S&B Group

Abstract:Founded in 2020, S&B Group is an unregulated broker registered in the United Kingdom, offering trading in Commodities, cryptocurrencies, stocks, indices, futures, forex, and options via the MT5 platform.

Note: S&B Group's official website - https://www.sandbg.com/ is currently inaccessible normally.

| S&B GroupReview Summary | |

| Founded | 2020 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Commodities, cryptocurrencies, stocks, indices, futures, forex, options |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | Live chat, contact form |

| Tel: +90 850 215 6551 | |

| Facebook, Instagram, YouTube and LinkedIn | |

Founded in 2020, S&B Group is an unregulated broker registered in the United Kingdom, offering trading in Commodities, cryptocurrencies, stocks, indices, futures, forex, and options via the MT5 platform.

Pros and Cons

| Pros | Cons |

| Diverse market instruments | Inaccessible website |

| Support MT5 | Unregulated |

| Popular payment options | Lack of transparency |

Is S&B Group Legit?

No, S&B Group is not regulated. Traders should carefully consider the risks it brings when choosing to trade with it.

What Can I Trade on S&B Group?

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Options | ✔ |

| Bonds | ❌ |

| ETFs | ❌ |

Account Type

S&B Group claims to offer six types of trading accounts, namely Custom, Credit, Insurance, Barter, Corporate, Transfer and Rent accounts. However, the broker didn't directly reveal any specific information about the minimum initial deposit requirement.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

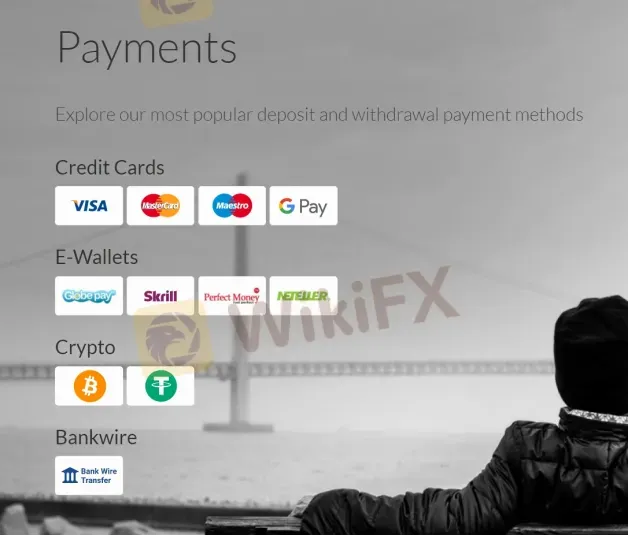

S&B Group accepts payments via credit cards (Visa, MasterCard, Maestro, G Pay), e-wallets (Globepay, Skrill, Perfect Money, Neteller), cryptocurrencies (Bitcoin, Tether) and Bank Wire Transfer.

Read more

Lirunex Joins Financial Commission, Boosts Trader Protection

Lirunex joins the Financial Commission, offering traders €20,000 protection per claim. A multi-asset broker regulated by CySEC, LFSA, and MED.

Capital.com Review 2025: Trading Account & Withdrawal to Explore

Despite its relative youth, the Cyprus-registered online broker Capital.com has garnered respectable attention from a large number of retail and professional investors since its 2016 launch. Capital.com is a frontrunner among low-cost trading products; it allows individual and institutional investors to trade contracts for difference (CFDs) on three thousand markets, including Forex, Stocks, Commodities, Indices, Cryptocurrencies, and more. Impressively, Capital.com is on board with ESG investments as well. You can begin trading CFDs on the Capital.com platform with as little as $20. You can trade CFDs on this platform without paying any commissions; the only fees involved are the spreads. This broker offers a wide range of platforms, including mobile apps, a desktop trading app, an API from Capital.com, Tradingview, and MetaTrader 4. Among Capital.com's many distinguishing features is the wealth of educational content and high-quality research it offers its users. The platform's Marke

Italy’s Securities Regulator Consob Orders Shutdown of 6 Illegal Financial Service Websitese

Italy’s financial regulator, Consob, has ordered the shutdown of six unauthorized financial service websites to combat illegal financial activities and protect investors. This action is based on regulatory powers granted under the 2019 “Crescita Decree.” Since 2019, Consob has blocked 1,211 fraudulent websites. Investors can use WikiFX to verify compliance and avoid investment scams.

WikiFX Review: Is Fortune Prime Global Reliable?

Founded in 2011, Fortune Prime Global (FPG) is an Australia-registered broker that offers a wide range of investment products (Forex pairs, Commodities, Stocks, Cryptocurrencies, Indices, and so on). Today’s article will show you what it looks like in 2025.

WikiFX Broker

Latest News

Spotting Red Flags: The Ultimate Guide to Dodging WhatsApp & Telegram Stock Scams

WikiFX Review: Why so many complaints against QUOTEX?

Trans X Markets: Licensed Broker or a Scam?

Judge halts Trump\s government worker buyout plan: US media

BaFin Unveils Report: The 6 Biggest Risks You Need to Know

IMF Warns Japan of Spillover Risks from Global Market Volatility

Beware of Comments from the Fed's Number Two Official

RBI: India\s central bank slashes rates after five years

Nomura Holdings Ex-Employee Arrested in Fraud Scandal

Pepperstone Partners with Aston Martin Aramco F1 Team for 2025

Rate Calc