NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Abstract:Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

The Quick Answer

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely.

This article breaks down why we reached this conclusion. We will examine the tricks used by NaFa Markets, from fake regulatory claims to the mind games commonly used in investment scams. Our goal is to study the pattern of NaFa Markets complaints and give you the tools to understand what makes a real user reputation versus a carefully built fake image. This isn't just about one broker; it's about giving you the knowledge to protect your money from similar threats in the future.

Warning Signs Analysis

The case against NaFa Markets is built on clear, obvious warning signs. These aren't small rule-breaking issues; they are major lies that affect the core of the broker's honest operations. For any experienced investor, these signs are immediate reasons to stay away when contemplating - Is NaFa Markets safe or a scam?

Fake Regulatory License

A real broker's most important feature is its regulatory status. Regulation is the legal system that protects your money, ensures fair trading practices, and provides a way to resolve disputes. It cannot be negotiated. NaFa Markets claims to be regulated by the “Sharjah International Free Zone (SAIF Zone)” under license number 19514. This claim is dangerously misleading.

To understand the lie, consider the following:

· Claim: Financial Regulation by SAIF Zone.

· Reality: The SAIF Zone is a free-trade zone created to attract general businesses like import/export, consulting, and shipping. It gives out commercial business licenses, which are the same as a business registration. The SAIF Zone has absolutely no power to regulate financial brokerage activities, oversee client funds, or enforce rules related to trading.

· Conclusion: This is a deliberate lie. Using a business license to pretend to be a financial regulatory license is a classic trick used by offshore scams to create a false sense of security. Real financial regulators in the UAE include the DFSA (Dubai Financial Services Authority) and the SCA (Securities and Commodities Authority). NaFa Markets is not registered or licensed by either of these legitimate organizations.

“Fixed High Returns” Promise

NaFa Markets has reportedly advertised a guaranteed “3% per month income” on investments. This promise is perhaps the most obvious warning sign of all. The foreign exchange and CFD markets are naturally unpredictable and risky. No legitimate broker in the world can or will ever guarantee a fixed rate of return.

Promising fixed, high profits is the main characteristic of a Ponzi scheme. These schemes work by paying supposed “returns” to early investors using funds collected from new investors. The entire structure cannot be sustained and is designed to collapse, but not before the operators have run away with the funds. Any company guaranteeing profits from market trading is, by definition, not engaging in legitimate trading.

The Fake Office

The physical address provided by the company is Q1-09-083/A, SAIF Zone, Sharjah. This address format is typical of a “Flexi-desk” or virtual office service. These services provide a mailing address and sometimes a shared desk to thousands of companies, allowing them to register a business without having a physical presence.

For a financial services firm that claims to manage client funds, the lack of a real, working headquarters is a major warning sign. It suggests a temporary, shell-company structure designed for secrecy and a quick exit. Legitimate financial firms have substantial physical operations with compliance, support, and management teams. A virtual office is a fake front, not a headquarters.

Your First Line of Defense

These regulatory and operational problems are the easiest warning signs to spot if you know where to look. They are the first line of defense against financial fraud. Deceptive brokers rely on the fact that most new investors won't take the extra step to verify their claims.

This is precisely why independent verification is essential. Before even considering a broker, a quick check on a comprehensive database, such as WikiFX, can instantly reveal whether its regulatory claims are true or fake, saving you from this exact trap.

Breaking Down User Feedback

The term “user reputation” can be misleading, as online reviews are easily manipulated. Scam operations frequently flood review sites with fake positive feedback to drown out the real complaints from victims. Learning to tell the difference between genuine feedback and fake praise is a critical skill for any investor.

Structure of Complaints

While NaFa Markets may not yet have a widespread public history of complaints, its business model allows us to predict the user experience with a high degree of certainty. Based on the patterns of identical scams, the NaFa Markets complaints will almost certainly follow this path:

1. Initial Success, Then Silence: After making a deposit, the user's account on the trading platform shows impressive and consistent profits. This is a trick to build confidence and encourage larger deposits. The trading platform is often a manipulated or stolen version of MT4/MT5 where the “profits” are completely fake.

2. The Withdrawal Block: The moment a user attempts to withdraw funds—whether the initial deposit or the supposed profits—the problems begin. The withdrawal request will be ignored, delayed indefinitely, or outright denied for a variety of false reasons.

3. The “Pay to Withdraw” Trap: This is the final stage and ultimate confirmation of the scam. The broker's “support” or “account manager” will contact the user, claiming that to release the funds, a payment is required. They will invent reasons like “capital gains tax,” “anti-money laundering verification fees,” “risk deposits,” or “account unlocking fees.” They create immense pressure and urgency. It is crucial to understand: A legitimate company will never ask you to pay capital to receive your own funds. Any funds sent at this stage will also be lost.

Spotting Fake Reviews

Scam brokers understand the power of social proof. They often hire services to post waves of fake 5-star reviews on platforms, such as Trustpilot, to create a surface of legitimacy. Here is a quick checklist to help you identify these fake testimonials:

· Overly Generic Praise: The reviews use vague, emotional language like “Best broker ever,” “Great platform,” or “I am so happy,” but provide no specific details about the platform's features, spreads, execution speed, or customer service experience.

· Focus on Easy Profits: Fake reviews often mention “making money easily” or talk about profits without mentioning the natural risks of trading. Real traders discuss strategy, risk management, and specific platform tools.

· Poor Grammar and Unnatural Language: Many fake reviews are outsourced and written by non-native speakers, resulting in awkward phrasing and grammatical errors.

· Suspicious Timing: A large number of 5-star reviews posted within a short period, often after a wave of negative reviews, is a strong indicator of a coordinated campaign to manipulate the score.

Finding Trustworthy Feedback

A broker's own website, with its curated “testimonials,” is pure marketing and should be ignored. To gauge true user reputation, you must turn to independent platforms that gather data and verify information.

A broker's own website or curated testimonials are unreliable. To gauge true user reputation, you must turn to independent platforms that gather data. A service, such as WikiFX, not only checks regulatory status but also collects and verifies user complaints, giving you a much clearer picture than a manipulated Trustpilot score.

The Copycat Trick

A particularly sneaky tactic used by fraudulent entities like NaFa Markets is the “copycat” strategy. They intentionally choose a name that is very similar to a well-established, legitimate financial firm. This is designed to confuse investors during their initial research, causing them to associate the scam with the reputation of the real company. It is vital to distinguish between them.

| Feature | ❌ NaFa Markets (SCAM) | ✅ Legitimate Firms (e.g., NAFA Capital Advisors) |

| Website | nafamarkets.com | nafacapital.com (or similar) |

| Business | Unregulated Forex/CFD Broker | Regulated Asset Management / Investment Funds |

| Promise | Guaranteed high monthly returns | Market-based returns, clear risk disclaimers |

| Regulation | Fake (SAIF Zone business license) | Genuine (e.g., SEBI in India, other national regulators) |

| Verdict | AVOID AT ALL COSTS | Unrelated, legitimate businesses |

This is not an accident. The choice of the name “NaFa” is likely a deliberate attempt to benefit from the brand recognition of entities like NAFA Capital Advisors in India or NBP Funds in Pakistan (formerly NAFA Funds). These are legitimate, regulated asset management companies that have no connection whatsoever to the fraudulent forex broker at nafamarkets.com. Always double-check the website URL and the specific regulatory details.

The Scam Playbook

If you have already deposited funds with NaFa Markets, you may be feeling confused, anxious, or even ashamed. It's important to understand that you are the victim of a professional criminal operation that uses a well-defined psychological playbook. Recognizing these steps can help you understand what is happening and prevent further losses.

A Breakdown of Its Tactics

1. The Honeymoon Phase: You open an account, and everything seems perfect. Your initial trades, likely directed by a “mentor,” appear incredibly profitable on its platform. This phase is designed to override your logical skepticism with the powerful emotions of excitement and greed. It builds your trust in both the platform and your “advisor.”

2. The Upsell: Once you are convinced of the opportunity, your account manager will contact you. They will congratulate you on your success and begin pressuring you to deposit more money. They will create a sense of urgency, claiming you can “reach a higher VIP level,” “unlock better returns,” or “participate in an exclusive, time-sensitive trade.” The goal is to maximize the invested capital they hold before you become suspicious.

3. The Inevitable Block: The moment you decide to secure your profits and request a withdrawal, the fake image comes out in the open. Suddenly, communication becomes difficult. Your requests are ignored or met with endless delays. The platform may even be manipulated to show a sudden, catastrophic loss to make it seem as though your funds are gone.

4. The Extortion Phase: This is the final act. You are told that your account is frozen or your withdrawal is blocked, but it can be released if you just make one more payment. They will demand funds in the name of fictional “taxes,” “cross-border transaction fees,” “risk deposits,” or “anti-money laundering verification.” They will be aggressive and persuasive, threatening that you will lose everything if you don't pay. This is the definitive proof of the scam. Any additional money sent will be stolen, just like the initial deposit.

Your Emergency Action Plan

Your next steps depend on whether or not you have already sent money to NaFa Markets. It is critical to act quickly and decisively.

If You Have NOT Deposited

If you have been in contact with them but have not yet sent any funds, you are in a fortunate position. Follow these steps immediately:

· Do NOT send them any money. Under any circumstances. Ignore any high-pressure tactics or promises.

· Block all contact. Block their phone numbers, email addresses, and any social media profiles they have used to contact you.

· Do not engage. Do not waste your time arguing, threatening, or trying to reason with them. You are dealing with anonymous criminals. Your only goal is to cut off all communication.

If You HAVE Already Deposited

If you have already sent funds, it is essential to act now to reduce the damage and prevent further loss.

· STOP all activity. Do not make any more deposits, no matter what it promises or threatens. Do not believe that sending more finds will unlock your existing ones.

· NEVER pay withdrawal fees. Do not pay any “taxes,” “fees,” or “deposits” the broker demands. This is a common tactic to extract more capital from victims who are desperate to recover their initial investment.

· Gather all evidence. Take screenshots of everything: your conversations with its representatives (WhatsApp, Telegram, email), all transaction receipts, and any details from your account on their platform.

· Contact your bank immediately. If you paid by credit or debit card, call your card issuer's fraud department and request a “chargeback,” explaining that you were the victim of a fraudulent service. If you paid by bank wire, contact your bank's fraud department, report the transaction, and ask if a wire recall is possible. Time is critical.

· Report to the authorities. File a report with your local police and your country's national cybercrime reporting agency. While the chances of recovery may be slim, reporting the crime is essential.

Conclusion: Your Shield

The evidence surrounding the question, Is NaFa Markets Safe or a Scam, points overwhelmingly to a sophisticated scam operation. The combination of a fake regulatory license, promises of guaranteed returns, and a typical shell-company setup makes it a high-risk entity that must be avoided. The predictable pattern of NaFa Markets complaints is a textbook example of investment fraud.

The ultimate lesson here extends far beyond one questionable broker. It is a lesson in proactive defense. Protecting your capital in the online world requires a habit of skepticism and due diligence.

To protect your hard-earned capital, make due diligence your default habit. Before you engage with *any* broker, take two minutes to perform a background check. A simple, free search on a trusted verification platform, such as WikiFX, is the single most effective step you can take to shield yourself from fraudulent brokers such as NaFa Markets.

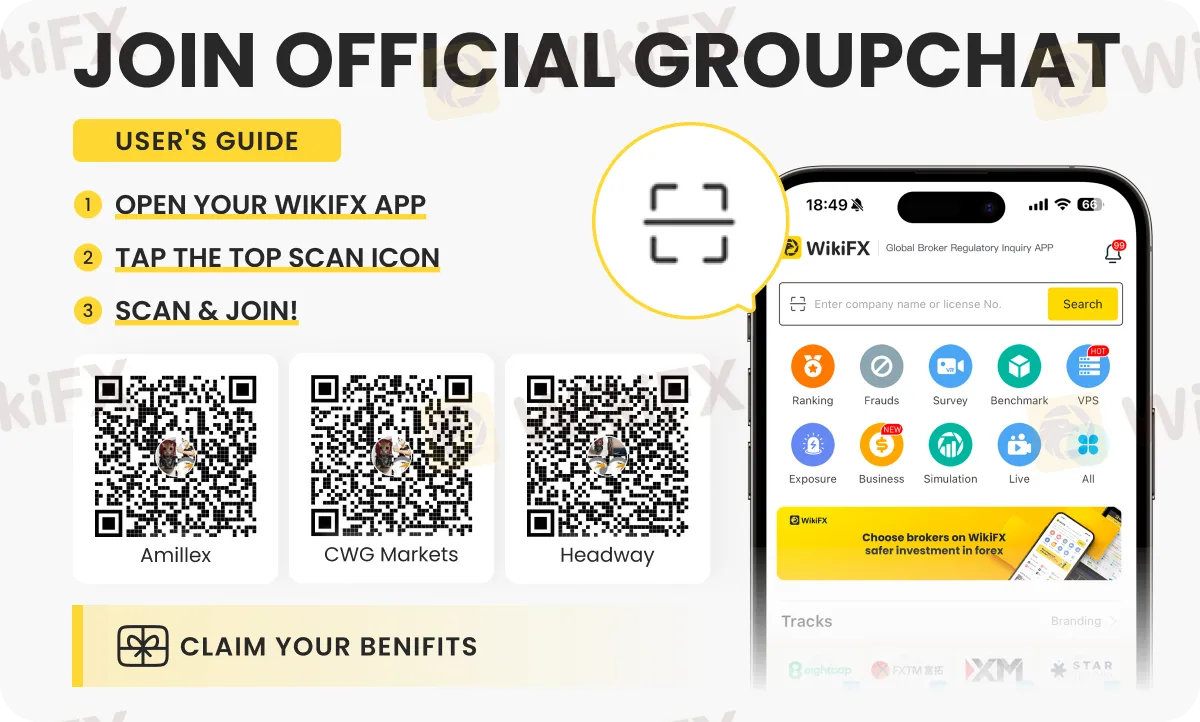

Check the latest forex updates on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.

Read more

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

Inside the Elite Committee: Talk with Ahmed Hassan

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

WikiFX Broker

Latest News

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Rate Calc