FX Live Capital Review: Regulation Status & 4 Facts You Must Know

Abstract:This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

This article is a review of FX Live Capital. It reveals many facts about the broker, including issues with its regulation and red flags that it tries to hide. This is a scam alert article, and traders and investors should read it until the end.

Offshore Regulation

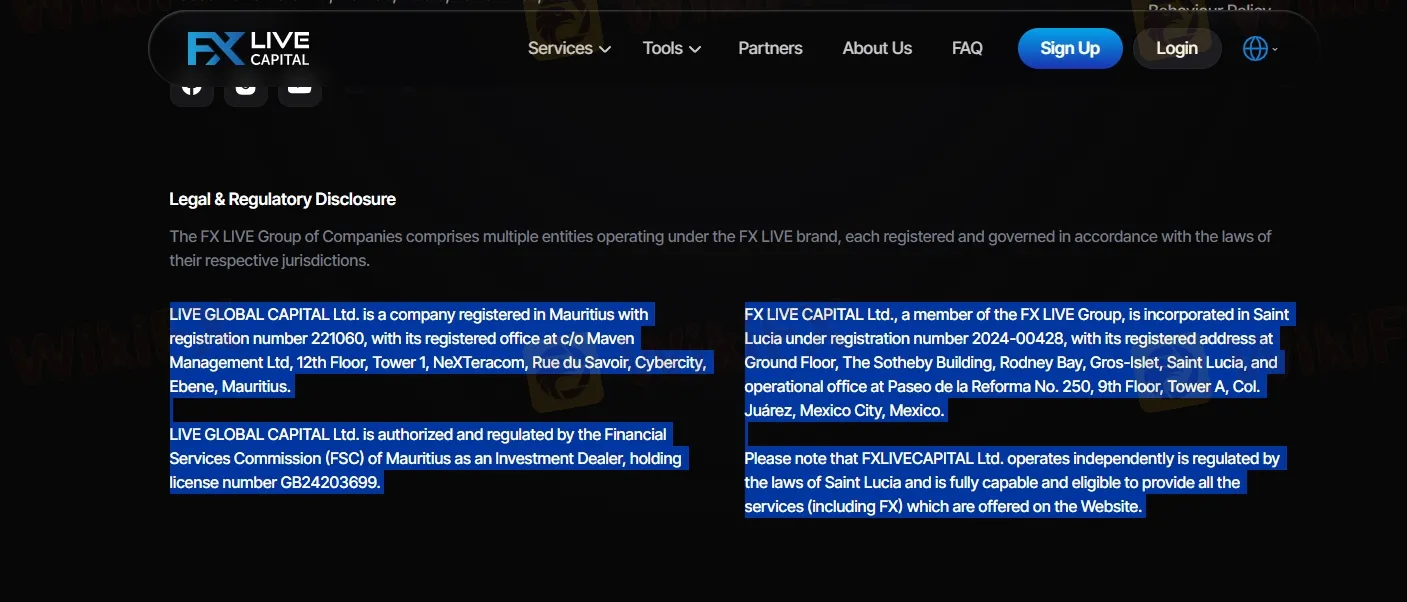

According to the broker, FXLiveCapital is registered in Saint Lucia under registration number 2024-00428, with its official address at The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia. The company also operates offices in Mexico, Argentina, and Dubai, indicating a broad international presence.

However, it is important to note that offshore regulation, such as registration in Saint Lucia, does not provide strong safety or investor protection. These jurisdictions typically lack strict oversight, which can leave traders exposed to higher risks.

Access to MT4/ MT5 ?

FXLive Capital provides traders with access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available under their “Zero Commission” account option. These platforms are offered in both desktop and mobile formats, giving users the convenience to monitor and execute trades on the go or from their personal workspace. With a wide range of tools and features, the platforms are built to support a smooth and flexible trading experience across all devices.

Is FXLive Capital a Prop Firm?

FXLive Capital is not a proprietary trading firm(PROP Trading Firm) As stated in its Google Play description, the company focuses on providing CRM and software solutions specifically designed for brokers, prop firms, and fund managers. Its platform helps these financial professionals manage their operations more efficiently, enhance client interaction, connect with trading platforms, and boost overall productivity.

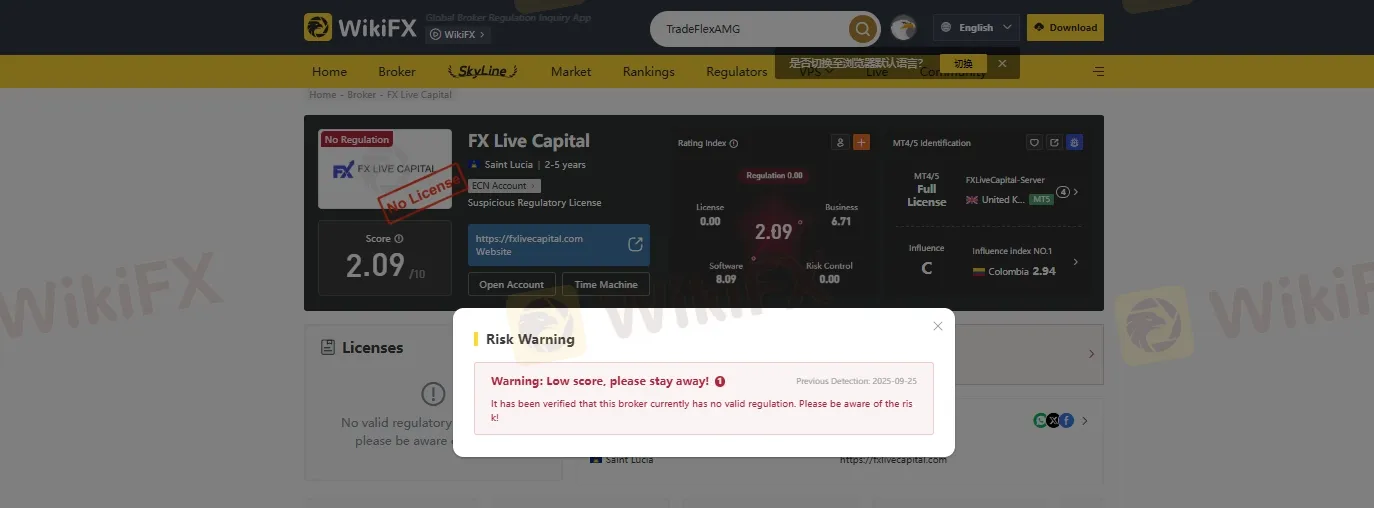

FXLive Capital on WikiFX

In our FXLive Capital review, we discovered that WikiFX, a well-known third-party platform that evaluates and rates forex brokers, gave this broker an alarmingly low score of 2.09 out of 10. This rating reflects serious concerns regarding the brokers credibility and operational transparency.

In addition to the poor score, WikiFX also issued a strong warning against FXLive Capital. The platform highlighted multiple red flags, including a lack of transparency and the absence of proper regulatory oversight. Due to these issues, FXLive Capital categorized as a high-risk, low-score broker, advising traders and investors to stay away from this platform to avoid potential financial loss.

Conclusion: Should You Trust FXLive Capital?

Based on everything revealed in this FXLive Capital review, this broker raises multiple red flags. From offshore regulation and unclear business operations to an extremely low score on WikiFX and official warnings, the risks associated with FXLive Capital are too significant to ignore.

Even though the broker offers MT4 and MT5, these platforms alone do not guarantee safety or legitimacy. The overall lack of transparency, absence of strong regulation, and poor third-party ratings make FXLive Capital a broker to avoid.

Read more

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

Tan Sri Arrested in RM300 Million Investor Scam Probe

A Tan Sri was among two individuals detained by the MACC over an alleged RM300 million investment scam in Kuala Lumpur. Authorities say the unapproved schemes promised high returns and caused millions in losses nationwide, prompting renewed warnings for the public to verify investments and avoid offers that seem too good to be true.

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

WikiFX Broker

Latest News

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Rate Calc