.51538

Scam

compensation

$198,000(USD)

24day2hour

.51538Solved after user's confirmation

Hong Kong

Hong Kong

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

I accept the way the customer complaint specialist handled it, and my father is going to have an operation and there is nothing I can do about it! I promise not to expose any more information on any platform! This is the end of the matter.

CPT MarketsReply

Reply

In reference to the customer's concern about the failure to stop loss at the related point, we confirm that the stop loss price set by the system is the trigger price, rather than the actual trading price; the actual transaction price that is triggered depends on the market conditions at the time, instead of the level of stop loss/profit that you set. Take a customers' order as an example: a customer goes short 0.50 lot of USOUSD, with stop loss being set at 118.550, after triggering stop loss, the order will be traded at 118.544; if a customer goes short for 2.00 lots of USDJPY, with the stop loss being set at 133.100, and after triggering stop loss, the order will be traded at 133.128. You are reminded that the K-line chart consists of the selling price (Bid), and long orders are traded according to the selling price (Bid), while short orders are traded according to the buying price (Ask); the customer's orders for short were closed according to the buying price (Ask). Once the stop loss is triggered, the position closing message will be sent to the liquidity provider after the order is traded at the price at the time; the stop/profit price you set is the trigger price, instead of the actual transaction price, which is dependent on the current market conditions; and the foreign exchange market is susceptible to various types of news and data releases, so the market is volatile; meanwhile, there are also many orders which were traded at the prices which were better than the stop loss level. Therefore, the platform did not maliciously provide slippage. Please be noted that CPT will not interfere with customer's transactions, and all quotations and transaction prices are subject to the liquidity providers.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

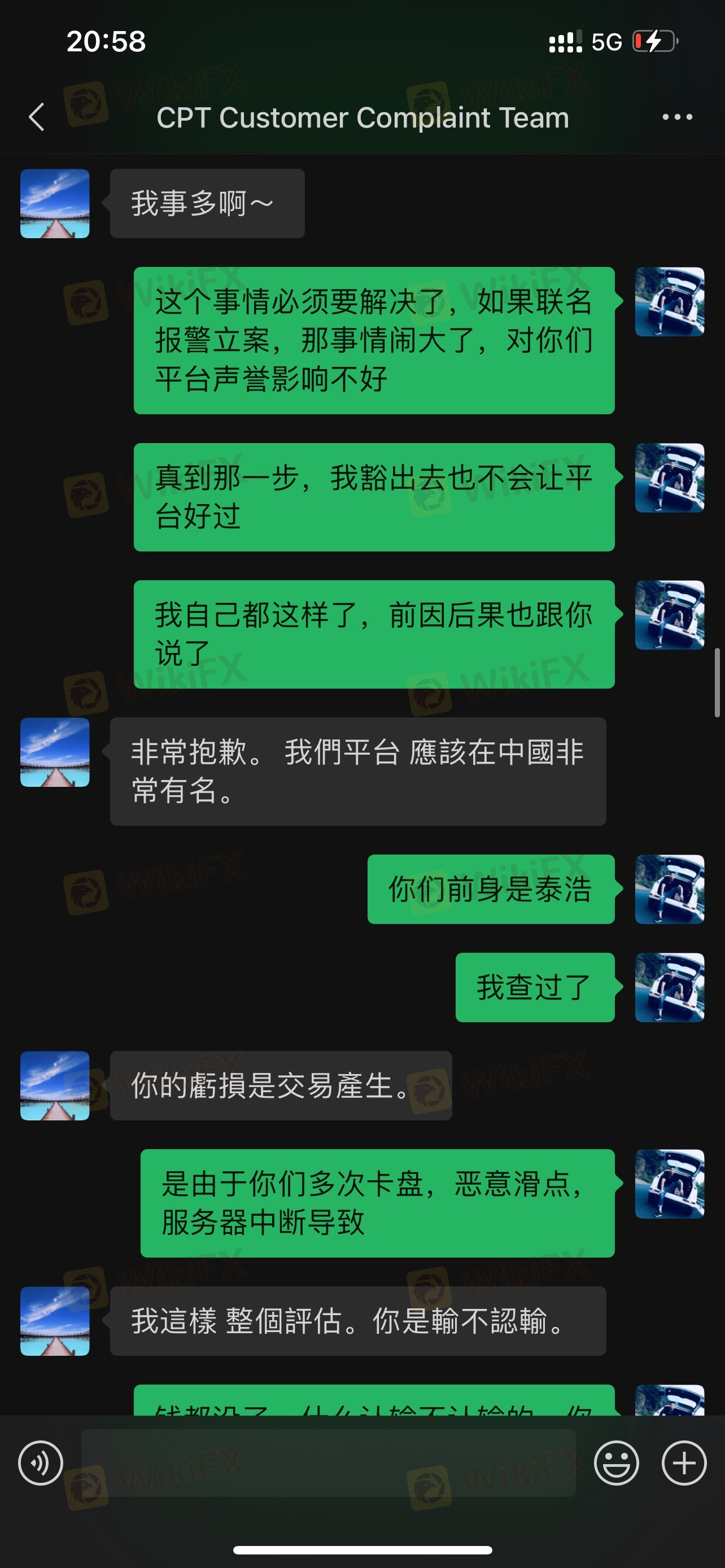

I would not have kept contacting you like this if I had not lost so much money. Just take a look at the account! If it weren't for your problems like trading delay, malicious slippage and server interruptions, would I have lost so much? I wouldn't have lost so much if your salesman had not induced me to deposit so much? Your platform is a terrible betting platform! If we can talk about it, then this matter will become very easy to dealt with. Try first, to make the mistake soundless serious, and then to reduce it to nothing at all.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

Your explanation doesn't make any sense. Since the stop loss is not triggered at the related level or it is triggered only beyond the stop loss, is it clear that you maliciously offer slippage. why do you close the quotation when I open a position? This is an excuse for your abnormal trading environment! Why do you close my trading backstage? Why can't I get through the customer service hotline 4001001103? Why don't you reply to me when I show my name via different phone? And block my phone number again when I make a call with the same number, why?Are you not feeling shameful? Or do you not want to pay for your actions? I told you that I wanted to consult with you in a proper way, but you just evaded responsibility! Today the police asked me to provide my trading account and the card number for deposit, but you shut down it! I have a simple request of having a sincere conversation with you! Although I reported the case to the police, now you still have a chance before a case is filed by the police!

CPT MarketsReply

Reply

In reference to the customer's concern about the failure to stop loss at the related point, we confirm that the stop loss price set by the system is the trigger price, rather than the actual trading price; the actual transaction price that is triggered depends on the market conditions at the time, instead of the level of stop loss/profit that you set. Take a customers' order as an example: a customer goes short 0.50 lot of USOUSD, with stop loss being set at 118.550, after triggering stop loss, the order will be traded at 118.544; if a customer goes short for 2.00 lots of USDJPY, with the stop loss being set at 133.100, and after triggering stop loss, the order will be traded at 133.128. You are reminded that the K-line chart consists of the selling price (Bid), and long orders are traded according to the selling price (Bid), while short orders are traded according to the buying price (Ask); the customer's orders for short were closed according to the buying price (Ask). Once the stop loss is triggered, the position closing message will be sent to the liquidity provider after the order is traded at the price at the time; the stop/profit price you set is the trigger price, instead of the actual transaction price, which is dependent on the current market conditions; and the foreign exchange market is susceptible to various types of news and data releases, so the market is volatile; meanwhile, there are also many orders which were traded at the prices which were better than the stop loss level. Therefore, the platform did not maliciously provide slippage. Please be noted that CPT will not interfere with customer's transactions, and all quotations and transaction prices are subject to the liquidity providers.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

The platform shut down my trading backstage and canceled my points. At the same time, I can not reach out to the customer service, who refused to reply to me. Is it reasonable for such a bad platform to show as a regulated broker at WikiFX?

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

CPT platform has shut down my account, and I am blocked to get through the customer service hotline 4001001103. Is it reasonable and legal?

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

I just submit some orders, and has not organized other accounts.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

I knew that WikiFX did not expose the case, and the customer service said that you did so in a bid to protect my privacy. I guess that it is more likely to protect the CPT platform rather than safeguard my privacy. Since the customer service of WikiFX expressed that the case would be exposed after a mediation, I strongly request a disclosure.

WikiFX Mediation CenterReply

Hong Kong

Hong KongReply

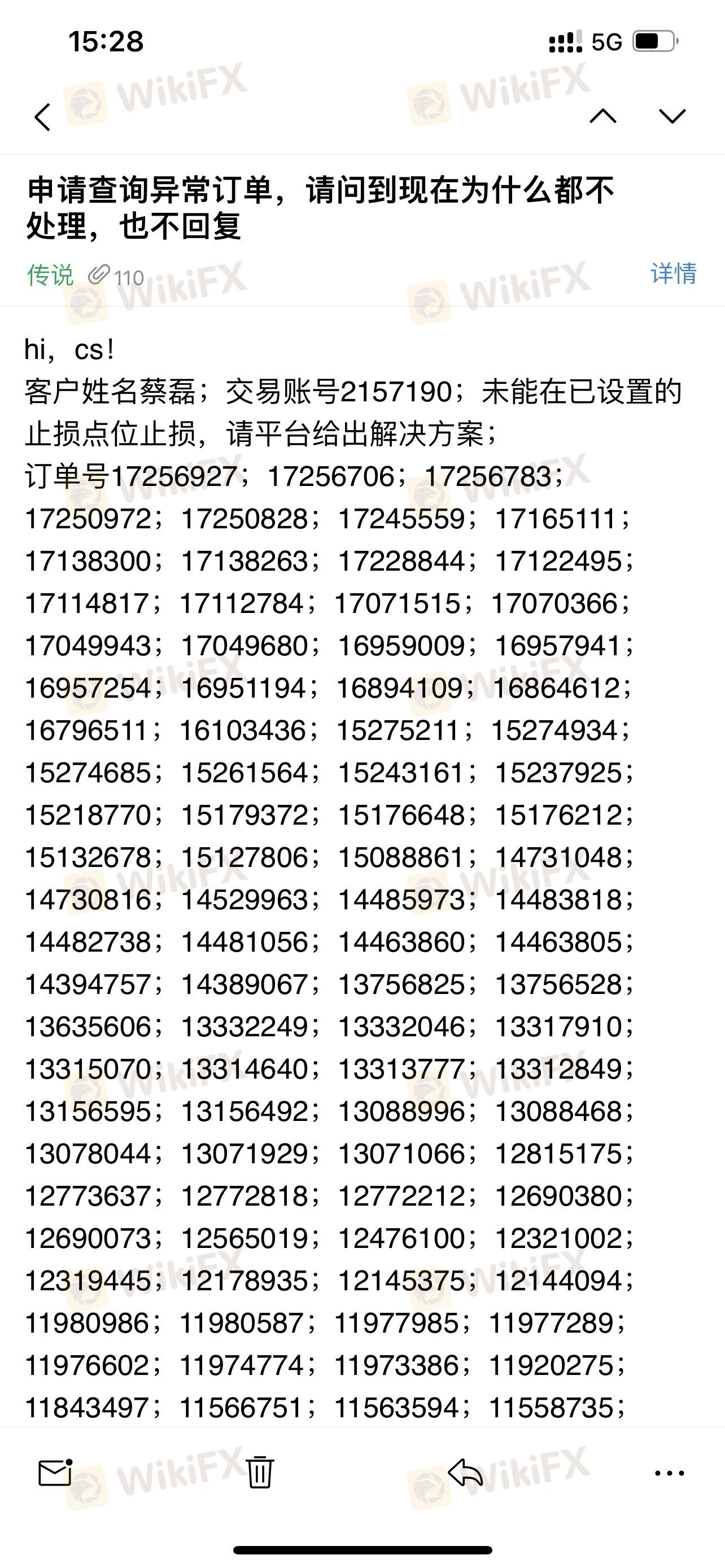

Can you please submit the detailed information including the order that got the problems like trading delay, slippage, and others?

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

WikiFX helps me communicate with the platform, and I believe that WikiFX is fair and just and will take into consideration the customers' rights and interests.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

Account name is Cai Lei and CTP account is 2157190

WikiFX Mediation CenterReply

Hong Kong

Hong KongReply

Dear customer, please submit the correct name for opening account. Thank you for your cooperation.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

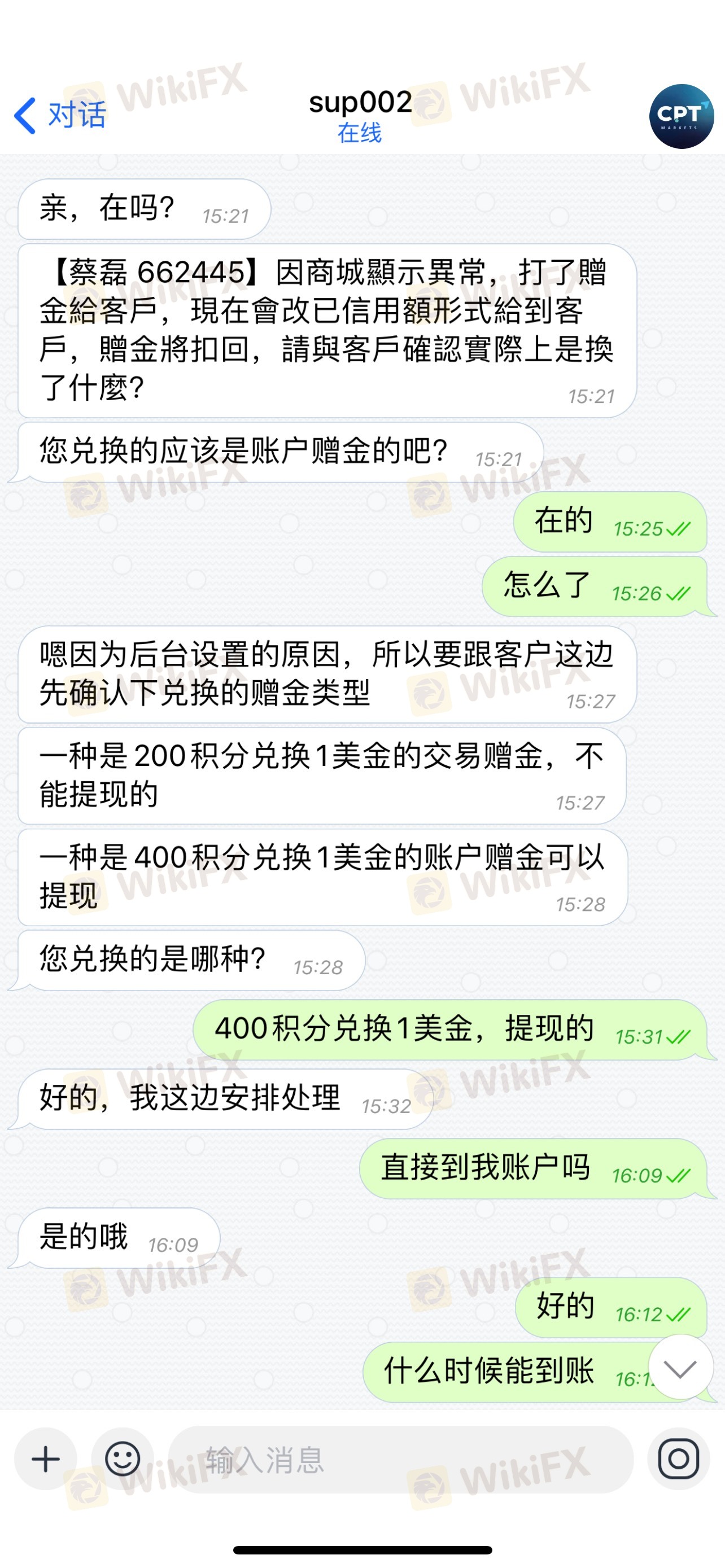

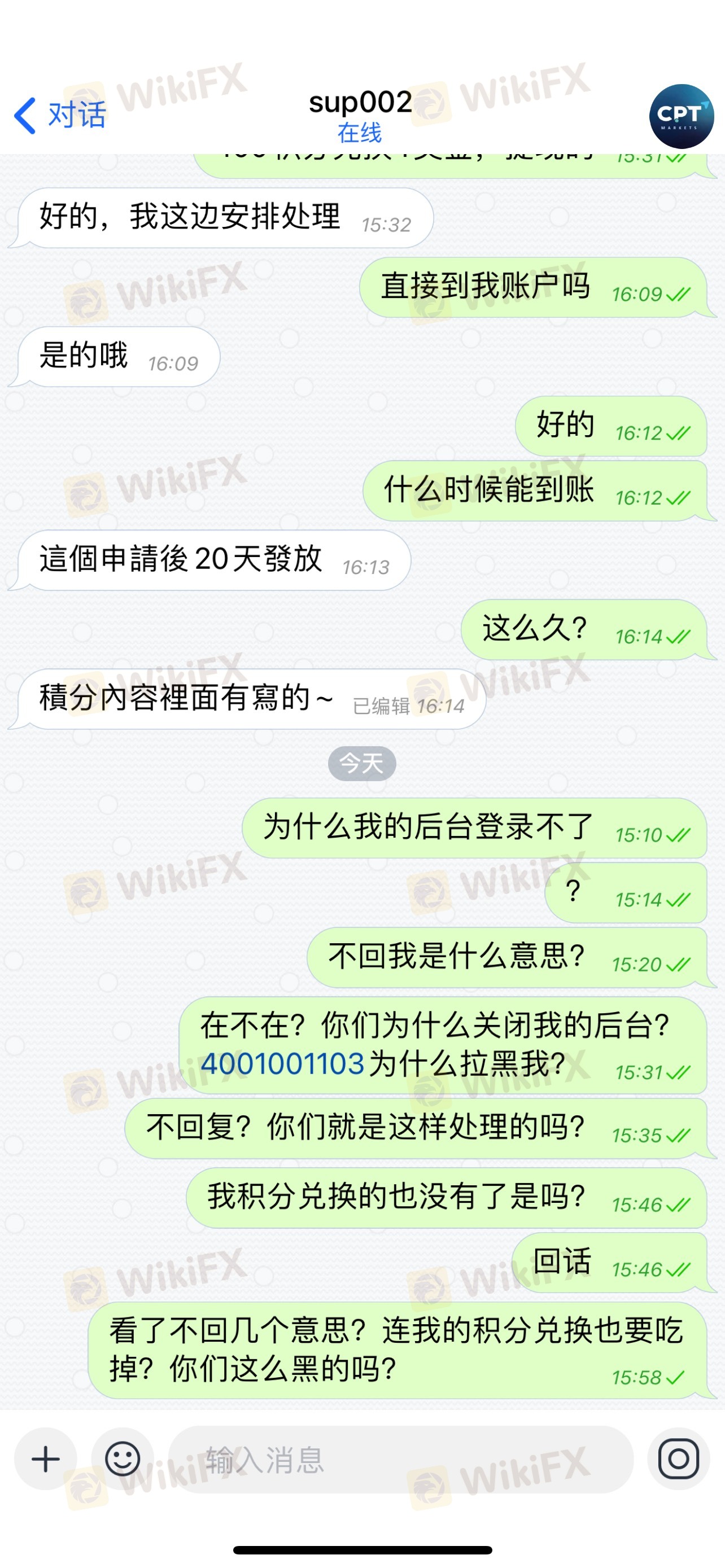

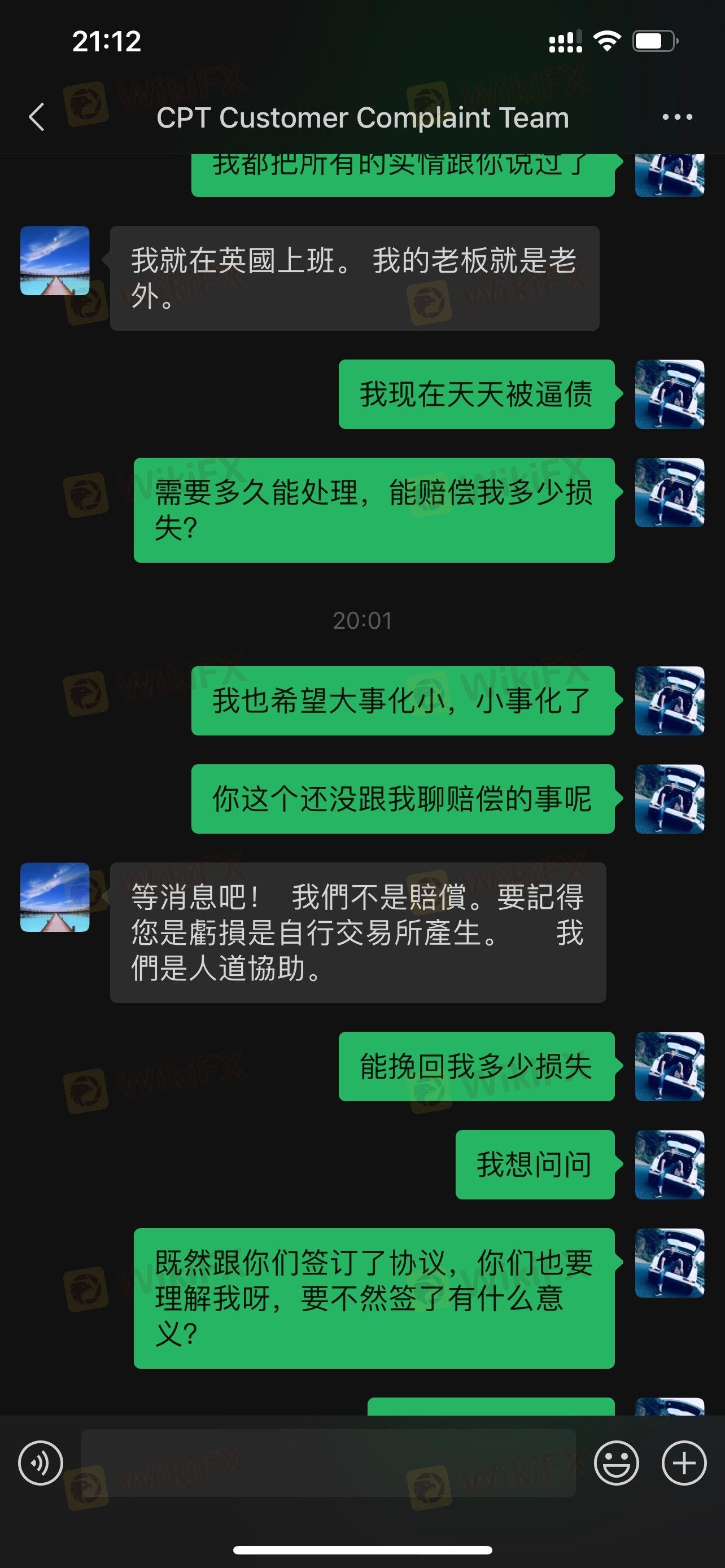

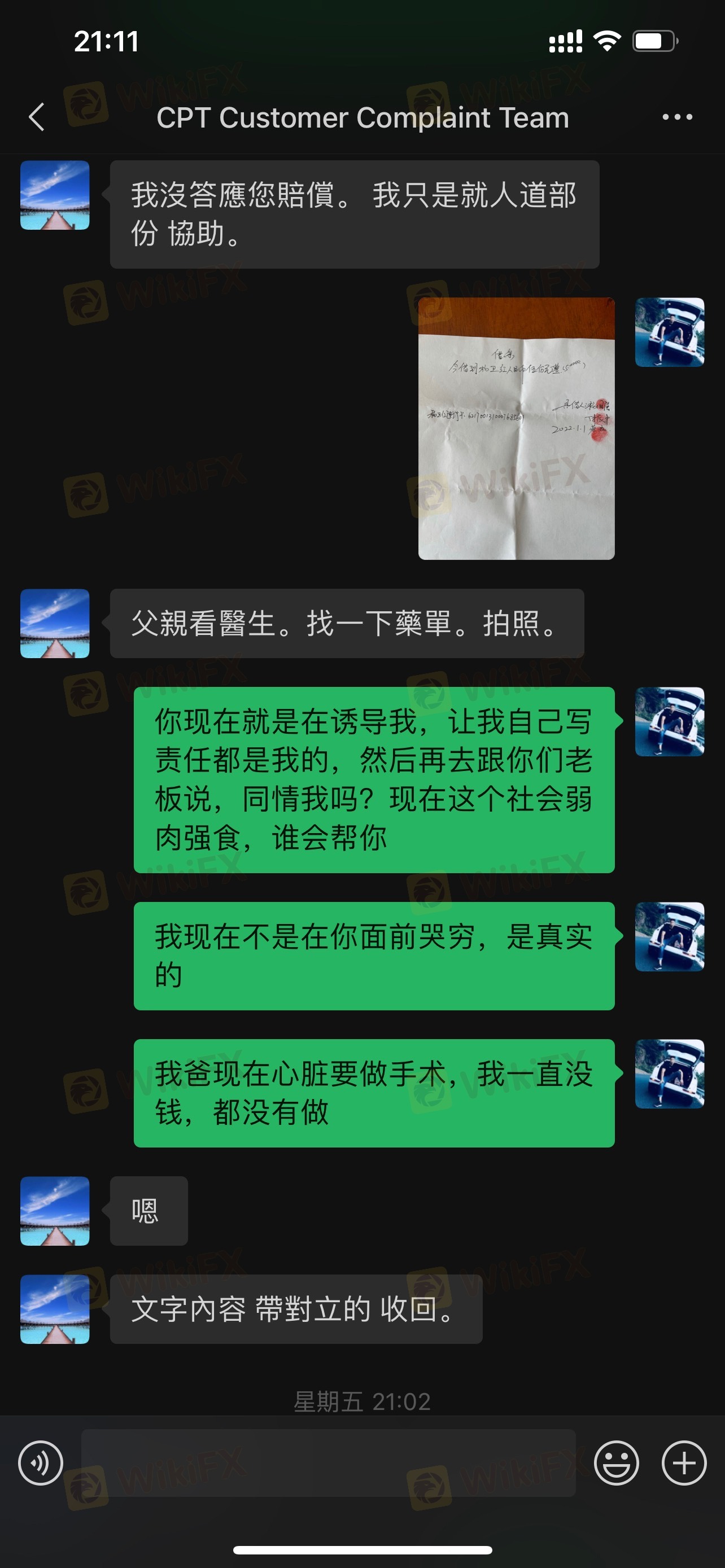

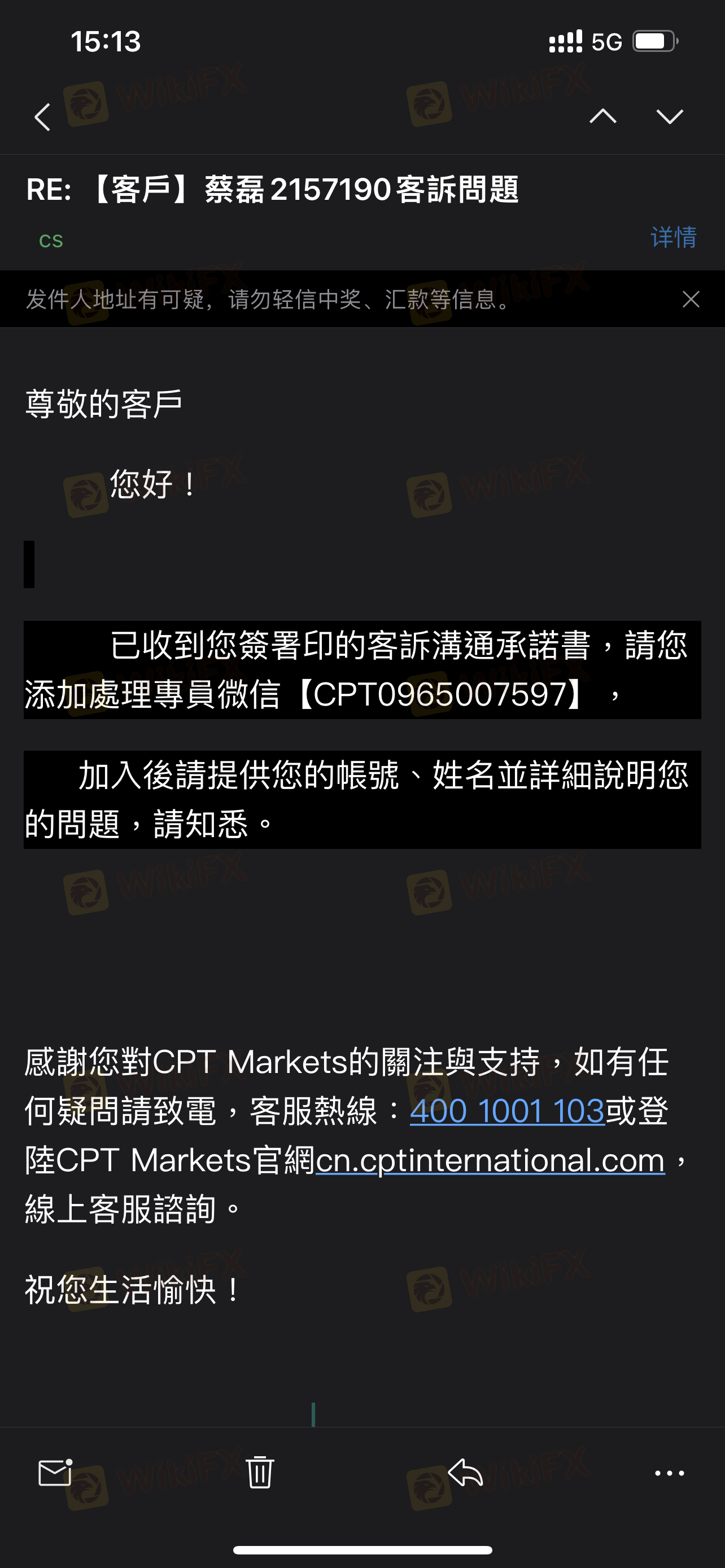

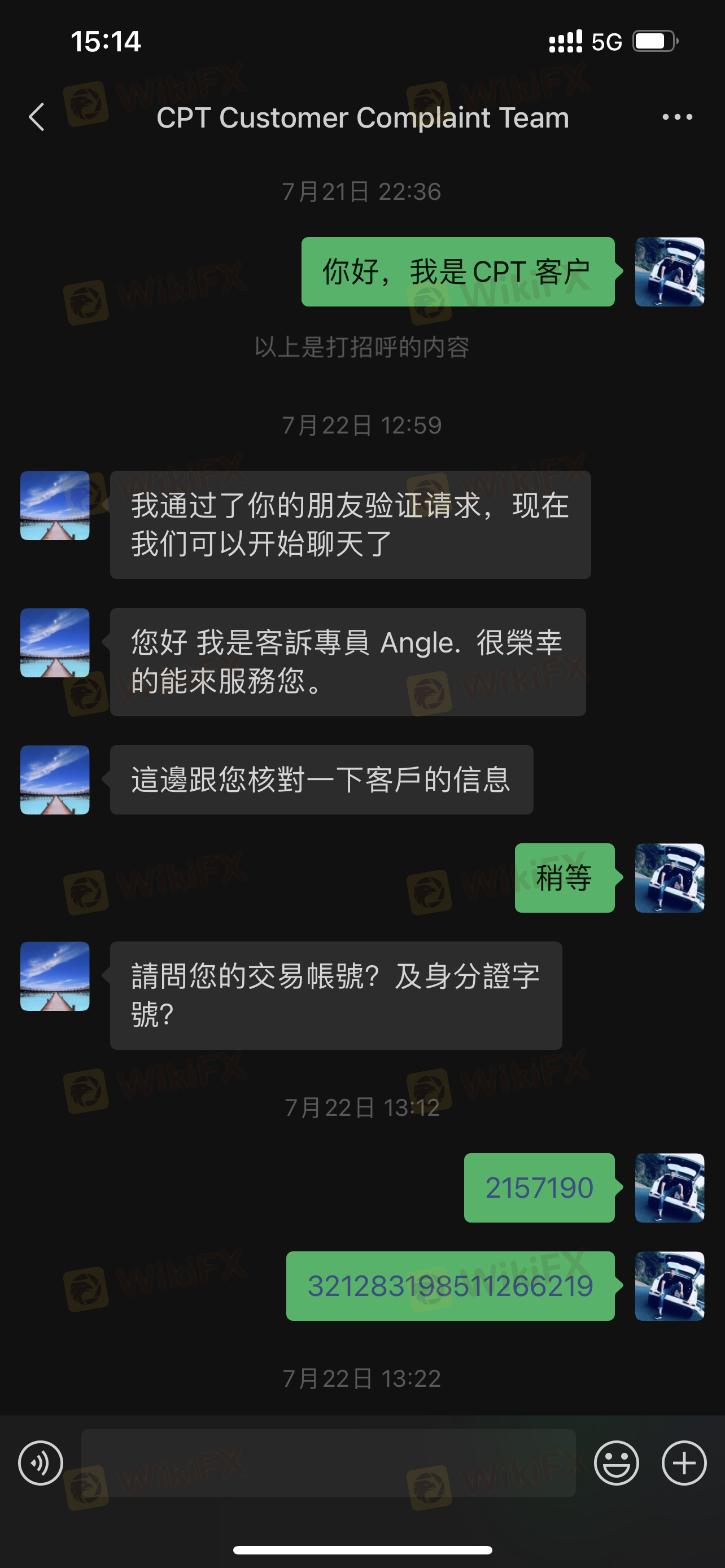

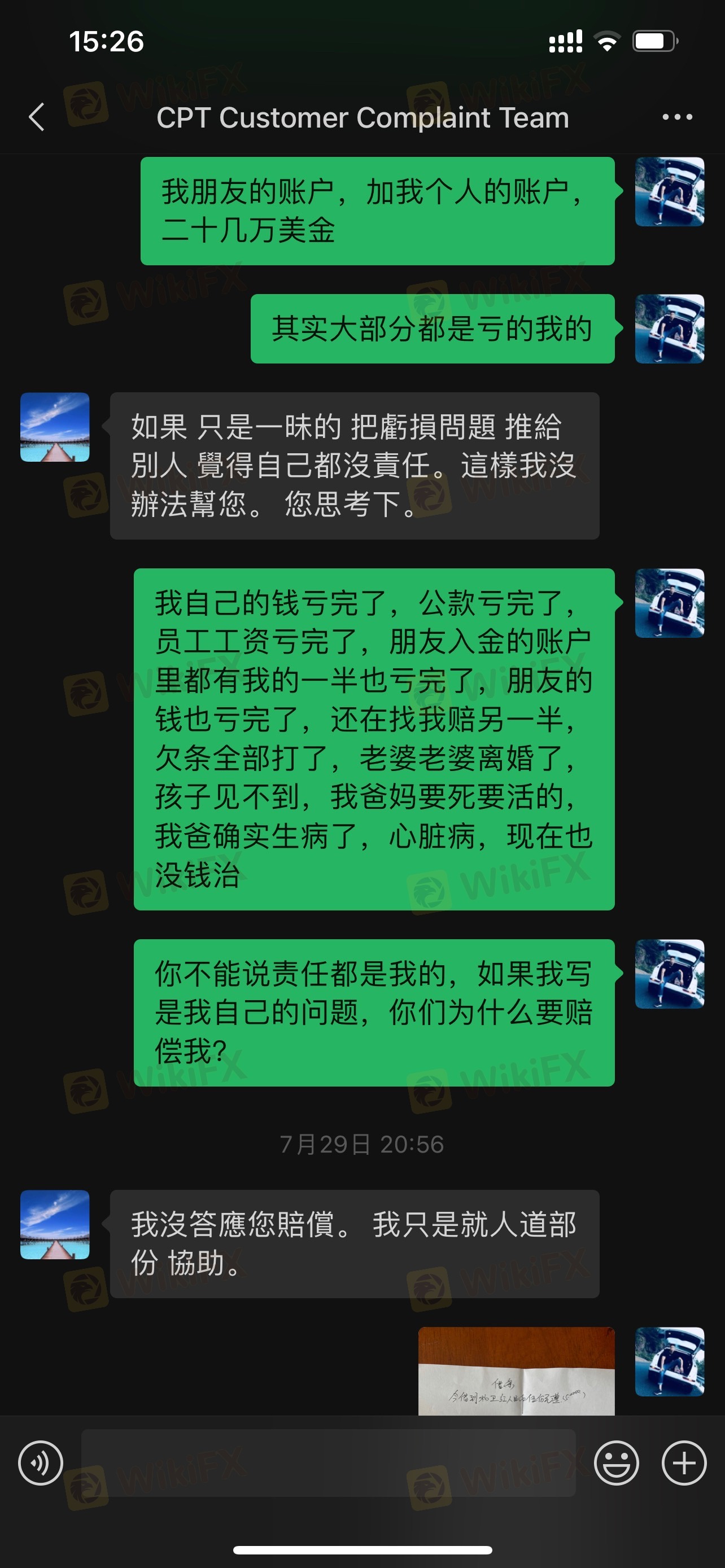

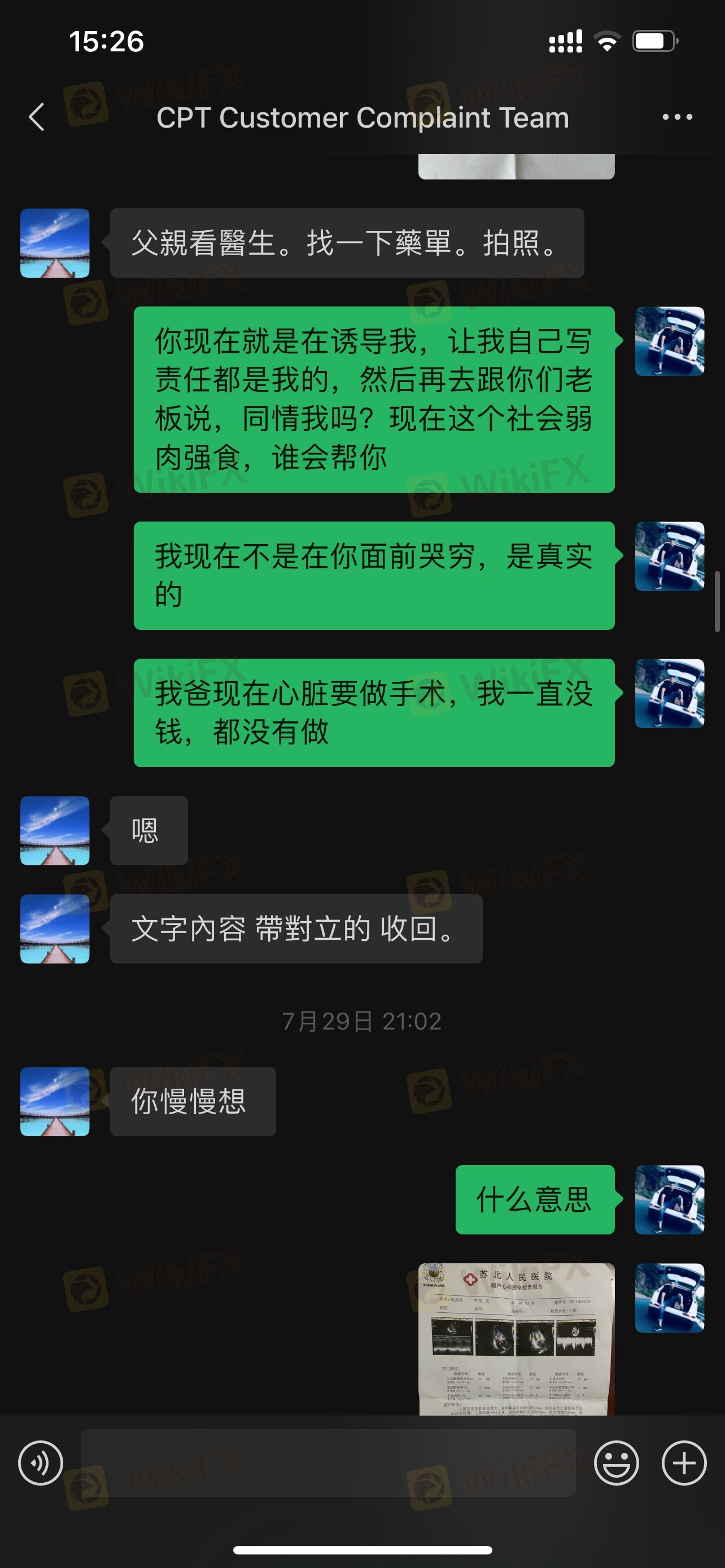

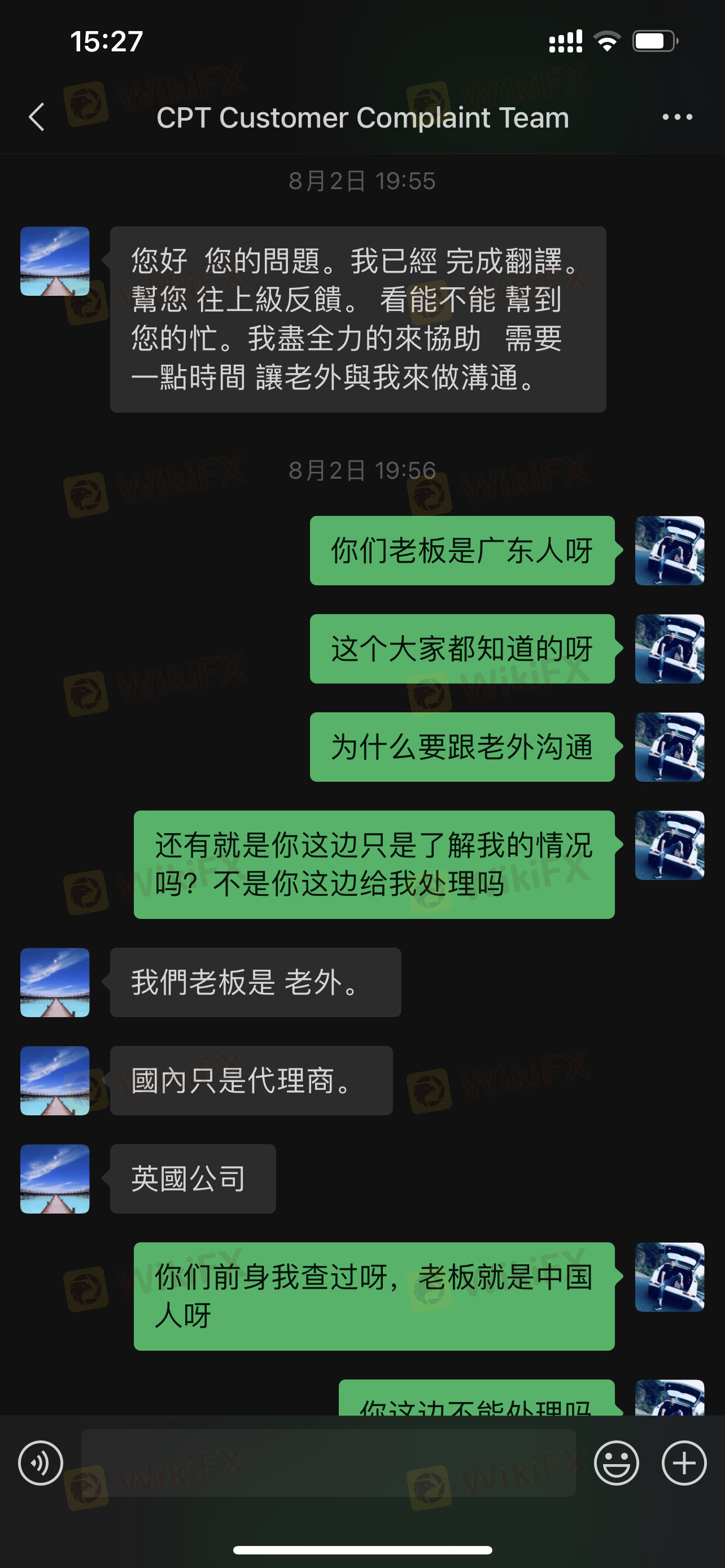

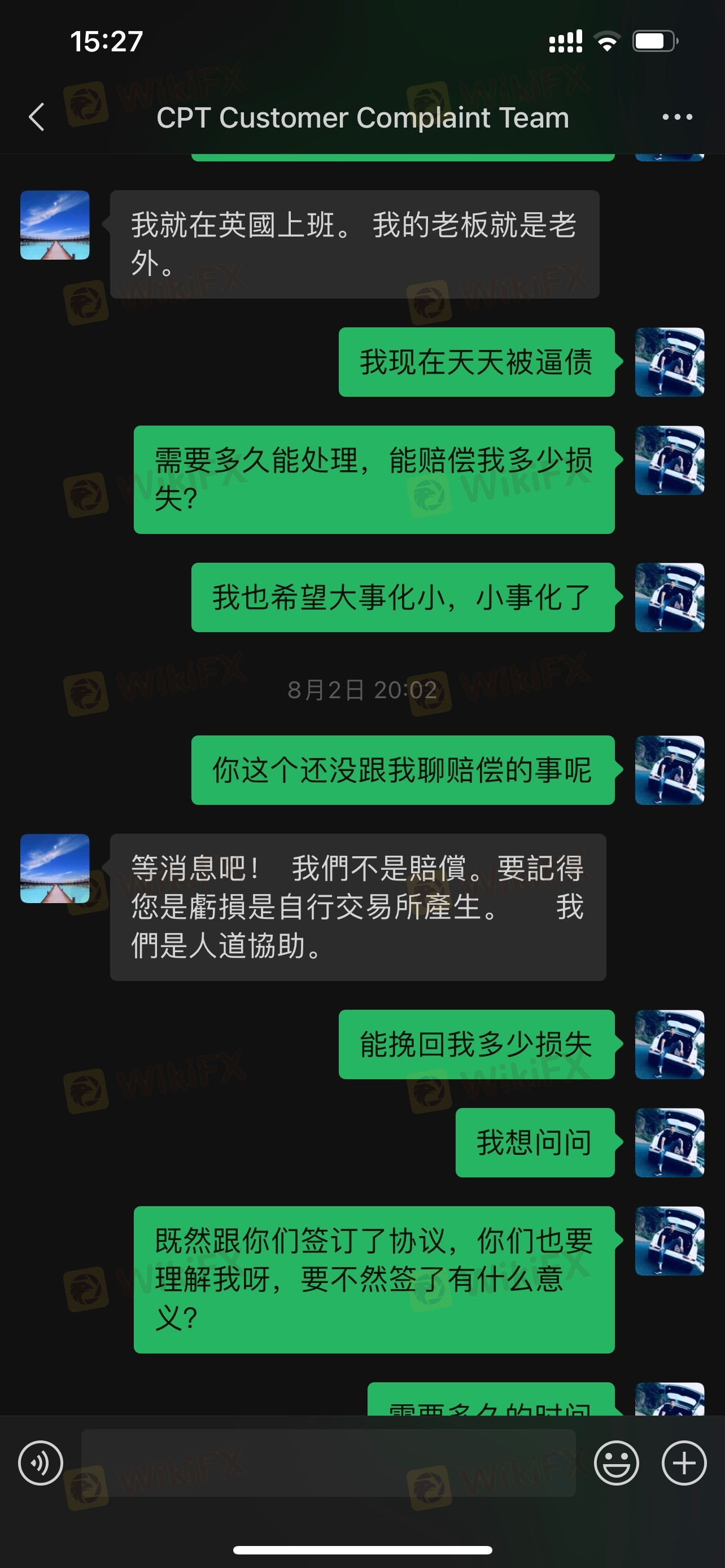

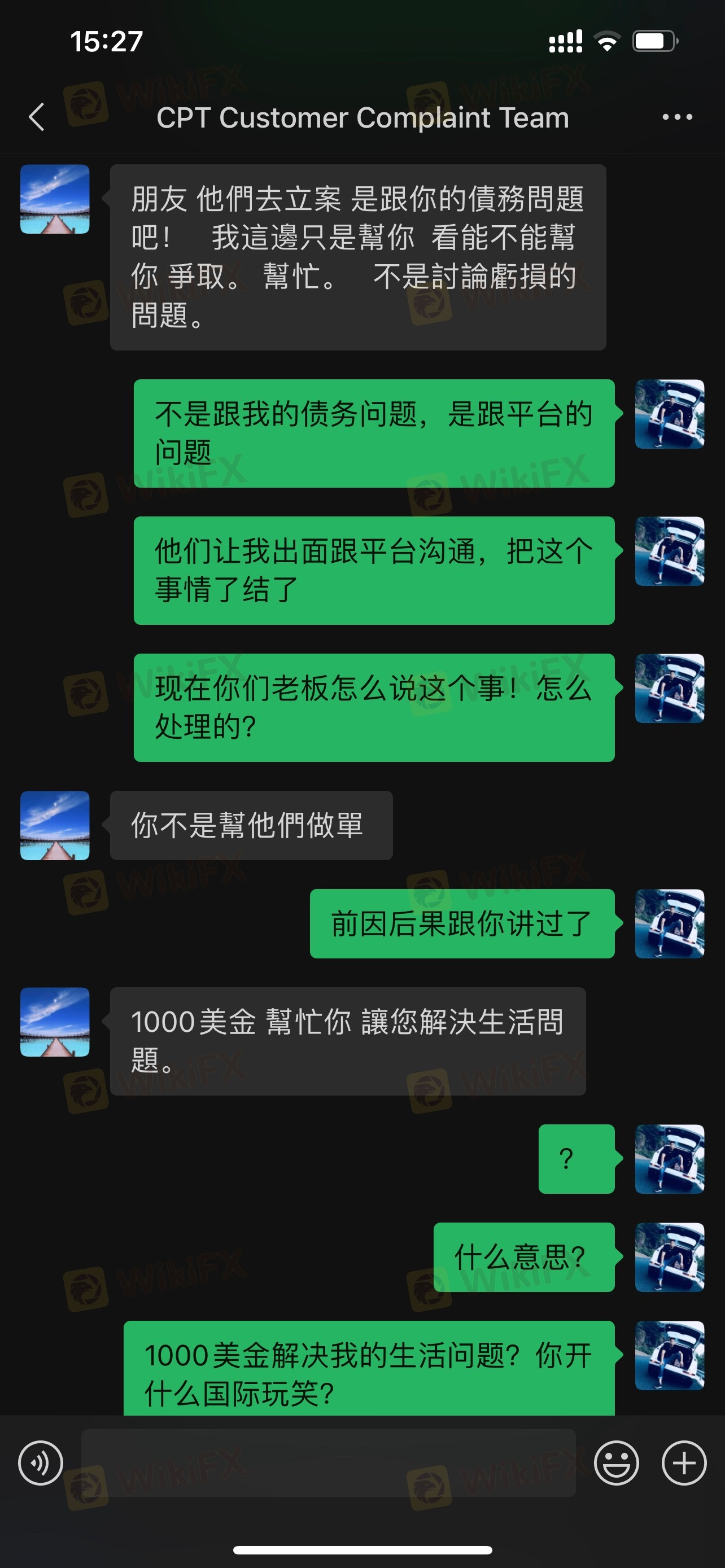

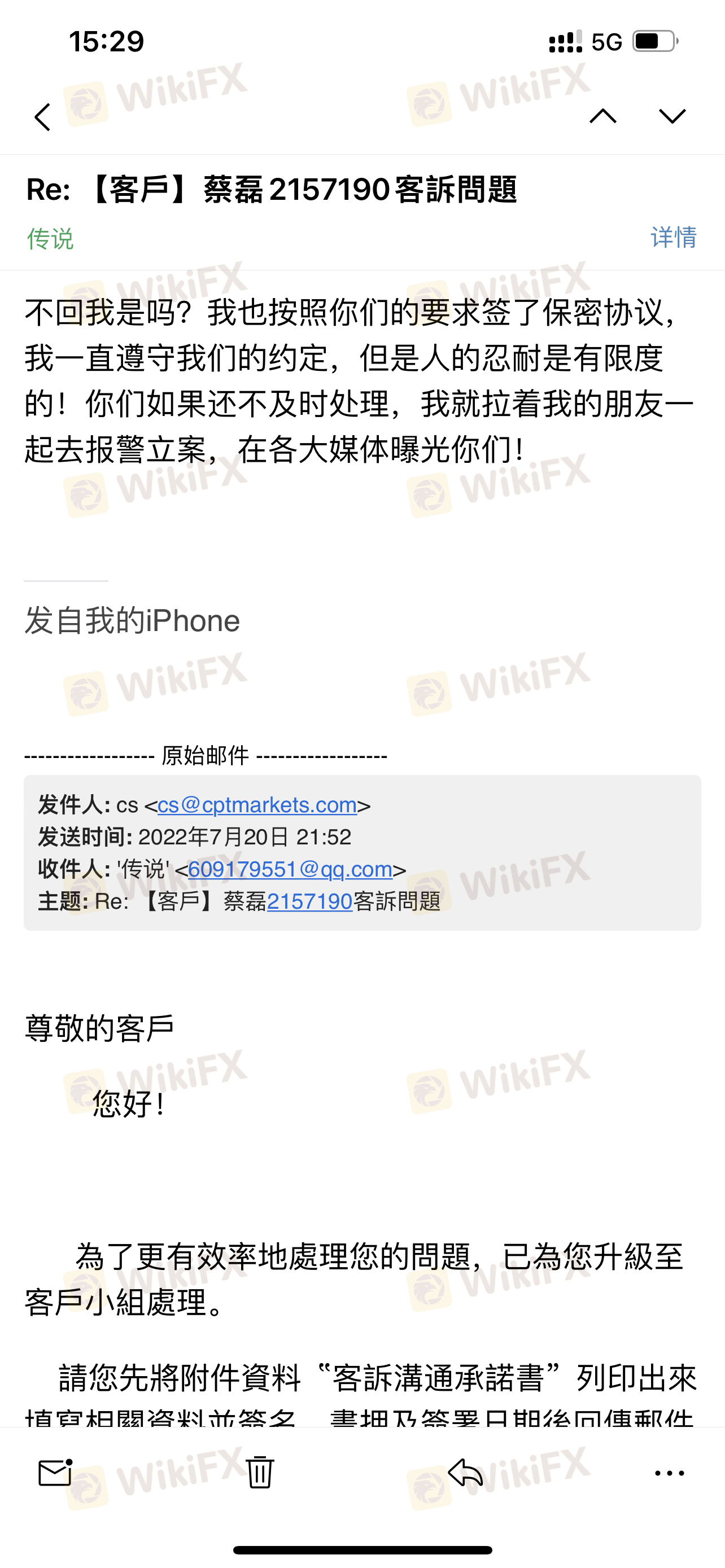

I upload the images of the non-disclosure agreement provided by CPT Markets and the conversation with customer complaint specialist.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

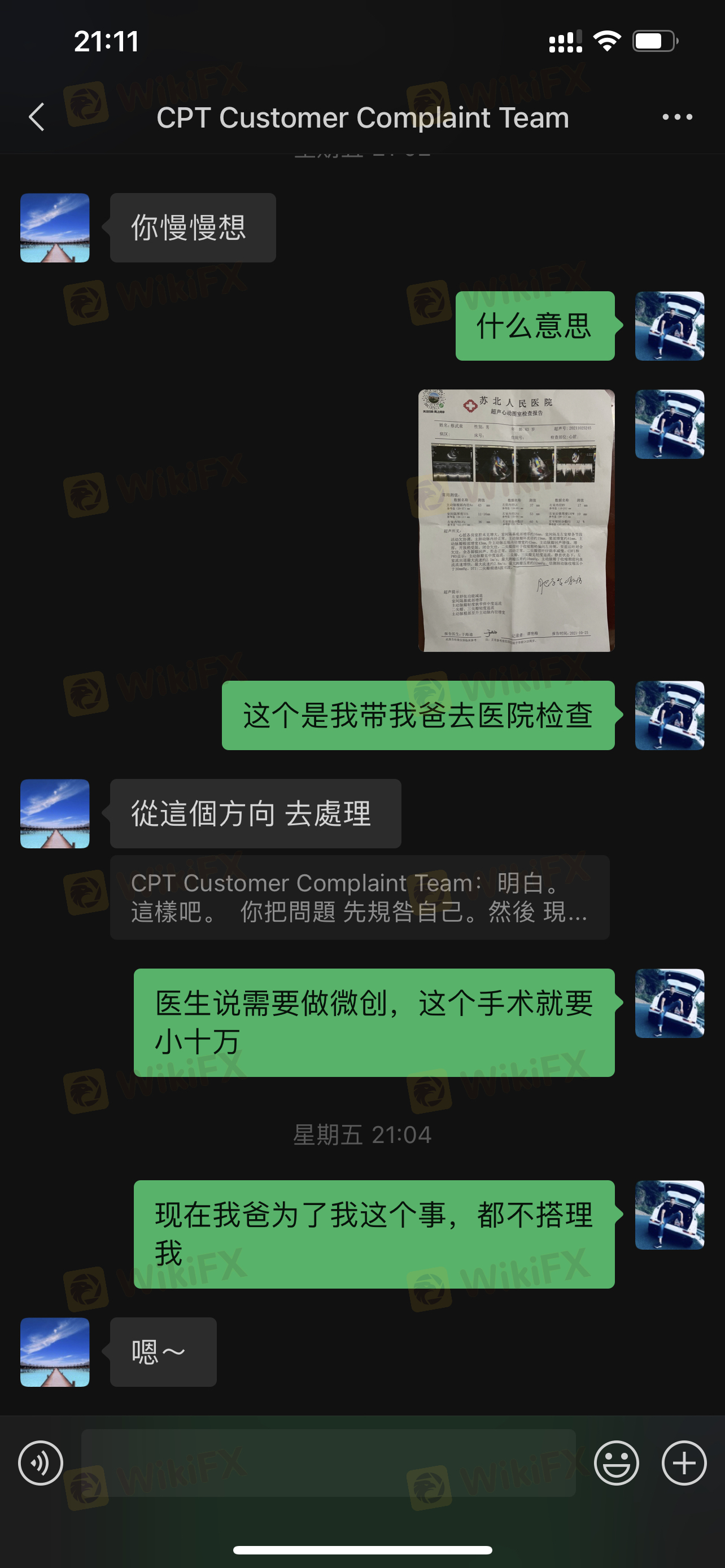

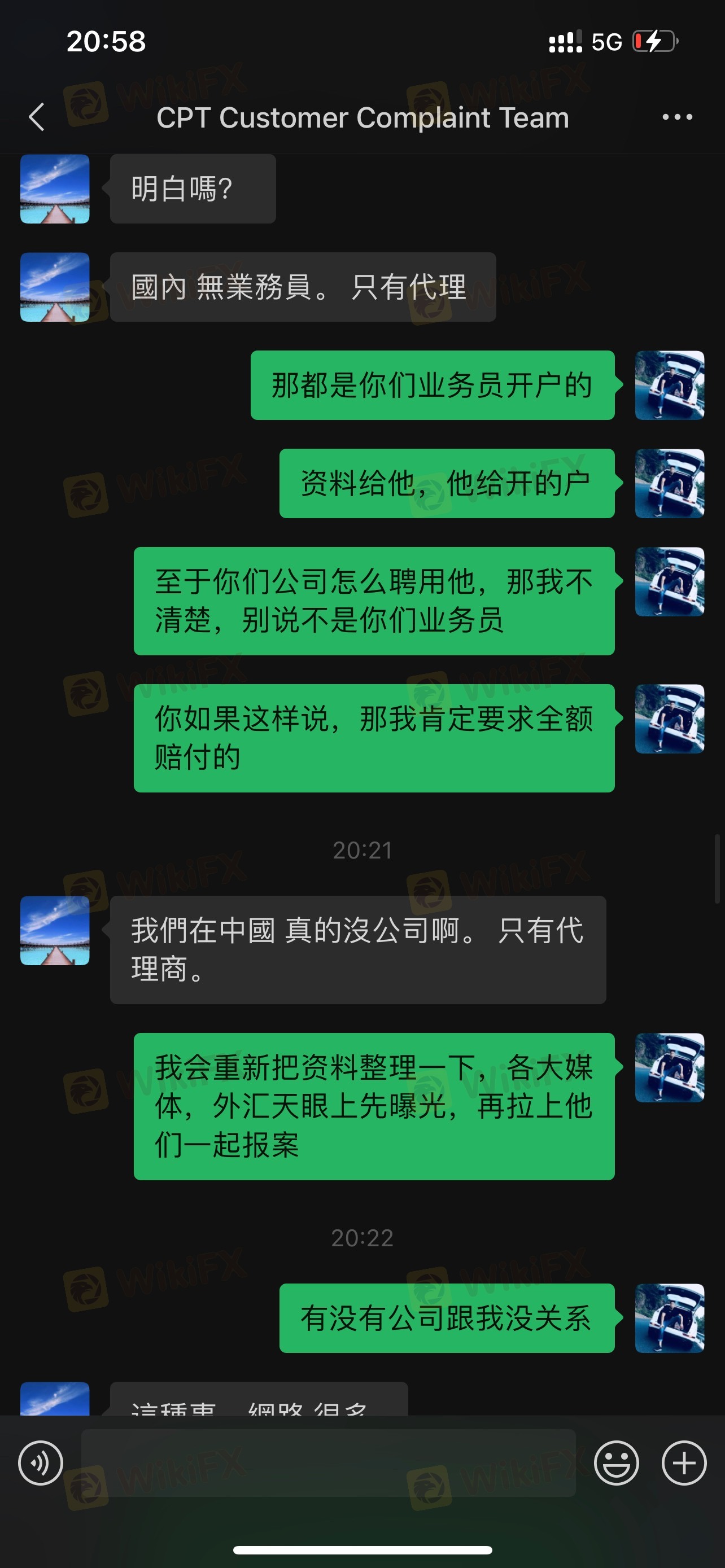

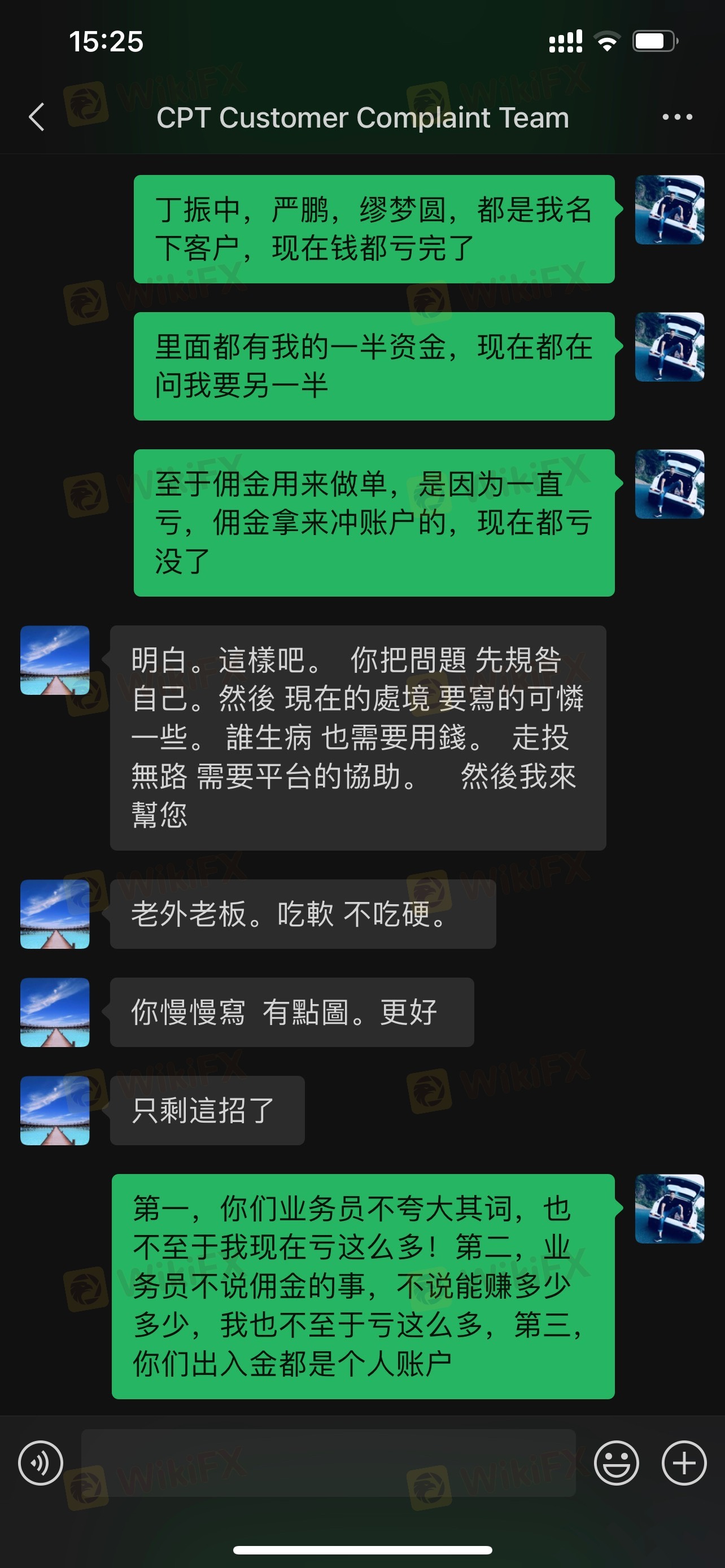

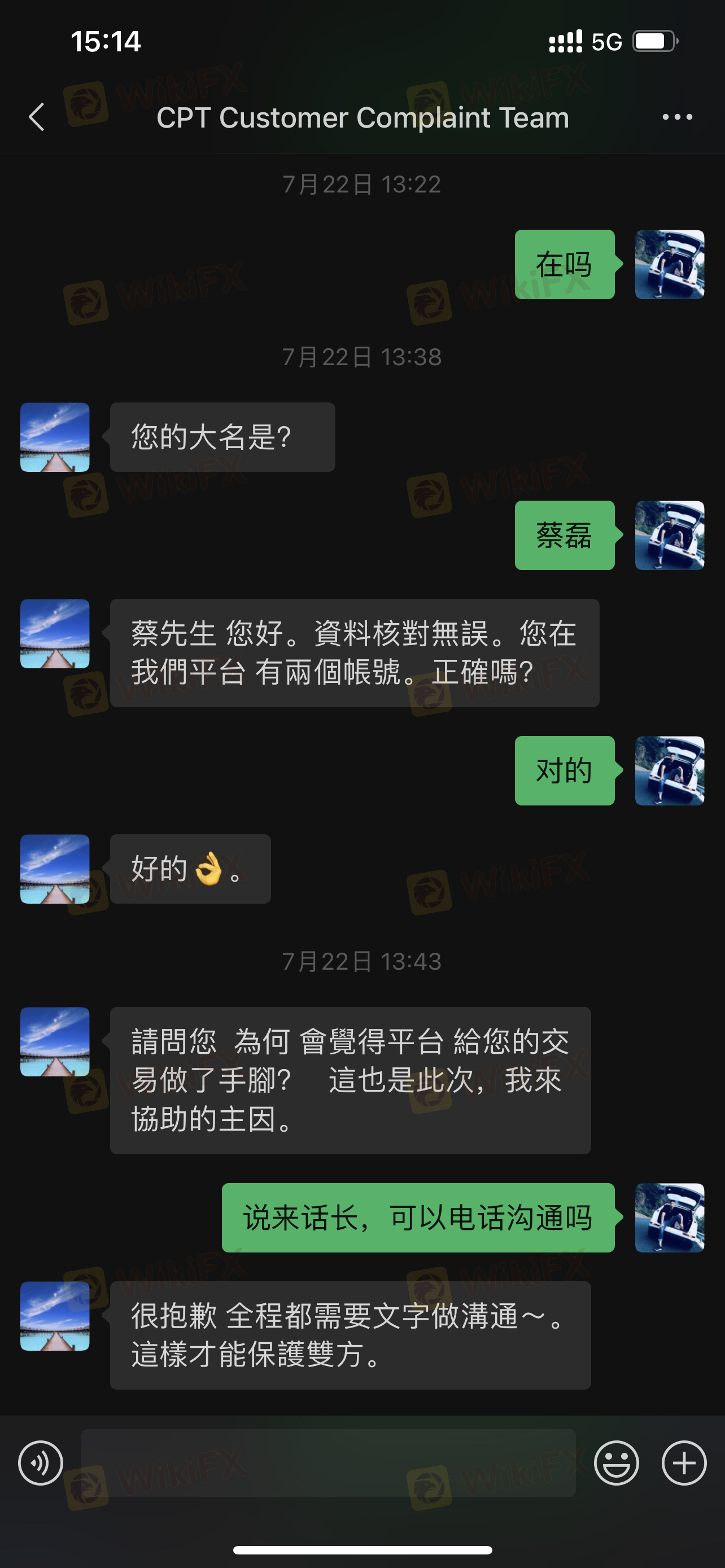

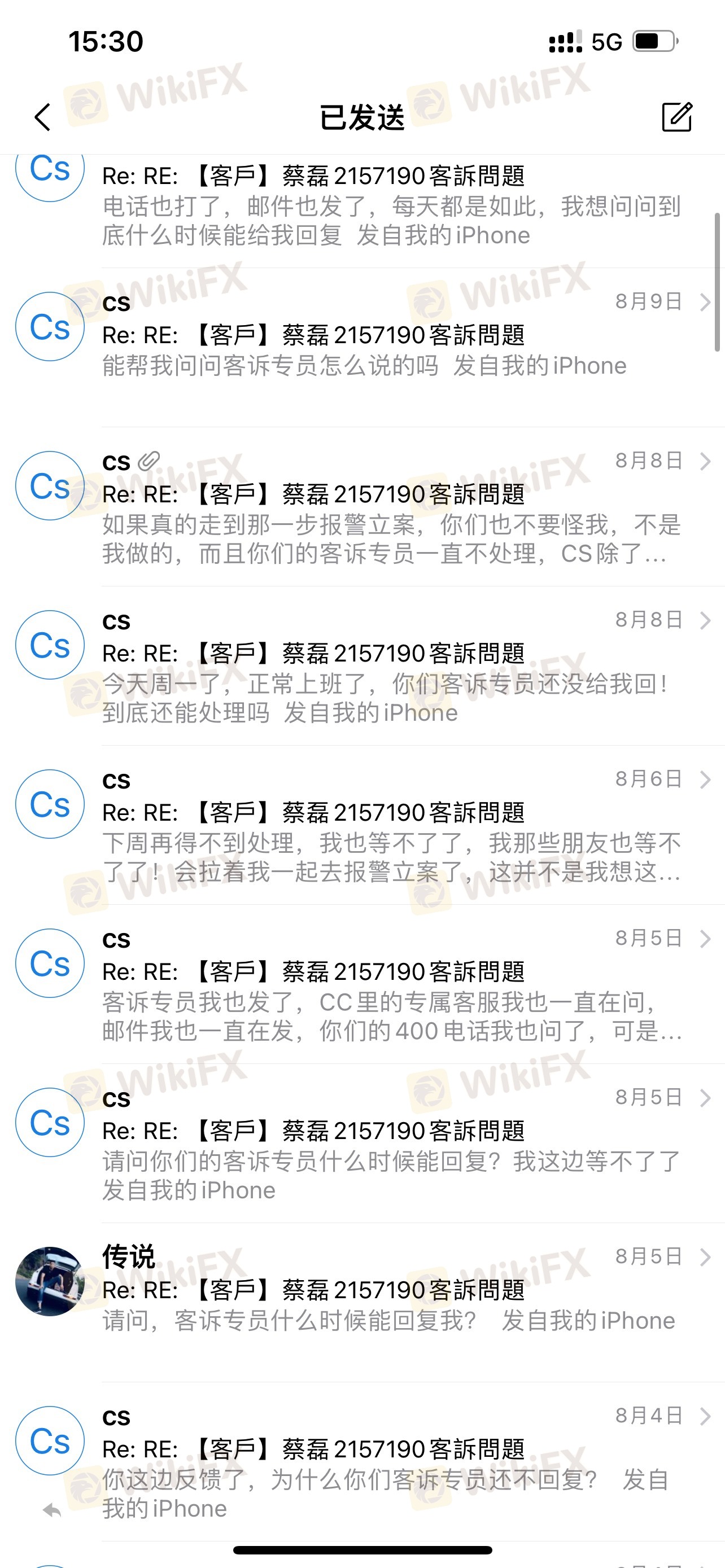

I upload the screenshot of chat with the customer service specialist of CPT Markets.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

I upload bank statement of deposit at CPT Markets.

.51538Supplemental Materials

Hong Kong

Hong KongSupplemental Materials

I upload the withdrawal images and the email sent by CTP Markets.

WikiFX Overseas Customer ServiceContact Broker

Hong Kong

Hong KongContact Broker

WikiFX Mediation CenterVerified

Hong Kong

Hong KongVerified

Statement:

2. Unauthorized reprints of cases in this platform are prohibited. Offenders will be pursued their legal obligations