Zinvest Spreads, leverage, minimum deposit Revealed

Abstract:ZINVEST FINANCIAL HOLDINGS LIMITED is a US SEC-approved settlement securities company based in China. It is a member of US FINRA/DTCC and a Hong Kong SFC licensed broker. Zinvest has been exploring the asset management business centered on technology and data since 2009.

| Zinvest | Basic Information |

| Company Name | Zinvest |

| Founded | 2015 |

| Headquarters | Hong Kong |

| Regulations | Suspected clone of SFC license BJJ179; not verifiably regulated |

| Products and Services | Trading in Hong Kong stocks, U.S. stocks, ETFs, warrants, callable bull/bear contracts, A-share market stocks |

| Leverage | Up to 10x for new stock subscriptions |

| Fees | $0.3 per U.S. stock option contract; minimal fees for Hong Kong stock IPO subscriptions |

| Trading Platforms | Zinvest Platform accessible across multiple devices; features online account opening, millisecond-order placement |

| Customer Support | Phone: 400-031-0319; Email: cszg@zvsthk.com; Online Chat; WeChat; Operating hours: Trading days 9:00 AM to 6:30 PM |

| Education Resources | Financial insights and market analyses through the official blog |

Overview of Zinvest

Zinvest emerged in the fintech scene in 2015, aiming to revolutionize the trading experience for investors interested in Hong Kong, U.S., and A-share markets. By offering features like zero commission trading, leverage up to 10x, and a secure trading platform across multiple devices, Zinvest caters to both novice and experienced traders seeking efficient and flexible trading solutions. However, its claim of being regulated by the SFC with license number BJJ179 is under question, suggesting potential risks for investors regarding the platform's legality and the safety of their investments.

Is Zinvest Legit?

Zinvest claims to be regulated under the China Hong Kong Securities and Futures Commission (SFC) with the license number BJJ179. However, this claim is suspected to be a clone of a legitimate license, indicating that Zinvest might not be actually regulated by the SFC. Investors should exercise caution and be aware of the potential risks associated with trading on platforms that may not be legitimately regulated.

Pros and Cons

Zinvest offers an attractive platform for traders interested in Hong Kong, U.S., and A-share markets, emphasizing zero commission trading and leveraging options up to 10x for stock subscriptions. Its user-friendly interface and rapid account opening process are designed to meet the demands of both novice and seasoned investors, promoting an efficient trading experience supported by robust security measures. However, the platform's appeal is significantly dampened by concerns over its regulatory status, with allegations of its license being a clone casting doubt on its legitimacy and the safety of client investments. This situation places a cloud over the otherwise promising features of Zinvest, making it a platform that potential investors should approach with caution. The lack of verified regulatory oversight raises serious questions about investor protection, dispute resolution, and the security of funds, which are critical considerations in the volatile world of online trading.

| Pros | Cons |

|

|

|

|

|

Products and Services

Hong Kong Market: Trading in Hong Kong stocks, ETFs, warrants, and callable bull/bear contracts.

U.S. Market: Trading in U.S. stocks and ETFs.

A-share Market: Trading in high-quality stock targets accessible through Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect.

How to Open an Account

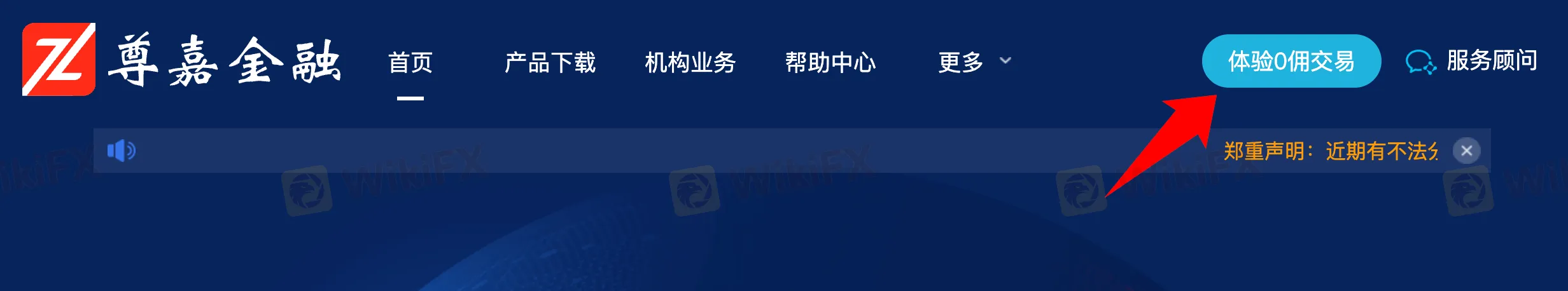

1. Visit the Zinvest website. Look for the “Experience zero commission trading” button on the homepage and click on it.

2. Opening an account on Zinvest is a quick and straightforward process:

User Registration: Users can either scan a QR code or download the Zinvest Financial App to sign up.

3. Rapid Account Opening: It takes just 2 minutes to fill out the account information for instant account opening success.

4. Zero Commission Trading: Once the account is opened, users can immediately start trading Hong Kong, U.S., and A-share stocks with zero commission.

Leverage

Offers up to 10x leverage for new stock subscriptions, with zero handling fees for cash subscriptions and low-interest rates for financed subscriptions, as low as 2%.

Fees

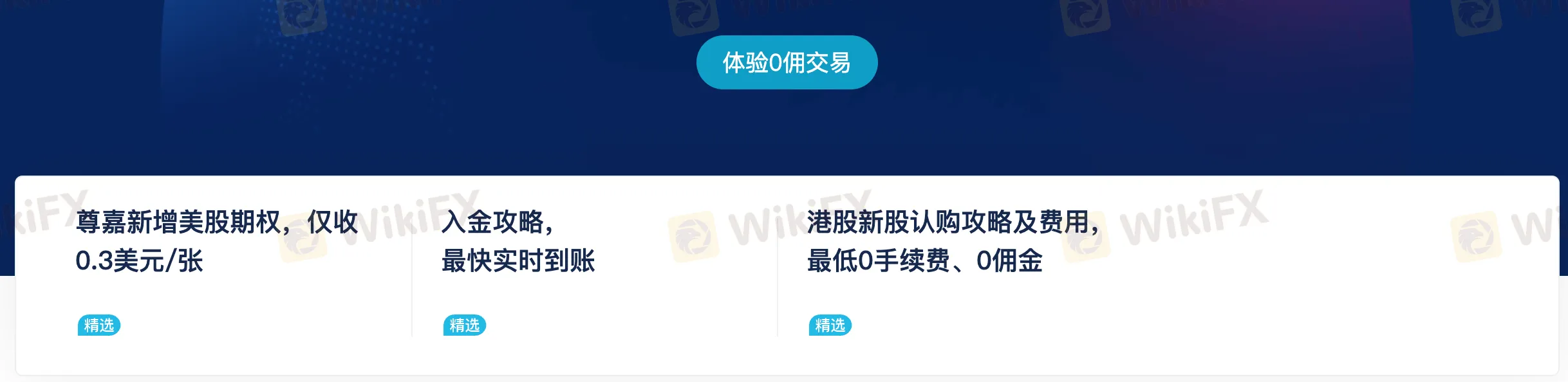

U.S. Stock Options: Zinvest has introduced options trading for U.S. stocks with a low fee of only $0.3 per contract.

Hong Kong Stock IPO Subscriptions: The platform provides a guide for subscribing to new Hong Kong stock IPOs, offering transactions with minimal fees, including zero handling fees and zero commission.

Trading Platforms

Zinvest offers a Zinvest Platform that is accessible across multiple devices to meet various user needs. It features online account opening, millisecond-order placement for fast trading, and bank-level encryption to ensure robust security.

Customer Support

Operating Hours: Available on trading days from 9:00 AM to 6:30 PM.

Phone Support: Users can reach out via 400-031-0319 for assistance.

Email Support: Queries can be sent to cszg@zvsthk.com for support.

Online Chat: Available for immediate assistance.

WeChat: Offers support through the popular messaging platform for convenience.

Educational Resources

Zinvest's educational resources encompass a diverse range of financial insights and market analyses, as exemplified by their official blog.

Conclusion

Zinvest stands out for its ambitious offerings in the trading market, providing access to key global stock markets with attractive conditions such as zero commission and high leverage options. The platform's user-friendly interface, coupled with its diverse educational content and responsive customer support, positions it as a viable choice for traders aiming to diversify their portfolio across Hong Kong, U.S., and A-share markets. However, the shadow of regulatory uncertainty looms large, marking a significant caveat for potential users. Investors are urged to proceed with caution, keeping in mind the balance between Zinvest's enticing features and the critical need for verified regulatory oversight.

FAQs

Q: Is there a regulatory body overseeing Zinvest's operations?

A: Zinvest claims regulation under the SFC with a specific license number. However, this claim is under scrutiny for authenticity, suggesting that investors should exercise due diligence when considering Zinvest for their trading needs.

Q: What trading options does Zinvest offer?

A: Zinvest provides trading options in Hong Kong stocks, U.S. stocks, ETFs, warrants, callable bull/bear contracts, and A-share market stocks through cross-border stock connect programs.

Q: What are the trading fees on Zinvest?

A: Zinvest charges a low fee of $0.3 per contract for U.S. stock options and offers minimal to zero fees for Hong Kong stock IPO subscriptions.

Q: Can I trade with leverage on Zinvest?

A: Yes, Zinvest offers up to 10x leverage for new stock subscriptions, with favorable conditions for both cash subscriptions and financed subscriptions.

Q: What support options does Zinvest provide?

A: Zinvest offers comprehensive customer support through phone, email, online chat, and WeChat, ensuring traders can receive assistance during trading days from 9:00 AM to 6:30 PM.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

Rate Calc