AnalystQue-Overview of Minimum Deposit, Leverage, Spreads

Abstract:AnalystQue, a trading name of AnalystQue Inc., is allegedly an unregulated, blacklisted and offshore forex broker registered in the UK that claims to provide its clients with over 16,000 tradable financial instruments with leverage up to 300:1 and tight spreads on the web-based and mobile trading platforms, as well as a choice of five different account types and 24/7 customer support service.

General Information & Regulation

AnalystQue, a trading name of AnalystQue Inc., is allegedly an unregulated, blacklisted and offshore forex broker registered in the UK that claims to provide its clients with over 16,000 tradable financial instruments with leverage up to 300:1 and tight spreads on the web-based and mobile trading platforms, as well as a choice of five different account types and 24/7 customer support service.

Market Instruments

AnalystQue advertises that it offers more than 16,000 trading instruments across 6 asset classes in financial markets, including forex, energy commodities, cryptocurrencies, currency options, precious metals and spot commodities.

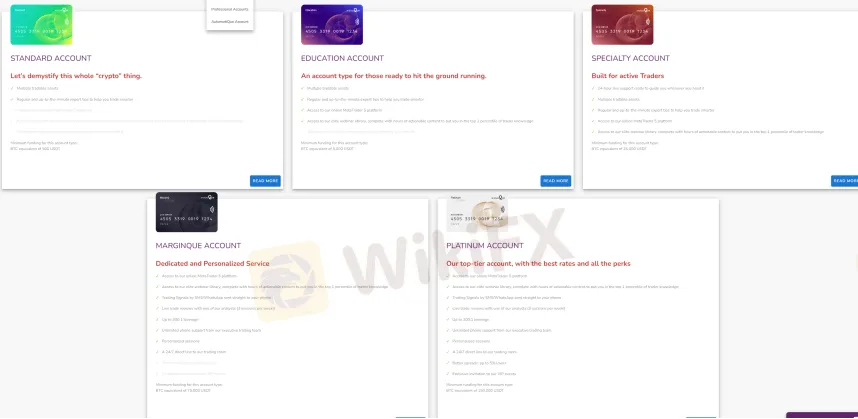

Account Types

There are five live trading accounts offered by AnalystQue, namely three primary account types of Standard, Education and Specialty, and two professional account types of Marginque and Platinum. Opening a Standard account requires the minimum initial deposit amount of BTC equivalent of 500 USDT, while the other four account types have much higher minimum initial capital requirements of BTC equivalent of $5,000, $25,000, $75,000 and $150,000 respectively. The broker also offers automatique accounts.

Leverage

A leverage ratio of up to 300:1 is offered by AnalystQue, which is much higher than that provided by most brokers. Inexperienced traders are advised not to use too much leverage since leverage magnifies gains and losses.

Spreads

As tested on AnalystQues platform, we understand that the spread for the benchmark EUR/USD pair is only 0.2 pips.

Trading Platform Available

Platforms available for trading at AnalystQue are Web Trader, iPhone Trading App, Android Trading App and Tablet Trading App. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

The only acceptable deposit and withdrawal option at AnalystQue is directly from one Bitcoin wallet to another. The minimum initial deposit requirement is said to be BTC equivalent of 500 USDT. The USDT stablecoin is meant to mirror the value of the US dollar. Approximately one US dollar is equivalent to one USDT. The standard account cost of $500 is actually quite high.

Fees

AnalystQue also charges an inactivity fee. In particular, if there has been no trading activity for three months, you will have to pay $50, and from the fourth month on, you will have to pay $100.

Customer Support

AnalystQues customer support can be reached by telephone: +44 20 3318 8788, WhatsApp: +44 7700 154456, email: cs@analystque.com or live chat. Company address: Saint Vincent and the Grenadines & Commonwealth of Dominica.

Read more

Is Copy Trading as Safe as It Seems?

Many traders want to make money without spending too much time learning. Copy trading seems like an easy way to do this. It allows you to copy the trades of experienced traders. You follow their moves, and your account mirrors their actions. It sounds simple. But is it really safe?

Darwinex Accounts & Darwinex Demo Accounts to Explore

Darwinex is a UK-based regulated online trading platform and broker that offers a unique approach to trading and investment. Darwinex goes beyond traditional brokerage by integrating innovative technology with trading, offering proprietary tools unavailable elsewhere. Its“Darwins”, investable algorithms, enable users to mirror successful traders' strategies. Traders can execute their own trades and also invest in other traders' strategies through these Darwins. The platform operates under FCA regulation and provides access to various markets, including forex, stocks, indices, commodities, and cryptocurrencies. Rather than a pure broker, Darwinex would be more like a community-focused platform.

TradingHub Expands in Australia with Bronwyn Hill as Senior Relationship Manager

TradingHub appoints Bronwyn Hill as Senior Relationship Manager to boost trade surveillance and compliance in Australia. Learn more about their growth plans.

MultiBank Group Launches UAE CFD Shares on MultiBank-Plus App and MT5

MultiBank Group introduces UAE CFD shares on MultiBank-Plus App & MT5, enabling global investors to trade DFM & ADX shares seamlessly.

WikiFX Broker

Latest News

EBSWARE Prop Launches Forex Trading Tournaments for Brokers

Key Risks and Downsides of Forex Trading Explained

How a Crypto Scam Cost Company Manager RM2.56 Million

TD Bank to Sell $14.9 Billion Schwab Stake, Repurchase Shares

Warning Against Agra Markets: Stay Cautious!

Hacker Who Breached SEC Account and Falsely Announced Bitcoin ETF Approval Faces Trial

Scam Exposed: GlobTFX Deceives Another Investor

Trump tariffs: Retaliate or negotiate - what will US partners do next?

VPFX Secures UAE SCA License, Expands FX and CFDs Services

Oil Prices Fluctuate as Iran and Trump Clash!

Rate Calc