WikiFX Review: WikiFX Review: Is MEDE Company a safe broker?

Abstract:In today's diversified world of investment and finance, financial currencies have become a hot cake for the public, and especially foreign exchange investment and finance is of great interest to investors worldwide. So which broker can we trust? Let's take a look at the “MEDE Company” today.

First of all, let's search“MEDE Company”on WikiFX APP to find more information. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

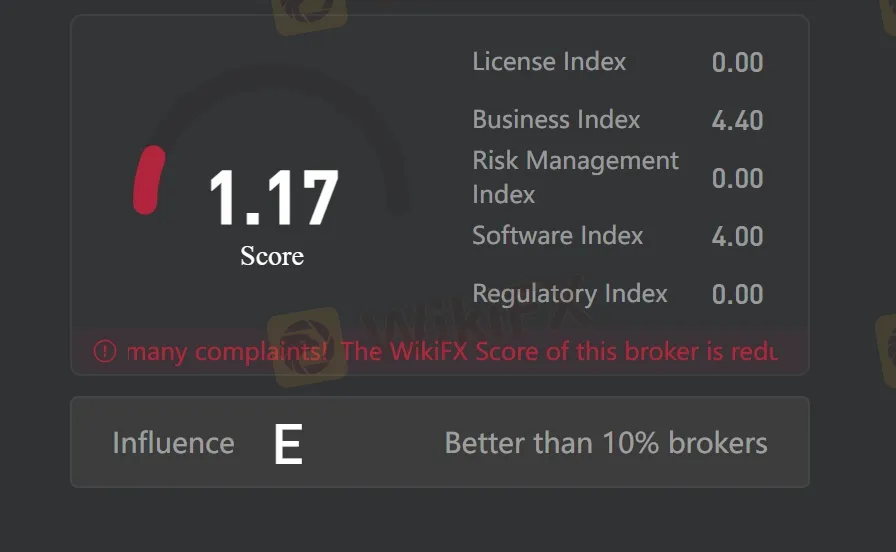

As you can see, based on information given on WikiFX (hettps://www.wikifx.com/en/dealer/2219069677.html), MEDE Company currently has no valid regulatory license and score is rather negative-only 1.77/10! Actually, WikiFX will comprehensively score dealers in five aspects: license index, business index, risk control index, software index and regulatory index. Since MEDE Company does not have any supervision and dose not obtain regulatory license, its license index, risk control risk control index and regulatory index are all 0 points, and the final total score is 1.17 points (full score of 10 points). Investors can be through the eye of the traders how the overall situation, at a glance, the higher the score, the more trustworthy, the lower the need to be vigilant!

Is all this information showed in WikiFX correct? We can start by looking at their regulators to find some clue.

Based on information given on WikiFX, MEDE Company seems to be a UK based Forex dealer. As a leading British financial regulator, the FCA(Financial Conduct Authority) is accountable to the UK Treasury and aims to ensure honest and fair markets by protecting investors, protecting financial markets and promoting competition. The core work is to regulate the market behavior of financial companies, investigate misconduct, supervise financial products, and ensure that financial services meet basic requirements or standards.

We can see from the screenshot that the search results are irrelevant company information, which makes it clear that the company is not regulated by the FCA.

Then what about the NFA? We can learn from above picture that MEDE Company is also registered in the United States.Being the one of the strictest and more well-respected financial regulator in the world, the NFA shows more convincing results.

As expected, the NFA register shows that although there is a company called MEDE Company it is not a member of the NFA and is not subject to NFA oversight. This company is only registered with exemptions for commodity pool operator and commodity trading advisor, which prevents it from providing financial services in the U.S. This is a way of simulating credibility used by many fraudsters.

Consequently, both the NFA and FCA findings are highly consistent with the WikiFX findings. This not only demonstrates the reliability of the WikIFX platform for traders' information, but also demonstrates our responsibility to every investor. Use real and reliable data to help investors stay away from “bad broker” and avoid risk.

In order to further verify the strength of MEDE Company, WikiFX also paid a visit to the brokers official website to learn more. Unfortunately, WikiFX was not able to open this page and access it – here is the error page that popped up when we attempted it.

Without access to the website, we cannot see for ourselves if it holds up to something like industry. As a professional broker, Its shocking that it does not have an official website or even the most basic information available to the public? Actually, most of investors should be highly vigilant when they see this. Do investors still dare to invest in such platforms that does not even want to display basic information?

In short, MEDE Company is clearly an untrustworthy and unreliable company, And WikiFX also proves this in various ways. Here are some comments posted by investors on the WikiFX platform.

It is no hard to see that many investors have been cheated by MEDE Company in various ways. WikiFX has also been using various methods to alert you to the ubiquity of forex scams.. Investors are advised to search relevant information and comments on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not.

Actually, compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models.

If you believe in WikiFX and have a need to invest in Forex,please be sure to download the WikiFX APP,you will be more likely to avoid unnecessary trouble and thus be prevented from losing money before investing in any broker! After all, the importance of being cautious and prudent can never be stressed enough.

Heres how to find us:

1) WikiFXs official website (https://www.WikiFX.com/en)

2) Download the WikiFX APP through this link (https://www.wikifx.com/en/download.html).

Read more

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Canada is striking back! If U.S. tariffs persist, Canada will impose retaliatory duties, escalating tensions in North American trade.

Admirals Resumes EU Client Onboarding After Pause in 2024

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

Crypto vs Forex: Which is Better? Which Should You Choose?

The global financial landscape has been reshaped by two dominant trading markets: cryptocurrency and foreign exchange (forex). Each offers unique opportunities, risks, and rewards, leaving traders and investors divided on which market holds the upper hand. But when it comes to choosing between them, is there a definitive answer, or does it all boil down to personal preference and risk appetite?

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

European leaders are working to repair Ukraine’s damaged relationship with the United States. Britain and France are leading a group of nations to create a plan to end the war with Russia. They hope to gain support from U.S. President Donald Trump, who has been hesitant about continued involvement.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Rate Calc