Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Abstract:If you are looking for a new broker, you might have stumbled upon OtetMarkets (or Otet Markets). They are a relatively new face in the industry, having established themselves in 2023. With a modern website and promises of high leverage using top-tier software like MT5 and cTrader, they certainly look the part.

If you are looking for a new broker, you might have stumbled upon OtetMarkets (or Otet Markets). They are a relatively new face in the industry, having established themselves in 2023. With a modern website and promises of high leverage using top-tier software like MT5 and cTrader, they certainly look the part.

However, pretty websites don't always equal safe funds. When we looked into the backend data provided by WikiFX, we found a concerning “Low Score” of 2.19 out of 10. This low rating usually acts as an early warning system for traders, suggesting that key safety pillars—like regulation and reputation—might be missing. Before you deposit your capital, lets break down exactly what this broker offers and where the risks lie.

Is OtetMarkets actually regulated?

The short answer is No.

According to the data available, OtetMarkets is not regulated by any Tier-1 or reputable financial authority.

While the company claims a headquarters in Saint Lucia, it is crucial to understand what this actually means for you as a trader. Saint Lucia is a popular destination for offshore business registration, but it does not function as a financial “regulator” in the same way the UK's FCA or Australia's ASIC does.

Why does this distinction matter?

When a broker holds a valid license from a major regulator, they are legally bound to follow strict rules designed to protect you. Without this oversight, you face several specific risks:

- No Segregation of Funds: Regulated brokers must keep your money in a separate bank account from the companys operating funds. An unregulated broker can theoretically mix your deposits with their payroll or debts, meaning if they go bankrupt, your money disappears with them.

- No Dispute Resolution: If OtetMarkets refuses a withdrawal or manipulates a trade, you have no government ombudsman to control them. You are essentially relying entirely on their “goodwill.”

- No Negative Balance Protection: In valid jurisdictions, you cannot lose more than you deposit. With offshore, unregulated entities, a sudden market crash could leave you owing the broker money.

What problems are users reporting?

While OtetMarkets is young (founded in 2023), they have already accumulated a significant volume of specific complaints. A recurring theme in the feedback involves technical anomalies that always seem to work against the trader.

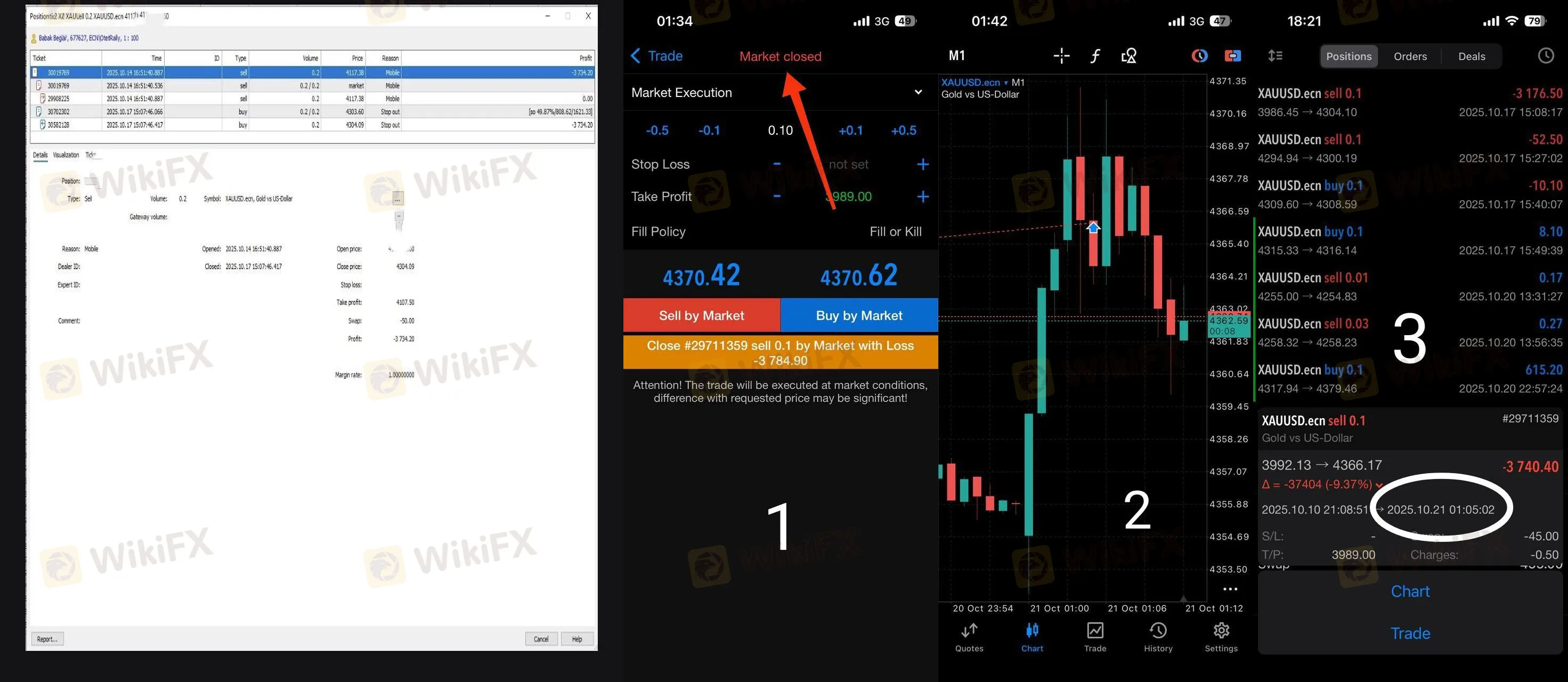

The “Hidden Gap” Incident

A user from Germany reported a highly concerning technical issue involving the XAUUSD (Gold) pair. The trader noted a “5-minute hidden gap” where the market moved, but the platform wouldn't allow them to close a sell position or hedge. The system threw a “Market Closed” error despite the market being active. This resulted in thousands in losses. When the trader contacted support, they allegedly received incorrect trade documents and denial.

Authorized Position Anomalies

Another serious allegation comes from a trader who attempted to open a micro-lot (0.01) position. According to their compliant, the system executed a full Standard Lot (1.00) instead. This massive jump in position size caused an immediate loss of 30% of their capital due to market movement. While the broker claimed it was a user typo, the trader insists they have screenshots proving otherwise.

Withdrawal Roadblocks and Excuses

Perhaps the most classic warning sign involves withdrawal delays. Multiple users, including one from Australia, reported that after depositing and trading (sometimes involving “bonus activities”), their withdrawal requests were rejected. The support team cited vague “server issues” or claimed to be processing “activities,” leading to delays stretching over days or weeks. When a broker blames a server error for their inability to send you your own money, it is often a major red flag.

What trading conditions does OtetMarkets offer?

If you are still considering them despite the risks, here is a breakdown of their trading environment. They structure their offer to be very attractive to aggressive traders, but this comes with its own dangers.

Account Types & Leverage

OtetMarkets offers five different account types: Otet Plus(+), ECN+, ECN, NO SWAP, and STOCK.

The headline feature here is the leverage, which goes as high as 1:1000.

- Educational Note: While 1:1000 leverage allows you to control huge positions with $500 or less, it is lethal for inexperienced traders. A 1:1000 ratio means a market move of just 0.1% against you can liquidate your entire account instantly. Regulated brokers are usually capped at 1:30 for this exact reason.

Spreads & Costs

The costs vary significantly by account. The “ECN+” account claims spreads from 0.2 pips, while the standard accounts start around 0.4 to 0.5 pips. These are competitive numbers on paper. However, in the unregulated space, low advertised spreads can sometimes be offset by “slippage” (where your trade executes at a worse price than you clicked), effectively acting as a hidden fee.

Trading Software

Credit where it is due: OtetMarkets provides access to MetaTrader 5 (MT5) and cTrader. These are the industry standards for charting and execution. They also have a proprietary platform. However, using legitimate software like MT5 does not legitimize the broker itself; many scam brokers purchase white-label licenses for MT5 to appear credible.

Bottom Line: Should you trust OtetMarkets?

Based on the evidence, we cannot recommend trading with OtetMarkets at this time.

The combination of being an unregulated entity (Score 2.19) and having multiple verified user reports regarding withdrawal failures and platform glitches makes them a high-risk provider. The reported issues—specifically the “lot size switching” and “hidden market gaps”—suggest a trading environment that may not be fair to the client.

There are hundreds of brokers who offer MT5 and competitive spreads but also hold valid licenses from strict regulators like the FCA or ASIC. Your capital safety is the most important factor in trading; risking it with an offshore broker that has a history of denying withdrawals is rarely worth the gamble.

Markets change fast, and so does broker status. To verify their current license status or check for new user complaints before depositing, search for OtetMarkets on the WikiFX App.

Read more

Stockity Review 2025: Is It Safe to Trade or a Scam?

Stockity is an online brokerage firm established in 2022 and registered in the Marshall Islands. While it has established a marketing presence in regions such as Indonesia, South America (Argentina, Brazil, Colombia, Peru, Chile), and parts of Asia (India, Thailand), its regulatory standing raises significant concerns. With a WikiFX score of just 1.42 out of 10, Stockity is categorized as a high-risk entity due to the absence of valid regulatory licenses and multiple unresolved user complaints.

Strifor Review 2025: A Risk Analysis of This Unregulated Broker

Evaluating a broker’s safety requires a close look at its regulatory status, trading environment, and user feedback. Strifor is a brokerage firm established in 2022 with its headquarters in Mauritius. While it offers digital account opening and the popular MT5 platform, its low WikiFX score of 1.99 and regulatory status raise significant concerns.

QuoMarkets Review 2025: Safety, Features, and Reliability

QuoMarkets is a UAE-based brokerage established in 2022, offering completely digital account opening and access to the MetaTrader 5 (MT5) platform. While the broker provides support for multiple account types and cryptocurrency funding, it currently holds a low WikiFX Score of 3.09. This score reflects significant concerns regarding its regulatory status, with licenses marked as "Exceeded" or "Unverified" and explicit warnings from financial authorities.

Titan Capital Markets Review 2025: Safety Warning and Scam Analysis

Titan Capital Markets, established in 2021, presents itself as a financial service provider headquartered in Australia. However, a detailed analysis of its regulatory status and user feedback suggests significant risks. With a dangerously low WikiFX Score of 1.45, this broker has been flagged for regulatory irregularities and a high volume of investor complaints regarding withdrawal failures.

WikiFX Broker

Latest News

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Rate Calc