Estock FX-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Estock FX, a trading name of Estock FX Fintech Services Ltd, is allegedly an international business company based in the USA and incorporated in St. Vincent & the Grenadines that provides its clients with the industry-standard MetaTrader4 and MetaTrader5 trading platforms, leverage up to 1:200, variable spreads on over 120 tradable financial instruments, as well as a choice of six different investment plans.

General Information

Estock FX, a trading name of Estock FX Fintech Services Ltd, is allegedly an international business company based in the USA and incorporated in St. Vincent & the Grenadines that provides its clients with the industry-standard MetaTrader4 and MetaTrader5 trading platforms, leverage up to 1:200, variable spreads on over 120 tradable financial instruments, as well as a choice of six different investment plans.

Market Instruments

Estock FX advertises that it offers more than 120 trading instruments in financial markets, including forex, energies, cryptocurrencies, shares, indices and metals.

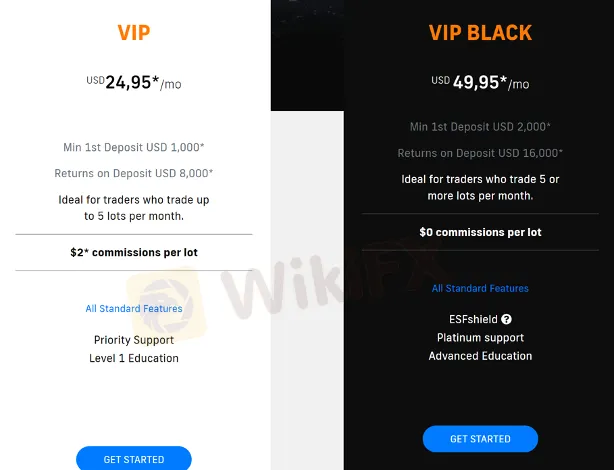

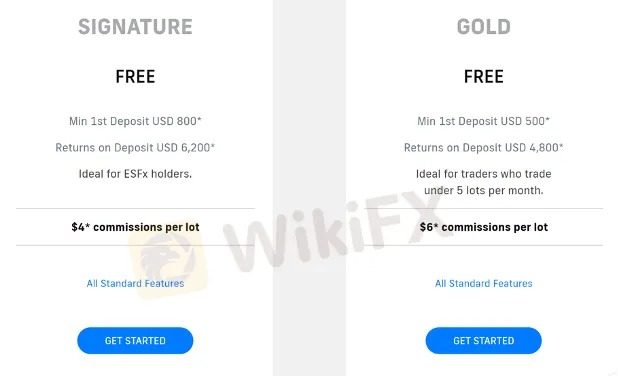

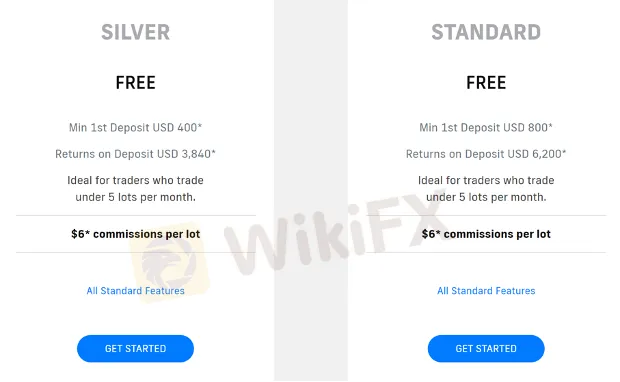

Investment Plans

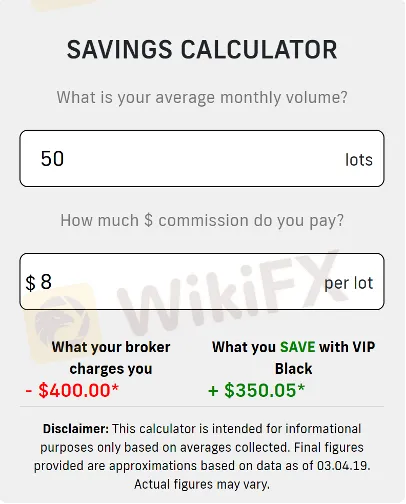

There are six investment plans offered by Estock FX, namely Silver, Gold, Signature, Standard, VIP and VIP Black. Starting a Silver plan requires the minimum investment amount of $400, while the other five investment plans with the much higher minimum initial capital requirements of $500, $800, $800, $1,000 and $2,000 respectively. The starting fee of Silver, Gold, Signature and Standard investment plans is free, while the VIP plan with a fee of $24,95 per month and the VIP Black with $49,95 monthly.

Leverage

The maximum leverage ratio provided by Estock FX is much higher than most brokers, up to 1:200, but on request up to 1:500. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads & Commissions

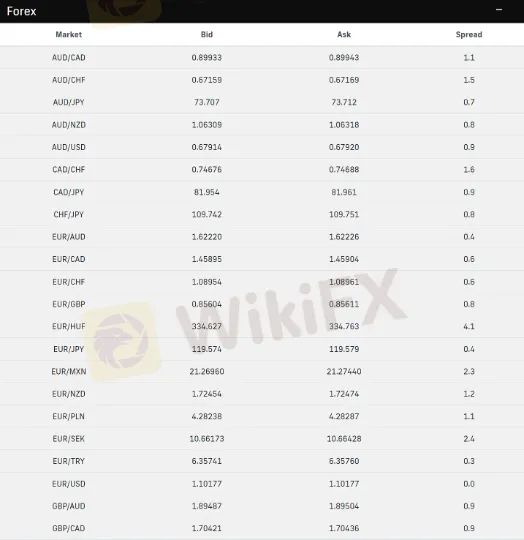

Spreads are influenced by what asset classes traders are holding. For example, the spread for the EUR/USD pair is 0.0 pips; the spread for the AUD/CAD pair is 1.1 pips; other specific information about other forex currency pairs can be found in the following screenshot. As for commissions, the Silver, Gold or Standard plan with $6 commission per lot; the Signature plan with $4 commission per lot; the VIP plan with $2 commission per lot; and the VIP Black plan with $0 commission per lot.

Trading Platform Available

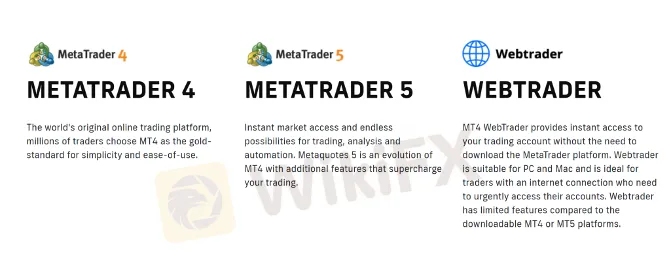

When it comes to trading platforms available,Estock FX gives traders three choices: Metatrader4, Metatrader5 and Webtrader, available on PC, Mac, the web and mobile. The MT4 and MT5 are known as the most successful, efficient, and competent forex trading software. The MT4 offers an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options. While the MT5 allows traders to execute trades on different financial markets through a single account and there is a hedging option. With the MT4 or MT5 mobile app, trading can be done from anywhere and at any time through the right mobile terminals.

Tools

Also, Estock FX provides its clients with a trading tool called Savings Calculator, whose interface seems to be quite simple and easy to use, just as the following screenshot shows.

Deposit & Withdrawal

Estock FX accepts deposits and withdrawals with Visa, Mastercard, Bank Wire, UnionPay, as well as cryptocurrencies of Bitcoin, Ethereum and others. The minimum deposit requirement is $400.

Customer Support

Estock FXs customer support can be reached by phone/WhatsApp: 15672460714, email: support@estockfx.com or send messages online to get in touch. Company address: Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines.

Read more

Forex Scam Defrauds Over RM100 Million from Hundreds of Investors

A foreign exchange (forex) investment scam that swindled more than 100 million ringgit from hundreds of investors has prompted the Malaysian International Humanitarian Organization (MHO) to take action.

Grow Trade Matrix Broker Review

In this review, we will examine this broker and why traders should carefully consider the risks involved before deciding to invest.

Degiro Review 2025: Trading Accounts, Demo Accounts and Withdrawals to Explore

DEGIRO claims to be a popular online broker known for its competitive trading fees and a great range of investment options, including stocks, ETFs, bonds, and options. DEGIRO stands out for is its low-fee structure, often significantly cheaper than competitors, achieved by focusing on execution-only services. This, however, comes at the cost of less comprehensive research tools and educational resources compared to full-service brokers. While functional, DEGIRO's platform is considered less sophisticated, lacking advanced charting, in-depth research, and real-time news. Additionally, its customer service has been criticized for some withdrawal problems, as well as being slow to respond at times.

Webull Partners with Kalshi to Launch Event Contracts

Webull teams up with Kalshi to integrate event contracts, offering new financial market tools. Learn how this impacts trading amid CFTC regulatory challenges.

WikiFX Broker

Latest News

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Trump tariffs: Retaliate or negotiate - what will US partners do next?

VPFX Secures UAE SCA License, Expands FX and CFDs Services

Oil Prices Fluctuate as Iran and Trump Clash!

Best Regulated Forex Brokers Offering Daily Trading Signals

RBI New Initiative: ‘bank.in’ to Protect You from Fraud

MultiBank Group Launches UAE CFD Shares on MultiBank-Plus App and MT5

TradingHub Expands in Australia with Bronwyn Hill as Senior Relationship Manager

Rate Calc