OnePro 12/24Market report

Abstract:EURUSD/USDJPY/XAUUSD/BITUSD

【EURUSD】

The UK, Euro Area and the US have re-heated up the new crown epidemic recently as we approach the Christmas holiday.

Many airports have been crowded due to control measures and that also made the epidemic more difficult to control.

Oxford Economics announced two weeks before December 5 that the eurozone recovery tracking index continued to decline from 83.4 points to 80.2 points which is a new low since May.

It said that the outlook in the euro area is still affected by the epidemic.

EURUSD short-term technical analysis above the buying strength is still quite strong.

With Alligator and KD both at golden crosses, there may be way to break through the largest consolidation range in the near future.

The recent euro movements is also due to low trading volume and has been oscillating between 1.12200 to 1.13800.

It is expected that the trading volume during the holiday period is low. This is worth the attention of investors.

EURUSD-H4

Resistance 1: 1.14000/ Resistance 2: 1.14800/ Resistance 3: 1.15200

Support 1: 1.12200/ Support 2: 1.11800

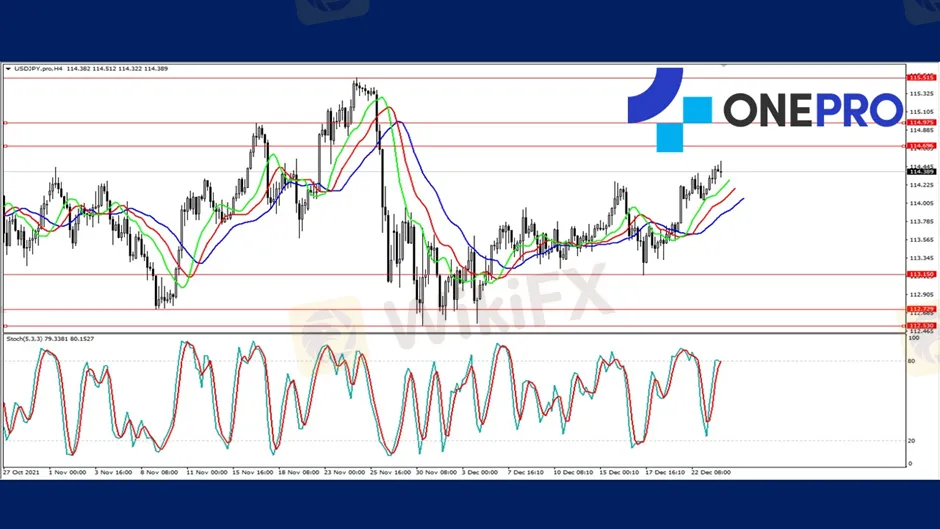

【USDJPY】

Due to the relationship between the epidemic and overall tourism suspension for a very long time, the price of the Japanese currency continued to depreciate. Many investors who were once Japanese tourism fans are thinking about whether they should take advantage of this time to accumulate the Japanese currency in their hands, and prepare to travel to Japan after the end of the epidemic.

The Japanese currency can be seen in the technical line type of USDJPY where Alligator is still at a golden cross and KD also showing a high-end figure. This shows that the buyer strength of USDJPY is still relatively strong. Investors who want to prepare to hoard Japanese yen may want to buy it slowly instead of a one-time outlay.

USDJPY-H4

Resistance 1: 114.700/ Resistance 2: 115.000/ Resistance 3: 115.500

Support 1: 113.200/ Support 2: 112.800/ Support 3: 112.500

【XAUUSD】

Christmas and New Year cheap festivals are getting closer. It looks like most people still have the tradition of buying gold as a giveaway. With the global risk situation next year still not good, the price of gold once again stood at $1800 per ounce even though there was an appreciation of the US dollar.

Gold's technical line shows an Alligator golden cross and KD's fast line turning down from the high-end figure. This is more likely to lead to a short-term decline in the death cross. Gold price has been continuing above the 1800USD position. With the U.S Christmas holidays coming next, trading volumes has shrunk rapidly and the market is waiting for a good opportunity next year.

XAUUSD-H4

Resistance 1: 1813.50/ Resistance 2: 1834.50/ Resistance 3: 1877.80

Support point 1: 1752.00/ Support point 2: 1751.80

【BITUSD】

The SEC rejected the application of the Valkyrie Bitcoin Fund and the Kryptoin Bitcoin ETF Trust. Both are these are bitcoin spot ETFs. The SEC said these 2 companies failed to meet the criteria for avoiding scams and safety and it could not protect the safety of investors funds. This disappointed some investors in the market. However, there will be two more Bitcoin ETFs that will soon enter the review.

From the technical analysis of Bitcoin, there was a shock near the price of $50,000, which is roughly between 53,000 and 48,000. Alligator shows a golden cross while KD is in the high-end figure. This shows that the strength of buying Bitcoins at this stage is still relatively strong. It will be interesting to see if the next resistance at 53000 can be broken. Traders may have to wait for a new step of information for a clear direction.

BITUSD-H4

Resistance 1: 53196.80/ Resistance 2: 55655.20/ Resistance 3: 59534.50

Support point 1: 47897.00/ Support point 2: 45547.50/ Support point 3: 41777.80

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

Learn more and visit the OnePro website today:

WikiFX Broker

Latest News

Pi Network Mainnet Launch: Game-Changer or Crypto Controversy?

GlobTFX Users Report Same Issue! But Why?

Rate Cut or Not? It Depends on Trump’s Policies

Why Do You Keep Blowing Accounts or Making Losses?

eToro Adds ADX Stocks to Platform for Global Investors

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

WikiFX Community Creator Growth Camp

Effect of Tariffs on Gold and Oil Prices

Rate Calc