FXView: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FXVIEW and its licenses.

FXVIEW is a brokerage firm that offers online trading services to clients around the world. It holds licences from regulators in Cyprus, South Africa, and previously in the United Kingdom. While some of these licences are still active, others have been revoked or have raised concerns. Traders should carefully check the status of each licence before deciding to open an account.

FXVIEW is licensed by the Cyprus Securities and Exchange Commission (CySEC) under licence number 367/18. This is its main and most reliable licence. CySEC is the financial regulator of Cyprus and a recognised authority within the European Union.

The licence held by FXVIEW is a Straight Through Processing (STP) type, which means that trades are sent directly to the market without interference from the broker. This licence is currently active and marked as “Regulated”, showing that FXVIEW is meeting the requirements set by CySEC.

For traders in the EU or EEA, this licence offers a level of protection and transparency.

FXVIEW was once listed with the Financial Conduct Authority (FCA) in the United Kingdom, under licence number 850138. However, this licence has now been revoked. The FCA is known for its strict rules and is considered one of the most respected regulators in the world.

The revoked status could be linked to changes caused by Brexit, as many brokers had to adjust their regulatory structures after the UK left the European Union. Still, a revoked licence is a warning sign. It means the broker is no longer authorised by the FCA to offer services in the UK. UK traders, or anyone relying on FCA regulation, should take extra care.

FXVIEW is also listed with the Financial Sector Conduct Authority (FSCA) in South Africa under licence number 50410. The FSCA is responsible for making sure financial companies in South Africa follow the rules.

However, FXVIEWs licence status with the FSCA is marked as “Exceeded”, which means the broker might be doing more than what the licence allows. This could create risks for traders, especially if something goes wrong and the FSCA cannot provide full protection.

Licences are one of the most important things to look at when choosing a broker. But its not enough to just see that a licence exists, as you also need to check if it is active and what it allows the broker to do.

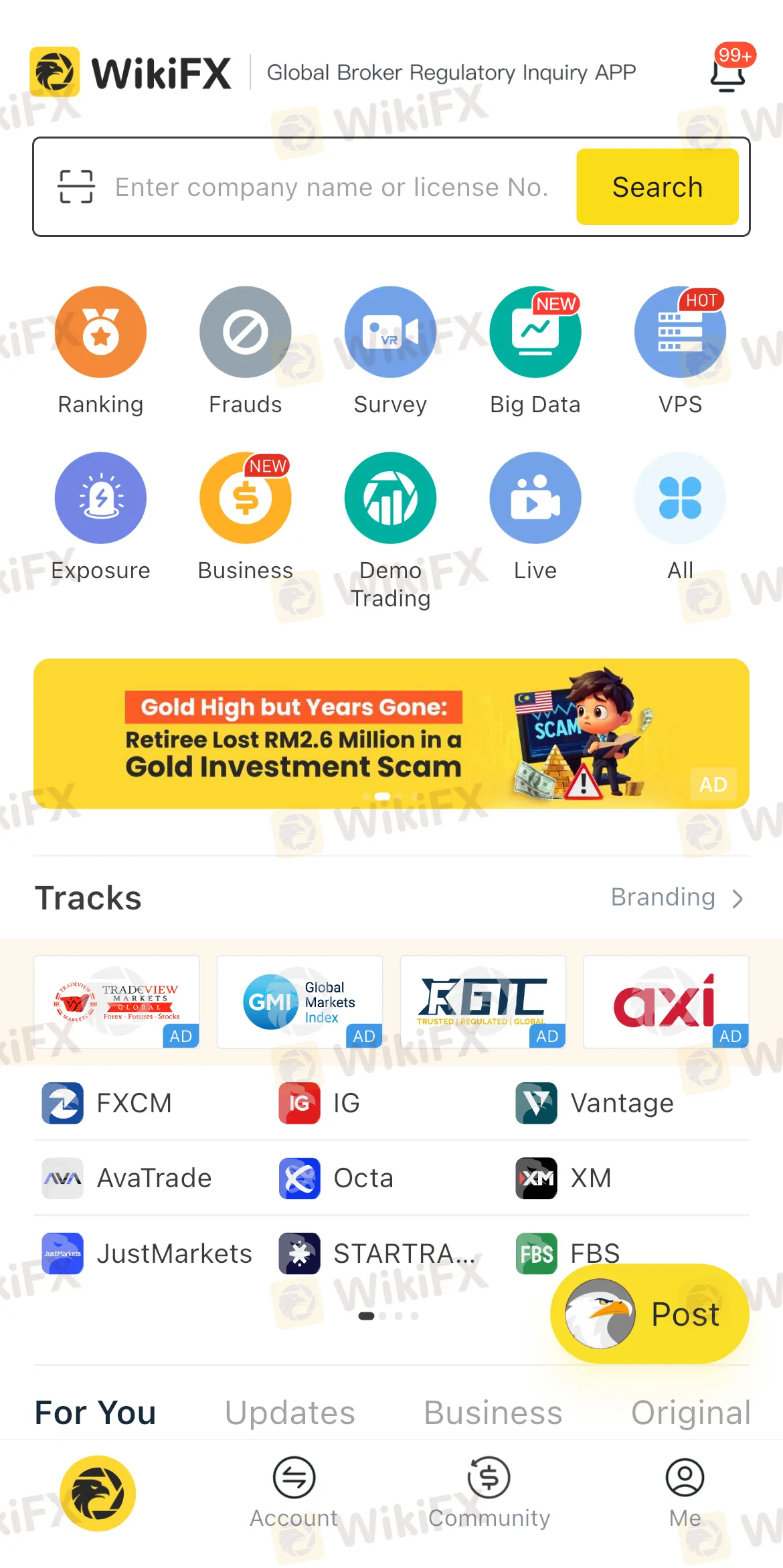

Platforms like WikiFX help traders by checking licences and looking at whether brokers follow rules in the countries where they operate. In FXVIEWs case, the CySEC licence is active, but the FCA licence is revoked, and the FSCA licence has issues with scope. This mixed status should make traders think carefully before moving forward.

Understanding a brokers true regulatory standing can help prevent problems later. Always take time to verify the facts before sending any funds or placing trades.

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc