OCBC Securities-Overview of Minimum Deposit, Leverage, Spreads

Abstract:OCBC Securities is a brokerage firm in Singapore with more than 35 years of experience in securities, derivatives, leveraged foreign exchange, and futures trading. Commissions vary from country to country, starting from a few dollars. The company provides 5 major accounts and various products and solutions access to 5 markets including Securities, Bonds, Leveraged Futures, Leveraged Forex, and Precious Metals.

| OCBC SecuritiesReview Summary | |

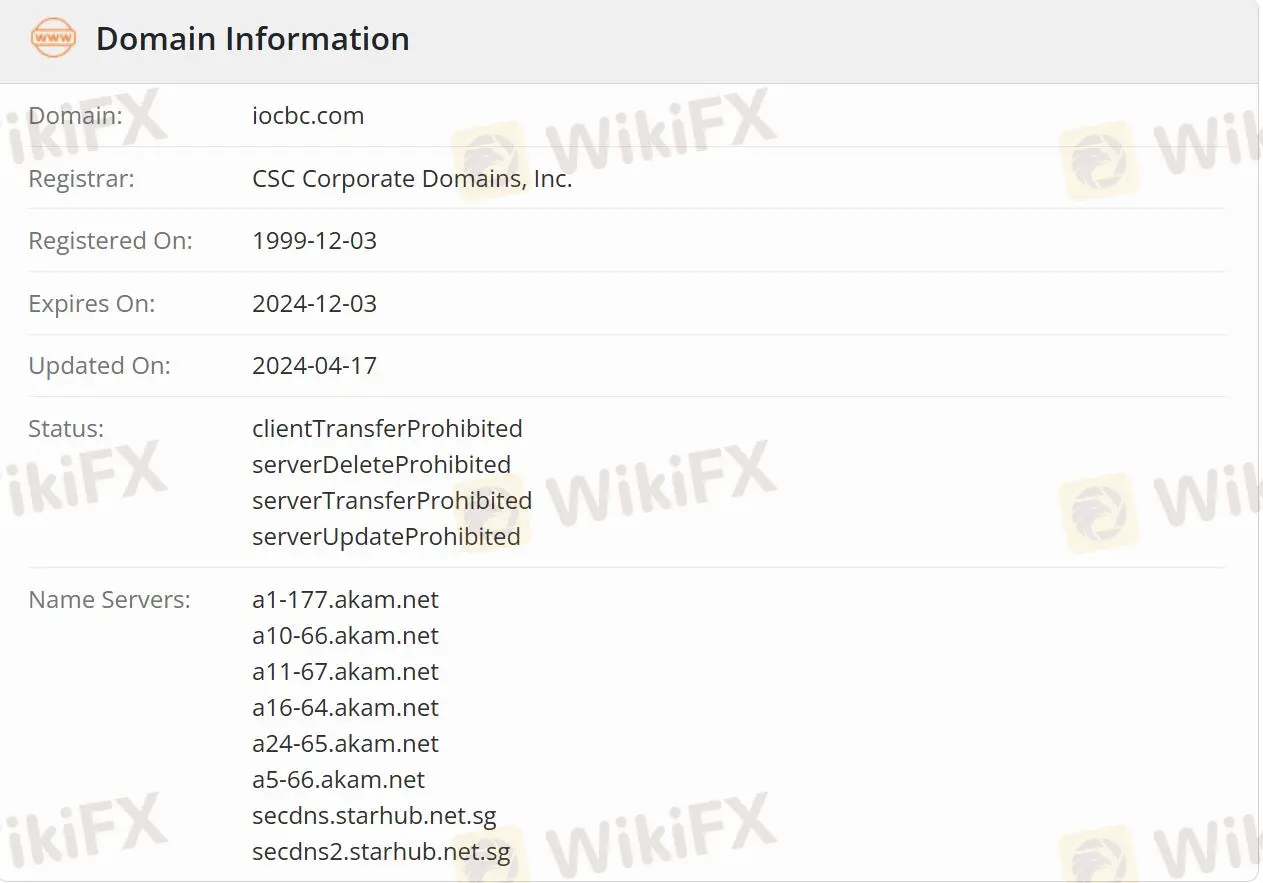

| Founded | 1999-12-03 |

| Registered Country/Region | Singapore |

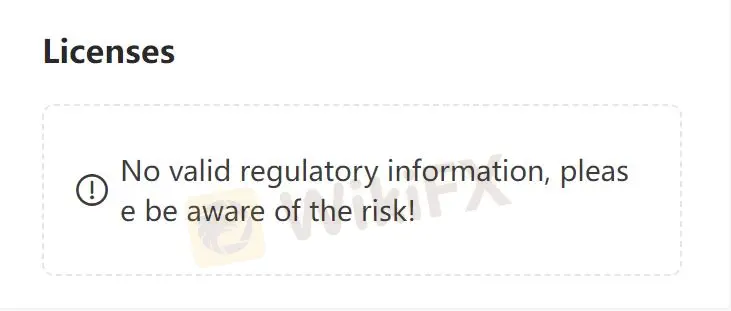

| Regulation | Unregulated |

| Products and Solutions | Securities/Bonds/Leveraged Futures/Leveraged Forex/Precious Metals/Share Financing/Share Borrowing |

| Leverage | Up to 1:50(Leveraged Forex Account) |

| Trading Platform | iOCBC Trading Platform/iOCBCfx Trading Platform/iOCBCfx Pro Trading Platform/Futures Trading Platform |

| Customer Support | Phone: 1800 338 8688(Local)+65 6338 8688(0verseas) |

| Email: cs@ocbcsec.com | |

| Social Media: Facebook, Twitter, YouTube, LinkedIn | |

OCBC Securities Information

OCBC Securities is a brokerage firm in Singapore with more than 35 years of experience in securities, derivatives, leveraged foreign exchange, and futures trading. Commissions vary from country to country, starting from a few dollars. The company provides 5 major accounts and various products and solutions access to 5 markets including Securities, Bonds, Leveraged Futures, Leveraged Forex, and Precious Metals.

Is OCBC Securities Legit?

OCBC Securities is not regulated, making it less safe than regulated brokers.

What products and solutions does OCBC Securities provide?

OCBC Securities provides 5 major products, such as Securities, Bonds, Leveraged Futures, Leveraged Forex, and Precious Metals. In addition, 2 main solutions include Share Financing and Share Borrowing.

Account Type

OCBC Securities provides a Basic Trading Account, a Leveraged Futures Account, a Leveraged Forex Account, a Share Financing Account, and a Share Borrowing Account.

Basic Trading Account: A cash trading account allows users to trade only with the funds available in the account without annual fees.

Leveraged Futures Account: Access a comprehensive range of futures including Stock Indices, Currencies, Commodities, Energy, Metals, and Interest Rates.

Leveraged Forex Account: Leverage up to 50 times and trade over 40 currency pairs including spot gold and spot silver.

Share Financing Account: Share financing lets the trade up to 3.5 times the user's original value with cash pledged as collateral and up to 2.5 times with shares pledged as collateral.

hare Borrowing Account: Engage in trading strategies such as shorting and hedging.

| Account Type | Suitable for |

| Basic Trading Account | Securities |

| Leveraged Futures Account | Futures |

| Leveraged Forex Account | Forex |

| Share Financing Account | Leveraged Trading |

| Share Borrowing Account | Leveraged Trading |

Trading Platform

4 major platforms are available including iOCBC Trading Platform, iOCBCfx Trading Platform, iOCBCfx Pro Trading Platform, and Futures Trading Platform.

iOCBC Trading Platform: Trade Securities, Exchange Traded Funds (ETFs), and Bonds.

iOCBCfx Trading Platform for Forex: Offer foreign exchange market with over 40 currency pairs including spot gold and spot silver.

iOCBCfx Pro Trading Platform for Forex: Access to over 40 FX Pairs as well as Spot Gold and Silver with 5x leverage.

Futures Trading Platform for futures: Provide Interest rates, Stock indices, Currencies, Metals, Energies and Commodities

| Trading Platform | Supported | Available Devices | Trading Products |

| iOCBC Trading Platform | ✔ | Mobile | Securities, Exchange Traded Funds (ETFs), and Bonds |

| iOCBCfx Trading Platform | ✔ | Desktop,Tablet, and Mobile | Forex and Precious Metals |

| iOCBCfx Pro Trading Platform | ✔ | Mobile, Microsoft, and Mac | Leveraged Forex and Precious Metals |

| Futures Trading Platform | ✔ | Desktop and Mobile | Futures |

Customer Support Options

Traders can get in touch with OCBC Securities by phone and email.

| Contact Options | Details |

| Phone | 1800 338 8688(Local)+65 6338 8688(Overseas) |

| cs@ocbcsec.com | |

| Social Media | Facebook, Twitter, YouTube, LinkedIn |

| Supported Language | English |

| Website Language | English |

| Physical Address | 18 Church Street #01-00 OCBC Centre South Singapore 049479 |

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

WikiFX Broker

Latest News

Robinhood Halts Super Bowl Betting Contracts After CFTC Request

3-Day Online Scam Trap: Victims Lose $200K—Don't Be Next!

Japan's January PMI has been released, investors need to pay attention to these points!

Investment Scam on Telegram: How a Woman Lost Over RM65,000

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Carmaker Kia becomes latest global firm to face tax trouble in India

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

Rate Calc