FX Wonders-Overview of Minimum Deposit, Leverage, Spreads

Abstract:FX Wonders is allegedly an unregulated forex broker based in Saint Vincent and the Grenadines that provides its clients with the industry-standard MetaTrader4 trading platform, leverage up to 500:1, variable spreads from 0.0 pips on multiple tradable assets, as well as a choice of three different account types.

Note: FX Wonders's official website: https://fxwonders.com/ is currently inaccessible normally.

| FX Wonders Review Summary | |

| Founded | / |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | No Regulation |

| Market Instruments | Forex, commodities, indices and shares |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| EUR/USD Spread | Floating around 0.2 pips |

| Trading Platform | MetaTrader4 |

| Minimum Deposit | $500 |

| Customer Support | Phone: +1-3454-5678-77 |

| Email: support@fxwonders.com | |

| Address: 305 Griffith Corporate Park, Beachmont Kingston, Saint Vincent & the Grenadines | |

FX Wonders is allegedly an unregulated forex broker based in Saint Vincent and the Grenadines that provides its clients with the industry-standard MetaTrader4 trading platform, leverage up to 500:1, variable spreads from 0.0 pips on multiple tradable assets, as well as a choice of three different account types.

Pros and Cons

| Pros | Cons |

| Demo accounts available | Non-functional Website |

| A wide range of trading products | No regulation |

| Diverse account types | High minimum deposit |

| Tight EUR/USD spread | |

| MT4 platform |

Is FX Wonders Legit?

At present, FX Wonders lacks valid regulation. We suggest that you look for another regulated one.

What Can I Trade on FX Wonders?

FX Wonders advertises that it offers some popular trading instruments in financial markets, including forex, commodities, indices and shares.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

There are three live trading accounts offered by FX Wonders, namely Standard, Swap Free and Platinum. Opening a Standard account requires the minimum initial deposit amount of $500, while the other two account types with the much higher minimum initial capital requirements of $1,000 and $10,000 respectively.

Leverage

FX Wonders says that different clients can enjoy different maximum leverage ratios. The professional clients can enjoy the maximum leverage of 500:1, and the retail clients can experience the leverage of 30:1. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spread and Commission

Spreads are influenced by what type of accounts traders are holding. FX Wonders reveals that the spread on the Standard account is between 0.0 and 0.8 pips, the clients on the Swap Free account can experience spreads from 1.0 to 1.2 pips, while the Platinum account with spreads of 1.0-1.2 pips.

As for commissions, the broker will charge the Standard account a commission of $3.5 per 100k traded.

To be more specific, as the test shows on the demo MT4 account, the spread for EUR/USD pair was floating around 0.2 pips.

Trading Platform

FX Wonders offers industry-leading trading software MetaTrader4. MT4 is known as the most successful, efficient, and competent forex trading software, offering an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options.

Deposit and Withdrawal

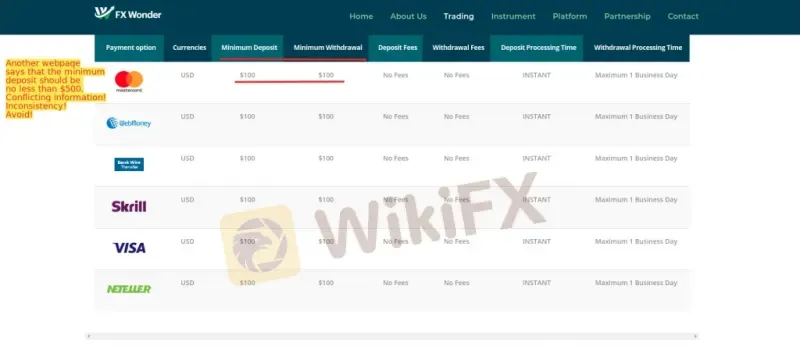

FX Wonders works with MasterCard, WebMoney, Bank Wire Transfer, Skrill, Visa and Neteller.

The minimum deposit requirement is said to be $100, while the brokers most basic account type requires an initial investment amount of $500 and the minimum withdrawal amount is said to be $100 free of charge.

As for the processing time of deposit and withdrawal requests, all deposits are instant, while all withdrawals can be processed within 1 business day.

Read more

Understanding the New York Forex Trading Session Time in the Philippines

The forex market operates 24 hours a day, 5 days a week, with different trading sessions that overlap and offer various trading opportunities. One of the most active trading sessions is the New York session, which plays a crucial role in the global forex market. If you're in the Philippines, understanding when the New York session overlaps with local time is essential for maximizing your trading potential.

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

WikiFX Broker

Latest News

FCA Tightens Financial Promotion Rules, Withdraws Nearly 20,000 Ads in 2024

EmpiresX Founders Fined $130M for Crypto Investment Fraud

Understanding the New York Forex Trading Session Time in the Philippines

Judge blocks Musk team access to Treasury Department records

Musk\s Doge takes aim at US consumer protection agency

Is the Russia-Ukraine Conflict Really Coming to an End?

Rate Calc