WIKIFX REPORT: Murrey Math Lines 07.06.2022 (AUDUSD, NZDUSD)

Abstract:Murrey Math Lines are support and resistance lines based on geometric mathematical formulas developed by T. H. Murrey. MM lines are a derivation of the observations of W.D. Gann. Murrey's geometry facilitate the use of Gann's theories in a somewhat easier application. Below are for some pairs:

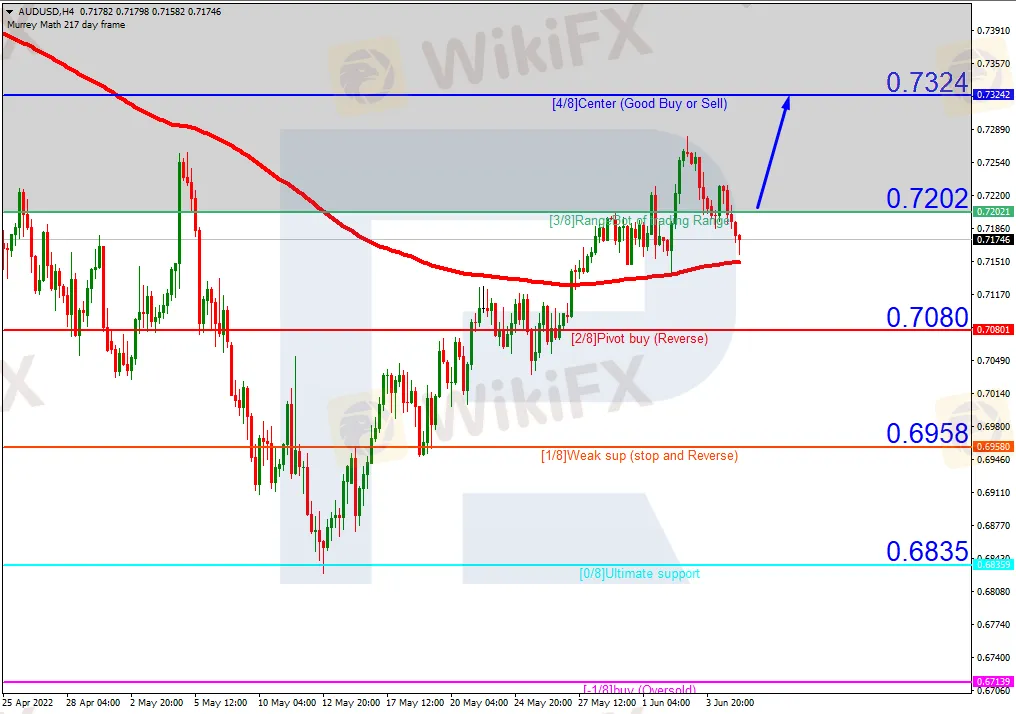

AUDUSD, “Australian Dollar vs US Dollar”

We can easily observe in the H4 chart, AUDUSD is trading above the 200-day Moving Average to indicate an ascending tendency. In this case, the price is expected to break 3/8 and then continue growing to reach the resistance at 4/8. However, this scenario may no longer be valid if the price breaks the support at 2/8 to the downside. After that, the instrument may reverse and resume falling towards 1/8.

In the M15 chart, the pair may break the upside line of the VoltyChannel indicator and, as a result, continue moving upwards.

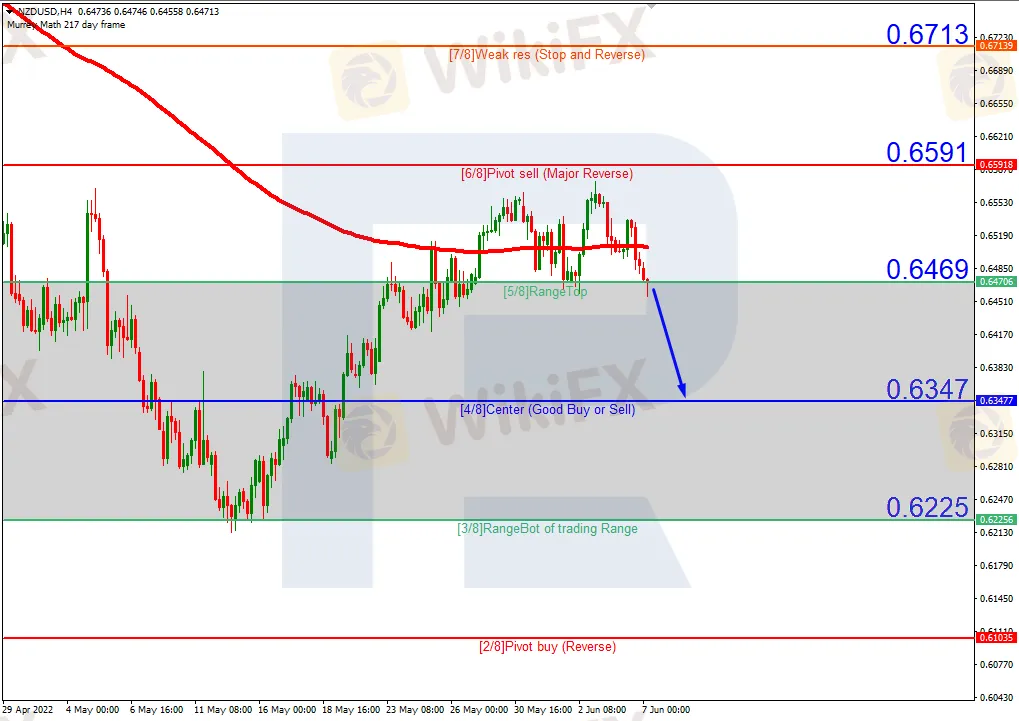

NZDUSD, “New Zealand Dollar vs US Dollar”

In the H4 chart, after breaking the 200-day Moving Average, NZDUSD is trading below it, thus indicating a possible descending tendency. In this case, the price is expected to continue moving downwards to reach the closest support at 4/8. However, this scenario may no longer be valid if the price breaks the resistance at 6/8 to the upside. After that, the instrument may reverse and grow towards 7/8.

As we can observe in the M15 chart, the pair has broken the downside line of the VoltyChannel indicator and, as a result, may continue its decline to reach 4/8 from the H4 chart.

Read more

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

Admirals Resumes EU Client Onboarding After Pause in 2024

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

How to Withdraw Funds from Pocket Option?

Pocket Option is considered a beginner-friendly trading platform, providing access to over 100 CFD instruments. Though not in an extensive range, 12 currency pairs, 10 cryptocurrencies, and stock indices are enough for focused and efficient trading. Particularly, forex trading starts at $10, perfectly fit for beginners' trading styles. Besides, Pocket Option provides a free demo account with virtual funds of $50,000 to give users risk-free practice. Though Pocket Option introduces commission-free option trading, they are less competitive in trading costs for other instruments.

Crypto vs Forex: Which is Better? Which Should You Choose?

The global financial landscape has been reshaped by two dominant trading markets: cryptocurrency and foreign exchange (forex). Each offers unique opportunities, risks, and rewards, leaving traders and investors divided on which market holds the upper hand. But when it comes to choosing between them, is there a definitive answer, or does it all boil down to personal preference and risk appetite?

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

Rate Calc