Trump’s Conciliatory Tone Bolsters Wall Street

Abstract:*Dollar stood firm while Wall Street extended gain as President Trump delivered a conciliatory statement on U.S.-China trade tension. *Trade war risk mitigated exerts pressure on safe-haven including

*Dollar stood firm while Wall Street extended gain as President Trump delivered a conciliatory statement on U.S.-China trade tension.

*Trade war risk mitigated exerts pressure on safe-haven including gold, Yen and Swiss Franc.

*Eyes on todays Initial Jobless Claims to gauge the dollar's strength.

Market Summary

U.S. equities rallied in the previous session as optimism grew over potential progress in U.S.-China trade relations, following remarks from Treasury Secretary Scott Bessent and reports that the White House is considering reducing tariffs on Chinese goods. Bessents comments at the Institute of International Finance highlighted an “opportunity for a big deal” with China, suggesting a possible de-escalation in the trade war. However, he also emphasized the need for structural reforms in global financial institutions, criticizing the World Bank for lending to advanced economies like China.

The S&P 500 and Nasdaq extended gains, recovering from last week's losses, while the Dollar Index (DXY) held steady near 99.50 as investors assessed the mixed signals on trade policy.

Easing risk aversion triggered a broad pullback in safe-haven assets, with gold prices slipping toward the $3,300 mark. Safe haven currencies such as the Japanese Yen and Swiss Franc also weakened modestly, though they continue to hover near elevated levels amid persistent geopolitical and macroeconomic uncertainties.

Crude oil prices remained volatile as traders awaited the latest U.S. inventory data—expectations point to a modest drawdown, which could provide further support to oil markets.

Looking ahead, todays initial jobless claims data will be closely monitored for further clues on the resilience of the U.S. labor market. A lower-than-expected reading could reinforce expectations of sustained economic strength, potentially bolstering the dollar and risk assets. Conversely, an uptick in claims may fuel concerns over softening demand, weighing on equities and supporting safe havens like Treasuries and gold. Market volatility is likely to remain elevated as traders assess the data alongside ongoing trade policy developments and geopolitical risks.

Current rate hike bets on 7th May Fed interest rate decision:

0 bps (95.2%) VS -25 bps (4.8%)

Source: CME Fedwatch Tool

Market Movements

DOLLAR_INDX, H4

The Dollar Index rebounded slightly as investors regained confidence following a more positive tone from the US on both trade talks and Fed independence. Trump clarified he has “no intention of firing” Fed Chair Powell, easing concerns over political interference. Meanwhile, hopes for a partial tariff rollback in US-China negotiations and comments from Treasury Secretary Bessent pointing to a near-term de-escalation helped lift market sentiment and risk appetite.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 36, suggesting the index might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 100.15, 102.95

Support level: 97.15, 95.85

XAU/USD, H4

Gold prices retreated slightly and hovered near support, as markets remained in wait-and-see mode over US-China trade talks. While both sides expressed interest in continued negotiations, no deal has been scheduled yet. China‘s Foreign Ministry accused the US of “extreme pressure,” warning it’s “not the right way to deal with China.” Trump, in contrast, adopted a softer tone, saying hes “not going to play hardball.” With no firm progress, market uncertainty persists, keeping gold in a consolidation phase.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 55, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 3375.00, 3495.00

Support level: 3275.00, 3200.00

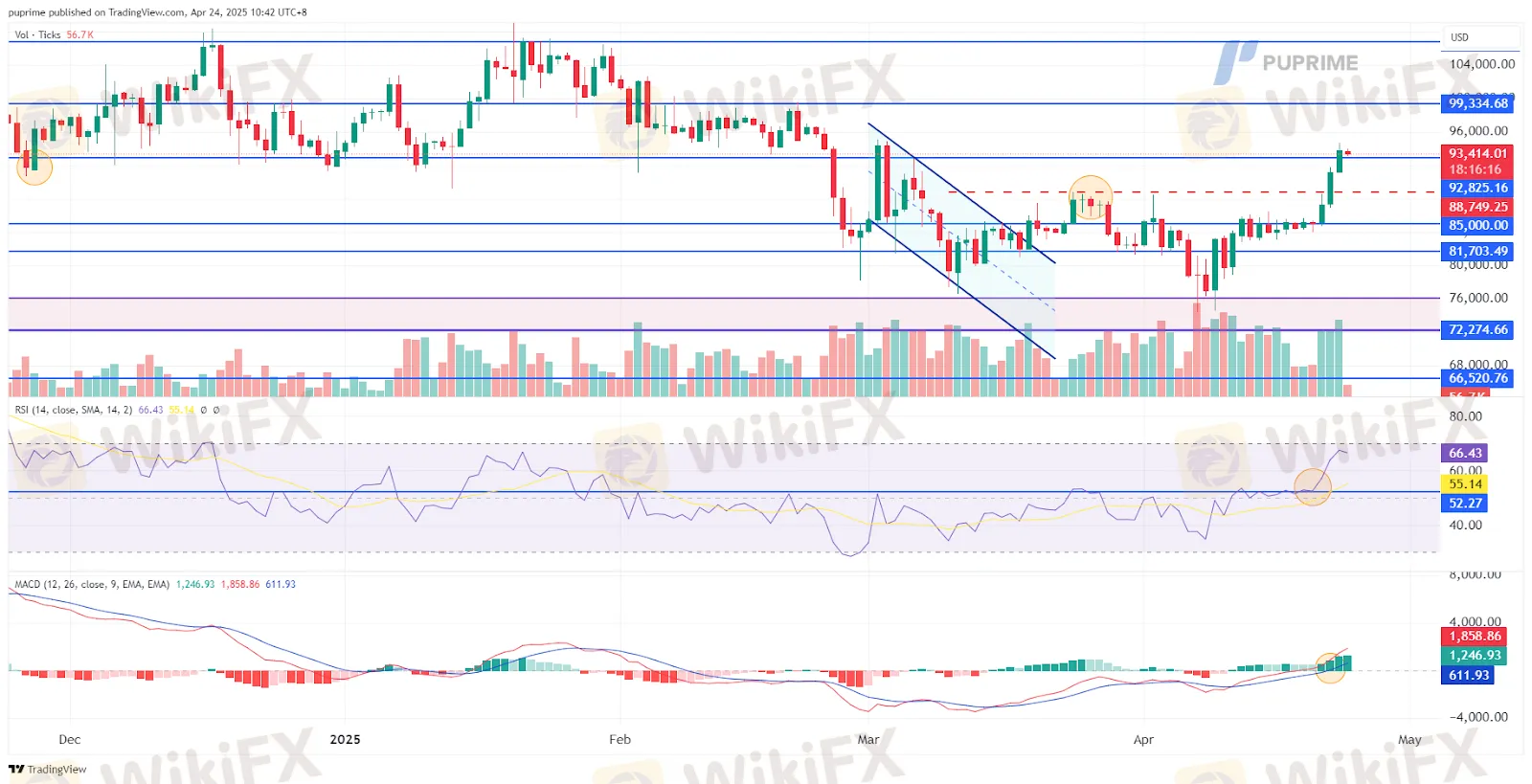

BTC/USD

Bitcoin soared past the critical $94,000 mark in the recent session, triggering over $600 million in liquidations, as the move above this pivotal level — last seen as a bullish structural break in February. The sharp rally has sparked speculation of a potential liquidity grab, raising caution over a possible near-term reversal. Despite the breakout, BTC paused for breath, suggesting that the current rally could be exhausting momentum. From a broader macro perspective, risk appetite across global markets remains subdued, limiting the upside potential for risk-sensitive assets like cryptocurrencies.

BTC/USD has surged decisively in the recent session, suggesting a bullish bias for BTC. If BTC is able to stand firm above its critical pivotal level at the $93,000 mark, it could be seen as a solid bullish signal for BTC. The RSI continues to gain while MACD has broken above the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 99,340.00, 106.780

Support level: 88,850.00, 85,000.00

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

Rate Calc