RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

Abstract:A Kuching woman lost RM91,000 after being lured into a fake investment scheme advertised on Telegram, where scammers promised high returns but disappeared after receiving multiple bank transfers. Police are investigating the case under Section 420 for cheating and have warned the public to stay alert to online investment scams.

A 35-year-old woman in Kuching has lost RM91,000 after being duped by a fake investment scheme promoted through the Telegram messaging app.

According to Kuching police chief ACP Alexson Naga Chabu, the victim lodged a police report on Jan 11 after realising she had been cheated. She was first approached by an unknown individual on Telegram who introduced what appeared to be a high-return investment opportunity. Enticed by the promise of quick and lucrative profits, she agreed to participate.

Following the instructions given, the woman transferred money in stages to several bank accounts provided by the scammer. In total, she made five separate transactions to five different accounts, amounting to RM91,000. At the time, she believed the transfers were part of the investment process.

Her suspicions were raised when she later tried to withdraw her capital and the promised returns but was unable to do so. Repeated attempts to contact the individual failed, and she eventually realised the investment scheme did not exist.

Police have classified the case under Section 420 of the Penal Code for cheating, and investigations are ongoing. Authorities continue to remind the public to be cautious of investment offers circulating on social media and messaging platforms, especially those promising unusually high returns.

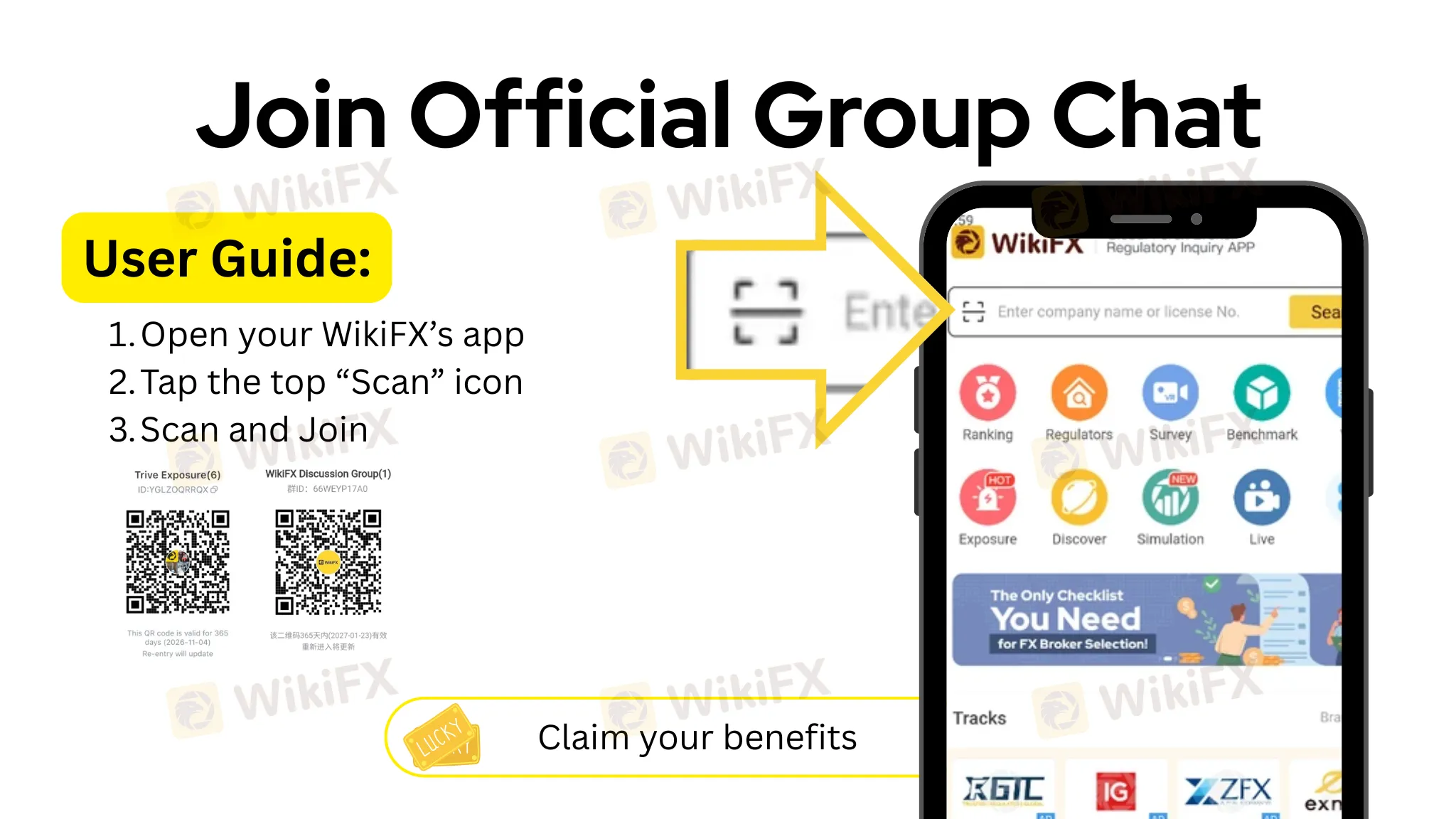

To reduce the risk of falling victim to such scams, investors are encouraged to verify the legitimacy of brokers and platforms before committing any funds. WikiFX provides tools that allow users to check regulatory status, broker backgrounds, risk ratings and user feedback, helping investors identify red flags early and protect their savings from fraudulent schemes.

Read more

HTFX Under Scrutiny: CySEC License Pulled, WikiFX Flags Scam Risks

Growing warnings surround HTFX after losing its European licenses and being flagged by WikiFX as a Ponzi-style platform, with repeated reports of withdrawal problems.

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

Tan Sri Arrested in RM300 Million Investor Scam Probe

A Tan Sri was among two individuals detained by the MACC over an alleged RM300 million investment scam in Kuala Lumpur. Authorities say the unapproved schemes promised high returns and caused millions in losses nationwide, prompting renewed warnings for the public to verify investments and avoid offers that seem too good to be true.

WikiFX Broker

Latest News

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Bitget Review: A Regulatory Ghost Running a Phishing Playground

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

Global Bond Shift: India Dumps US Treasuries Amid ‘Sell America’ Narratives

Morgan Stanley Looks to Expand in Asia

African Credit & Banking: Afreximbank Drops Fitch; Zenith Expands footprint

HTFX Under Scrutiny: CySEC License Pulled, WikiFX Flags Scam Risks

South African Rand Finds Support in Economic Optimism and Mining Sector Resiliency

Rate Calc