocks, allowing them to participate in the ownership and potential growth of specific companies.

- Metals: In addition to precious metals like gold and silver, MALEYAT may offer trading in other metals such as copper and platinum. These metals are often used for industrial purposes and can also serve as a store of value.

Account Types

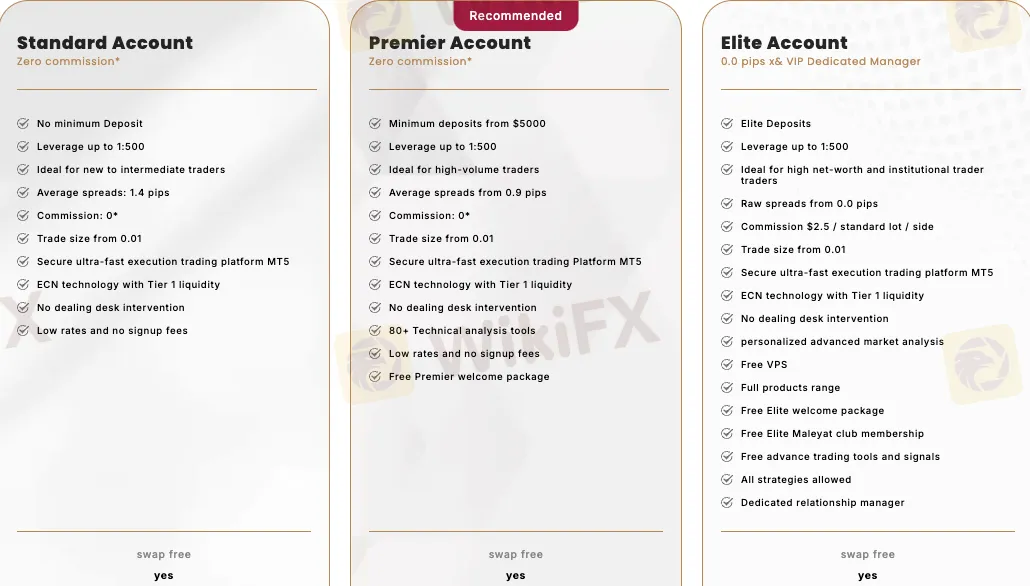

MALEYAT offers three expertly designed account types to cater to traders at every level, from novices to institutional professionals.

The Standard Account is ideal for beginner to intermediate traders, providing zero commission, no minimum deposit, and competitive spreads starting from 1.4 pips. For high-volume traders, the Premier Account features tighter spreads from 0.9 pips, advanced analysis tools, and a complimentary welcome package with a minimum deposit of $5,000.

The Elite Account, tailored for high-net-worth and institutional traders, delivers raw spreads from 0.0 pips, a dedicated manager, free VPS, advanced trading tools, and membership in the exclusive Maleyat Club.

All accounts benefit from ultra-fast MT5 execution powered by ECN Tier 1 liquidity, no dealing desk intervention, and a swap-free option for Islamic accounts.

| Feature | Standard Account | Premier Account | Elite Account |

|---|---|---|---|

| Commission | Zero commission* | Zero commission* | $2.5 per standard lot per side |

| Minimum Deposit | No minimum deposit | $5,000 | Elite deposit requirements apply |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Ideal For | New to intermediate traders | High-volume traders | High-net-worth individuals and institutional traders |

| Spreads | Average 1.4 pips | From 0.9 pips | Raw spreads from 0.0 pips |

| Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| Platform | MT5 | MT5 | MT5 |

| Technology | ECN with Tier 1 liquidity | ECN with Tier 1 liquidity | ECN with Tier 1 liquidity |

| Execution | No dealing desk intervention | No dealing desk intervention | No dealing desk intervention |

| Analysis Tools | N/A | 80+ Technical tools | Personalized advanced market analysis |

| Additional Perks | Low rates, no signup fees | Free Premier welcome package | Free Elite welcome package, VPS, advanced tools, Elite Maleyat Club membership |

| Strategies | All strategies allowed | All strategies allowed | All strategies allowed |

| Manager Support | N/A | N/A | Dedicated relationship manager |

| Swap-Free Option | Available for Islamic accounts | Available for Islamic accounts | Available for Islamic accounts |

Leverage

MALEYAT offers its clients a maximum trading leverage of up to 1:500. Leverage in trading refers to the ability to control a larger position in the market with a relatively smaller amount of capital. In this case, a leverage ratio of 1:500 means that for every $1 of your own capital, you can control a position worth up to $500 in the market.

Spreads and Commissions

MALEYAT offers competitive commission and spread structures across its account types. The Standard Account and Premier Account both feature zero commission, with spreads starting from 1.4 pips and 0.9 pips, respectively. The Elite Account charges a commission of $2.5 per standard lot per side, offering raw spreads from 0.0 pips.

Deposit & Withdrawal

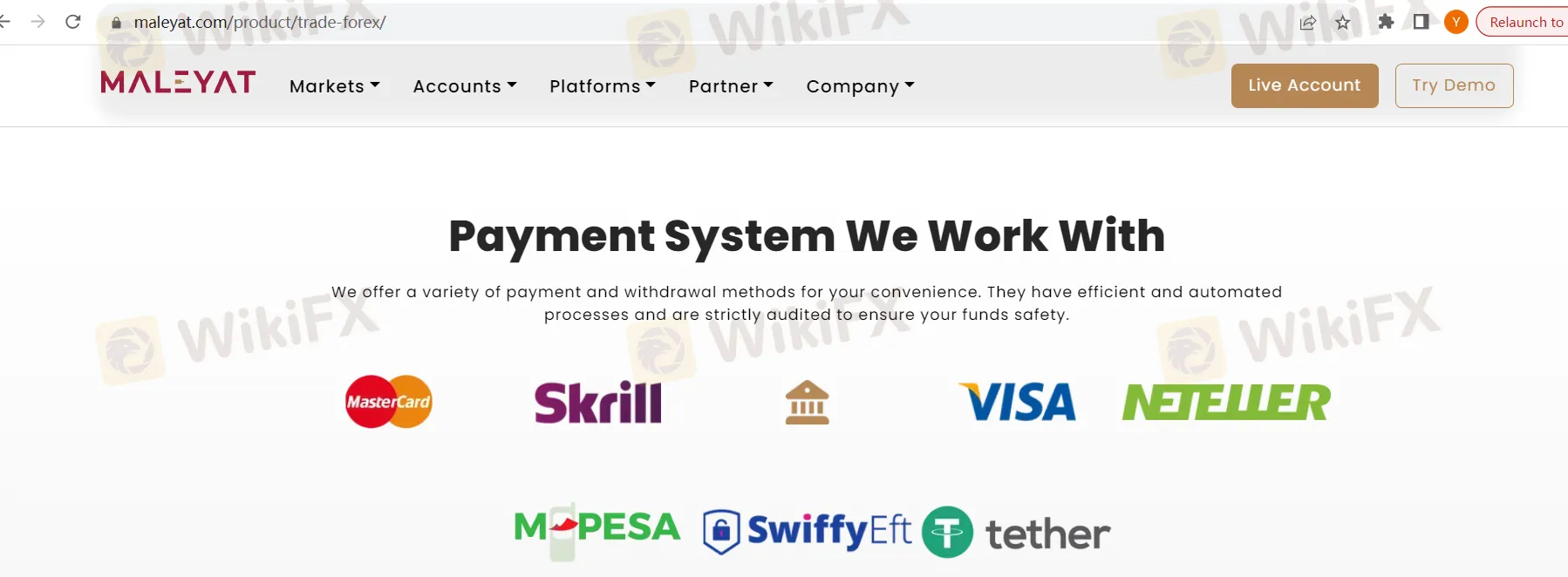

MALEYAT offers a variety of secure deposit and withdrawal methods to suit clients' needs.

Deposit Methods:

- Credit Cards: Visa and Mastercard

- eWallets: PayPal, Skrill, Neteller, and more

- Bank Transfers: Wire transfers for reliable funding

- Local Solutions: Regional payment methods

- Cryptocurrency Wallets: Bitcoin, Ethereum, and other digital assets

Withdrawal Methods:

- Bank Transfers: Secure transfers to access funds

- eWallets: Quick access to profits

- Credit Cards: Withdraw to credit cards if used for deposits

- Cryptocurrency Wallets: Withdraw to crypto wallets for digital asset deposits

Trading Platforms

Maleyat Web Trader is a user-friendly and versatile online trading platform that provides traders with access to the financial markets directly from their web browsers.

Customer Support

Maleyat is available 24/5 to assist with any questions or concerns. Their registered office is located at 106, 4th Floor, TBE, 96 Rivonia Road, Sandton, Johannesburg, 2191, South Africa (FSCA Registered). They can be reached at +971 600 554 433 or +971 4 541 9002 for support.

Read more

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

NPE Market Review: Why to Stay Away

NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

ZarVista Community Feedback: What Users Really Think About This Broker

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc