NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Abstract:When you come across a broker, such as NEWTON GLOBAL, your main concern is simple: Can you trust it for investments? The search for "Is NEWTON GLOBAL Legit" comes from needing a clear, fact-based answer to protect your capital. We understand this urgency. Read on as we answer this query.

The Immediate Answer

When you come across a broker, such as NEWTON GLOBAL, your main concern is simple: Can you trust it for investments? The search for “Is NEWTON GLOBAL Legit” comes from needing a clear, fact-based answer to protect your capital. We understand this urgency. Before getting into the details, let's address the main issue directly.

A Watchdog's Perspective

From an investigative viewpoint, the initial evidence about NEWTON GLOBAL raises immediate and serious concerns. Our analysis, based on data from independent verification platforms, points to an operation with an extremely high-risk profile.

Here are the critical findings at a glance:

· Key Finding: No valid, verifiable financial regulation from a reputable authority.

· Trust Score: An alarmingly low score of 1.41 out of 10.

· Official Warning: The consensus from verification bodies is clear: “High potential risk, please stay away.”

These initial data points are not opinions; they come from a systematic review of the broker's operational and legal framework. As we will detail, these findings are supported by independent verification platforms, such as WikiFX, which track broker legitimacy through regulatory data and user experiences. This pattern of evidence forms the basis of our cautionary stance.

A Deep Dive into Red Flags

A low score and a warning are just the beginning. To truly understand the risk, we must break down the elements that contribute to this assessment. Examining the specific red flags associated with NEWTON GLOBAL provides a clear picture of why caution is not just advised, but essential. This deep dive helps you recognize similar warning signs in the future.

The Lack of Valid Regulation

The single most important factor in a broker's legitimacy is its regulatory status. A regulated broker operates under the supervision of a government financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These bodies enforce strict rules designed to protect traders, including keeping client funds separate and participating in compensation schemes.

NEWTON GLOBAL, operating under the company name NEWTON GLOBAL Commercial Business (NGCB) LTD, is registered in Mauritius. While Mauritius has a financial services commission, it is considered an offshore jurisdiction with significantly weaker regulatory oversight compared to tier-1 authorities.

More critically, independent verification reports find that NEWTON GLOBAL currently holds “No Regulation.” The broker's license status is flagged as “Suspicious Regulatory License.” This means there is no credible, top-tier regulatory body overseeing its operations and ensuring it follows fair financial practices. Trading with an unregulated broker removes the most fundamental layer of protection for your funds, leaving you with little to no recourse in case of disputes, withdrawal issues, or insolvency.

Understanding the 1.41/10 Score

A trust score is not a random number. It is a data-driven metric calculated by combining multiple factors. These typically include:

· License Index: The quality and validity of the broker's licenses.

· Business Index: The broker's operational stability and business practices.

· Risk Management Index: The broker's ability to manage financial risks and protect client funds.

· Software Index: The quality and security of its trading platforms.

· Regulatory Index: The strength of the regulatory oversight.

A score as low as 1.41 out of 10 is a severe criticism of a broker's entire operation. It indicates systematic failures across nearly every assessment category. It suggests that from a risk management perspective, the broker fails to meet even the most basic industry standards for safety and reliability. Such a score is a definitive warning that the broker's operational framework is fundamentally flawed and poses a significant danger to traders' capital.

Voices from the Trading Community

While data provides a structural overview, real-world user experiences reveal how a broker operates in practice. The “Exposure” section on verification platforms serves as a public record of user complaints, and the reports concerning NEWTON GLOBAL are deeply troubling.

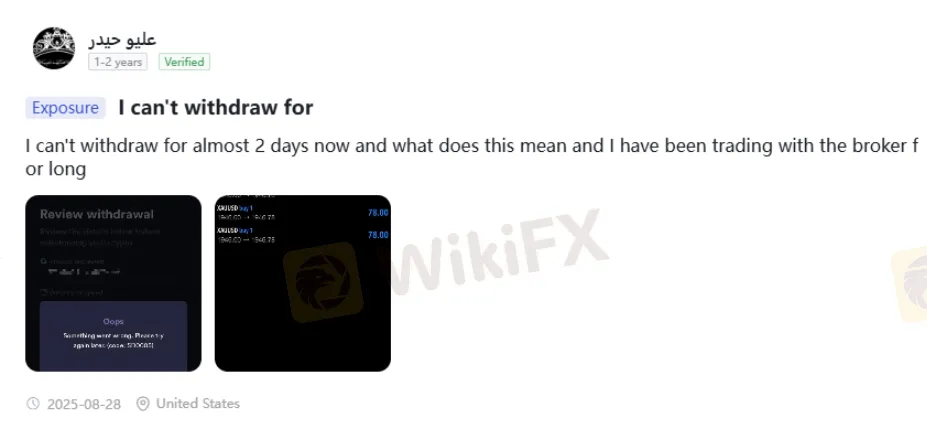

One user, “عليو حيدر,” posted on August 28, 2025, with a straightforward complaint: “I can't withdraw for almost 2 days now.”

This type of issue, where traders are unable to access their own funds, is a classic red flag for a problematic broker.

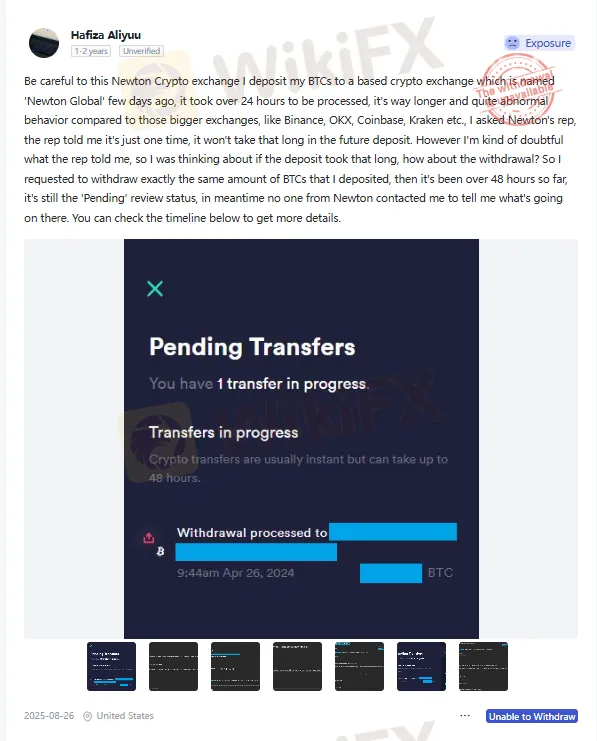

An even more detailed account comes from user “Hafiza Aliyuu” on August 26, 2025. This user describes a multi-stage negative experience. First, a BTC deposit took over 24 hours to process, which is highly unusual for crypto transactions. Worried about this delay, the user attempted a withdrawal. After more than 48 hours, the withdrawal request was still stuck in “Pending” status, with no communication from the broker's support team. This user's testimony points directly to potential withdrawal obstruction, a hallmark often associated with a possible NEWTON GLOBAL scam.

In contrast, a single positive review from June 27, 2024, by user “fxhjjj” states, “Joining their program was the best decision I made this year!!!” We must analyze this critically.

The review is generic, lacks any specific details about trading, withdrawals, or platform performance, and stands in stark isolation against detailed, evidence-backed negative reports. In our experience, such vague, overly enthusiastic reviews can sometimes be a red flag themselves, used to reduce the impact of legitimate complaints.

Prospective traders can and should review these raw user reports on verification platforms such as WikiFX. These platforms are an essential resource for seeing past a broker's marketing and understanding its true performance and trustworthiness.

A Critical Look at Services

To provide a balanced analysis, it is important to examine what NEWTON GLOBAL claims to offer. Often, high-risk brokers attract clients with appealing trading conditions. However, these “pros” must be weighed against the overwhelming operational risks we've identified.

Accounts, Leverage and Spreads

NEWTON GLOBAL structures its offering across several account tiers, a common practice in the industry. The low entry point is designed to attract new traders.

| Account Type | Minimum Deposit | Spreads (from) |

| Silver | $500 | 1.5 pips |

| Gold | $2,000 | 0.8 pips |

| Platinum | $10,000 | 0.5 pips |

The broker also offers high leverage up to 1:500. It is crucial to understand the dual nature of leverage. While high leverage can amplify profits, it drastically increases the risk of significant losses, often leading to a complete wipeout of a trading account. This risk is magnified exponentially when dealing with an unregulated entity where your capital is already at risk.

Platforms and Market Access

The broker provides access to the widely recognized MetaTrader 5 (MT5) platform and lists its own proprietary “NG Trader” as coming soon. The availability of MT5 lends an air of legitimacy, as it is a powerful and popular platform.

However, it is critical to note the absence of MetaTrader 4 (MT4). For millions of traders, MT4 remains the industry standard due to its simplicity and vast library of custom indicators and expert advisors. The lack of MT4 could be a significant drawback.

The range of tradable instruments includes Forex, Commodities, Stocks, and Indices is a standard offering for most online brokers.

The “Pros” vs The Reality

Attractive features can be misleading when the foundation of the broker is unstable. A side-by-side comparison puts the advertised benefits into their proper context.

| Claimed Pro | Critical Reality |

| MT5 Platform Available | While MT5 is a legitimate platform, the software itself does not guarantee the broker's integrity. A fraudulent broker can operate on a legitimate platform, and the platform cannot protect you from the broker's actions. |

| Multiple Contact Channels | The availability of a phone number, email, and live chat means little when users report that their fundamental issues, such as withdrawal requests, are not being resolved. Effective support is about problem resolution, not just availability. |

| High Leverage (1:500) | For an unregulated broker, high leverage is more of a risk than a benefit. It encourages over-trading and can lead to rapid, catastrophic losses, from which you have no regulatory recourse to recover. |

This comparison demonstrates that the perceived advantages are overshadowed by fundamental, non-negotiable risks related to regulation and fund safety.

Final Verdict and Safeguard

After a thorough examination of the evidence, we can provide a definitive conclusion and, more importantly, a clear path forward to protect yourself as a trader.

Is NEWTON GLOBAL Legit or a Scam?

While we cannot legally label any company a “scam,” NEWTON GLOBAL exhibits all the major warning signs of an untrustworthy and high-risk operation. The evidence points overwhelmingly to a broker that you should avoid.

Let's summarize the conclusive evidence:

· No verifiable, top-tier regulation to protect your funds.

· An extremely low trust score of 1.41/10, indicating systematic failures.

· Multiple, detailed user reports of withdrawal failures and processing delays.

· Registration in a high-risk offshore jurisdiction known for weak oversight.

Based on this evidence, we conclude that engaging with NEWTON GLOBAL presents a significant and unacceptable risk to your trading capital. The probability of encountering issues, particularly with withdrawing funds, appears to be very high.

Your Most Powerful Tool

To avoid brokers like NEWTON GLOBAL, you must adopt a simple, non-negotiable rule: Never deposit funds with a broker before thoroughly verifying it on an independent regulatory and review platform.

We explicitly recommend that every trader make it a habit to use a comprehensive tool, such as WikiFX, before opening an account. Such platforms are designed to be your first line of defense. They allow you to:

1. Instantly check a broker's regulatory status and license details against official databases.

2. See a transparent, data-driven trust score that summarizes its operational risks.

3. Read real, unfiltered user reviews and exposure reports to see how the broker treats its clients in real-time.

This is not just a recommendation; it is a critical step in your due diligence process. A five-minute check can save you from months of stress and the potential loss of your entire investment.

What a Legit Partner Looks Like

To move forward constructively, it helps to know what to look for in a truly legitimate trading partner. A trustworthy broker will proudly display these attributes, and they will be easily verifiable.

Use this checklist in your future searches:

· ✅ Tier-1 Regulation: The broker is regulated by a top-tier authority like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or other reputable national bodies.

· ✅ Long-standing Reputation: The broker has a proven track record of reliable operations over many years, ideally a decade or more.

· ✅ Transparent Fees and Processes: All costs, spreads, commissions, and withdrawal procedures are clearly stated and easy to find. There are no hidden terms.

· ✅ Overwhelmingly Positive Reviews: Look for consistent, detailed praise from a large number of users, specifically regarding fast withdrawals, responsive support, and platform stability.

Your capital is your primary tool in trading. Protecting it by choosing a well-regulated and reputable broker is the most important trade you will ever make.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

MultiBank Group Analysis Report

Pepperstone Analysis Report

TradingPro: Regulation, Licences and WikiScore Analysis

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Weltrade Review: Safety, Regulation & Forex Trading Details

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Rate Calc