ActivTrades Review 2025: Regulatory Status and Safety Analysis

Abstract:ActivTrades is a veteran brokerage established in 2005 with headquarters in Mauritius. With over nearly two decades of operation, it holds a prominent position in the market, reflected by a WikiFX Score of 7.37 and an "A" influence ranking. The broker is particularly active in regions such as the UAE, Brazil, Argentina, and Austria.

ActivTrades is a veteran brokerage established in 2005 with headquarters in Mauritius. With over nearly two decades of operation, it holds a prominent position in the market, reflected by a WikiFX Score of 7.37 and an “A” influence ranking. The broker is particularly active in regions such as the UAE, Brazil, Argentina, and Austria.

Despite its high score and long history, recent user feedback highlights significant controversies regarding fund withdrawals and profit deductions. This review analyzes the regulatory framework, trading platforms, and recent exposure data to help you decide if ActivTrades is the right choice for your trading needs.

Is ActivTrades Legit? Regulatory Framework

ActivTrades operates under a hybrid regulatory model, holding licenses from a top-tier authority and an offshore regulator, while also facing regulatory challenges in other jurisdictions.

Current License Holdings

| Regulator | Country | License Details | Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | License No. 434413 | Regulated (Tier 1) |

| Securities Commission of The Bahamas (SCB) | Bahamas | License No. Unreleased | Offshore Regulated |

Regulatory Analysis:

- Positive Status: The FCA license (ActivTrades Plc) is a significant trust indicator, providing high-level protection for clients under UK jurisdiction.

- Offshore Component: The entity regulated by the SCB (ActivTrades Corp) allows for different trading conditions but offers less stringent oversight compared to the UK entity.

- Revoked Status: The broker previously held a license with the Dubai Financial Services Authority (DFSA) (No. F003511), which is currently listed as Revoked.

- Negative Disclosure: In 2023, the Indonesian regulatory body BAPPEBTI included ActivTrades in a disclosure regarding blocked illegal commodity futures trading websites, classifying the listing under “Blacklist” for operating without local licensing.

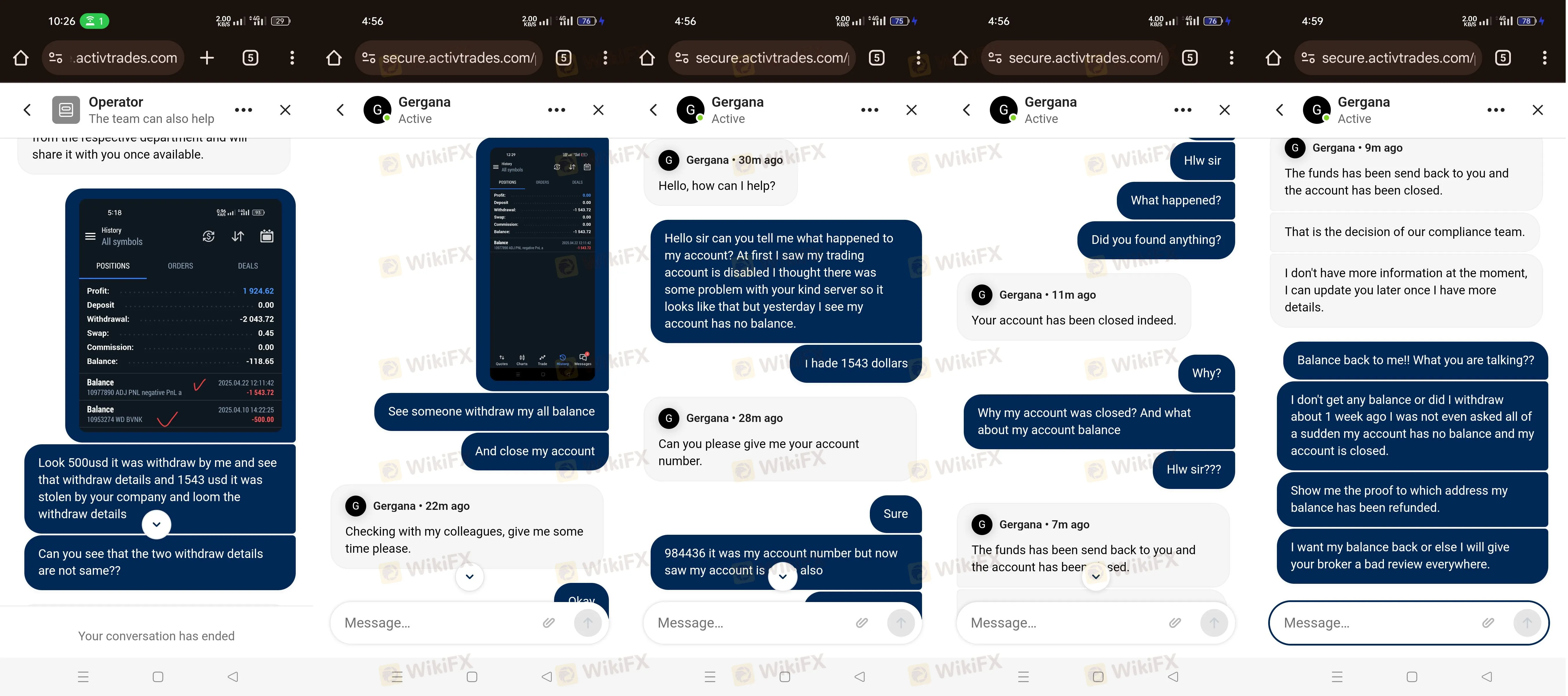

User Complaints and Exposure: Is Funds Safety at Risk?

While ActivTrades holds a high score, the Exposure section on WikiFX shows a concerning trend. In the last three months alone, there have been 9 complaints. The most reported issues involve the removal of profits and account closures.

Major Complaint Themes (2024-2025)

1. Profit Removal and Deposit Issues

Multiple users from Pakistan and Bangladesh have reported that after making profitable trades, their profits were deducted without clear explanations. In severe cases, users claimed their initial deposits were also withheld.

- Case 1 (Pakistan, 2025-08): A user reported, “They removed my profit and they also removed my deposit amount” after a withdrawal attempt.

Case 2 (Pakistan, 2025-06): Another trader claimed a loss of 33,253.79 USD in profits, stating the broker refused to return real money.

3. Positive Feedback

Conversely, some users (e.g., from Germany and the UK) have praised the broker for its reliability, variety of platforms, and strict adherence to leverage limitations required by regulators, indicating a mixed user experience depending on the region or entity involved.

ActivTrades Trading Platforms and Software

ActivTrades offers a mix of industry-standard and proprietary software. The broker supports MT4 (MetaTrader 4), MT5 (MetaTrader 5), and a self-developed platform.

- Mobile Focus: The broker provides specific apps for iOS and Android, which are listed as available for download.

- Software Rating: The software engineering environment is rated as “Perfect” by WikiFX technical assessment.

- Limitations: According to the data summary, while the broker utilizes major platforms, there are reports that it “unfortunately does not support Windows, MacOS, Web, or other applications” in certain configurations, which traders should verify before opening an account if they rely heavily on desktop trading.

Pros and Cons of ActivTrades

Based on the available data, here is a summary of the broker's strengths and weaknesses:

Pros:

- High Trust Score: WikiFX Score of 7.37.

- Tier-1 Regulation: Regulated by the UK FCA.

- Established History: Operating since 2005.

- Platform Variety: Offers MT4, MT5, and proprietary software.

- Global Support: Customer service is available in over 9 languages, including Arabic, German, English, and Chinese.

Cons:

- Surge in Complaints: Recent reports of profit deductions and withdrawal denials.

- Regulatory Warnings: Blacklisted by Indonesias BAPPEBTI; Revoked DFSA license.

- Offshore Entity: Clients under the Bahamas entity have different protections than those under the UK entity.

Final Verdict: Is ActivTrades Safe?

ActivTrades presents a conflicting profile. On paper, it is a highly reputable broker with solid UK regulation (FCA) and a two-decade history, justifying its high WikiFX score. However, the recent cluster of complaints regarding profit removal and account closures—particularly from clients in Asia and the Middle East—raises valid concerns for potential traders.

If you choose to trade with ActivTrades, verify which entity you are registering under (UK vs. Bahamas) as protections vary significantly.

Protect your capital: Before depositing, check the latest complaints and regulatory status on the WikiFX App to ensure the broker's conditions haven't deteriorated further.

Read more

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

TopstepFX Review: Investigating Fund Withdrawal Denial Claims & Other Trading Issues

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.

Checking if Mazi Finance is Real: Is This a Fake Broker or a Real Trading Company?

If you're wondering, "Is Mazi Finance legit?" or worried about a possible Mazi Finance scam, you are asking the right questions. These are the important first steps every trader must take to protect their capital. In a market full of chances to make money, there are just as many traps. Our goal is to give you a clear, fact-based answer. We have done a complete investigation into Mazi Finance, looking at its legal status, company structure, user experiences, and trading conditions. This is not a review based on marketing claims; it is a check for legitimacy based on facts we can prove. To be direct, our findings show that Mazi Finance operates with serious warning signs that should worry any trader. The biggest problem is its complete lack of proper regulation from any respected financial authority. This fact alone puts it in a high-risk category. This article will explain exactly what that means for you and your money.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

PXBT Review: A Seychelles-Based Trap for Your Capital

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Beware ThinkMarkets: Forex Fraud Cases Exposed

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc