User Reviews

More

User comment

6

CommentsWrite a review

2023-04-20 02:37

2023-04-20 02:37

2023-02-23 16:09

2023-02-23 16:09

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index0.00

Business Index7.52

Risk Management Index0.00

Software Index4.00

License Index0.00

Single Core

1G

40G

More

Company Name

FXFlat Bank GmbH

Company Abbreviation

fXFLAT BANK

Platform registered country and region

Germany

Company website

Company summary

Pyramid scheme complaint

Expose

| FXFlat Review Summary | |

| Founded | 2006 |

| Registered Country/Region | Germany |

| Regulation | BaFin (Exceeded) |

| Market Instruments | CFDs, Futures and Spot Forex |

| Demo Account | / |

| Leverage | Up to 1:200 (Spot forex) |

| Spread | / |

| Trading Platform | MetaTrader 4, MetaTrader 5 |

| Minimum Deposit | / |

| Customer Support | Live chat |

| Phone: +49 210210049400 | |

| Email: service@fxflat.com | |

| Facebook, Instagram, LinkedIn, YouTube, Twitter | |

FXFlat is a German brokerage firm operating as a market maker. It is regulated by the Federal Financial Supervisory Authority (BaFin), known for its strict financial oversight. However, its license was exceeded.

| Pros | Cons |

| MT4 and MT5 available | Exceeded BaFin license |

| Live chat support | Commission charged for futures trading |

| Free account management | |

| Various payment options |

FXFlat is supervised by the German Federal Financial Supervisory Authority (BaFin) under license number 109603. However, it was exceeded.

| Regulated Country | Regulated Authority | Current Status | License Type | License Number |

| German Federal Financial Supervisory Authority (BaFin) | Exceeded | Common Financial Service License | 109603 |

FXFLAT offers trading services in CFD-Trading, Futures and Spot Forex.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Futures | ✔ |

| Spot Forex | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

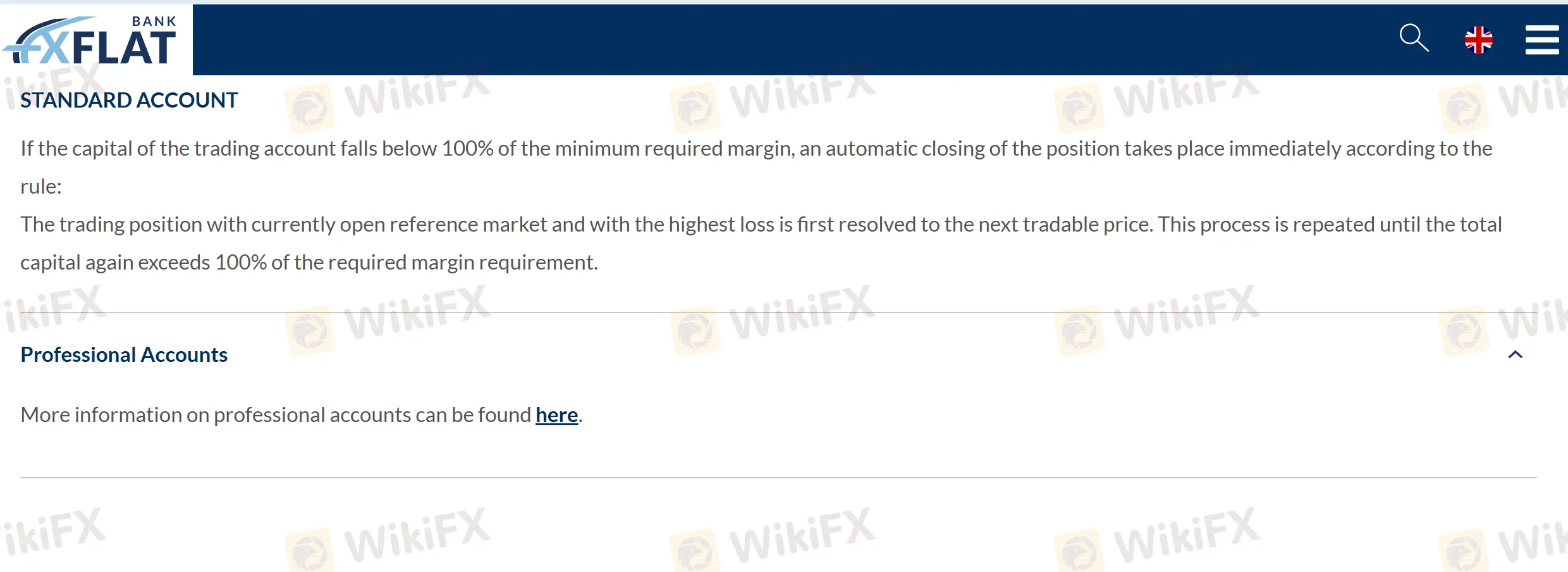

FXFlat offers two types of accounts: Standard Account and Professional Account. However, detailed account features are not revealed.

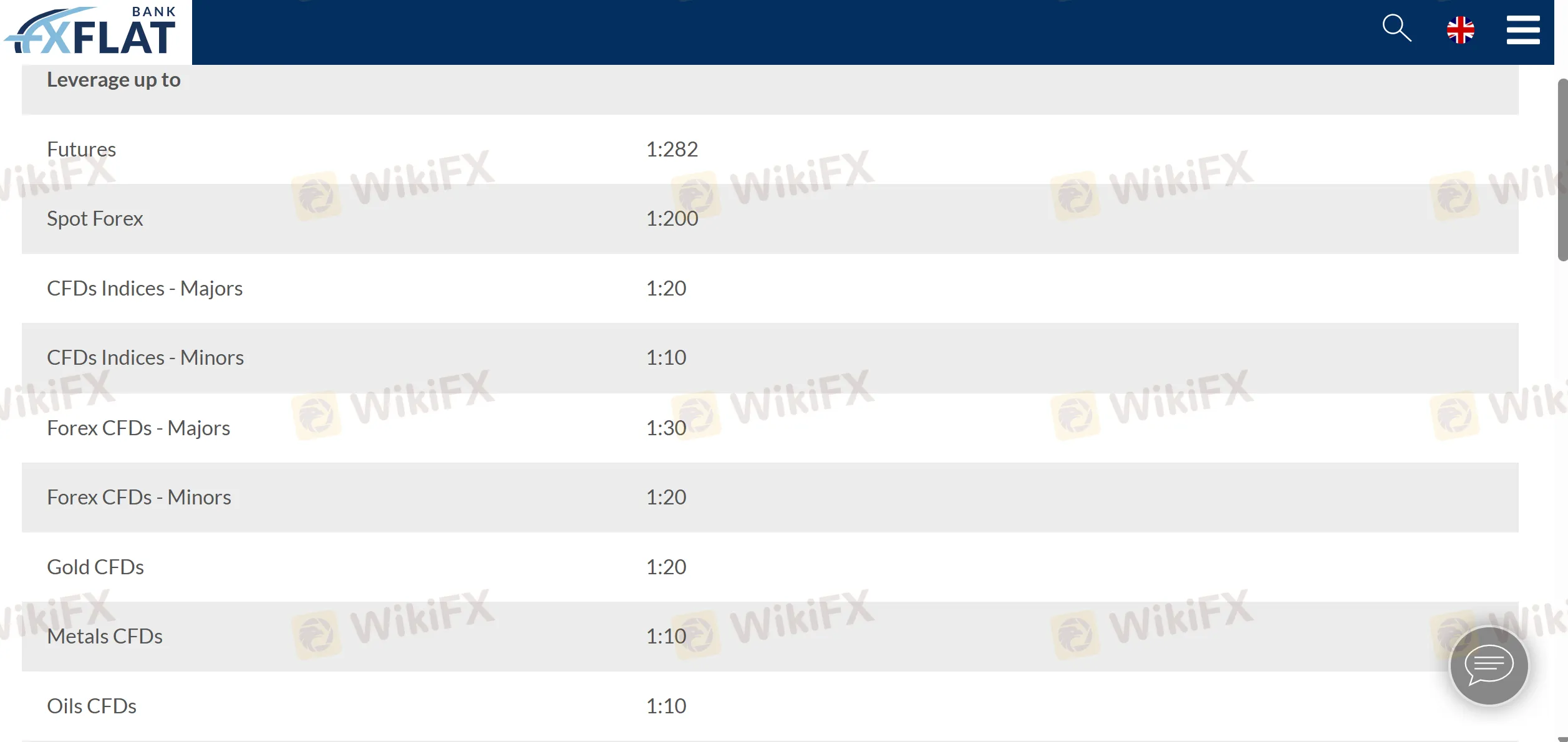

XFLAT provides flexible leverage options tailored to different asset classes, enabling traders to optimize their strategies while managing risk.

| Trading Assets | Maximum Leverage |

| Futures | 1:282 |

| Spot forex | 1:200 |

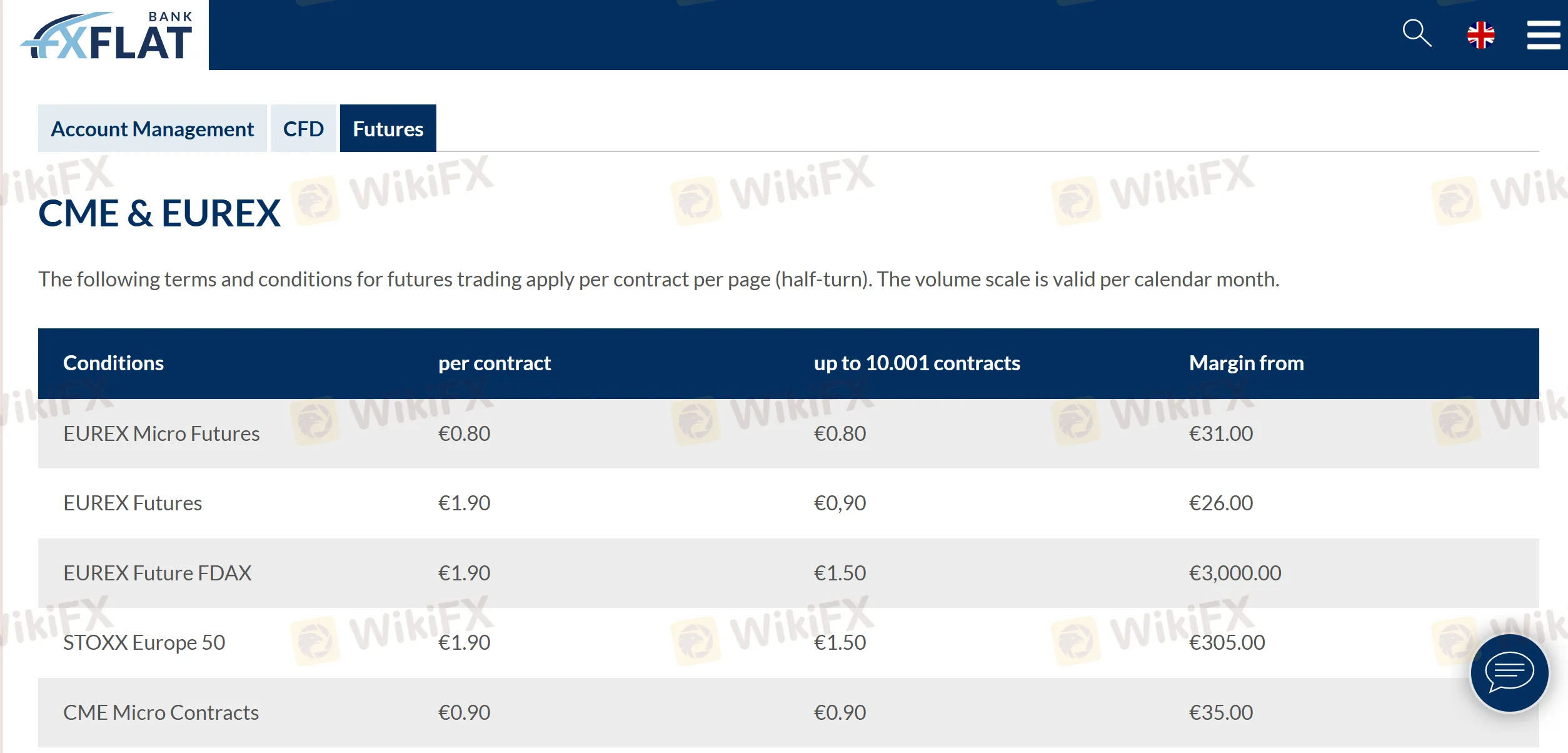

Account management services are free of charge, and CFDs trading does not charge any commission fees. However, fees are charged in futures trading, varying between €0.80 and €5.90 per contract.

FXFLAT supports both a proprietary MetaTrader 4 (MT4) and the MetaTrader 5 (MT5) platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | mobile, desktop | Beginners |

| MetaTrader 5 (MT5) | ✔ | mobile, desktop | Experienced traders |

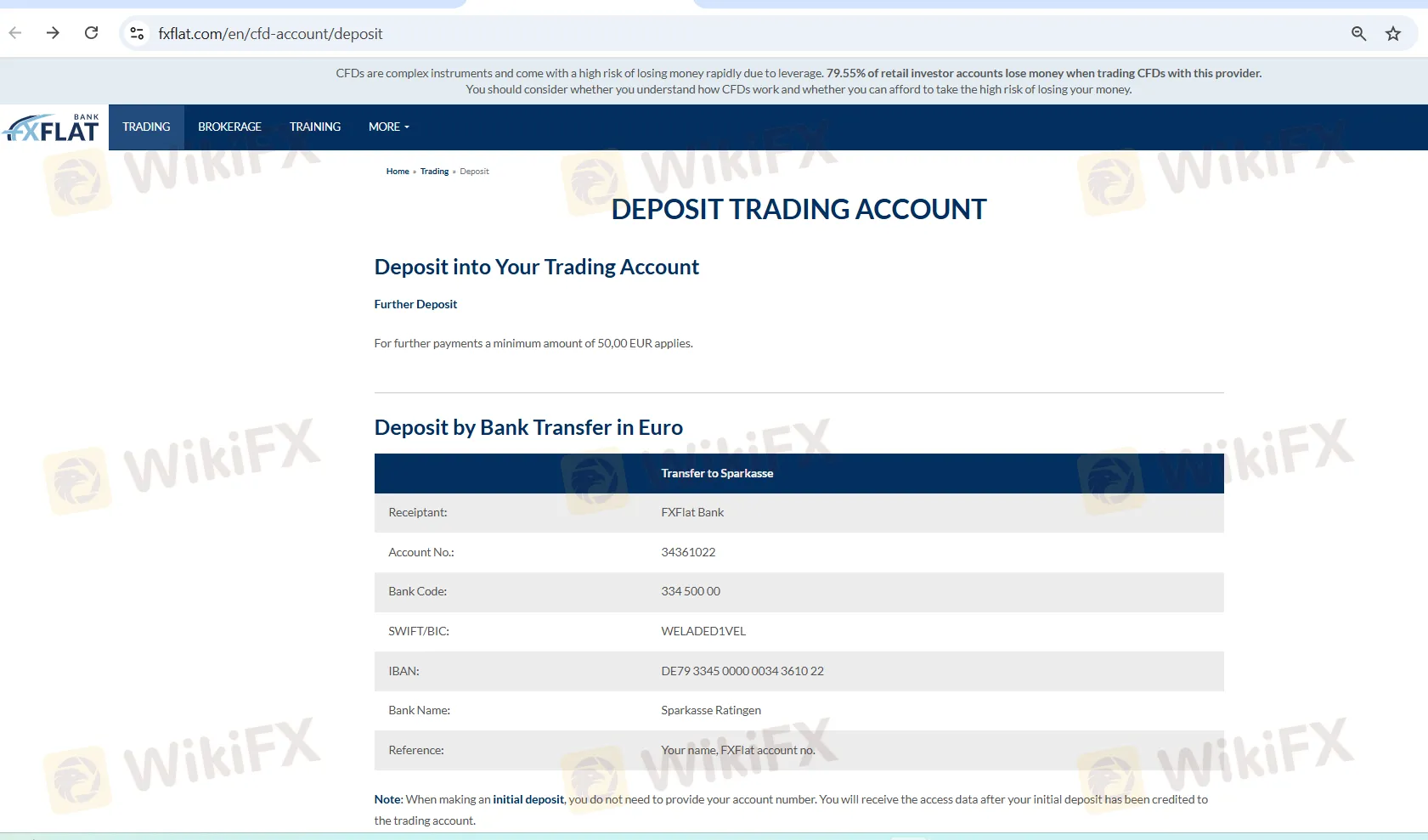

FXFlat different types of payment options, including iDeal, Mastercard, Maestro, VISA, Paypal, Skrill, and Klarna. As for bank transferring, customers can deposit funds into FXFlat Bank in EUR. The minimum initial deposit is not clear, but a minimum amount of 50,00 EUR is required for further deposit.

Making profits, but FXFlat is cancelling all of them? Do you constantly face losses due to slippage by the Germany-based forex broker? Is your forex trading account getting deactivated after making the FXFlat withdrawal request? Do you have to constantly deal with poor customer support issues? You are not alone! Many traders have openly expressed their frustration over these issues online. In this FXFlat review article, we have shared some of their complaints. Read on!

WikiFX

WikiFX

Thinking of trading with FXFlat in 2025? Before you invest, read what real traders say. This FXFlat Review 2025 dives into the broker’s regulation, trading platforms, and customer feedback.

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2023-04-20 02:37

2023-04-20 02:37

2023-02-23 16:09

2023-02-23 16:09