FxFincrop-Some important Details about This Broker

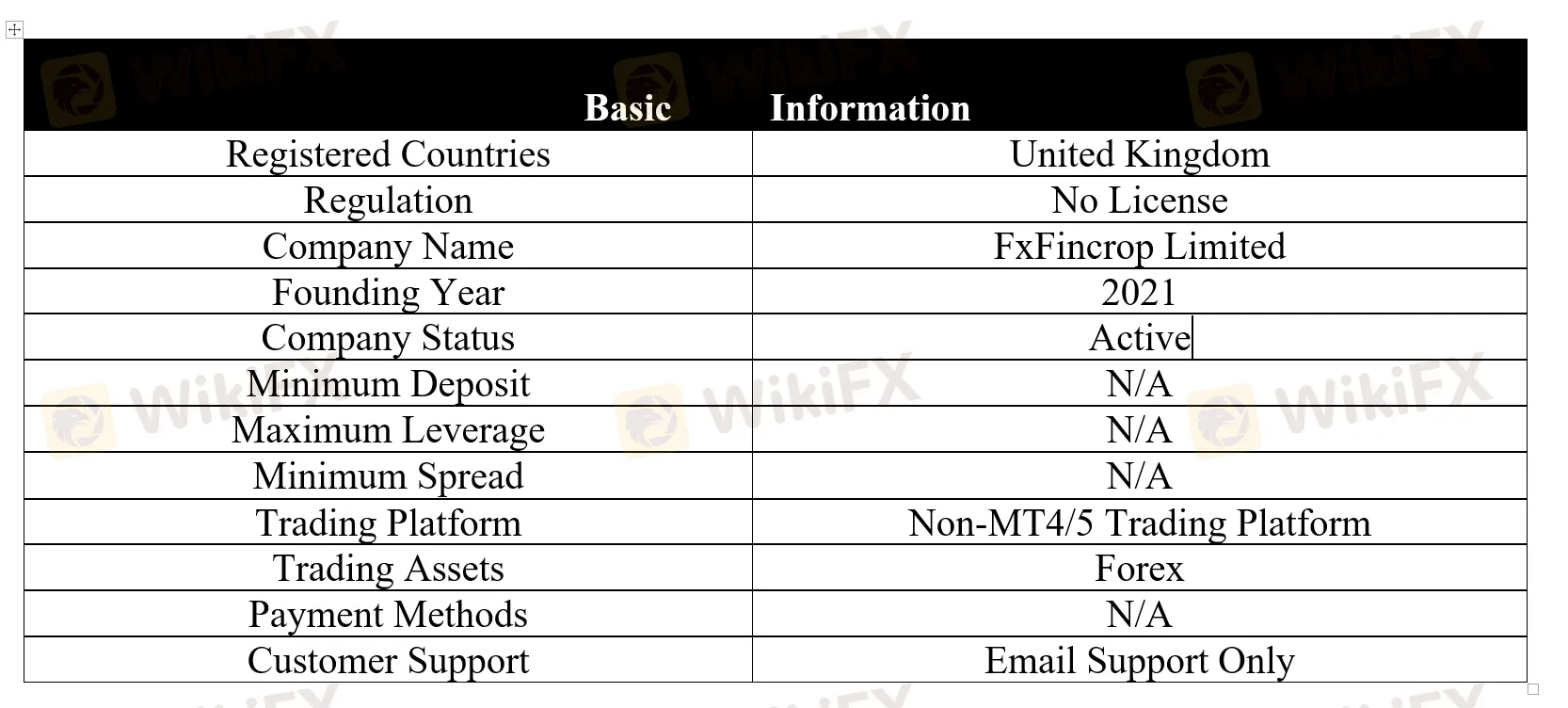

Abstract:Incorporated on 31 May 2017, FxFincrop is a financial provider registered in the United Kingdom, not established long, with an operating time of less than two years. As this brokerage houses official website cannot be opened for now, we could obtain limited information. Further details on its trading assets, trading platform, spreads and commissions, deposit and withdrawal and more, are not disclosed. FxFincrop is owned and operated by a company named FxFincrop Limited, however it does not hold any regulatory license.

Since FxFincrops official website (https://fxfincrop.com/) is under maintenance at the moment, we could only piece together the rough picture of this forex broker by gathering some relevant information from other websites.

General Information

Incorporated on 31 May 2017, FxFincrop is a financial provider registered in the United Kingdom, not established long, with an operating time of less than two years. As this brokerage houses official website cannot be opened for now, we could obtain limited information. Further details on its trading assets, trading platform, spreads and commissions, deposit and withdrawal and more, are not disclosed.

FxFincrop is owned and operated by a company named FxFincrop Limited, however it does not hold any regulatory license.

Minimum Deposit

FxFincrop does not disclose its minimum deposit requirements. However, given the fact that this is an unregulated forex broker, investors are not advised to invest with it.

Leverage

No trading leverage information is mentioned anywhere. Many offshore forex brokers tend to offer high leverage to attract more investors. However, as leverage can also cause serious fund losses, it is important for inexperienced traders to choose the proper amount that they feel most at ease.

Trading Platform

Please note that FxFincrop fails to offers its clients access to the industry-leading MT4 or MT5 trading platform. And we could find details on its trading platform offered anywhere.

Customer Support

Traders can reach out to FxFincrop about any questions or concerns they may have about their accounts or their trading through the following methods:

Email: support@fxfincrop.com

Registered Company Address: 20-22 Wenlock Road, London, England, N1 7GU

Other more effective and direct contact channels, such as phone support, whatsapp, are not available.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Forex Trading: Scam or Real Opportunity?

Meta: Explore forex trading: Is it a scam or real opportunity? Learn how it works, debunk myths, manage risks, and avoid scams with tools like WikiFX App. Start trading safely today!

Trade Nation 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Donald Trump’s Pro-Crypto Push Boosts PH Markets

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Japan’s Shift in Crypto Policy and What It Means for Investors

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Rate Calc