FXFlat Review 2025! Read FXFlat Trustpilot Reviews

Abstract:Thinking of trading with FXFlat in 2025? Before you invest, read what real traders say. This FXFlat Review 2025 dives into the broker’s regulation, trading platforms, and customer feedback.

Thinking of trading with FXFlat in 2025? Before you invest, read what real traders say. This FXFlat Review 2025 dives into the brokers regulation, trading platforms, and customer feedback.

About FXFlat

FXFlat, founded in 1997 by Rafael Neustadt, is a German Forex and stock broker that provides access to global financial markets. The company operates under FXFlat Bank GmbH, offering a wide range of trading services to retail and professional clients.

Is FXFlat Legit?

Headquartered in Ratingen, near Düsseldorf, Germany, FXFlat Bank GmbH has been operating since 1997. According to the company, it has been supervised by the Federal Agency for Financial Services Supervision (BaFin) since 1998. In 2015, FXFlat became a licensed securities trading bank, which allows it to provide expanded financial services under German regulatory oversight.

FXFlat Trading Instruments

FXFlat offers a broad selection of financial instruments, enabling clients to trade in:

• Stocks

• Bonds

• Options and Futures

• ETFs (Exchange-Traded Funds)

• Commodities

• Spot Forex and CFDs

The broker provides access to over 100 markets in 33 countries, giving traders a diverse range of global investment opportunities.

FXFlat Trading Platforms

FXFlat supports several professional trading platforms, including:

• MetaTrader 4 (MT4)

• MetaTrader 5 (MT5)

• AgenaTrader

• ATAS

• Trader Workstation (TWS)

FXFlat Customer Support

FXFlat provides customer support 24 hours a day, Monday through Friday, via phone and live chat.

• Telephone: +49 2102 100 494 00

• Email: service@fxflat.com

For any inquiries, assistance, or general information, clients are encouraged to contact the FXFlat Support Team.

FXFlat Trustpilot Reviews

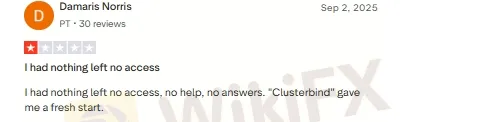

1. Unresponsive Customer Support

Several users have criticized FXFlat for its poor customer support, describing it as unresponsive and unprofessional.

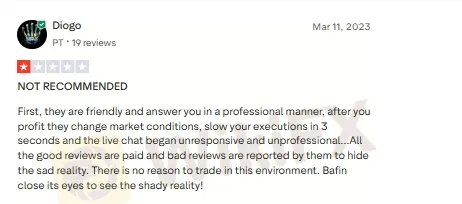

2. Unprofessional Live Chat

Another user mentioned that while the live chat agents initially appear friendly and professional, their service quality quickly deteriorates. Users reported execution delays of up to three seconds and claimed that the live chat later became unhelpful and unprofessional. According to this user, “There is no reason to trade in such an environment.”

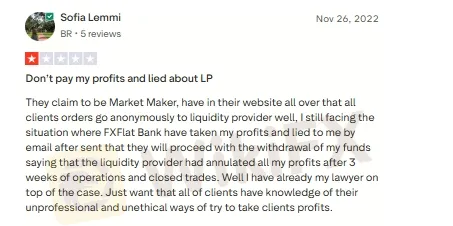

3. Misleading Communication with Customer

One client stated that FXFlat misled him regarding the withdrawal of his profits. After being assured via email that the funds would be processed, the company allegedly failed to deliver on that promise.

4. Allegations of Fraudulent Activity

Another user labeled FXFlat a “scam company,” claiming that the broker refused to release client funds, deleted profits, and banned accounts. The user warned others: “Do not deposit here! Stay away!”

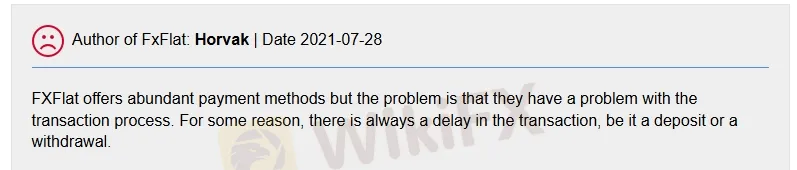

5. Problematic Transaction Process

Although FXFlat offers multiple payment options, some clients reported consistent delays and issues with transaction processing, calling the system unreliable.

Conclusion

Youve read this FXFlat Review 2025 and now understand the broker more clearly. The Trustpilot reviews reveal what traders really think — some even warn of a potential scam alert.

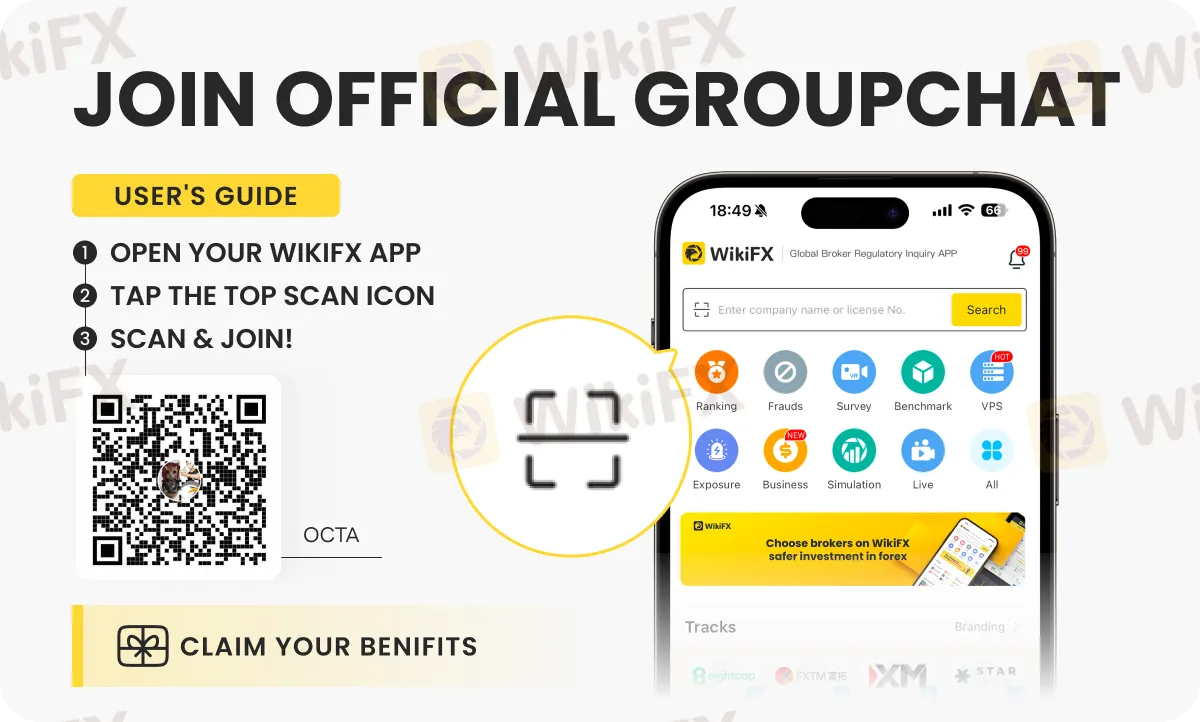

Join the community :

We‘ve created a Octa Broker small community of passionate traders where we share competitions, contests, and the latest daily news, etc. We’d love to have you there!

Read more

Checking if Vida Markets is Real and Safe

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

Vida Markets Regulatory Status

Picking a broker is one of the most important choices a trader can make. Beyond costs and trading platforms, the main protection for a trader's capital is the broker's regulatory status. A careful check of licenses, company registrations, and compliance history is not just smart; it is necessary. When it comes to Vida Markets, our review of public information shows major regulatory warning signs and a high-risk profile that should make any potential investor very careful. The main question of whether Vida Markets is a safe and regulated company is complicated, with an answer that points strongly toward a negative result. The broker's business structure is a mix of offshore registration, a license being used beyond its legal limits, and a recently canceled license from another country. This is made worse by an extremely low WikiFX score of 2.16 out of 10, a number that serves as an immediate and clear warning. Also, many serious user complaints create a worrying picture of the real tra

Vida Markets Review: Serious Warning Signs and Customer Problems Revealed

This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: "Low score, please stay away!" This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

South Africa's Reform Agenda Gains Traction, Business Sentiment Improves

4T Review 2026: Is this Forex Broker Legit or a Scam?

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Rate Calc